There’s No Free Lunch: What PPP borrowers should be aware of to avoid future problems

May 5, 2021

At a glance:

- The Main Takeaway: Between the pressure to distribute funding and the vast increase in the number of new applications, the Paycheck Protection Program (PPP) is ripe for fraud.

- Impact on Your Business: If you don’t have a solid understanding of the PPP, then you’re at risk for either breaking the rules or falling victim to a fraudulent scheme yourself.

- Next Steps: Familiarize yourself with the PPP guidelines, the most common types of fraud, and common missteps to ensure your business is protected and in compliance.

If you are ready to apply for a PPP loan and need guidance to ensure you’re making the right decisions, please contact Aprio today.

The full story:

When the Paycheck Protection Program (PPP) was rolled out almost a year ago, it became the largest government relief program dedicated to helping businesses weather the economic effects of COVID-19. As of this writing, the U.S. Small Business Administration (SBA) has given out (through private lenders) billions of dollars in PPP loans to small businesses affected by the pandemic. And under the recently passed Consolidated Appropriations Act, even more businesses will be eligible to apply for PPP loan funding.

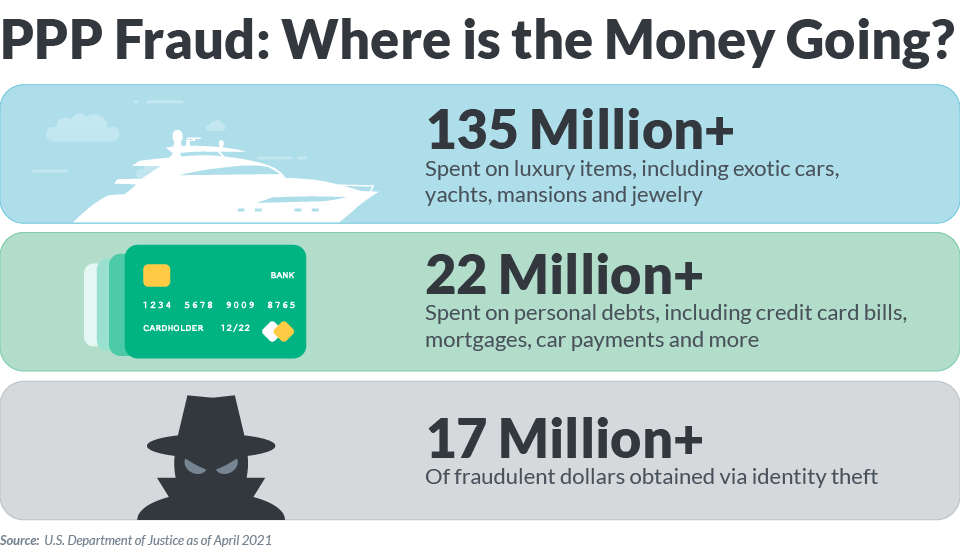

There is both internal and external pressure for the SBA to get PPP loan funding out fast, which presents internal control risk. But aside from that factor, with more PPP loan applications also comes more opportunities for bad actors to abuse the system. According to the SBA’s inspector general, as of February, more than 57,000 potentially ineligible borrowers took $3.6 billion from the PPP.[1] The U.S. Department of Justice (DOJ) has prosecuted over 100 defendants in more than 70 criminal cases related to the PPP, in addition to claiming more than $60 million in cash from fraudulently obtained PPP funds.[2]

With the evolving rules surrounding the PPP, the complex nature of the application process and the opaque guidelines, which are often subject to interpretation, the stakes are high. To help your business avoid potential investigation, litigation and missteps, it’s worth providing a refresher on how PPP loans work to ensure you’re complying with the appropriate guidelines.

Let’s recap: how do PPP loans work?

The PPP was created as part of the Coronavirus Aid, Relief and Economic Security (CARES) Act, with the goal of providing loans to businesses that had been negatively affected by the pandemic. PPP funding was designed to help businesses retain employees, maintain payroll, and keep up with necessary expenses amid lockdowns and restrictions imposed by states and municipalities. Under the PPP:

- Eligible small businesses can receive loans with a 1% interest rate.

- Loans issued prior to June 5, 2020, have a maturity of two years, while loans issued after June 5, 2020, have a maturity of five years.

- Businesses will not be charged any fees by the government and lenders.

- Businesses aren’t required to provide collateral or personal guarantees.

In terms of loan forgiveness, loan payments will be deferred for businesses that apply for forgiveness until the SBA remits the business’s forgiveness amount to the lender. If the business does not apply for loan forgiveness, payments are deferred 10 months after the end of the covered period for the business’s loan forgiveness (between eight weeks and 24 weeks, according to the SBA).

Remember that the PPP is meant to be an incentive for businesses to keep staff on payroll, which means they can only use funds for specific purposes:

- To help cover payroll costs, including employee benefits.

- To pay for rent, mortgage interest, utilities, worker protection costs related to the pandemic, uninsured property damage costs, and expenses for operations or supplier costs.

The SBA will forgive loans if businesses meet all the employee retention criteria and use the funds for eligible expenses only.

Where businesses have gone wrong

Under the CARES Act, businesses eligible for the PPP must make good-faith verification that they are using PPP loans due to financial hardship caused by the pandemic, and that they will put the funds toward the use cases outlined by the SBA. In addition, businesses must certify in good faith that they are not receiving duplicate funds from other SBA programs, and that they do not have any current suspensions, federal debarments or any delinquent federal loans (moving forward, the SBA may or may not provide more clarification around this good-faith certification in an attempt to reduce future instances of fraud).

If the SBA finds a business in violation of those terms, then that could produce an instance of fraud, putting the business in a potential investigation and lawsuit for defrauding the federal government.

With broad regulations and lack of due diligence due to the urgent nature of the pandemic’s economic impact, the PPP is extremely vulnerable to fraudulent applications or improper usage of funds by businesses since inception. There has been a wide variety of PPP fraud cases filed with the DOJ thus far, including individuals who lied on their PPP loan applications about having legitimate businesses, and individuals who claimed to use their PPP funds for the approved purposes, but instead put them toward personal luxuries, such as cars, home renovations and other items.

For instance, in February, a Florida man pleaded guilty for fraudulently obtaining approximately $3.9 million in PPP loans — instead of using those funds to support his business, he used them to purchase a $318,000 Lamborghini sports car.

Another popular fraud scheme has been the creation of false companies and falsified payroll, banking and tax return records to lead lenders to believe the applicant is both legitimate and in need of PPP funds. A Texas wedding planner was charged with one count of false bank statements, three counts of wire fraud and four counts of money laundering, in a scheme in which he sought more than $3 million in fraudulent PPP loans.[1]

The wedding planner provided fraudulent applications by claiming he had more than 120 employees earning wages when there actually were no employees working for his business at the time.[2]

The bottom line

Of course, most businesses that are applying for PPP funding are doing so in good faith; but it’s important to understand the program isn’t simply “free money” to be used at your leisure. As the SBA reopens its application process for Second Draw PPP Loans and more businesses apply for funding, it’s crucial to partner with an expert that can help you approach the process in a responsible manner, with accounting records, internal controls and documentation to support the transactions.

At Aprio, our Litigation Support and Forensic Accounting team is here to keep your business safe from potential risks. Aprio also has a nationally recognized PPP team, which regularly helps businesses navigate the application process.

If you are ready to apply for a PPP loan and need guidance to ensure you’re making the right decisions, please contact our team today.

[1] “Owner Of North Texas Wedding Planning Company Charged With Coronavirus-Relief Fraud,” CBSN Dallas-Fort Worth, June 23, 2020, accessed March 2021.

[2] Ibid, 3.

[1] Geoff Colvin, “Round 2 of PPP loans could be open to even more fraud,” FORTUNE, January 12, 2021, accessed February 2021.

[2] “Six Charged in Connection with a $3 Million Paycheck Protection Program Fraud Scheme,” U.S. Department of Justice press release (Washington, DC, January 28, 2021).

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

About the Author

Haley Beatty

Haley Beatty is a forensic accounting and financial crime reporting expert. Her specialties include anti-money laundering (AML) and know your client (KYC) investigations and regulatory compliance. Haley has advised some of the world’s largest financial institutions and has led teams of up to 500 investigators. She works closely with clients to establish and advance AML compliance, monitoring, and reporting programs that exceed regulatory requirements. Haley has experience advising a broad spectrum of financial industry clients, from FinTech companies to MSBs and transaction processors.