Taxes for Expats: How to Reduce Tax Liability Working Overseas

September 26, 2017

Taxes for expats is increasingly a hot topic in today’s globalized world. More and more professionals are choosing to live and work outside their country of birth, especially as industry-specific trade barriers continue to break down.

In many cases, people who relocate for personal and work-related reasons are responsible for compliance with tax regulations, rather than their employer. To protect yourself from falling victim to expensive penalties, you must understand your U.S. tax filing requirements.

As a U.S. citizen or green card holder, you are taxed on your worldwide income and will be required to continue filing tax returns. If you’re living outside the States on April 15, you will have an automatic extension to file your U.S. tax return by June 15. Keep in mind you’ll likely also have filing requirements from the country in which you currently live, even if there is no tax liability.

The good news? Taxes for expats can often be lower than those for homebound taxpayers.

With exposure to taxation in multiple jurisdictions, expats face the risk of double taxation. However, Social Security agreements and income tax treaty agreements exist between the United States and numerous countries to protect individuals from double taxation.

By taking advantage of these agreements, as well as the foreign earned income, foreign housing exclusion and foreign tax credits, you can eliminate your likelihood of succumbing to this tax pitfall.

Exemptions for US Taxes on Foreign Income

The principal tax break for expats is the foreign earned income exclusion. Every year, this inclusion is adjusted for inflation. In 2017, it allows you to avoid U.S. income taxes on up to $102,100 in income earned abroad. This does not apply to pay received from the U.S. government or military, as these payments are not considered foreign income.

Also, as detailed in IRS Notice 2017-21, you may be eligible for an additional exclusion based on your housing expenses abroad. Here’s how it works: Your total housing expenses above an annually established base amount — $16,336 for 2017 — can be excluded, subject to a limit equal to 30 percent of the earned income tax exclusion (i.e., $30,630 in 2017), or a higher amount in IRS-designated cities where housing costs are particularly high.

Suppose you had $50,000 in housing expenses in a foreign city this year. The amount exceeding the $16,336 base would be $33,664. This number goes beyond the $30,360 standard housing expense exclusion limit, but you’d still be able to get the benefit of the maximum exclusion amount ($30,630 in this example) less the base housing amount of $16,336, for an exclusion of $14,294.

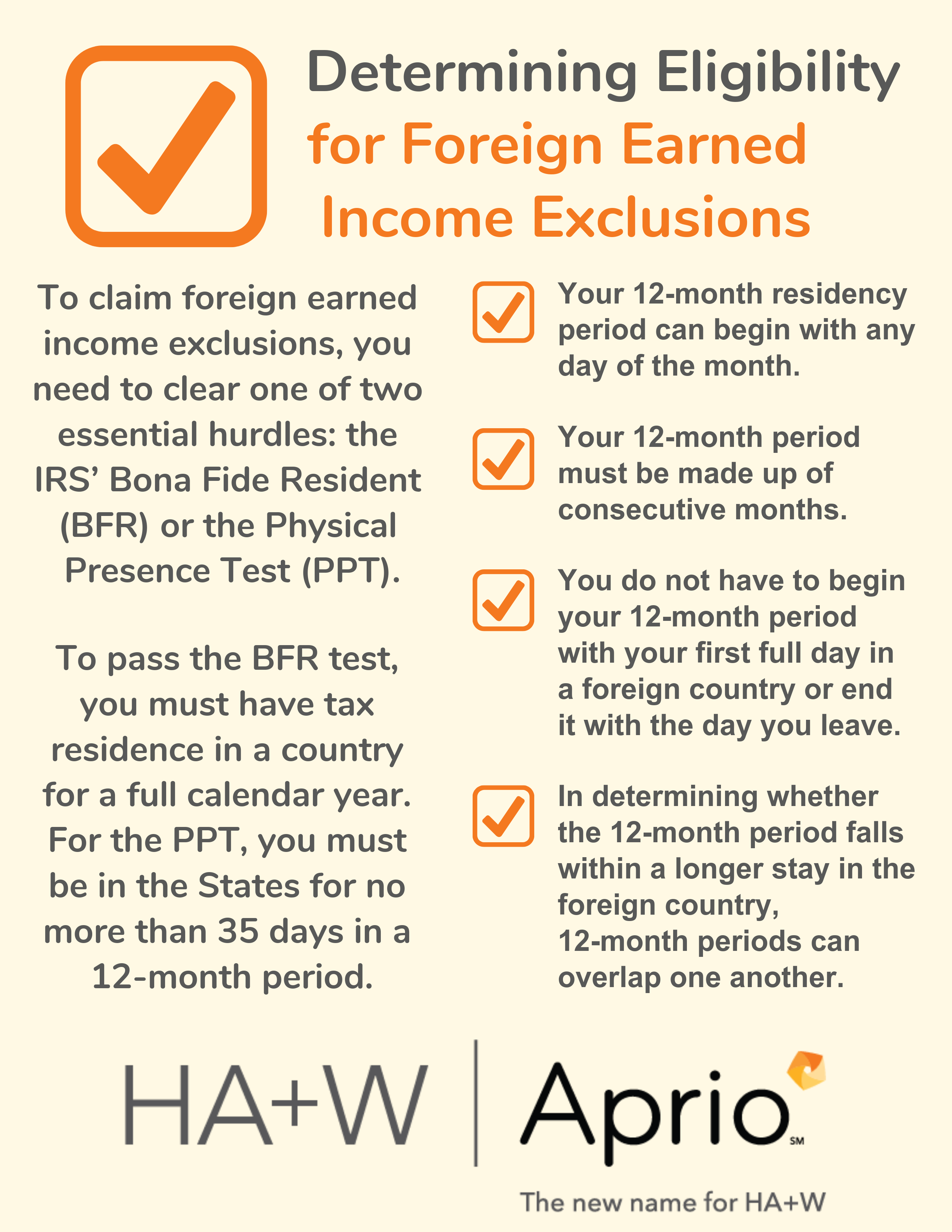

Determining Eligibility for Foreign Earned Income Exclusions

For additional guidance, use the IRS’ Interactive Tax Assistant tool to determine whether you’re eligible to claim the benefits highlighted above. Overall, you need to clear one of two essential hurdles: the IRS’ Bona Fide Resident (BFR) or the Physical Presence Test (PPT).

To pass the BFR test, you must have tax residence in a country for a full calendar year. Once you pass the BFR test, you may be able to qualify for the part-year exclusions in arrival and departure years. For the PPT, you must be in the States for no more than 35 days in a 12-month period:

- Your 12-month residency period can begin with any day of the month.

- Your 12-month period must be made up of consecutive months.

- You do not have to begin your 12-month period with your first full day in a foreign country or end it with the day you leave.

- In determining whether the 12-month period falls within a longer stay in the foreign country, 12-month periods can overlap one another.

If you pass these tests, you will also be able to exclude an additional amount for housing costs incurred abroad. The exclusion or deduction amount will vary based on where you’re living, and the IRS sets higher housing expense exclusion ceilings for many large cities. For example, Rome’s 2017 limit is $44,200.

Be sure to check the updated table each year for exclusion amounts per location. If you qualify under either test (even in a following year), your foreign earned income and housing exclusions may be prorated for short years.

Maintaining the Status Quo

If, during a given year, you manage to clear the hurdles and exclude foreign earned income, the IRS will assume you maintain this status until you revoke it. Once you revoke the foreign earned income exclusion, you may not utilize it again for another five years.

Foreign Tax Credit or Deduction

An expat who is subject to tax outside the U.S. may be able to take a credit using Form 1116 or a deduction on Schedule A for the amount of income tax paid. You may use foreign tax credits and the foreign earned income exclusion on the same tax return. But you won’t be eligible to either deduct foreign taxes listed on Schedule A of your 1040 or take a tax credit related to income that is excluded. For additional information on the ins and outs of the foreign tax credit, see the IRS Publication 514.

H2: Foreign Financial Asset and Entity Reporting

Remember that expats are subject to fulfill certain foreign reporting requirements for US taxes on foreign income, such as:

- Foreign Bank Account Reporting (FBAR) if the total value of all accounts outside the U.S. exceeds $10,000

- Foreign financial asset reporting with the tax returns

- Reporting for ownership in certain foreign entities

Penalties for non-compliance with these reporting requirements can start with $10,000 per delinquent form, with increased penalties for willful non-compliance. The IRS has programs available so you can file prior-year delinquent tax returns while reducing some of the applicable penalties.

Aprio Can Help You Navigate Taxes for Expats

To take full advantage of the tax provisions that exist to minimize double taxation, act now: Review your filing requirements, compliance dates, housing costs per city and income and expenses incurred in foreign locations. An international tax consultant can help you navigate how to reduce tax liability by taking advantage of foreign earned income exclusions.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.