IRS Tax Notices 6173, 6174, and 6174-A, What They Mean and What To Do.

December 2, 2019

Did you receive the IRS tax notice 6174, 6174A or 6173 in connection with your virtual currency transactions?

If you had virtual currency transactions in any of the relevant tax years (2013 through 2017), you may have been one of the 10,000 taxpayers who received a tax notice letter from the IRS recently.

If you are not concerned by this, remember the IRS has an impressive track record of identifying tax evaders and enforcing tax law. The agency made history in helping put Al Capone behind bars, the infamous gangster who eluded the FBI ultimately succumbed to the IRS. To this day the IRS has continued to shatter the false presumptions that one could outsmart the agency. For example, Silk Road involved computer geniuses but that did not stop the agency’s 2013 crack down on this online drug distribution network.

In December 2016 the IRS issued a summons demanding information on 500,000 Coinbase customers. On Nov. 28, 2017 after a court battle with the IRS, the United States District Court for the Northern District of California ordered Coinbase to provide the IRS with the following documents for accounts with at least the equivalent of $20,000 in any type of transaction on its’ platform during the 2013-2015 years:

-

- Taxpayer ID # or Social Security Number

- Name

- Birth date

- Address

- All transactions in the account(s)

On Feb. 23, 2018 Coinbase notified a group of approximately 13,000 customers about this summons regarding their accounts. If you received that notification, it is likely you received one of the three letters the IRS sent out.

Lack of guidance was never a valid excuse

According to the IRS Notice 2014-21, virtual currency transactions are to be treated as property for tax purposes.

On the basis of virtual currency transactions being property, few individuals have taken the position to apply like-kind exchange rules. The Tax Cuts and Jobs Act (TCJA) clarified that ‘like-kind exchange’ only applies to real estate transactions effective, Jan. 1, 2018. Prior to this date, there remains a question as to whether virtual currency transactions could take advantage of the like-kind exchange rules. While the current letters in circulation do not discuss like-kind exchanges, they do suggest that like-kind exchanges do not apply to virtual currency transactions.

Even though the guidance on virtual currency transactions has been sparse, that has never been a valid ground to skip the tax reporting obligations.

Understanding the intensity of each letter type

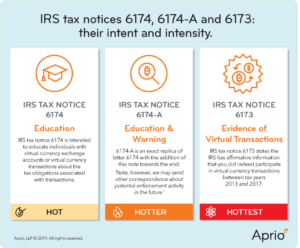

The IRS has issued three types of letters based on the information they have on each individual taxpayer, and in the order of intensity they are: 6174, 6174-A and 6173.

IRS letter 6174 is aimed at educating the individuals with virtual currency exchange accounts (or other virtual currency transactions) about the tax obligations surrounding virtual currency transactions.

IRS letter 6174-A is an exact replica of letter 6174 with one difference and that is this note towards the end: ‘Note, however, we may send other correspondence about potential enforcement activity in the future.’

Essentially, this note puts taxpayers on notice that the IRS can take action in the future if any non-compliance is proved based on any information that the IRS may obtain.

Any transaction other than simply purchasing virtual currencies creates a tax event. According to the IRS letters, this includes exchanging one virtual currency for another (for instance, Bitcoin for Ether) or receiving new coins as payment for services and making payments for any goods or services with virtual currencies. What the 2014 IRS notice nor the three letters circulating today do not address is how to treat for tax purposes new coins received in a hard fork for holding certain virtual currencies. For instance, receiving Bitcoin Cash for holding Bitcoin, or receiving coins for free in an airdrop.

That brings us to the most critical of these notices: IRS Letter 6173.

If you have received the IRS tax notice 6173 letter, it means the IRS has affirmative information that you did indeed participate in virtual currency transactions between the 2013 and 2017 tax years.

You will have to gather all the information for respective tax years and compare it to what was reported on your tax returns to see if there are any discrepancies. The fact that the IRS issued Notice 6173, means it’s more likely that you may not have reported all your virtual currency transactions.

What to do if you have received the IRS letter?

First, take a deep breath. While any correspondence from the IRS should be taken seriously, there is no need to panic.

Understanding the intensity behind each of these letter types as described above, you have to review the letter and assess the next steps based on your personal situation by answering these questions:

Did you have any virtual currency transactions that needed to be disclosed in relevant tax years? Were they disclosed?

Do you believe that the IRS has issued notice based on sales you made on virtual currency exchanges, such as Coinbase, and you are certain you have no other transactions?

If the only transaction you have is purchases, then there may be no tax reporting at this point and you can ignore the correspondence if you received the IRS Notice Letter 6174.

For taxpayers with any type of transaction outside of simple purchases, you have to look at some important aspects.

Retroactive amendments may be required: If you do believe you have virtual currency transactions that were not properly reported before and you have received IRS Letter 6174-A or 6173, then you should take proactive steps to amend your tax returns and get your tax reporting up-to-date.

Getting current with your reporting obligations is not enough: When you amend the tax returns to report previously undisclosed transactions, the IRS will have the right to assess interest and penalties, including negligence related penalties.

“For individuals, the understatement of tax is substantial if it exceeds the greater of $5,000 or 10 percent of the tax that must be shown on the return.” In other words, if your tax result changes by $5,000 or more due to amending your tax returns, the IRS may assess a negligence penalty.

Including a statement explaining why the transactions were not reported earlier and having appropriate back up to support the statements could help either reduce or abate these penalties at the discretion of the IRS.

Taxes and penalties are the least of your worries: If you are among the individuals who held virtual currencies in a foreign virtual currency exchange for any part of the relevant tax years and you meet the thresholds of FinCEN Form 114 regulations, then you may have to proactively correct your FinCEN Filing status.

Generally speaking, FinCEN-related delinquencies could be considered a criminal offense and you want to take steps to avoid non-compliance.

Don’t venture alone, consult a professional: What makes virtual currency transactions even more complex is that it’s not just the sale of virtual currencies that triggers a tax event, using it to pay for services or exchanging one virtual currency for another or receiving compensation in virtual currency or even merely being a recipient of an airdrop could trigger a tax event.

Unless you are well aware of the obligations and related disclosures, it is wise to use professional help in dealing with these IRS Notice letters.

Advantages of Aprio on your side

We at Aprio are considered pioneers in this space because have been helping clients dealing with virtual currency transactions since 2013, plus we started accepting Bitcoin for services in 2015.

Our professionals can work with you to assess your individual situation and help take the necessary steps.

Closing remarks/Conclusion

If you believe you have virtual transactions that needed to be reported but have not been, do everything you can to rectify the situation as soon as possible. You need to do this even if you were not among the lucky 10,000 taxpayers who received a letter from the IRS.

For assistance with your crypto-assets, contact Mitchell Kopelman at mitchell.kopelman@aprio.com.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

About the Author

Mitchell Kopelman

National Leader in Aprio’s Technology Practice, and Tax Partner, Mitchell works with SaaS companies in FinTech, HealthTech, Transaction Processing, Blockchain and Gaming. Whether a company is pre-revenue, starting up, growing, or preparing for a liquidity event, Mitchell works with them to maximize their potential at each stage. He is known for promoting research, innovation and entrepreneurship by enabling companies to be successful, regardless of where they are in their business lifecycle.

(404) 898-8231