Summary: Canada enters 2026 with slow but stabilizing growth, with consensus forecasts placing real GDP expansion in the 1.2%–1.4% range. The economy has moved past its mid-2025 contraction and is gradually regaining momentum. Trade uncertainty remains the biggest drag on this recovery: U.S. tariff volatility and the upcoming 2026 CUSMA review continue to hold back business investment and disrupt export patterns. Against this backdrop, public capital spending has become a central driver of growth. This article explores GDP growth trends in 2025 and the insights business leaders can derive from the data heading into 2026.

Canadian business leaders can be forgiven for being more cautious than optimistic when reading GDP forecasts. The numbers don’t feel like they match the pace of the practical business environment with outlooks always seeming a bit better than data on the ground. External shocks like the U.S. tariff shifts and geopolitical tensions only add to the uncertainty. Therefore, any meaningful assessment of Canada’s growth path into 2026 must begin with insights drawn from varied sources.

This outlook does exactly that.

The data coming in from the recent federal budget (Budget 2025), the International Monetary Fund (IMF), ratings agencies, and private economists show an economy working through real frictions, including weaker investment, unpredictable trade conditions, softer labour-market dynamics, and population-growth adjustments. Yet the same research also shows the contours of a gradual improvement supported by stabilizing exports, firming domestic demand, public-sector capital spending, and inflation returning to target range.

GDP forecasts don’t solve systemic business issues, but they do reveal the forces shaping financing conditions and buyer behaviour. Taken together, these signals form a practical roadmap for planning budgets and hiring cycles for 2026.

A Slow Expansion Takes Shape

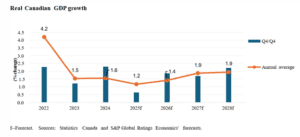

The emerging consensus places real GDP growth at 1.2% in 2025 and 1.4% in 2026, according to S&P Global Ratings. The federal government’s private-sector survey sits slightly below that, at 1.1% for 2025 and 1.2% for 2026. The numbers differ at the margins but send the same signal: growth is returning, although gradually and under tight constraints.

The S&P’s quarter-over-quarter projections underline this path. After the economy contracted in Q2 2025, momentum improved through the second half of the year. The fourth quarter is expected to post a mild uptick, helped by firmer payroll growth, a modest lift in business sentiment, and one-off consumer activity tied to major sporting events. While the lift is limited, it marks a shift from stall speed to measured expansion heading into 2026.

Figure 1: Real Canadian GDP Growth

Data from Trading Economics supports this direction. GDP expanded at 2.2% in the first quarter of 2025, driven largely by firms front-running U.S. tariffs. Growth then contracted by 1.6% in the second quarter as exports fell sharply and business investment softened. The economy recovered in the third quarter with 2.6% annualized growth, supported by a stronger trade balance and a surge in government capital spending, particularly defence investment and institutional building upgrades.

The data suggests that the worst of the slowdown is behind us, and while the recovery will not be fast, the base case shows a return to steady, moderate growth as the calendar turns to 2026.

Trade Frictions Continue to Shape the Recovery

The U.S. tariff environment remains the central variable for Canada’s growth trajectory. Stated tariff rates jumped sharply across 2024 and 2025, though the effective rate on Canadian exports remains lower than headline figures suggest: 3.8% based on U.S. collection data and 5.9% based on Bank of Canada estimates. High compliance under the CUSMA has insulated much of Canada’s export base.

Even so, the impact on investment has been pronounced. According to tBudget 2025, businesses delayed or cancelled projects in the first half of 2025, and private-sector forecasters expect investment weakness to continue while uncertainty around the 2026 CUSMA review remains. Manufacturers and exporters have felt the strain most directly, with sentiment falling and hiring softening in tariff-exposed segments.

According to S&P’s economic outlook report for 2026, exports to the U.S. fell 2.5% from January to August 2025 compared with the previous year, while exports to other markets rose in a clear sign of trade diversion prompted by tariff risks. These shifts have softened Canada’s productive capacity and contributed to uneven growth in 2025.

The good news is that the baseline assumption across major forecasters is that trade conflict will gradually de-escalate through 2026. While this expectation supports the GDP outlook, it also carries significant uncertainty.

Policy and Public Investment Play a Larger Role

With private investment still soft, public capital spending has moved to the foreground. The Budget 2025earmarks C$280 billion in additional investments over five years, covering infrastructure, productivity, competitiveness, defence, and housing. Ottawa expects this to contribute to a total of C$1 trillion in combined public and private capital formation.

That scale is critical. It supports non-residential structures, advances energy and defence capabilities, and reinforces long-term housing supply. These are all areas that influence project pipelines for multiple sectors.

The IMF endorses this investment-led strategy while recommending clarity around Canada’s fiscal anchor. Its latest review argues for reinstating a debt-to-GDP anchor instead of the deficit-to-GDP anchor to reinforce credibility and help ensure investment plans remain sustainable.

Labour Markets and Inflation Move Toward Balance

The labour market has eased without collapsing. Employment gains in September and October 2025 were sizeable but centred in part-time positions, indicating underlying softness. Hours worked and job-finding rates remain muted.

According to the S&P, the unemployment rate is expected to improve from an average of 6.9% at the end of 2025 to 6.6% in 2026, a modest but positive shift. It signals that hiring conditions could stabilize for operators and they will be able to retain more labour.

Figure 2: Canadian Unemployment Rate

Inflation continues to move towards the Bank of Canada’s target. Core inflation is expected to average 2.6% in 2025 and 2.4% in 2026, with headline inflation remaining inside the 1%–3% range due to the removal of reciprocal tariffs and the earlier elimination of the carbon tax.

The Bank of Canada also cut its policy rate to 2.25% in October and has signalled a pause. Forecasters expect the rate to hold steady through 2026, keeping borrowing costs predictable, which will be crucial for businesses planning capital projects or refinancing.

Scenario Mapping: What Could Shift the Path

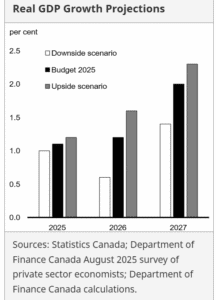

Budget 2025 offers clear scenarios that matter for business planning.

Figure 3: Real GDP Upside & Downside Scenarios

Downside risks include persistent trade conflict, weak oil prices, and slower U.S. growth. These are factors that can push Canada into a period of near-zero activity in late 2025 and early 2026. Under this scenario, real GDP could contract in Q4 2025 and stall afterward, with higher unemployment and roughly C$51 billion less in nominal GDP per year through the forecast horizon.

The upside scenario depends on faster resolution of global and bilateral tensions. Easing tariffs and stronger U.S. growth combined with an increase in business investment could lift Canada’s performance, adding C$25 billion in nominal GDP per year.

What This Means for 2026 Planning

As a business decision-maker, here are some important takeaways around the Canadian growth outlook:

- Conditions will likely improve, but not fast enough to erase the pressures of the past two years.

- Cross-border strategy requires more attention than usual due to tariff uncertainty and shifting U.S. demand.

- Public-sector investment will be a major source of opportunity, especially in infrastructure and defence.

- Borrowing costs remain predictable, offering planning stability even if capital is not cheap.

- Domestic demand will grow but unevenly, as population dynamics and labour-market softness work through the system.

The path to 2026 is clearer than it was a year ago. For operators who build plans around steady footing rather than rapid upswing, this environment offers a workable foundation shaped by resilience and a gradual recovery.

To learn more about how the Canadian growth outlook may impact your 2026 business plans, schedule a consultation with Aprio today.

Sources:

https://budget.canada.ca/2025/report-rapport/overview-apercu-en.html

https://tradingeconomics.com/canada/gdp-growth

https://www.cbc.ca/news/business/canadian-economy-resilient-trade-shock-imf-report-9.7004484

https://www.rbcwealthmanagement.com/en-asia/insights/global-insight-2026-outlook-canada