The Pulse – What’s happening in the Economy and the Capital Markets: 11/23/20 – 11/27/20

November 30, 2020

Executive Summary

The separation between Wall Street and Main Street re-emerged this week with Wall Street reporting a very strong November following solidified election results and progress on a COVID-19 vaccine. Concurrently, the U.S. economy saw weakened consumer numbers and an improving industrial goods sector (though the improvement pace is slowing). Online shopping remains hot with post-Thanksgiving season sales already setting records.

The Markets

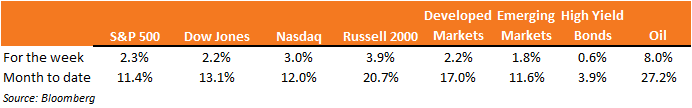

November was an outstanding month for the markets as two big uncertainties were further clarified – the 2020 Presidential election results and COVID-19 vaccines progress. The most cyclical and stressed sectors rallied hard following the news of lowered risks.

Small cap U.S. stocks were up nearly 21% and the price of a barrel of oil up 27%, reflecting the strength of the cyclical rebound. Energy, Financials and Industrials are the top performing sectors for the month as the markets have priced in the economic recovery of a post COVID-19 vaccine world. Not surprisingly, the poor performers are the steadier sectors – healthcare, utilities and consumer goods.

The Economic News

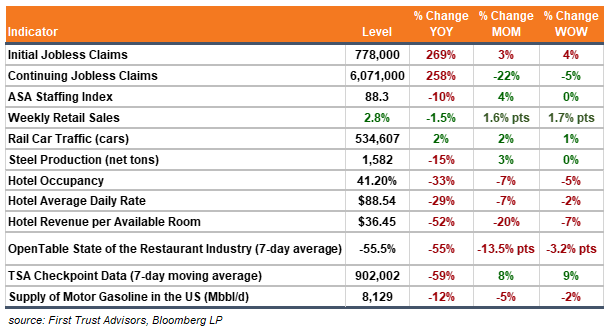

The High Frequency Data points to continuing trends from the last few weeks:

- COVID-19’s effect on vulnerable aspects of the economy, jobs and the consumer; and

- The consistent improvements in the industrial goods sector.

Initial Jobless Claims are rising again as businesses retrench with the rise in COVID-19 cases.

- Claims were up week over week and month over month.

- Continuing claims continue to decline, which is positive.

Industrial goods data points remain green.

- Steel production is up from last month.

- Rail Car Traffic is up from last month and higher than last year.

- Capacity Utilization and Industrial Production were ahead of expectations and increased compared to September reports (stats supported by Government data).

- Air travel improved, likely due to the Thanksgiving holiday, down less than 60% year over year and with a few days around Thanksgiving hitting 1 million.

- The hotels/lodging sector continues to struggle and saw little progress.

Consumer activity has continued to slow over the last few weeks.

- Consumer Retail Sales for October were below expectations and well below September.

- Consumer Confidence was below expectations with a significant miss from the Consumer Expectations component.

- Personal Income declined 0.7% below expectations of flat change and is down nearly 1% from September.

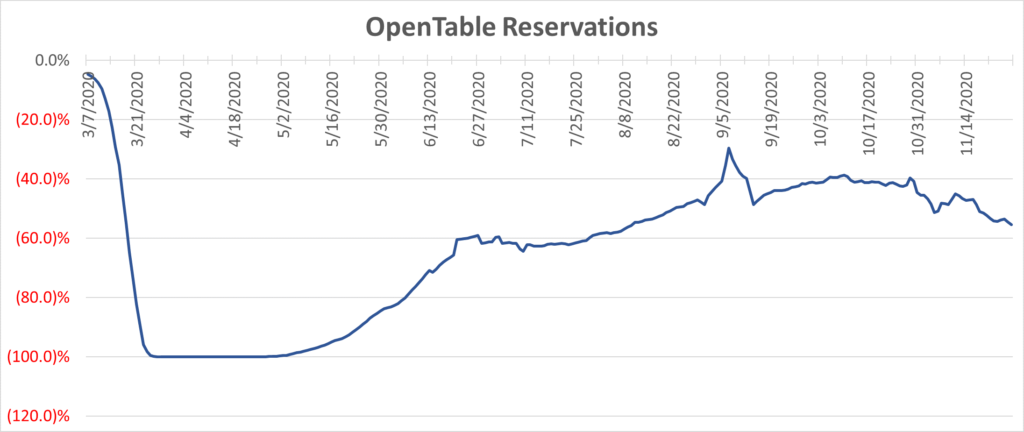

OpenTable dining has continued to decline with higher COVID-19 cases and cooler weather.

* 7-day average

Source: OpenTable

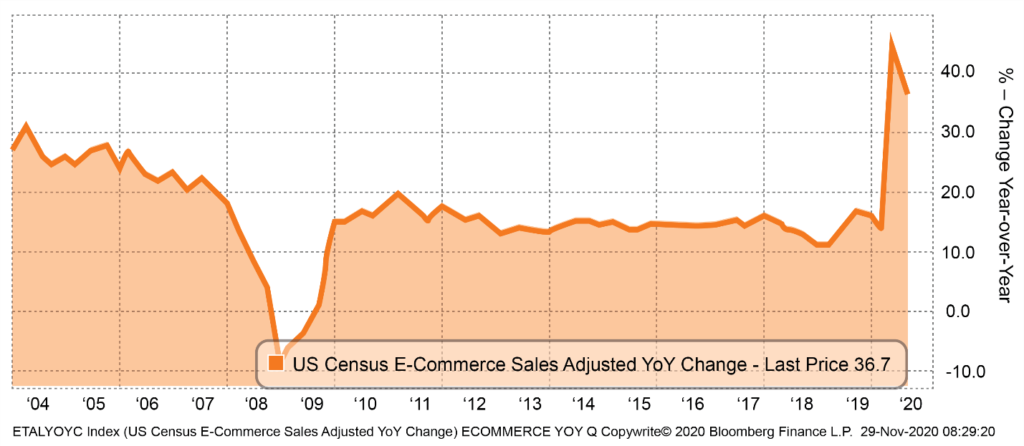

Focus of the Week – eCommerce

Q3 eCommerce growth is on fire and continued the Q2 surge as more economic activity shifted online. The multi-channel growth, including online ordering and local pickup, has accelerated.

Recent comments from retailers’ earnings calls highlight the eCommerce growth.

- Target online sales grew 155%, contributing 11 percentage points to full store comparisons.

- Q3 online sales were $2 billion, more than 2014’s full year of online sales.

- Williams-Sonoma online sales accelerated to a record comp of 49%.

- Tyson Foods online sales grew 126% in the most recent quarter and 99% for the full year.

- Home Depot online sales grew 80%, with about 60% of orders picked up at stores (as opposed to delivered).

- Lowe’s online sales grew 106%.

A Few Stories that Caught My Eye

- Black Friday 2020 the second largest online spending day in U.S. history.

- Tech world mourns the passing of former Zappos CEO.

- The big lessons from history.

- Kick like a girl – Vanderbilt plays 1st woman Power 5 Division 1 game.

To discuss these ideas and how they may affect your current investment strategy schedule a consultation with Simeon Wallis.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (November 30, 2020) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.