Commercial real estate is showing signs of resilience as tighter capital conditions and higher costs persist. Transaction activity is stabilizing, and we believe volumes are poised to improve. Valuations appear to have bottomed out, with excess supply gradually being absorbed. Below, six charts illustrate why the outlook for investors and operators is becoming more constructive.

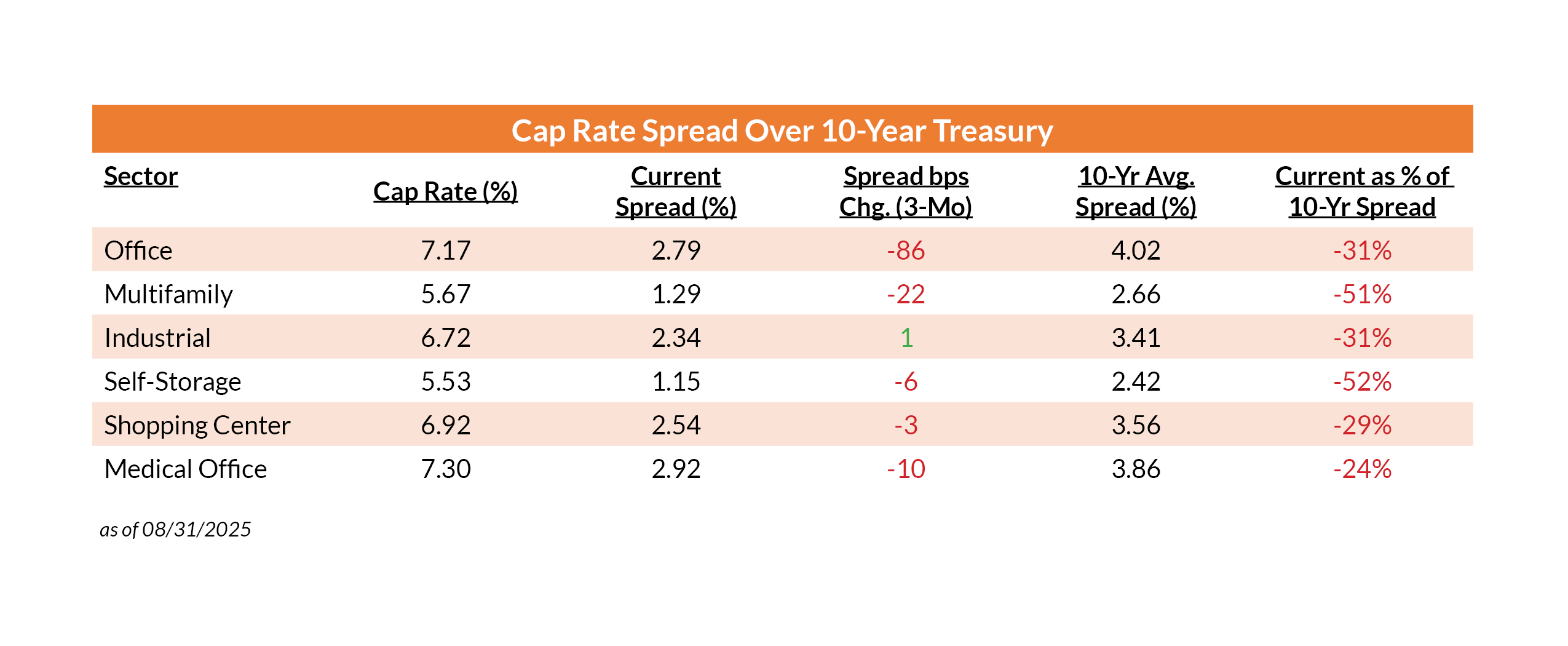

1. Cap rate spreads stay tight across the board

Source: RCA, NAREIT, & ICE Data Indices, LLC

Cap rates remain above 7% for Office and Medical Office, but the spread over the 10-year Treasury is narrow. Multifamily (-51%) and Self-Storage (-52%) are trading at spreads less than half their long-term average relative to bonds. Only Industrial showed a slight improvement in spreads over the last quarter.

Note: The narrower the spread, the less additional return an asset owner is receiving for the additional risk of owning that asset compared to a risk-free asset, such as the U.S. 10-Year Treasury bond.

What this means for you: Real Estate’s income premium versus Treasuries is depressed. Consequently, real estate investors should be highly selective and focus on assets with resilient cash flow, long leases, and demand-driven pricing power that can lead to higher net operating income growth. When spreads are narrow, NOI growth becomes your safety net.

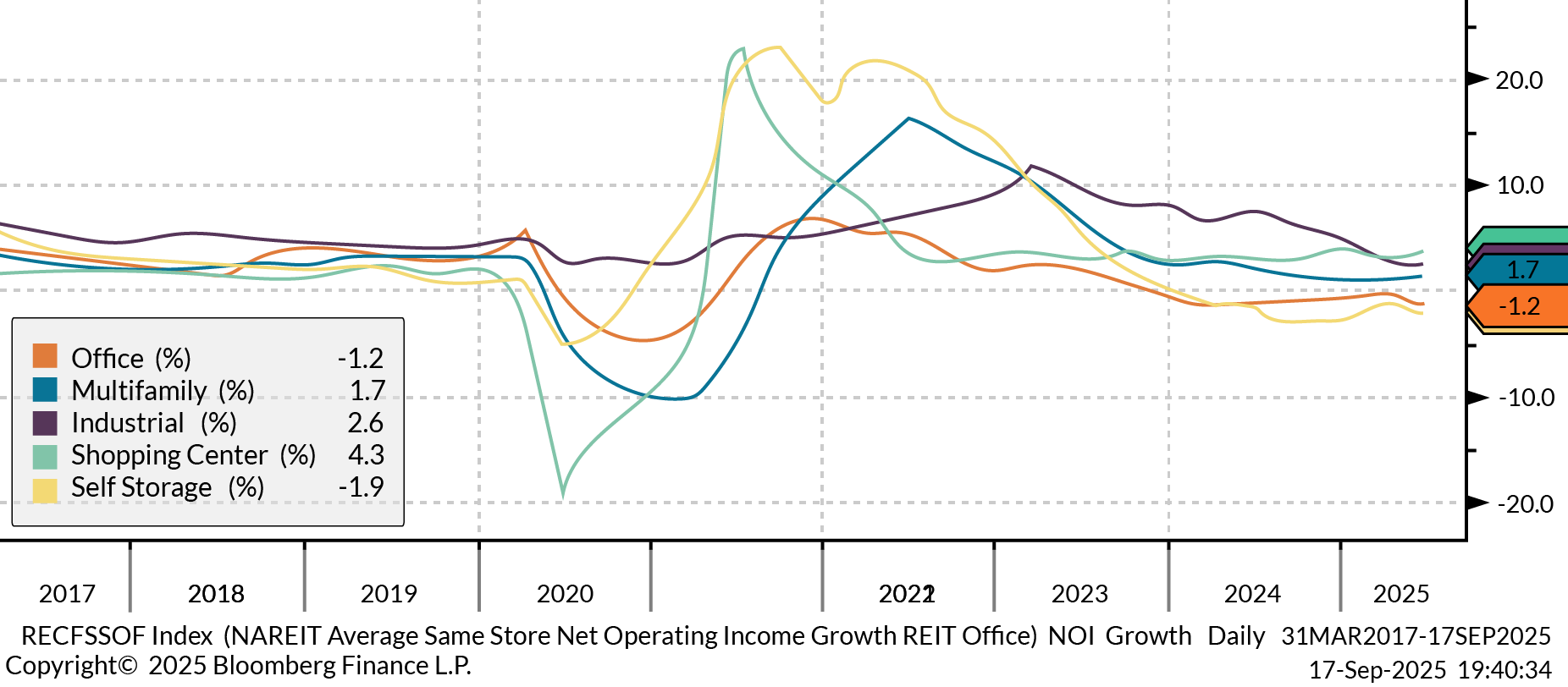

2. NOI growth remains uneven across sectors

Source: Bloomberg Finance L.P.

Industrial (+2.6%) and Shopping Centers (+4.3%) continue to post positive Net Operating Income (NOI) growth, while Office (-1.2%) and Self-Storage (-1.9%) have declined. Multifamily is positive, but modest at +1.7%. The divergence highlights the relative environment of supply versus demand across asset types.

What this means for you: Office and Self-Storage owners can unlock value by focusing on lease restructuring and cost management. Industrial and Shopping Centers continue to offer growth opportunities, especially for disciplined investors. Multifamily is stabilizing, and as oversupply eases, prospects should gradually improve.

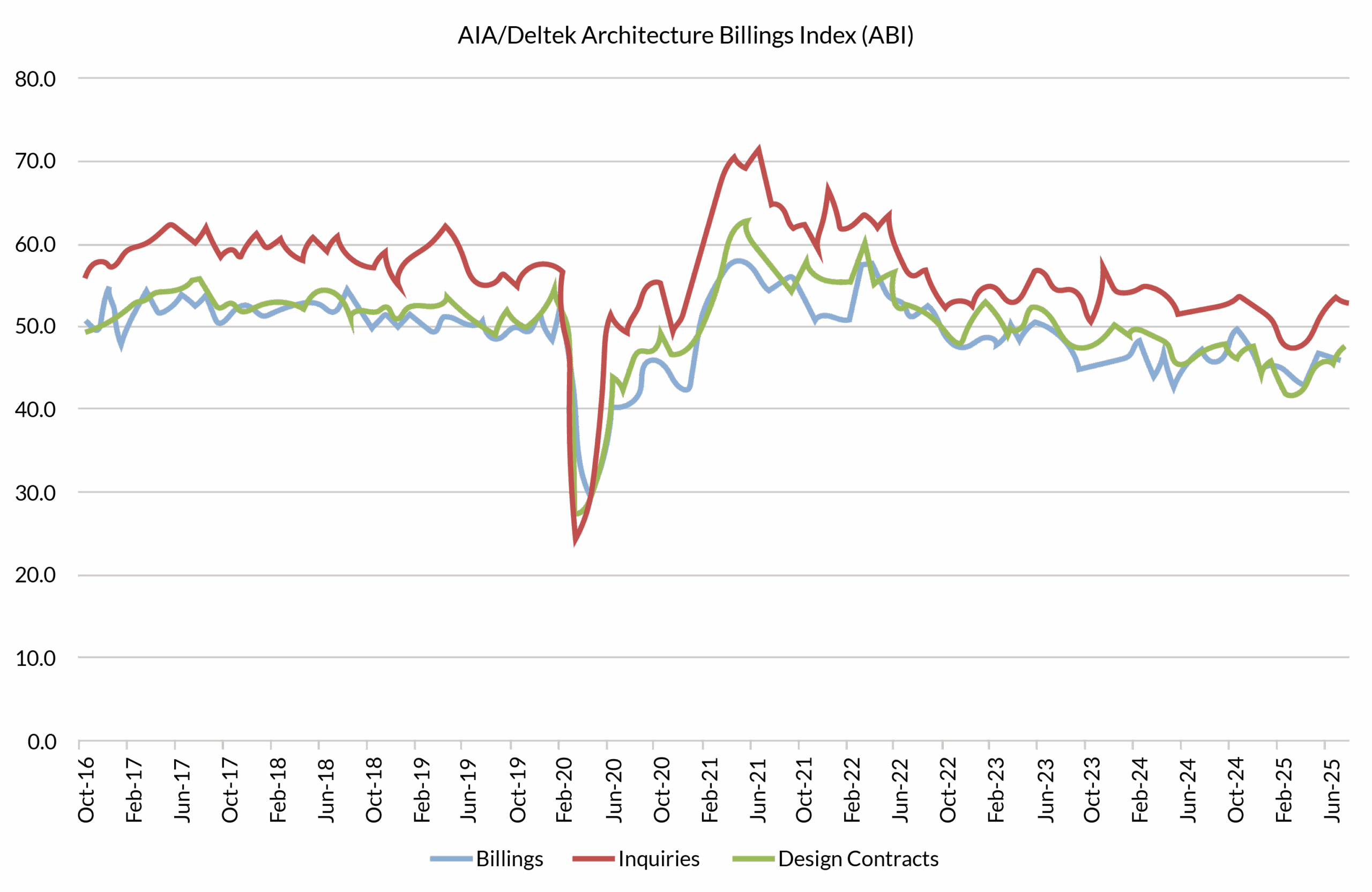

3. Architectural billings hint at tepid future supply

Source: AIA Economics

The Architecture Billings Index (ABI) remains below 50, signaling contraction in design activity. While inquiries picked up slightly, design contracts and billings are sluggish, showing a clear sign that new development pipelines are weak.

What this means for you: Less new construction now means future supply will be constrained. Well-located existing assets will benefit from scarcity value. Owners should invest in property upgrades to stay competitive, while developers should carefully weigh risks before breaking ground.

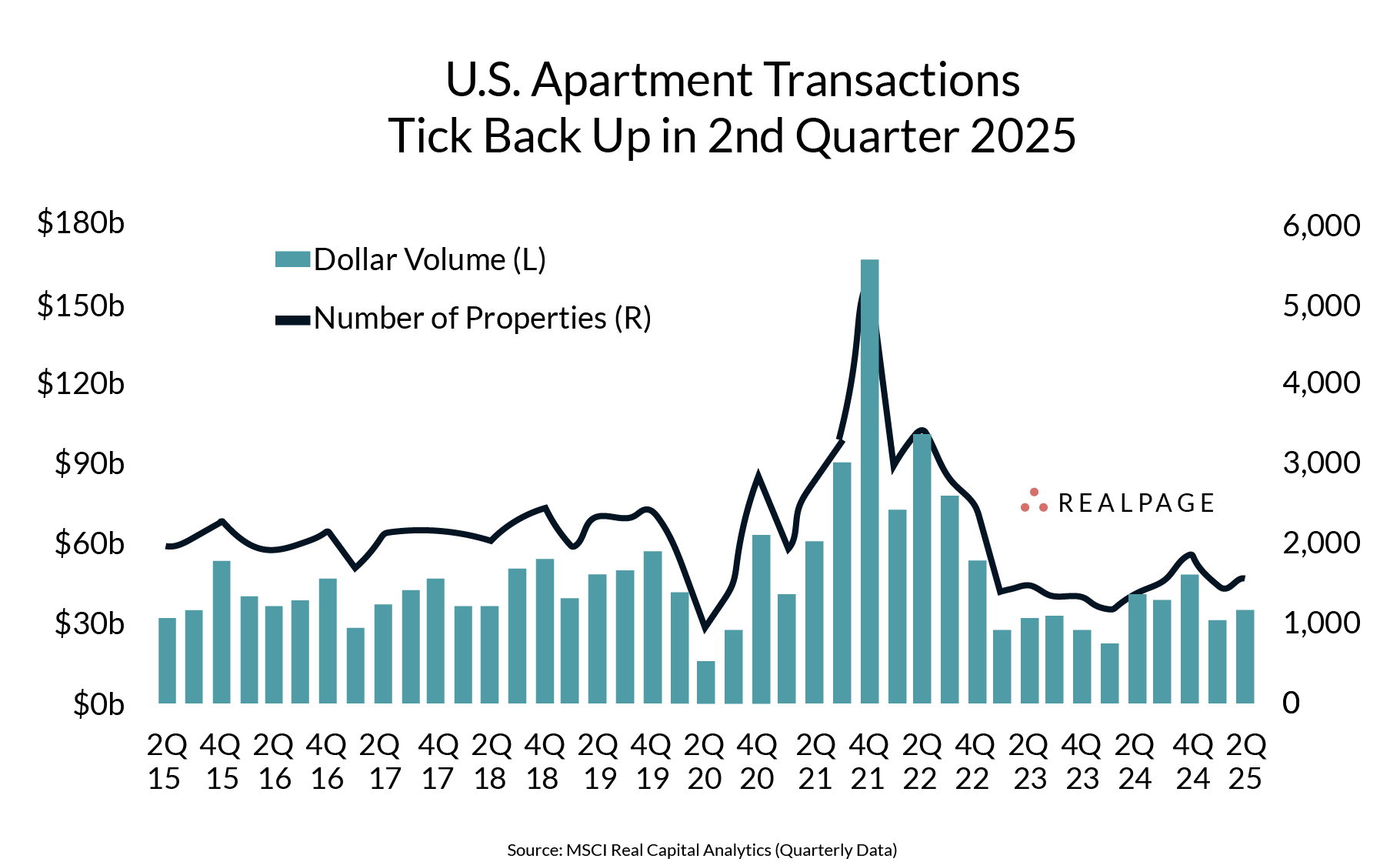

4. Apartment transactions show early signs of stabilization

Source: RealPage

Apartment sales volumes picked up modestly in Q2 2025, with both transaction counts and dollar volumes improving from 2024 lows. While far from the pandemic-era boom, the market appears to be finding its footing.

What this means for you: Liquidity is returning, particularly in multifamily, supporting better price discovery and deal flow in the quarters ahead. Investors should look for distressed sellers, but be prepared to pay up for high-quality, well-leased properties in supply-constrained markets.

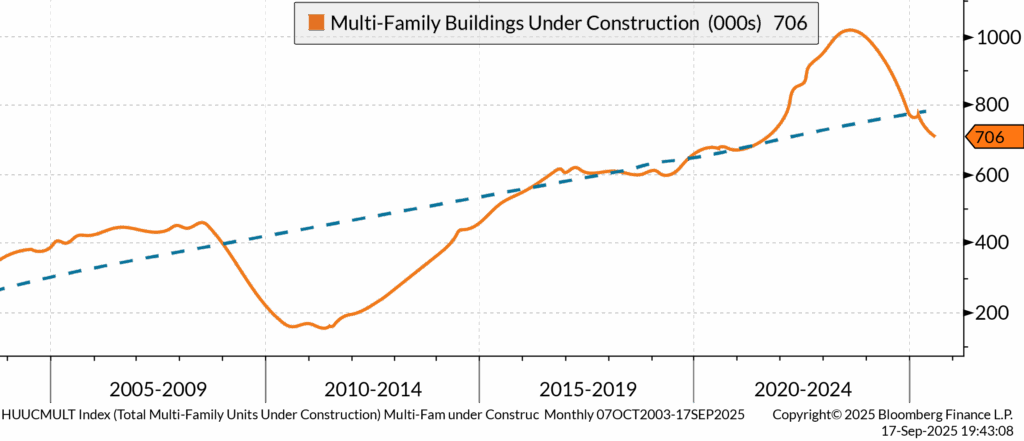

5. Multifamily construction activity is cooling

Source: Bloomberg Finance L.P.

Units under construction have declined from a peak of nearly 1 million to about 706,000. While still elevated, the numbers are falling fast. The slowdown reflects tighter financing, high input costs, and softening rent growth in oversupplied markets.

What this means for you: Expect continued headwinds in markets where supply remains high. This correction sets up a healthier balance in the long term. Patient investors could find buying opportunities as weaker owners exit. Focus on markets with population growth and migration tailwinds.

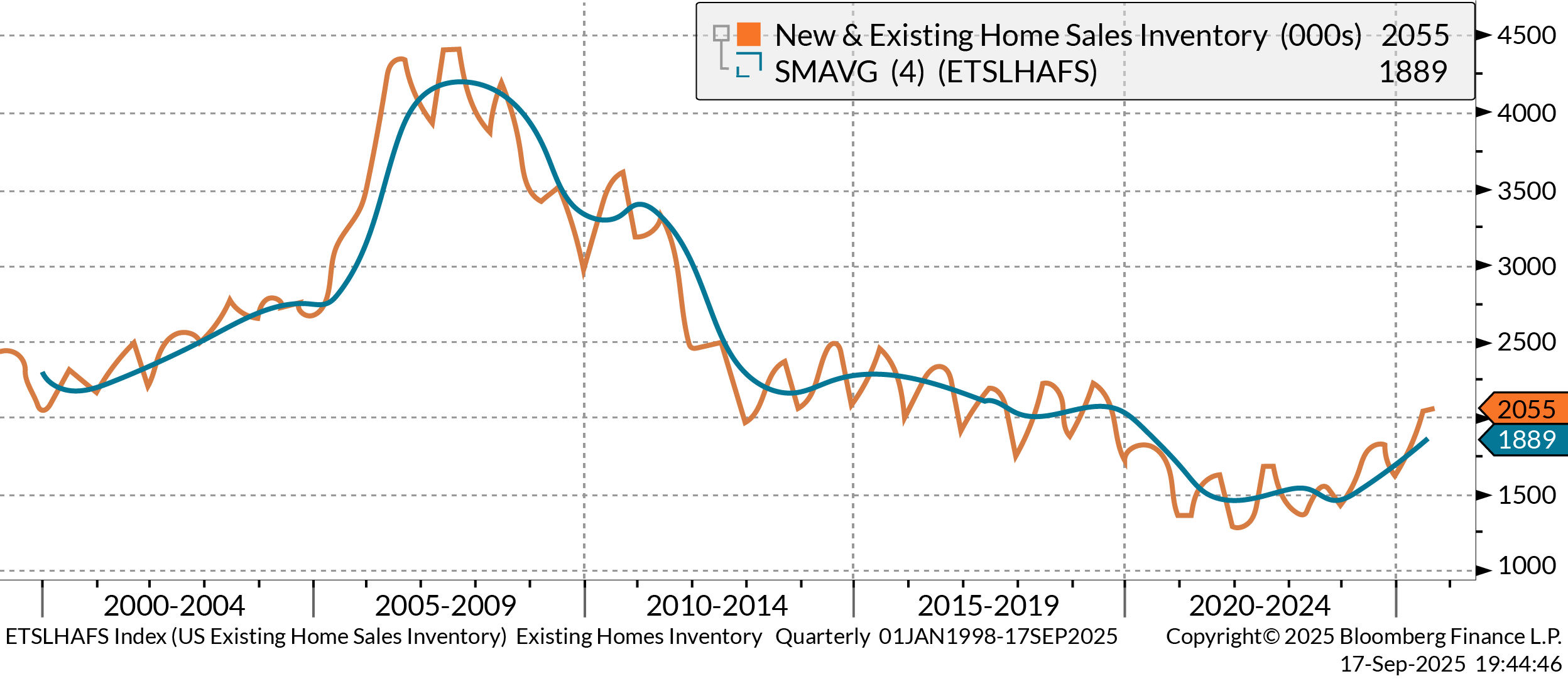

6. Housing inventory is being rebuilt from historic lows

Source: Bloomberg Finance L.P.

For the first time in years, new and existing home inventory in residential real estate has climbed above 2 million units. While still below pre-2008 norms, this steady rise signals more balance in the housing market.

What this means for you: More available homes may ease rent pressure in multifamily. For real estate investors, this shift could mean slower multifamily rent growth ahead, underscoring the importance of location, affordability, and tenant quality in underwriting.

This commentary is brought to you by our advisors at Aprio.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q