Navigate the customs and tariffs system with confidence

Leverage Aprio’s Customs and Tariffs Services knowledge to minimize customs duties and comply with requirements enforced by US Customs and Border Protection (CBP).

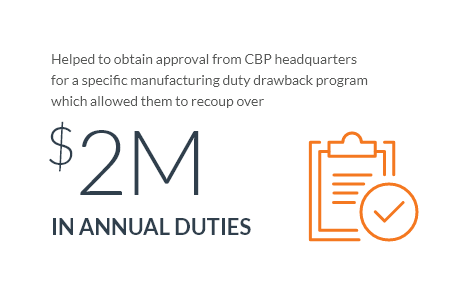

Results you can count on

Aprio’s advisors deliver proactive international tax and trade services in 60+ languages. This is how we deliver results and facilitate the open communication required to help businesses overcome the challenges of importing and exporting tangible products.

International trade experience that makes a difference

“My customs broker or foreign supplier did it” is not a valid defense when it comes to inaccurate declarations for imports and non-compliance.

Aprio’s dedicated Customs and Tariffs Services team has more than a decade of experience helping clients reduce the headaches associated with shipping goods in and out of the United States.

We guide you through US international trade laws and regulations, performing health checks to ensure compliance and identifying opportunities to mitigate penalties and save on duties.

Our clients span a broad range of industries

Aerospace

Automotive

Consumer Products

Electronics

Steel & Aluminum

Manufacturing & Distribution

Life Science

Aprio’s Customs and Tariffs Services team brings over a decade of experience helping clients navigate the complexities of shipping goods in and out of the United States and overcome the challenges of complying with evolving customs and tariff rules. We guide you through U.S. international trade regulations to maintain compliance while identifying opportunities to save on duties and mitigate risks.

Compliance guidance to help with smooth transactions

Optimize Import duties and tariffs for cost-reduction

Optimize import duty and tariff costs with tariff classification, valuation, and origin

Maintain compliance with customs regulations for smooth import transactions

Resolve import issues such as seizures, penalties, and forced labor

Provide strategic insights through import data analytics

Core elements of customs and tariffs rules

Today’s continuously evolving global environment makes it difficult for businesses who import or export tangible products to comply with the lengthy and complex customs and tariffs rules. There are three core compliance elements for customs and tariffs:

Tariff Classification

(Duty Rate)

Is your product properly classified?

There are thousands of rules and tariff classifications making it vital to have your products properly classified with a 10-digit code to determine the appropriate duty rate.

Customs Valuation

(Ad Valorem)

Have you reviewed the custom valuations for your products?

It’s important to follow customs rules to ensure you are properly appraising your products and factoring in the potential of transfer pricing when importing from related parties.

Country of Origin

(Special Tariffs)

Are you importing from a country that has additional duty fees?

Depending on the country of origin of where your product is sourced, you may face additional duty charges, or the product can enter duty-free.

Aprio’s comprehensive customs and tariffs services include:

- Tariff Classification & Re-engineering

- Country of Origin Analysis

- Customs Valuation Review

- Free Trade Agreement (FTA) Eligibility Review

- First Sale for Export

- Duty Refund Claims (Protests)

- Customs Ruling

- Import Data Analytics (Automated Commercial Environment (ACE) System)

- Duty Drawback

- Importer-Self Assessment (ISA) Program

- Customs Seizure/Detention

- Forced Labor Compliance

- Prior Disclosure/Penalty Cases

- Export Controls & Sanctions

- Customs Audit* Actions

(Forms 28 & 29, Focused Assessment) - Global Import Landed Cost Review

- Import/Export Compliance Manual

- Routine-on-Call Advisory Services

- Customs Trade Partnership Against Terrorism (CTPAT)

- Superfund excise tax

Expand Your Knowledge

Articles & Downloadable Material

Is it a fit?

Let's find out