Summary: Aprio industry leaders explored how indirect rates have evolved from a compliance checkbox into a critical driver of operational excellence, pricing power, and enterprise value. The introduction of the One Big Beautiful Bill (OBBB) Act reshaped the federal marketplace. Understanding and optimizing wrap rates has never been more essential for contractors seeking to maintain their competitive edge, as more commercial firms enter the government contracting industry.

What are Wrap Rates?

Wrap rates, also referred to as the direct labor “multiplier”, is a fully burdened labor rate, the rate at which an organization must bill out its direct labor units to cover its direct and indirect costs, before any profit is made. It is also known as Loaded Labor Rates (with or without fee), Fully Loaded Rate, Fully Burdened Rate, Billing Rate, etc.

What Does It Mean to Have Wrap Rates at the Center of Operational Decisions?

Wrap rates should be central to every major operational decision and not just an afterthought. Each major business decision you make, considering wrap rates, directly impacts your business’s competitiveness, whether you transition from capability-based to customer-facing business units or adopt matrix delivery models.

On the mergers and acquisitions side, the OBBB enables the consolidation that we have been seeing in the government contracting space. For organizations implementing the wrap rate discipline, the fortress balance sheet is considered a top-line growth driver, alongside cost management and EBITDA preservation. This approach helps leadership understand whether operational shifts will maintain competitive positioning or inadvertently price the organization out of target markets.

Benchmarking emerged as a critical discipline, particularly end-to-end process benchmarking that examines costs across functions (like procure-to-pay or hire-to-retire) rather than isolated monoliths. Using wrap rate as part of your operational decision-making rubric significantly strengthens your organization.

Wrap Rate as a Dynamic Enabler of Price Range

Unless operating at the cutting edge of technology, most government contractors face intense price competition across their pipelines. Wrap rate is the key performance indicator (KPI) that rewards cost management leaders, as demonstrated by the Pwin seen across your pipeline, EBITDA, and balance sheet. If your business is in the market to sell or buy, having the ability to assess wrap rates is a differentiator for a potential acquisition or getting an optimal enterprise value.

In the current business landscape, competitive wrap rate and price are paramount to Pwin. You should understand the taxonomy of your bid wrap, native wrap segments, service centers, IWTA, subcontractor blend, and bid-specific levers to stay competitive.

A particularly valuable tool that was discussed in the webinar was the advanced agreement with approval by the government. It may be time-consuming to establish, but advanced agreements provide cost certainty, reduce audit risk, enhance budgeting predictability, and create flexibility for corporate-focused bids or must-win recompetes. These agreements align the government and contractor on pricing, allowability, and indirect rate treatments, streamlining everything from proposal development to contract closeout.

Here are the benefits of advanced agreements:

-

- Cost Certainty: reduces the risk of later disputes with DCAA or the contracting officer and protects the retroactive disallowances or penalties.

-

- Predictability: helps your business with budgeting, forecasting, and process, and has a positive impact on company culture.

-

- Better Financial Planning: it’s going to be more competitive and compliant and is aligned with the budget process.

-

- Increased Efficiency: saves time and reduces the administrative burden.

-

- Rate Development: enables better pricing strategies and more accurate proposals.

-

- Improved Audit Process & Readiness: speeds up incurred cost audits and contract closeouts.

For contractors, this translates into faster audits, better alignment of financial planning across functions, and the ability to use rate structures strategically rather than reactively. It’s critical to think of your ‘effective’ wrap rate as a dynamic enabler of the price range, not a frozen integer on a page to which the direct cost strategy should yield.

Enterprise Value (M&A)

Enterprise value is the third pillar to the competitive advantage for wrap rates, and targets with competitive, strategically aligned, and well-managed wrap rates trade at premium multiples. There is a premium for cost management, as reflected in the wrap rate. As mentioned above, wrap rate is considered a leading KPI on buy-sell transactions, and no matter which side of the transaction you are on, it’s good practice to have a focus on the wrap rate. It is recommended to include wrap analysis, with particular focus on segment disclosure and the allocation model, in your M&A search criteria.

A frequently overlooked opportunity is the post-close DCAA restructuring proposal, which can justify two-to-one (sometimes three-to-one) cost recovery on acquisition-related expenses. Many private equity-backed deals miss this opportunity, leaving costs that would otherwise be allowable as an anchor that drags down margins. Harmonizing cost structures to recover restructuring costs through wrap rates can be substantial.

Why are Award & System Considerations Necessary?

What’s necessary from a financial planning & analysis (FP&A) standpoint for developing wrap rates to be competitive, especially if you’re looking to get into new agencies or engage in any M&A activity, is to look at these considerations and see if they still make sense:

-

- Contract Requirement

-

- Reporting Requirement

-

- Timekeeping

-

- Billing

-

- Project Ledger

-

- Cost Accounting

-

- Generally Accepted Accounting Principles (GAAP)

Generally, making sure that, from an accounting standpoint, everything is auditable, especially if you are looking to get acquired or potentially acquire a business. Multi-year financial statement audits are typically requested, so having these different areas of the business in place to pull information from can help drive the transaction.

Composition of Total Cost

Total contract cost combines direct and indirect costs to represent the full cost of a project. Direct costs are expenses clearly linked to a specific project, such as labor and materials. Indirect costs are general expenses, such as overhead and administration, not tied to any one project.

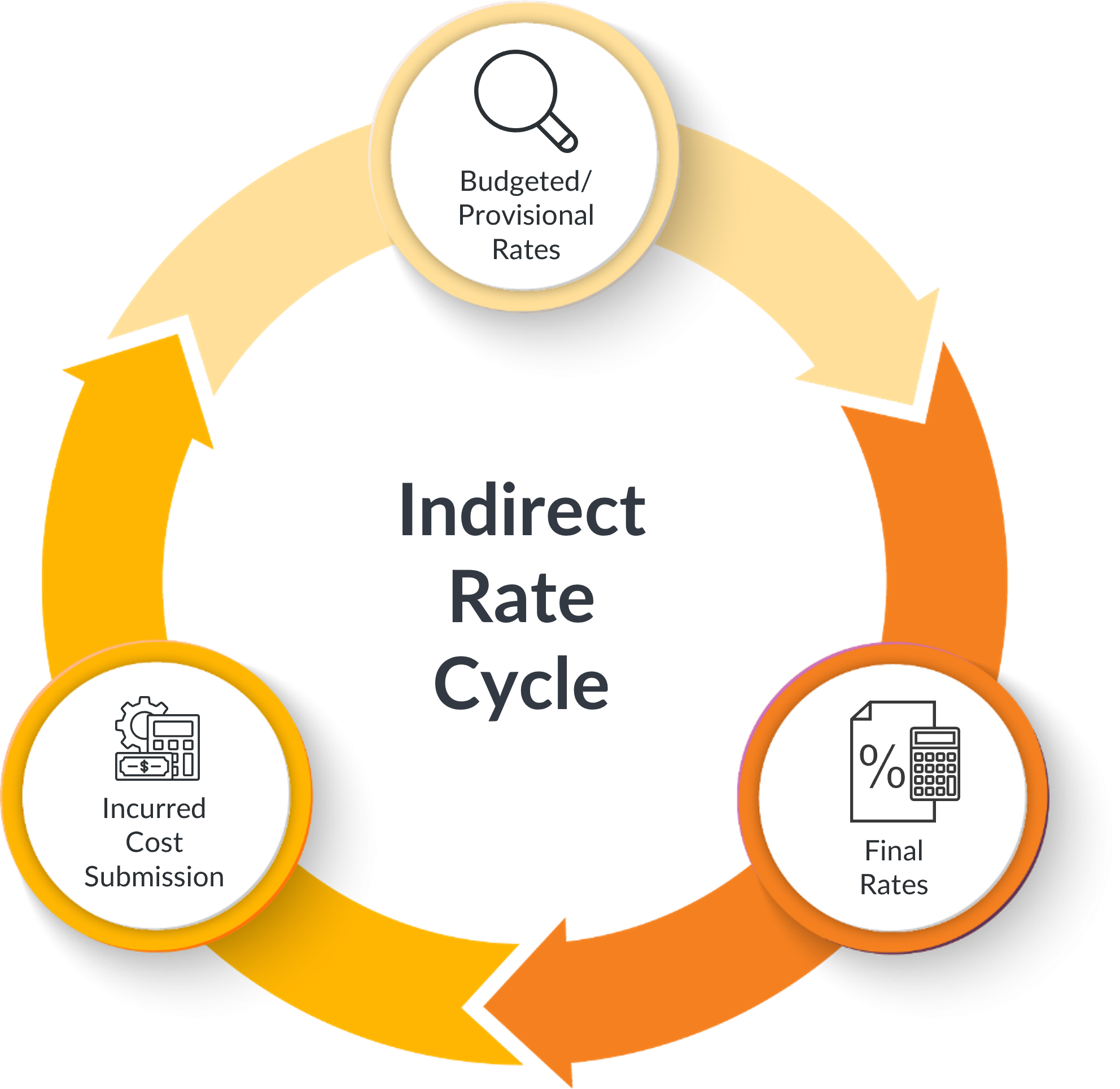

Indirect Rate Cycle

The indirect rate cycle is in sync with forecasts and projections. We see the rates as a full cycle, monitored the whole year. As you monitor it, you might adjust mid-year if provisional rates change, especially if there’s a fluctuation. Maybe a contract gets lots midway, or there’s an unplanned big purchase, or there’s an instance where you had a Pwin very low. These changes, whether sudden or controlled, can drastically change your rate.

It’s one big cycle, and you need alignment with the overall business strategy. Have regular check-ins to assure everything is aligned and that your business development team is aligned with your strategic vision for this rate cycle.

Levers of Rate Structures

A good strategy when evaluating levers is to consider the rate structure holistically. Does it represent your organization? If so, is it a good representation of your organization? Remember, when we look at rates, we are guided by the organization’s strategic vision. What are the goals? What wrap rate do you need to reach? The rate structure should be defined by your organization and tailored to its needs.

The rate structure should align with your budgeting and forecasting strategy and with the strategic goals you are pursuing. Look at your costs, improve them, and make sure they reflect the structure itself to be competitive and drive the bottom line.

Three Different Types of Pools

What areas can you look into to refine your rates and costs?

1. Fringe Pool

These are the common costs from a fringe pool standpoint: benefits, insurance, PTO, sick leave, jury duty, retirement, taxes, bonuses, and payroll admin fees.

2. Overhead Pool

These are the common costs from an overhead pool standpoint: training, scheduling, recruiting, travel, licenses, management, facilities, IT/equipment, conferences, and geographic location.

3. General & Administrative Pool

These are the common costs from a general & administrative pool: finance, travel, c-suite, insurance, legal, corporate, accounting, IT/equipment, business development, procurement, contract admin, and consultants.

Some questions to consider: How do you define each type of common cost? Is it a company-wide plan? Is it legally documented? Can you reduce a specific cost? Do you have SCA or collective bargaining? Who is receiving the benefit of that cost? It’s essential to look at it everywhere because these costs could really affect your wrap rate.

When entering post-acquisition integration, having a defined timeline and being able to justify, with good documentation, that two-for-one savings can help recover many of these costs enables you to be competitive and assure a profitable recovery.

System Impacts

When discussing wrap rates, you must be on the same page on terminology. You need to clarify the fee structure and understand each other’s perspectives from a systems standpoint. There are some fundamental aspects of these systems that this information is derived from, including your accounting system and financial reporting.

-

- The Pre and Post Award Accounting System review determines the adequacy of a contractor’s cost accounting system.

-

- The Financial Accounting System reports total amounts incurred for each cost element (labor, materials, etc.) at a company-wide level.

-

- The Cost Accounting System distributes and allocates costs among specific contracts, jobs, or other cost objectives in a causal/beneficial relationship.

-

- The Estimating System includes budgeting and planning controls and generates estimates of costs and other data included in proposals.

When developing your wrap rates, recognize that different cycles can impact your indirect costs. If you’re undergoing an audit of these rates, make sure you know which department or team is conducting it. Having an advanced agreement can simplify and expedite the audit process. So, familiarize yourself with these agreements and understand when to push back.

Who is Responsible for Subcontractors?

If you’re a subcontractor, the Prime contractor is the one responsible to “flow down” the requirement for an accounting system if awarding a contract based on cost. It’s critical to clarify roles in large organizations entering the government sector from a commercial background, as it can get confusing. Many start as subcontractors to build their past performance. Remember, if you are the prime contractor, you are responsible for the project, while subcontractors work through the prime.

The System Considerations

From a system standpoint, several issues arise when creating a competitive wrap rate. First, there’s often inadequate separation between direct and indirect costs, which leads to inaccurate pricing and costing. Costs may be categorized inconsistently, sometimes as overhead or general and administrative (G&A) expenses, making it essential to map these costs and their beneficiaries clearly.

Timekeeping can also be overly general, lacking the detail needed to differentiate between departments. Additionally, many companies overlook unallowable costs, either failing to identify them or choosing to ignore them, which negatively impacts profit margins.

Lastly, assure that your procedures comply with Generally Accepted Accounting Principles (GAAP) and Cost Accounting Standards (CAS). Having the right technology is also essential for effective cost allocation, especially for manufacturers managing costs across multiple projects.

Final Thoughts: Wrap Rates are Strategic Tools, Not Compliance Obligations

Wrap rates are more than just tools. From a competitive standpoint, how do operational discipline, pricing power, and enterprise value relate to your FP&A process and the development of your indirects so you can approach the market in a more strategic and competitive position? Understanding these relationships can position you more strategically in the market.

Mastering wrap rates is key to achieving strategic dominance and should be a focus in organizational decisions across operational, pricing, and transactional areas. As the federal marketplace continues to change under the OBBB, government contractors need trusted advisors who understand both compliance requirements and strategic value creation.