The dental economy is settling into a more predictable pattern as 2025 draws to a close. Hiring pressures have eased, wages remain high, and patient demand varies by service type. Now is the time to tighten operations, invest in your team, and position your practice for long-term growth.

Here are six key insights to consider as the new year approaches.

1. Dental job postings have stabilized after years of sharp swings

After a period of heavy volatility, job postings for dental offices have flattened and now closely track national hiring trends. The market is steadier, with year-over-year growth just above zero.

Indeed.com Job Postings for Dental

Key takeaway: The competitive and costly hiring market is beginning to ease. Practices can prioritize retaining excellent staff instead of hastily filling vacancies. Thoughtful hiring and retention investments are now feasible without competing against numerous offices offering signing bonuses.

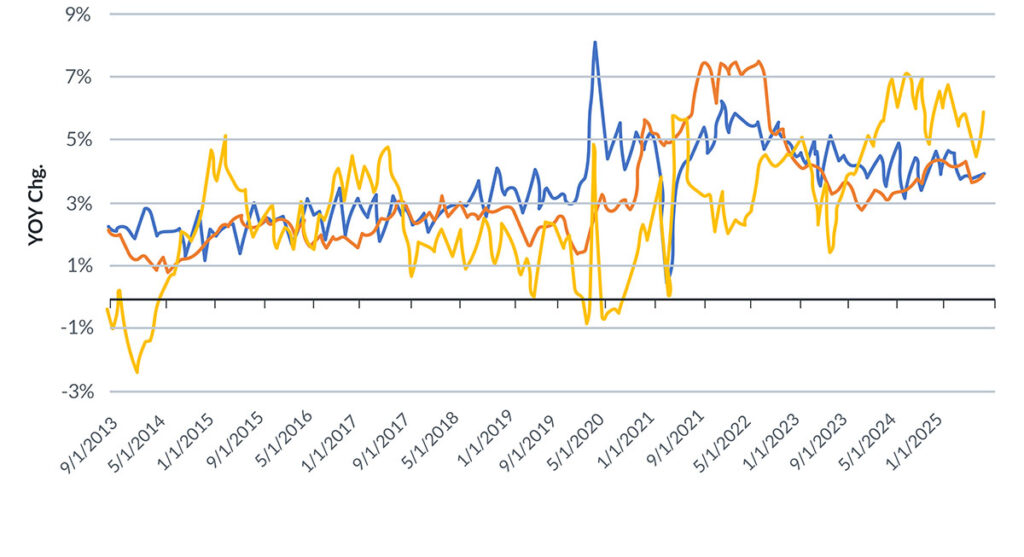

2. Wage growth for dental offices remains high but is no longer surging

Dental office wages continue to outpace both national and broader healthcare trends. While pay increases have slowed from pandemic highs, they remain near the top of the range.

Wage Growth

Key takeaway: Competitive compensation has become a baseline expectation for dental practices. It is wise to plan for annual raises of 4-6% for hygienists to help control unexpected costs later.

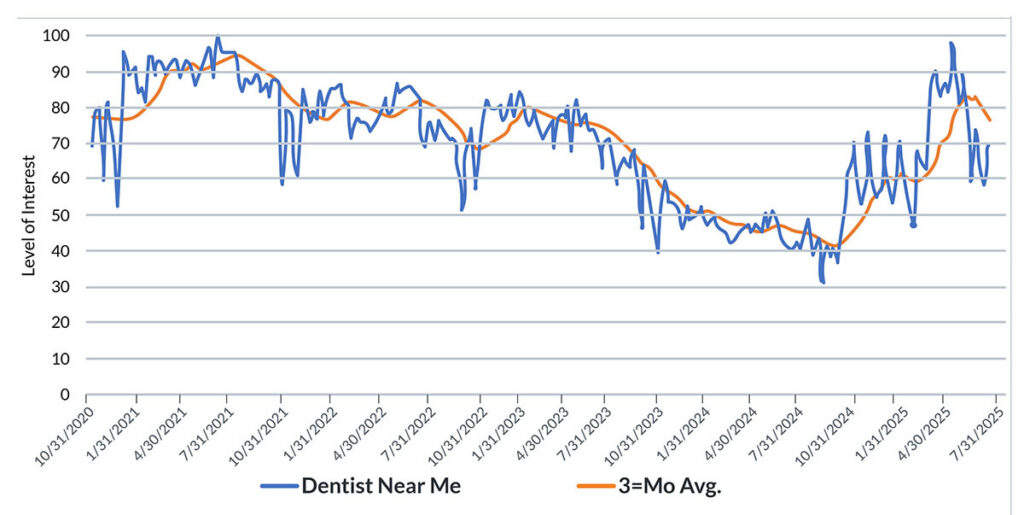

3. Online searches for “Dentist Near Me” have taken another dip

Search interest climbed earlier this year but has softened heading into year-end. Current levels are still significantly lower than the highs seen in 2021 and 2022.

Google Trends: “Dentist Near Me”

Key takeaway: Acquiring new patients through online searches has become more challenging. The importance of patient experience and word of mouth has grown. Simple follow-up text messages after procedures can be a more effective strategy for driving growth than additional online advertising.

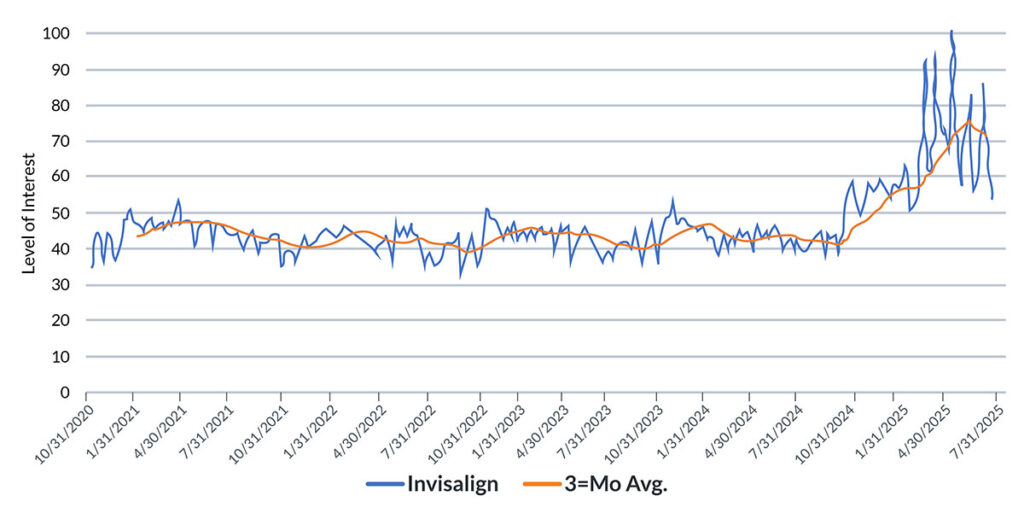

4. Invisalign demand is cooling after a hot run earlier in the year

Interest in Invisalign surged in early 2025 but has since slowed. Demand remains higher than in previous years, but momentum has eased.

Google Trends: Invisalign

Key takeaway: Elective procedures continue to grow but require intentional promotion. Training front desk staff to offer quick smile assessments to new patients can drive more conversions than marketing alone.

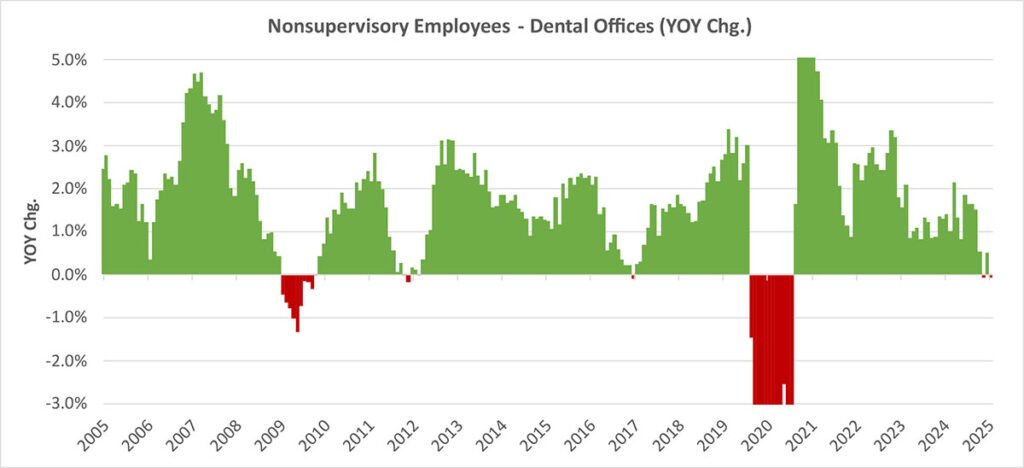

5. Employment in dental offices is still growing, though at a slower pace

Employment in dental offices has returned to modest, steady growth after years of extreme swings. The staffing environment is normalizing.

Nonsupervisory Employees – Dental Offices

Key takeaway: Hiring competition remains moderate, particularly for experienced staff. Offering flexible scheduling — such as one or two days per week — can help your practice differentiate without increasing salaries.

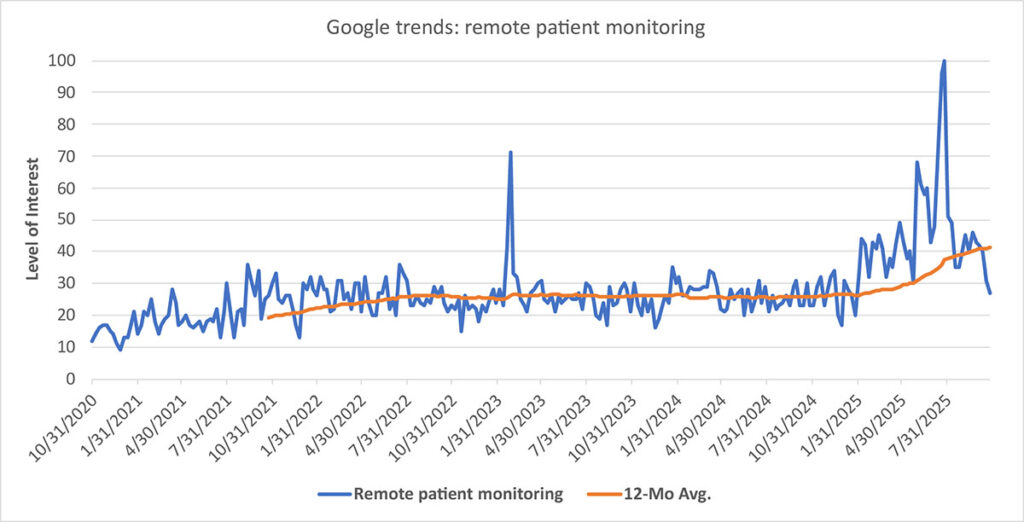

6. Remote patient monitoring is gaining interest, but adoption remains gradual

Interest in remote patient monitoring is on the rise; however, adoption remains gradual and significantly lower than the peaks observed in telehealth.

Google Trends: remote patient monitoring

Key takeaway: Patients are increasingly interested in tech-enabled care. Virtual post-operative check-ins for implant patients can enhance satisfaction without increasing chair time, making them a valuable addition for certain practices.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful. Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.