Transfer Pricing Services & Advisory

As a leader in transfer pricing, Aprio can help you reduce your global effective tax rate and avoid double taxation and costly penalties. Our streamlined processes and transfer pricing experience can save you time and money while taking planning, compliance and reporting burdens off your plate.

Transfer Pricing Practice Leader |

Tax Partner

Aprio Advisory Group, LLC

Results with confidence

If you are considering selling an international

business or seeking investment capital, you need to make sure your transfer pricing practices and documentation are in order.

Aprio’s experience and proven transfer pricing

processes deliver results with confidence.

Insight delivered

When it comes to navigating the complexities of transfer pricing, experience matters. Aprio is the largest privately held international tax practice in the Southeastern U.S. and has delivered global tax, audit* and advisory services for more than three decades.

As a recognized transfer pricing leader, Aprio partners with other CPA firms to provide their clients with competitive solutions to meet their transfer pricing needs.

Reduce your global effective tax rate — for less

At Aprio, we are all about saving our clients money. From experience, we know that transfer pricing presents a unique opportunity to optimize your tax strategies and reduce your global effective tax rate.

Transfer pricing solutions for every stage of your business

Transfer pricing isn’t always a one-size-fits-all proposition, so we’ve developed solutions to meet the needs of companies at every stage of the business lifecycle. Regardless of the size or stage of your company, Aprio can tailor our transfer pricing services to meet your needs.

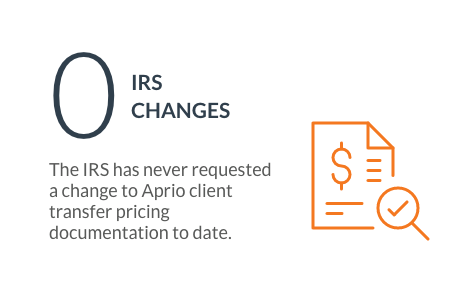

Transfer pricing studies made easy

Clients often ask, “How much of my staff’s time will this transfer pricing study take?” At Aprio, we are committed to delivering a better transfer pricing experience. We’ve developed a streamlined process that creates less business disruption and delivers documentation that can stand up to the toughest regulatory scrutiny.

ASSESS

Aprio’s risk assessment analyzes all current transfer pricing policies on a country-by-country basis.

ESTIMATE EXPOSURE

The results of the risk assessment are analyzed to estimate exposure.

STRATEGIC PLANNING

We develop and implement transfer pricing strategies that achieve overall tax objectives , and we work with legal counsel in developing the required intercompany agreements.

DOCUMENTATION

We prepare transfer pricing documentation including the proper economic analysis for all material intercompany transactions.

CONTROVERSY SUPPORT

We stand behind our work and with you to provide support during transfer pricing controversies.

Conduct business in your language

Aprio serves inbound clients across Asia, Africa, Australia, Canada, Europe and the Middle East. Receive the international accounting knowledge you would expect from a large global provider delivered by senior-level team members that “speak business” in 60+ languages including:

Transfer Pricing

RESOURCES

Articles

Downloads

Is there a fit?

It costs nothing to find out.