The Pulse on the Economy and Capital Markets: July 5–9, 2021

July 12, 2021

Executive summary

- Key market news and headlines: U.S. stocks turned out another strong performance last week ahead of second quarter earnings reports.

- A new agenda from the White House: The Biden administration announced plans to boost competition across a variety of industries, ultimately fostering employee mobility and cracking down on Big Tech.

- A big week for crypto: New SPAC deals in the space and a landmark auction sale have put a renewed focus on the explosive influence of cryptocurrency in the markets and economy.

In the markets

“Big wheels keep on turning…”

The U.S. stock market continued its strong performance as the S&P 500, Dow Jones Industrial Average and Nasdaq indices closed Friday at all-time highs. Several large wealth managers, such as BlackRock, J.P. Morgan, Morgan Stanley and Goldman Sachs, commented that they see the economic outlook for growth remaining strong, despite concerns signaled in the government bond market.

This week, companies will start reporting their second quarter earnings. After doubling earnings expectations in Q1, Q2 earnings are expected to grow 91% compared to Q2 2020, when shutdowns hammered the economy. We’ll be watching for margins and how well companies have been able to increase prices to mitigate inflation.

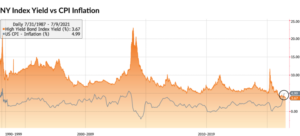

Bond investors are supposed to receive interest rates above the rate at which money depreciates (a.k.a. inflation). For the first time in decades — if not ever — the yield on high-yield bonds (formerly known as “junk bonds”) was below the inflation rate. This is akin to depositing money at a bank and earning an interest rate less than the fees banks charge.

The current anomaly reflects bond investors’ comfort that the economy will stay strong, as well as a need to search for higher yields for bond portfolios. It also shows that investors are increasingly willing to risk the most vulnerable companies and may default in exchange for marginally better yields than alternatives.

Competition: part of the Biden agenda

Competition is supposed to be at the heart of capitalism. Capital should flow to where there are profits to be made, and competition for those profits leads to product/service innovation and lower costs for customers. It also leads to more startups, more market share for smaller businesses and, thus, more job growth. That’s the theory behind capitalism.

In actuality, incumbent companies protect margins and market share by acquiring competitors. Recently, Big Tech and hospital systems have been accused of this practice. In industries with slowing growth, consolidation enables cost-cutting and typically eliminates jobs.

Last week, the Biden administration set an agenda to increase competition across a variety of industries; additionally, they proposed increasing employee mobility to pursue higher-paying opportunities by limiting noncompete agreements and industries from employing burdensome occupational licensing requirements. According to the Cato Institute, 20% of U.S. workers are employed in licensed occupations.

The “so what?”

- Acquisitive companies should start factoring in longer diligence periods and potentially higher transaction costs.

- For employers, deepening employee engagement becomes increasingly important as the barriers to mobility are reduced and employee turnover potentially increases.

Aprio can help companies manage both of these efforts through our Transaction Advisory Services and Aprio Talent Solutions. Contact us to learn more.

The Social Network hearts crypto

First the Winklevii (a.k.a. the Winklevoss twins) … now Peter Thiel.

Peter Thiel invested in the blockchain software company, Block.One, which launched the crypto exchange, Bullish. On Friday, Bullish announced that it was going public via merging with a special-purpose acquisition company (SPAC) in a deal valued at $9 billion. This was one day after another multibillion-dollar crypto SPAC deal: on Thursday, USD Coin (USDC) stablecoin affiliate Circle Internet Financial said it would go public in a $4.5 billion merger with a SPAC.

The infrastructure behind cryptocurrencies is becoming increasingly well-capitalized, meaning their investors will have the financial resources to withstand whatever volatility comes with coins and tokens.

Is cryptocurrency forever, too?

Last week, renowned auction house Sotheby’s auctioned a 101-carat diamond that sold for $12.3 million, which was paid in crypto; this was the largest payment accepted for jewelry using cryptocurrency. As we reported in a previous issue of The Pulse, Sotheby’s competitor, Christie’s, accepted $69 million for the art piece, “Everydays: The First 5,000 Days,” by the artist Beeple.

When compared to another store of value — gold — we see that Bitcoin is still holding up strong historically, even with its recent sell-off.

A few stories that caught my eye

- Richard Branson and his crew have officially embarked on their journey to space (link).

- The war between the Chinese government and American stock listings of Chinese companies claimed another victim with the plunging of the $70 billion IPO, Didi Chuxing (link).

- John Carreyrou was The Wall Street Journal investigative journalist who broke the Theranos story and the alleged fraud by its founder, Elizabeth Holmes, all of which he detailed in his book, Bad Blood. As Holmes’s trial nears, Carreyrou shares his predictions and implications for Silicon Valley entrepreneurs (link).

- Elon Musk goes to court this week to defend Tesla’s controversial acquisition of his distressed company, SolarCity. Billions of dollars are on the line (link).

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (July 12, 2021) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.