Sales Tax Consulting and Compliance

Get the guidance and technology you need to manage your sales tax obligations.

Partner with Aprio for proactive sales tax consulting and technology-enabled compliance solutions. Ask about our managed Sales Tax Compliance programs that scale with your business.

Kevin Watson

Managing Director, Indirect Tax Leader

Aprio Advisory Group, LLC

Who needs Aprio Sales Tax Consulting?

If your business has recently expanded, or if you are a domestic or international business purchasing or selling a company operating in multiple states, you may have unknown sales and use tax obligations that could prove costly later. Aprio’s State and Local Tax (SALT) team provides proactive sales tax consulting and solutions to help you achieve and maintain compliance with state and local sales tax laws.

Our services are a good fit for small- to mid-size businesses with annual revenues between $5-$500 million in the following industry sectors who are willing to adopt new technology to streamline compliance.

e-Commerce and Retail

SaaS and Technology

Manufacturing and Distribution

Proactive solutions that drive tangible benefits

Our mission is to help clients understand and manage their sales and use tax obligations so they can grow their businesses with confidence. Our consulting services and technology-enabled sales tax solutions help clients save time and mitigate risks that can impede business objectives.

Refocus employees on growth and operations

Save on tax penalties through Voluntary Disclosure Programs

Register your business properly with state & local governments

Stay compliant with monthly sales tax filings and payments

Avoid costly mistakes and staff turnover

Track and monitor ongoing sales tax nexus

Get a clean due diligence report from investors/buyers

Increase the value of your business

Get your compliance score

Aprio’s sales tax assessment will rate your compliance in the states you do business on a scale from 0-100. Your assessment comes with a free no-obligation consultation.

Aprio is your one-stop sales tax solution

Sooner or later every business has sales tax problems. Aprio’s SALT approach simplifies compliance by providing support across the sales tax compliance lifecycle. Aprio can show you how to make sales tax compliance as easy as one- two- three.

1

Nexus

Studies

Identify current and prior obligations

Research taxability

Quantify prior exposure

2

Voluntary Disclosure Agreements

Client anonymity

Mitigate penalties

We guide you to become current

3

Managed Sales Tax Compliance

Implement the right technology solution

Preparation and filing

We handle notices and nexus monitoring

Smart managed sales tax programs from Aprio

Dealing with a sales tax surprise is far more costly than implementing an Aprio managed sales tax program. All of our managed programs include setting you up with the right technology solution for your business.

Dedicated Aprio sales tax professionals can either help you with ongoing compliance or handle everything as a managed service.

State Compliance and Entity Management Services

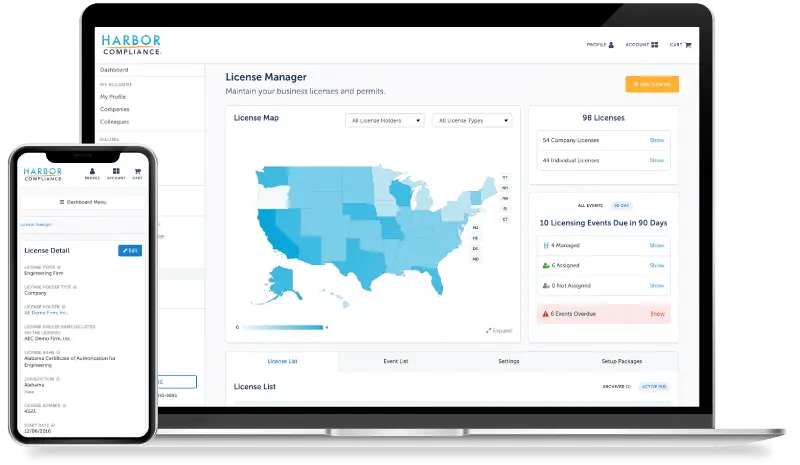

Are regulatory requirements and government paperwork holding your business back? State Compliance and Entity Management powered by Harbor Compliance, provides an all-in-one compliance solution with the technology and specialized services you need to simplify regulatory filings and manage risk. Learn More >

A Strategic Approach to Sales Tax Overpayment Refunds

Complex tax regulations and changing state laws can often result in companies inadvertently overpaying sales tax.

Aprio’s Sales Tax Overpayment Services team can help. We leverage a comprehensive approach to recovering overpaid capital including:

Conducting thorough reviews of historical transactions

Reviewing and identifying purchase data and invoices that qualify as overpayments

Filing a refund with vendors or states to recover overpaid taxes

Implementing best practices to help ensure future compliance

Contact us today to learn more about how we can help you recover overpaid taxes.

Simplify Sales Tax Compliance With Aprio + CereTax

Feeling overwhelmed by multi-state sales tax compliance as your business grows? Aprio’s sales tax solution scales with you, simplifying expansion into new verticals and minimizing audit risks. Automate your sales tax compliance with Aprio, offering hyper-scaling, flexibility, and detailed analytics, all while easing the burden on your IT team. Discover how Aprio can streamline your sales tax automation now. Learn more >

Say goodbye to sales tax surprises

Partner with Aprio to simplify sales tax compliance. Make being blindsided by new state and local tax liabilities a thing of the past.