Portfolio Companies: Are You Eligible for the ERC?

April 19, 2021

30 Second Summary:

- Portfolio Companies and the ERC: While a controlled group relationship is generally unlikely between a private equity firm and its portfolio companies, special controlled group rules may apply when claiming the ERC in some scenarios.

- Impact On Your Business: Controlled group rules applicable to the ERC can play a significant role in employer eligibility and credit value and are a critical component in accurately calculating your credit.

- Next Steps: If your company receives private equity funding, you need to carefully examine your relationship with that firm (as well as any other companies with shared ownership) to ensure you don’t miscalculate or undervalue your credit.

Not sure whether controlled group rules apply to your company? Aprio’s ERC team can assess your unique scenario and develop a tailored strategy to maximize your credit.

The full story:

As we’ve discussed before, companies within controlled groups can still qualify for the Employee Retention Credit (ERC), but special aggregation rules do apply. These rules can introduce significant complexity to an ERC calculation, which only becomes more nuanced for companies receiving funding from a private equity firm.

Do the controlled group rules for the ERC apply to private equity structures?

Companies that receive private equity funding may be wondering whether controlled group rules apply to the relationship between a portfolio company and its private equity funder when claiming the ERC? Luckily, the answer is typically no.

The controlled group rules applicable to the ERC are generally favorable towards most private equity structures, primarily for two reasons:

1. Controlled group rules for ERC eligibility only apply to companies that are operating a trade or business, and

2. Controlled group rules for ERC eligibility do not apply when there are more than 5 owners involved in the relationship.

Both of these reasons will typically sever any potential controlled group relationship between a private equity firm and its portfolio companies for the purposes of the ERC. Ownership of private equity firms typically involve more than 5 individuals or entities, and the firms are generally not considered to be operating a trade or business by IRS standards – this is all good news for portfolio companies hoping to claim and maximize their credit.

So are portfolio companies exempt from controlled group rules entirely?

Certainly not. While it is unlikely that a portfolio company will be in a controlled group with a private equity firm, there is still a possibility that a portfolio company can be part of a controlled group with another entity.

Consider the following example:

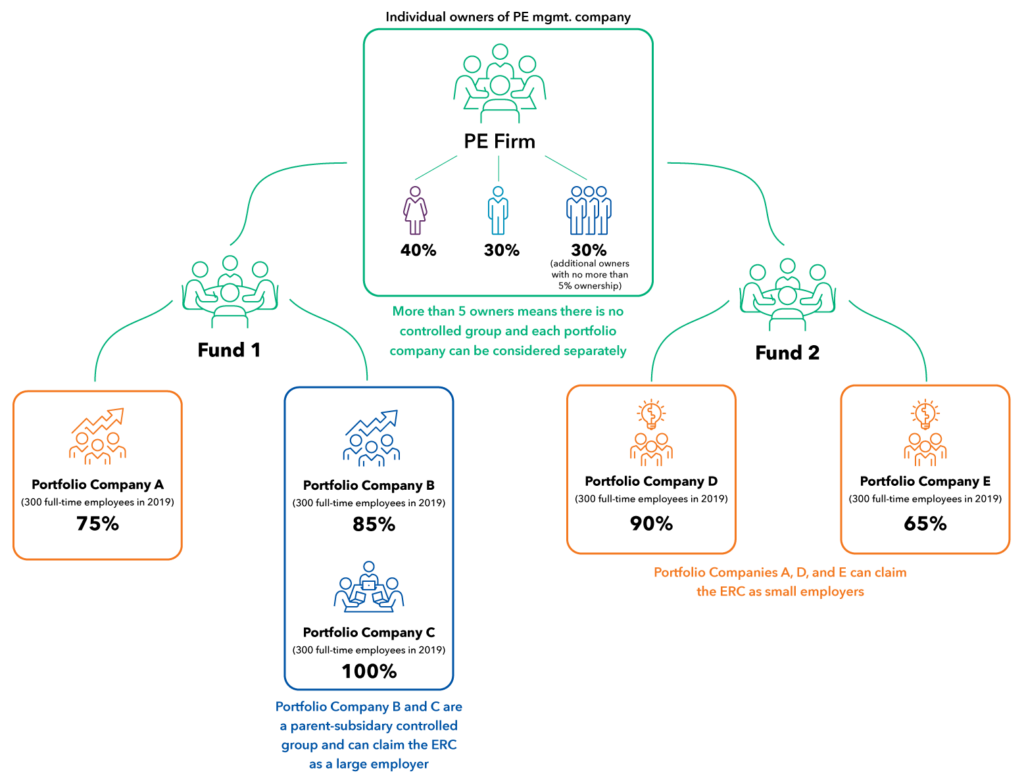

In the private equity structure illustrated above, there is no controlled group relationship between the private equity firm and the portfolio companies since the firm has more than 5 owners of varying stakes. While this permits Portfolio Companies A, D, and E to each claim the ERC as individual entities, it’s not so simple for Portfolio Companies B and C. Because Portfolio Company B has 100% ownership of Portfolio Company C, the two are in a parent-subsidy controlled group and must follow controlled group rules when determining their eligibility and size classification.

Assuming that each portfolio company had an average of 300 full-time employees in 2019, the controlled group rules require Portfolio Companies B and C to aggregate their full-time employee count as a single employer. This brings the total number of full-time employees to 600, classifying the pair as a large employer and limiting their qualified wages to only what was paid to employees not providing services. All other portfolio companies in this example meet the qualifications for a small employer and can claim all employee wages.

The bottom line

As the example above illustrates, the ERC can still be extremely beneficial to companies receiving private equity funding, and the controlled group rules are generally favorable to portfolio company and private equity firm relationships. However, there is still a great deal of complexity involved in calculating and maximizing your credit, especially when controlled groups are a concern.

Failing to catch an applicable controlled group relationship could cause major headaches and potential penalties later on. Aprio’s dedicated ERC team specializes in developing a tailored strategy that will maximize your credit value while adhering to all of the latest guidance and regulations.

Don’t risk potentially miscalculating or undervaluing your credit. Contact our ERC Team today to assess your ERC eligibility.

Disclaimer for services provided relative to SBA programs and the CARES Act

Aprio’s goal is to provide the most up to date information, along with our insights and current understanding of these programs and regulations to help you navigate your business response to COVID-19.

The rules regarding SBA programs are constantly being refined and clarified by the SBA and other agencies In certain instances, the guidance being provided by the agencies and/or the financial institutions is in direct conflict with other competing guidance, regulations and/or existing laws.

Due to the evolving nature of the situation and the lack of final published rules, Aprio cannot guarantee that additional changes or updates won’t be needed or forthcoming and the original advice given by Aprio may be affected by the evolving nature of the situation.

You need to evaluate and draw your own conclusions and determine your Company’s best approach relative to participation within these programs based on your Company’s specific circumstances, cash flow forecast and business strategy.

In situations where resources are provided by third parties, those services should be covered under a separate agreement directly with that service provider. Aprio is not responsible for the actions of any other third party.

Aprio encourages you to contact your legal counsel to address the legal implications of the impact of the CARES Act and specifically your participation in any of the SBA programs.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.