Top Tech Company Retirement Plan Options That Attract Top Talent

November 4, 2020

Attracting and retaining top talent is a ubiquitous challenge for tech companies and startups, an industry where competition is fierce and cash flow may be limited. In light of these challenges, businesses in the technology industry often look for creative solutions to further boost their compensation packages.

We previously discussed the value of equity incentives and stock options for growing companies in the technology industry, but another useful avenue for luring new talent is a competitive retirement plan.

Let’s look at some of the most popular retirement plan options and how some of the biggest tech companies currently compare in their offerings. These trends may inspire you to optimize your company’s retirement plan for 2021, especially if you’re planning to grow your team.

Top Plan Options

If your company is considering offering or improving a retirement plan option as a way to attract new talent, there are three primary plans you should consider. These are the three plans most offered by big tech companies, so they’re a good first step to ensure your compensation packages are competitive in the industry.

- 401(k)

Most employers and employees are familiar with 401(k) plans, and justifiably so – they are, by and large, the most popular employer-sponsored retirement plan option.

In a 401(k), employees make contributions directly from their paychecks, and employers have the option to match that contribution to maximize savings. This type of plan is designated as a “qualified” retirement plan, meaning it is eligible for special tax benefits.

More employers are also including the ability to contribute after-tax or Roth dollars to the 401(k) plan. This plan provision allows employees to pay taxes on the contributions today and enjoy tax-free earnings and distributions in retirement.

A competitive 401(k) package likely includes a strong employer contribution, so if you offer (or are considering offering) a 401(k), you need to evaluate your position on employer contributions. Aprio can help you maximize your potential contributions without overextending your company’s financial position.

- Profit Sharing

If you’re not sure whether a 401(k) with employer contributions is right for your business, but you still want to provide a strong retirement incentive for your employees, you may want to consider a profit-sharing plan.

The profit-sharing plan can be set up as a standalone plan or offered alongside a 401(k) plan. Profit sharing is a discretionary employer contribution, meaning employees have no control over how much is contributed or when the contribution is made. The amount each employee receives is typically set as a percentage of their annual compensation, and companies generally make a profit-sharing contribution once per year.

Like with employer contributions to a 401(k), you may be unsure of the most appropriate amount to contribute if you choose to offer a profit-sharing plan. There are some standard calculations to guide this determination, but the best way to build this plan is by working with an expert advisor who can make suggestions based on your unique business needs.

- Nonqualified Deferred Compensation (NQDC)

An NQDC plan, also called a 409A plan, is compensation that an employee earns but has not yet received from their employer. Because this compensation is not yet part of the employee’s earned income, it is not counted as taxable income, which provides a popular workaround for high earners who are subject to the cap on employee contributions to traditional retirement plans.

NQDCs allow these high-income earners to defer ownership of their compensation to avoid income taxes and maximize investment growth. For this reason, NQDCs are a popular option for very large tech companies with employees whose income and potential contributions exceed the limitations of traditional retirement plans.

This type of plan is not appropriate for every business, but it may provide a competitive incentive if your company is looking to hire C-suite or other executive positions that may earn a higher wage.

How Tech Companies Compare

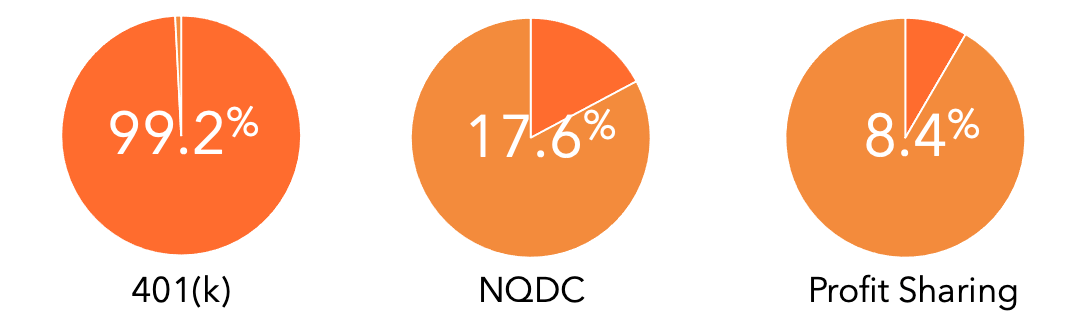

To offer a competitive retirement package as a tech company, it’s important to understand the current trends in the industry. The visual above illustrates how the three most popular plans, including 401(k)s, NQDCs and profit sharing, are currently represented in the technology industry. This should allow your company to assess where they stand in comparison.

Based on this data, it is safe to say offering a 401(k) is table stakes if you want your package to be competitive, but any options beyond that begin to sweeten the pot. While the popularity and appropriateness of plan options can vary by the size of the company, they each have their merits and are worth considering as you seek to optimize your own company’s retirement package.

For instance, while more than 8% of all tech companies offer profit sharing, the popularity of this option goes up as the size of the company goes down. This suggests profit sharing could be a useful option for smaller startups looking for creative compensation options. Alternatively, while an average of nearly 18% of tech companies offer NQDCs, that percentage rises sharply for larger companies. In fact, 50% of all tech companies with more than $1 billion in revenue offer NQDC plans, illustrating its popularity with higher revenue companies.

The Bottom Line

There is no more important component to a tech company’s success than its employees. Offering creative compensation packages that include incentives like competitive stock options and retirement plans is a tried and true way to attract the best talent and grow your company. To make sure your company’s retirement stands up to the competition, work with a knowledgeable advisor who can assess your business needs and recommend a comprehensive package.

At Aprio, we act as your holistic advisor to ensure your company’s retirement plan design meets your corporate goals, especially as a growing company. We use the latest research to make sure your company’s 401(k) plans are competitive, while also helping you maximize your contributions and tax savings. For more information about optimizing your company’s retirement plan for 2021, contact Michael Saulnier, Director of Aprio’s Retirement Plan Services.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.