How the New ASC 606 and ASC 340 Guidance Impacts SaaS Companies

July 21, 2021

ASC 606 and ASC 340 at a glance:

- The main takeaway: Many companies have already implemented the new ASC 606 and ASC 340 guidance but have found that the new standards are complex and come with a wide range of implications.

- Impact on your business: Implementation cost allocation and commission expense deferral are two of the most significant challenges SaaS companies have had to deal with from both a dollar and recordkeeping perspective.

- Next steps: Aprio’s expert team can help companies better navigate the new guidance for a smoother transition and fewer disruptions.

Schedule a free consultation to learn more.

ASC 606 and ASC 340 – the full story:

Companies were required to adhere to and implement ASC 606 Revenue from Contracts with Customers and ASC 340 Other Assets and Deferred Cost (which we’ll collectively refer to as the “new guidance”) for years starting after December 15, 2018, prior to another extension by the Financial Accounting Standards Board (FASB) on May 20, 2020. This extension extended the effective implementation date to years starting after December 15, 2019.

Many of Aprio’s clients have already implemented the new guidance, but we feel it’s important to share the most common changes from prior guidance that have had the biggest impact on SaaS companies —from both a dollar and recordkeeping perspective.

1. Is implementation distinct?

The most significant impact companies have dealt with after adopting the new guidance relates to Step 2 and determining performance obligations.

Under prior guidance, for a deliverable to be recognized as a separate element, it had to have value to a customer on a standalone basis. The delivered item had value on a standalone basis if it was sold separately by any vendor or the customer could resell the delivered item on a standalone basis. SaaS companies that performed all of their own implementations generally couldn’t recognize the implementation as a separate element and would have to defer the implementation fees over the estimated life of the customer.

Under ASC 606, the terminology has changed, and a promised good or service is required to be separately accounted as a performance obligation if it is distinct; this is in contrast to the old terminology, which stated that an element was required to be separately accounted for if it had standalone value to the customer.

A good or service that is promised to a customer is distinct if both:

- The customer can benefit from the good or service either on its own or together with other resources that are readily available to the customer, and

- The entity’s promise to transfer the good or services to the customer is separately identifiable from other promises in the contract (that is, the promise to transfer the good or service is distinct within the context of the contract).

Companies need to evaluate the underlying guidance and interpretations closely to conclude whether implementation fees for their company are distinct and can be recognized as a separate performance obligation. Under the new guidance, more SaaS companies — especially those in which implementation is not complex — have concluded that their implementation fees are distinct, which has allowed them to accelerate revenue.

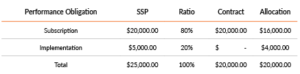

One of the downsides to concluding implementation is a distinct performance obligation, which comes into play when implementation fees are waived; total contract consideration needs to be allocated to the performance obligations based on their standalone selling prices (SSPs).

Companies are required to establish SSPs for each of their performance obligations and allocate contract consideration to all the performance obligations in the contract. When implementation is provided for free, the company in question will need to reallocate contract consideration from other performance obligations in the contract.

For example, consider a simple SaaS contract which has two performance obligations, including a one-year subscription and implementation. The company’s SSP for the subscription is $20,000 and $5,000 for implementation, but the contract includes $20,000 for the subscription and $0 for the implementation. In this example, the company is required to allocate the contract consideration based on the relative SSP and would allocate $4,000 to the implementation and $16,000 to the subscription.

This was one area of the new guidance that companies spent the most time implementing. Companies not only needed to calculate the impact of the reallocation, but they also needed to change processes in their accounting software to avoid manual computations going forward.

2. Commission expense deferral

The other most impactful change we identified for SaaS companies relates to contract costs. Under prior guidance, contract costs could be expensed as incurred or capitalized and amortized, which created inconsistencies in practice.

The new guidance requires contract costs to be capitalized in certain circumstances. Commissions were the most common area of contract costs impacted by the new guidance. Most companies expensed commissions as incurred prior to their adoption of the new standard. Under the new guidance, if commissions are paid as a result of obtaining a contract or contracts, and they are considered to be recoverable, they are required to be capitalized if the amortization period, which includes anticipated renewals, is longer than a year. The contract costs are amortized over their “useful life,” which the guidance defines as the period over which an asset is expected to contribute directly or indirectly to future cash flows.

Under the old guidance, the period for amortization was the average customer life; for companies that have high customer retention rates, the length of that time period could be significant. Although many companies do use their average customer life for an amortization period, the guidance allows alternative approaches, including using the life of the underlying software platform. This alternative life approach can simplify the need to adjust the amortization period each year as the estimated customer life changes, as long as it is consistently longer than the life of the underlying platform.

The bottom line

The new guidance is complex and, as you can see, it also has a wide range of implications for SaaS companies. Fortunately, Aprio is here to help. We can partner with you to help you adhere to and implement the new guidance and ensure a seamless transition for your SaaS company.

To schedule a consultation and discuss the implementation process in greater detail, contact us today.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

Recent Articles

About the Author

Robert Casey

Rob is known for combining deep, technical audit experience with common sense, resulting in not only time savings for his clients but also cost savings. His approach also reduces the complexity of quarterly filings and annual closings. He specializes in revenue recognition, working with high-tech companies, especially SaaS and software businesses. Over the past 20 years, Rob has reviewed thousands of contracts in the manufacturing, distribution, technology and service company industries to discover potential revenue recognition issues. Rob’s expertise has led him to be the ideal business coach and consultant for many of his clients, positioning them for smart growth.

(404) 898-7432