At a glance

-

- The main takeaway: Third-party delivery is here to stay, but success depends on strong operational controls, regular reconciliation, and clear team processes to protect profits and customer satisfaction.

-

- Impact on your business: Understanding the chargebacks is the first step. Tracking, analyzing, and addressing their root causes—while also identifying patterns of inaccurate disputes—is critical for protecting your margins and assuring a better customer experience with every order.

-

- Next steps: Whether you’re new to managing chargebacks or looking for ways to improve your current processes, Aprio’s Restaurant, Franchise & Hospitality team can give you give you practical insights and tools to support you in your business.

The full story:

Aprio’s Restaurant, Franchise & Hospitality team is hosting a 4-part webinar series titled “McDonald’s Franchisee Owners/Operators Essentials: Navigating Financial Success with Aprio,” a focused webinar series designed for McDonald’s decision-makers. Our second installment, Drive Thru to Drop-off: Take Control of Delivery Operations and Tackle Chargeback Head-on, discussed chargebacks from third-delivery platforms and how to navigate the complexities of it. (McDonalds)

Third-party delivery is here to stay, but success depends on strong operational controls, regular reconciliation, and clear team processes to protect profits and customer satisfaction. Understanding the chargebacks is the first step. Tracking, analyzing, and addressing their root causes—while also identifying patterns of inaccurate disputes—is critical for protecting your margins and assuring a better customer experience with every order.

Whether you’re new to managing chargebacks or looking for ways to improve your current processes, this article will give you practical insights and tools to support you in your business.

What are chargebacks, and why do they matter?

Delivery and chargebacks are two important areas that are impacting profitability and operations for McDonald’s owners/operators. Third-party delivery platforms like Uber Eats, DoorDash, and Grubhub have become a core part of the McDonald’s business model, offering convenience for customers and increased sales potential for restaurants. Here are the key benefits:

-

- Expanded reach: Access to customers who prefer delivery over dine-in or drive-thru.

-

- Increased sales: Boosts topline revenue, especially during off-peak hours.

-

- Platform marketing: Exposure through in-app promotions and featured listings.

Chargebacks and refunds are two of the main challenges in delivery, and here’s why:

-

- Chargebacks & refunds: Customer disputes can reduce revenue if not controlled.

-

- Fees & commissions: Margins are tighter due to platform charges.

-

- Accuracy & handoff: Delivery success depends on order precision and team execution.

Chargebacks can happen when third-party delivery platforms suspect a problem with an order. They typically arise due to multiple factors:

-

- Missing or incorrect items: For example, French fries are the #1 most ordered but also the #1 most commonly missed item, and 35% of customers do not reorder within 60 days from a restaurant that made an accuracy error.

-

- Late or incomplete deliveries: There is an additional 1% commission per minute of ADWT (average driver wait time) over 4 minutes.

-

- Customer complaints or refund requests: A customer is complaining about the quality of the product.

-

- Operational errors during handoff: An incorrect bag has been given to the driver, and there is no verification of the driver’s name or platform. This will lead to the wrong person taking the order—accidentally or intentionally—rushed, or unsupervised pickups.

Additionally, while many chargebacks are tied to genuine service issues, there are cases where customers may dispute an order inaccurately or take advantage of the refund process, resulting in a chargeback even when the order was fulfilled correctly. This makes tracking and documentation vital processes in reducing chargebacks.

Why do these matter? Even a small handoff mistake can result in a chargeback, a refund, and a hit to customer satisfaction. That’s why many operators implement extra checks—like driver name confirmation, bag tagging, or a dedicated handoff station—to reduce risk and protect margins.

Best practices for reducing chargebacks

Chargebacks can be a major headache for restaurants, eating into your profits and causing administrative headaches. To help reduce chargebacks on third-party delivery sales, business owners should take proactive steps such as implementing a combination of best practices that focus on documentation, communication, and process integrity. Here are some key strategies to help you protect your business:

Standardize your order process

Consistency is key. Start by creating a clear, repeatable process for how orders are prepared and packed. Use a checklist to verify every item in the bag before it’s sealed. Make sure all special instructions from customers are visible to kitchen staff and packers. For high-risk items that are often subject to “missing item” claims, consider using a double-seal method for extra security.

Label everything clearly

A disorganized label can easily lead to a mix-up. Every bag should be clearly marked with the customer’s name, order number, and the platform it came from (e.g., DoorDash, Uber Eats). If an order has multiple bags, put a number on each bag to assure the driver hands over the correct order(s) during the delivery. It is recommended to use high-quality labels that won’t fall off during transit.

Implement a driver handoff protocol

The handoff is a critical point where things can go wrong. Designate a specific pickup area and use clear signage to direct drivers. A dedicated staff member can manage handoffs during busy hours, confirming the driver’s name and platform before releasing the order. You can also use a “driver check-in” log or screen to keep a record of pickups.

Maintain proof of fulfillment

When a chargeback occurs, having proof is your best defense. Some platforms have a feature where you can take a photo of the packed and labeled order before it’s handed off. Having security cameras near the pickup area can also provide video evidence in the event of a dispute. Always keep a record of order and handoff timestamps to support your claims.

Regularly track and review chargeback data

Don’t wait for chargebacks to pile up. Set aside time each month to review your chargeback reports. Look for patterns in the data, such as specific items or times of day that are frequently linked to disputes. This can help you identify and fix underlying issues in your process.

Train and reinforce with staff

Your team is your first line of defense. Educate them on the financial impact of chargebacks. Run through everyday scenarios, like what to do with a rushed driver or how to handle a complex, multi-bag order. Acknowledging staff who help reduce these issues can build accountability and encourage best practices.

Report invalid disputes

Dispute invalid chargebacks directly through the platform’s portal and provide all supporting documentation you’ve collected, such as photos or timestamps. If you notice a pattern of fraudulent claims from a specific customer, report it to the platform.

Monitor customer abuse

Keep an eye out for customers who repeatedly request refunds. If you notice a pattern of fraudulent claims, notify your platform’s representatives. Some platforms offer tools to flag suspicious customers or prioritize disputes, helping you manage potential abuse more effectively.

By following these simple steps, you can significantly reduce chargebacks and assure your revenue stays where it belongs—in your business.

Real-world insights

We reached out to a few organizations that are already seeing success with chargeback prevention. They have implemented solid controls that make a difference in their organizations, reducing fees and keeping operations steady. Aaron Baack is a Supervisor whom we have worked with, and he recommends building orders on a tray before bagging to assure accuracy. Additionally, saving receipts from an order that hasn’t been picked up to be eligible for credit. Lastly, assign a dedicated delivery person for peak delivery hours.

We also have Drew Hoffman, who shared his thoughts on higher volume stores. They added a screen dedicated to preparing delivery orders to streamline the process and reduce confusion. To drive accountability in their organization, Drew’s team built the Delivery Commission into their bonus program—if a location goes over the negotiated commission rate, they don’t get full credit for the delivery fee; instead, they reduce that delivery fee credit by the amount of commission over the standard rate.

Drew’s organization also adapts Aaron’s strategy for peak delivery hours and has dedicated team members specifically for their delivery and curbside pickup during peak hours. They also send out a weekly recap email of the week before, including errors, sales, guest counts, average dasher wait time, and customer satisfaction rating. If there’s an issue, the general managers are expected to review the security footage to identify the problem and report back to Drew. They post these recaps and utilize them as training for the improvement of team members.

Reporting chargebacks via e-Sales

When a delivery platform issues a chargeback, it refunds the customer and deducts that amount from your payout. However, if you don’t report that chargeback amount correctly in your sales data, your sales remain overstated.

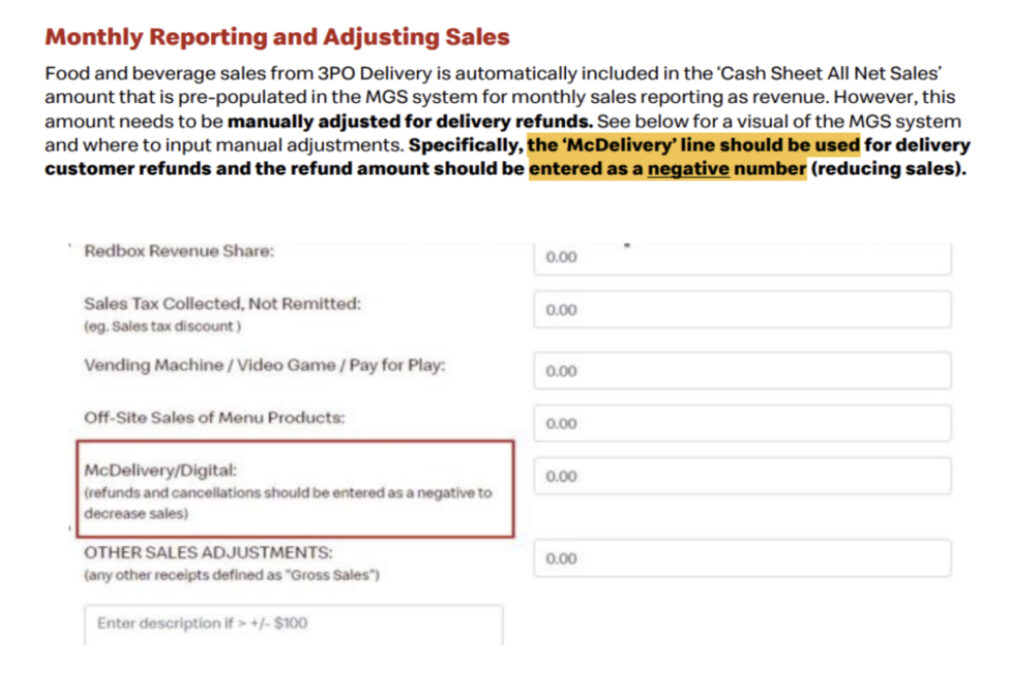

Here is an example of manually reporting your sales for delivering chargebacks. We’ve highlighted the McDelivery/Digital where you put your refunds and cancellations as a negative number to adjust your sales line, so that you will be paying the correct amount of fees.

Why should you reduce e-Sales for chargebacks?

Chargebacks reduce your revenue, so they should also reduce your reported sales. Making this adjustment helps assure you’re not overpaying on fees, keeps your financials clean, and gives you a more accurate view of your restaurant’s performance. Overstated sales can negatively impact several key areas:

Overstated reportable sales = overstated fees & percentages

As McDonald’s royalties, rent, and other assessments are calculated as a percentage of sales, if you don’t reduce your reportable sales to reflect the chargeback, you’re paying fees on money you didn’t receive.

Distorts restaurant-level profitability

Unadjusted chargebacks inflate your top-line sales but not your bank deposits, skewing profitability reports. This can make it harder to identify operational trends and manage your bottom line accurately.

Impacts performance metrics

Key indicators like average check, guest count, and delivery mix can be misrepresented if chargebacks are not appropriately reflected. Accurate reporting supports better decision-making and provides a clear understanding of performance.

Compliance with McDonald’s accounting standards

McDonald’s recommends reducing net sales for refunded amounts. Failing to do so can result in inconsistent financial reporting across restaurants or franchise groups.

How to stay on top of third-party delivery revenue

We recommend pulling reports from your third-party providers. Depending on your delivery volume or which frequency works best with your organization, you can pull reports daily, weekly, or monthly. The reports should include gross sales, refunds/chargebacks, fees/commissions (promotional/discount dollars should not be recorded as a fee expense, as those are accounted for as reduced sales within the POS system), marketing fees (should typically be $0 unless you have opted into a 3PO marketing), and net payout (subtotal + tax – commissions & fees – marketing spend – adjustments).

Next, compare platform-reported gross sales to what’s recorded in your point of sale (POS). Confirm that all delivery orders are included. Any adjustments (promos or discounts) should be reflected upon appropriately. Lastly, 3PO reports will typically show gross sales, so you would need to reduce by discounted and promotional sales to tie to quick service restaurants (QSR).

It is equally important to verify your net payout from the delivery platform to your actual bank deposit. Keep in mind that there may be delays in deposits during weekends or holidays, but your deposits should be coming in on a fairly consistent schedule. Consider reconciling weekly to smooth out the process.

Properly record any adjustments in your accounting software. Separately record fees from chargebacks for a more accurate profit and loss (P&L) data, and remember to reduce your sales. For promotional or discount dollars, do not lump those in as fees, because those are already built into your reduced sales total that you see in your POS. They are being offset via the food over base promo dollar report. Additionally, double-check any platform reports to make sure that your marketing fees are 0. If you are seeing something in there, then that means you opted into a marketing campaign that’s outside the standard.

If the sales don’t match or deposits are short, investigate discrepancies. Review specific orders flagged for refunds, check for missing batches or reporting delays, and reconcile tips or promos that may be posted on different days. If you see anything that doesn’t match, definitely set aside time to identify the problem. Gather any backup you have to figure out solutions.

Tips for a smooth reconciliation

A solid reconciliation process will not only protect your revenue, it’ll keep your reporting clean and accurate, and it’ll let you catch issues early on before they snowball into bigger and more costly problems down the road. Here are a few quick steps you can implement:

-

- Use a standardized worksheet or template to track weekly delivery activity.

-

- Assign one team member or bookkeeper to own the process for consistency.

-

- Flag high chargeback days for further operational review—this is often where issues begin.

A strong delivery reconciliation process protects your revenue, improves reporting accuracy, and helps you spot trends or errors early, keeping more money where it belongs: in your business.

Sales tax remittance

Lastly, let’s talk about sales tax and who is responsible for sales tax on third-party delivery platforms. In some states, third-party delivery platforms are considered marketplace facilitators, which means they collect and remit sales tax on your behalf, and you don’t need to include that tax in your sales tax filings. This is a more straightforward process if you know your state’s rules; otherwise, it could potentially be an issue.

If your state does not permit third-party delivery platforms to collect and remit sales tax on your behalf, it means you have to do the process and make sure it’s reported correctly.

It is imperative to know your state’s rules for each delivery platform, review monthly sales tax reports for proper treatment, or reach out to your accountant if you’re unsure.

The bottom line

Managing delivery platforms and chargebacks is not always a straightforward process, but it’s an essential part of your business in protecting your bottom line. Aprio’s Restaurant, Franchise & Hospitality team can provide the right tools and right processes to help you navigate chargebacks and delivery fees that are a big part of your P&L line item.

In case you missed it: Learn how ratios can provide restaurant owners with valuable insights into how their business operates in our first installment, Unlock the Power of Your Numbers: Understanding and Improving Key Financial Ratios.