Summary: The Latin American business landscape will shift significantly in 2026, shaped by global tax changes, new trade and logistics dynamics, and tightening compliance restrictions. Now is the time for cross-border businesses to review their entity structures, trade strategies, and risk frameworks to stay ahead. In this article, Aprio shares insights and action steps Latin American businesses can take to maintain regional and global growth.

2026 is shaping up to be a pivotal year for cross-border Latin American companies. While opportunities abound for global business success, many challenges are scattered across the path to growth, including inflationary pressure, currency volatility, and infrastructure constraints, among others.

However, cross-border businesses can still position themselves to thrive through uncertainty if they plan proactively and start working with their trusted business advisors early. In this article, we take a deeper dive into the issues and trends affecting cross-border Latin American businesses, as well as tips and strategies to prepare effectively.

What challenges and opportunities will Latin American businesses face in 2026?

As we look ahead to the next 12 months, there are several major trends that stand out and will prove to be game-changing for Latin American businesses:

- Global supply-chain realignment: As near-shoring gains steam, Latin American businesses should expect trade patterns to shift in 2026. Specifically, Mexico, Brazil, and Central America are poised to capture new manufacturing and logistics investments, as more multinational companies rebalance away from Asia.

- Evolving tax and regulatory regimes: Governments across Latin America are modernizing their tax codes, such as the adoption of VAT taxes on certain digital services across the region. What’s more, many Latin American countries are tightening their oversight on transfer pricing, which means it’s essential for cross-border businesses to review and potentially update their transfer pricing policies.

- Sustainability and traceability demands: To maintain access to U.S. and EU markets, many Latin American exporters are now being required to document their emissions, product sourcing guidelines, and social-impact metrics. We expect more governments will join the push for environmental, social, and governance (ESG) -focused regulations regarding trade and commerce moving forward, which means all Latin American companies that operate across borders should prepare accordingly.

- Digital transformation: Next year, technology will continue to influence the way multinational companies do business. From electronic invoicing to AI-based compliance monitoring, companies need to meet the rising bar for data accuracy and timeliness to attract and retain solid customers.

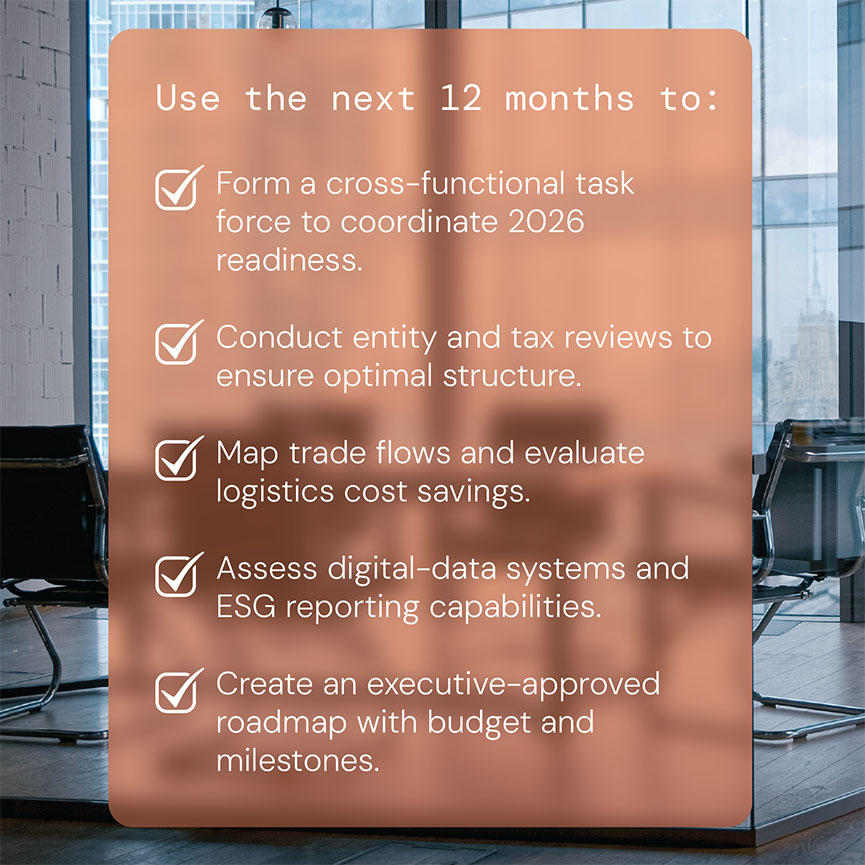

For Latin American companies, these forces create both challenges and opportunities to make a greater impact. Before the year is up, take ample time to re-evaluate your internal and external structures, risk exposure, and trade strategies to put yourself in the best-possible position to succeed in 2026.

How can companies strengthen their tax and entity structures before 2026?

Global tax law changes show no sign of slowing down. In the U.S., the One Big Beautiful Bill (OBBB) reshapes how Latin American companies may be taxed on business dealings with customers, suppliers, and partners in the states. To stay both compliant and efficient in the face of evolving tax regimes, Latin American businesses should:

- Revisit entity structures: In collaboration with a CPA who is knowledgeable in U.S. tax law changes, determine what type of structure provides the most favorable operational and tax outcomes for your business. Whether it’s for regional headquarters, shared-service hubs, or free-trade-zone entities, you need to review all your needs to identify the right path for success.

- Perform a transfer-pricing and value-chain review: If you are preparing to shift production locations, you need to make sure your intercompany pricing framework accurately reflects where value is created.

- Monitor digital-services tax developments: Countries like Mexico, Colombia, and Chile continue to expand electronic invoicing and digital-service tax reporting requirements. If you are based in one of these countries, be sure to review your tax strategy and take steps to maintain compliance.

- Anticipate more tax enforcement: Many global tax authorities are using new data analytics tools and programs to detect inconsistencies faster than ever, increasing the cost of non-compliance. Make sure that your business is well-prepared to meet reporting requirements to reduce the risk of errors and protect your bottom line.

Before the end of the year, schedule a meeting with your tax team to reassess your tax picture and make sure you are prepared for potential changes in 2026. At Aprio, we provide our clients with a tax structure readiness review, in which we assess their entity footprint, supply-chain flows, and local compliance exposures to identify opportunities for simplification and greater savings.

What trade and supply-chain strategies will position businesses for success?

Latin America’s logistics and trade systems are evolving alongside global market dynamics. Research from Americas Market Intelligence projects continued growth in exports from countries like Mexico and Brazil as near-shoring accelerates in 2026. At the same time, external factors like more tariff changes and sustainability-related shipping surcharges will play a role in reshaping cost structures.

When it comes to trade and supply chain, Latin American business owners should take these steps heading into next year:

- Evaluate near-shoring opportunities.

- Leverage free-trade zones and bonded hubs.

- Model total landed costs.

- Stay current on customs reforms and consider working with an experienced customs and tariffs advisor.

If you need help taking these action steps, reach out to your professional advisory team for advice and strategies to optimize your supply-chain structures, customs processes, and cost management approach before 2026.

How can technology and data readiness support compliance and growth?

According to Americas Market Intelligence’s recent survey of executives across the region, the top three business priorities for 2026 are operational efficiency, cost reduction, and technology adoption. Internally, your technology stack should include tools that allow you to:

- Integrate finance and supply-chain data

- Automate tax and compliance workflows

- Use scenario modeling to project costs and pinpoint potential delays

- Implement cybersecurity and data-privacy safeguards

If your tech stack falls short on any of these criteria, then you may need to make some upgrades. Third-party consulting firms like Aprio can provide you with a practical roadmap to close data gaps, streamline compliance, and support rapid decision-making as 2026 approaches.

Final thoughts

The year isn’t over yet, but the window for 2026 planning is closing. Keep in mind that many organizational reforms take months or even years to execute effectively. If you wait until January to assess your structures and pinpoint gaps, then you’ll find yourself reacting rather than leading the charge.

Fortunately, you don’t have to go it alone. Aprio’s International Business Services team partners with companies across Latin America and beyond to optimize tax structures, trade strategies, and cross-border operations. Our advisors combine deep technical knowledge with practical, on-the-ground experience to help clients turn complexity into clarity and opportunity.