The Venture Capital Market – March 2020

March 13, 2020

By: Simeon Wallis, Chief Investment Officer, Wealth Management

Key Trends

As “exit multiples” – i.e. the multiples paid for venture-backed companies at IPO or sale – establish the valuation and return for earlier-stage investors, trends in the public company markets and M&A multiples will ripple to the valuations of earlier stage companies over time. As a result, start-up company investors and entrepreneurs must keep one eye on the public markets and adjust their own company valuations as the public market investors change theirs.

The big change in the venture market in 2019 was that public markets were not receptive to private company valuations and the economics of those companies’ business models to the extent private market investors expected. IPOs for VC-backed companies had mixed results, where highly anticipated “unicorns” such as Uber, Lyft, SmileDirectClub and Dropbox, struggled under the expectations of public market investors. The most glaring example was the failed IPO of WeWork that resulted in a cash crunch for the company, termination of the founder and company senior executives, layoffs and accepting a bailout deal from a prior investor at an estimated 80 percent discount from the company’s last financing round. What changed was that public market investors demanded profitability or a near-term path that achieves profitability from companies that were used to GAAC – Growth at Any Cost.

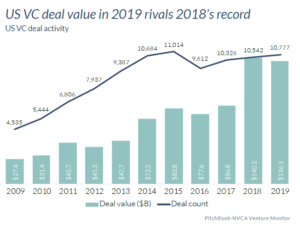

We would expect to still see a strong volume of deals, given the capital that has been raised by VCs, however at lower valuations than recent rounds, across all stages of company, as institutional investors still demand returns that meet their hurdles. According to Silicon Valley Bank, 2019 capital raised by U.S. venture funds reached $46 billion, driven by positive net cash flows and increased funds sizes. The $46 billion represents the second-highest annual investment in the last 10 years.[1]

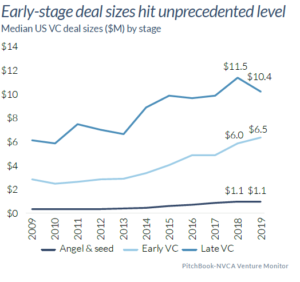

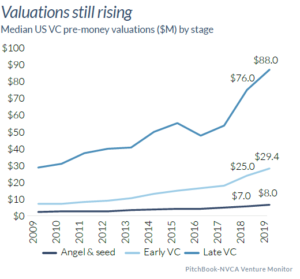

The trend of deal-size inflation continues. Deal sizes across the board are seeing high levels of funding, and as a result, valuations continue to increase. Over the last decade, the valuation of early VC and later stage VC have more than doubled

In general, start-ups are delaying raising capital. This follows a trend that started in 2012, whereby the median company is waiting approximately three years to raise funds from investors. A critical driver of this phenomenon is that the cost of starting a company has declined with the traditional costs of infrastructure, due to the growth of cloud services. Put another way, if a company does not need to purchase numerous servers and then grow into its underutilized capacity over time, and instead can procure server capacity as needed, the necessity of raising funds can be delayed.[2]

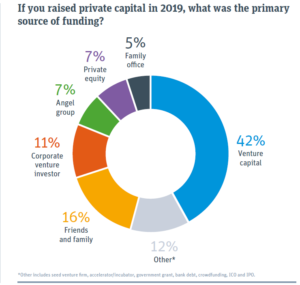

Surprisingly, in 2019, start-ups did not receive most of their funding from Venture Capital (though it was the top source). According to a Silicon Valley Bank study of nearly 1,100 companies across the globe, nearly 60 percent received funding from non-VC sources.[3]

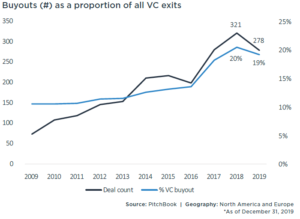

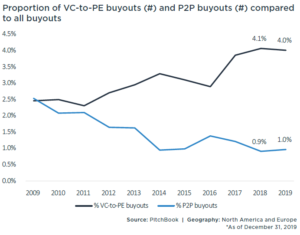

The other side of start-ups are the exit. A key trend is the role that Private Equity (a.k.a. Buyout funds) are playing in the exit process for venture capital backed companies. This will likely accelerate if the IPO window closes to VC-backed companies. According to PitchBook, Buyout firms accounted for 19 percent of VC exits in 2019, roughly double the percentage a decade earlier; this translated into over 275 exits in 2019, down from 2018, but still the second highest amount on record. Not only is private equity growing as a portion of VC-backed company exits, but it is becoming an increasing percentage of the private equity-backed acquisitions. This reflects the strong cash flow nature of SaaS-based and traditional software companies once those business have reached, or are approaching, scale.[4]

In summary, the VC market remains robust with 2019 one of the strongest years on record. There’s significant dry powder sitting at VC funds. What’s changed in 2019 is that the IPO market, and the public investors that participate in it, demanded profitability/cash flow – or a clear path to it – as opposed to the Growth at Any Cost philosophy of unicorns and their VC backers. As a result, valuation multiples have declined, which will flow through to early stage valuations soon. Additionally, private companies will have to adopt the realistic path to profitability perspective and should plan their operations accordingly. Lastly, given the significant funds raised, private equity firms are stepping in to be buyers of VC-backed companies, filling a hole potentially left by the public markets.

For questions or more information, contact Simeon Wallis, Chief Investment Officer, Aprio Wealth Management, at simeon.wallis@aprio.com.

[1] Silicon Valley Bank, Venture Monitor, Q4 2019.

[2] Ibid.

[3] Silicon Valley Bank, 2020 Global Startup Outlook

[4] Pitchbook, VC-to-PE Buyouts: Adapting the PE Playbook

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. Simeon brings two decades of professional investing experience in publicly traded and privately held companies, as well as senior-level operating and strategy consulting experiences.