Are You Overpaying on Duties for Imported Goods?

October 10, 2023

At a glance

- The main takeaway: The First Sale Rule offers substantial savings on import duties for qualified international transactions.

- Impact on your business: With proper planning and transparent documentation, importers can optimize cost structures by applying the most relevant customs valuation rules.

- Next steps: Schedule a consultation with Aprio’s Tariffs and Customs advisor to assess your company’s customs valuation strategy and determine whether you qualify for substantial duty savings.

The full story:

In recent decades, the U.S. Customs and Border Protection’s (CBP) First Sale Rule has gained traction as a strategic way for importers to substantially reduce the customs duties paid on imported goods. The First Sale Rule provides importers in multi-tier transactions a viable alternative to the more commonly used Transaction Value method, which generally calculates duties based on the price the U.S. importer actually paid to the last seller for the merchandise. In contrast, the First Sale Rule method allows the importer to base the customs valuation of the imported products on the price of the “first sale,” which is usually the factory price of the products.

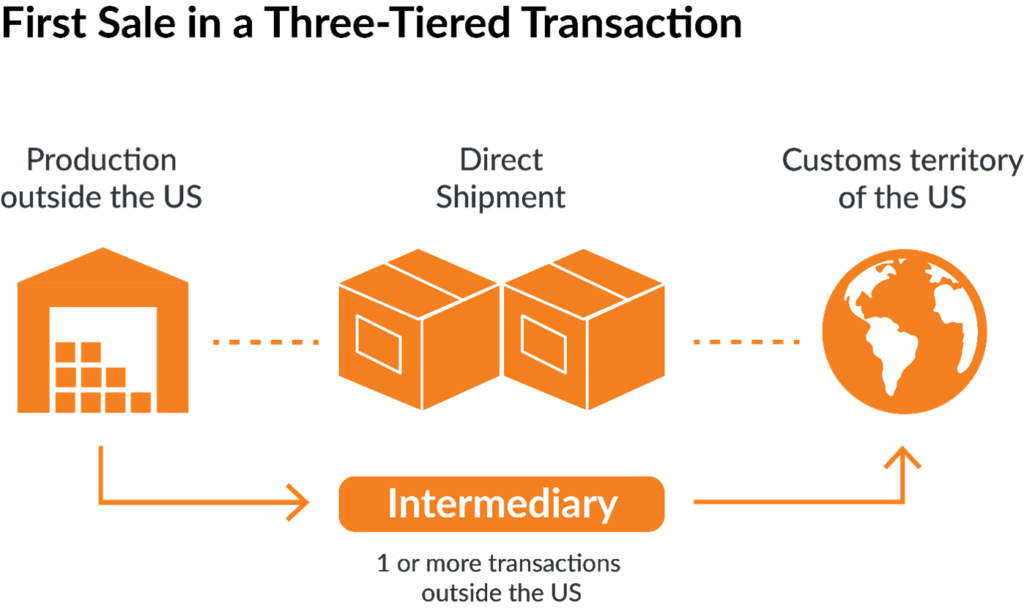

In multi-tiered transactions, the U.S. importer is purchasing the goods from an intermediary, who first purchased those goods directly from the foreign manufacturer – typically at a lower cost for the purpose of reselling for a profit. Sometimes goods can be sold among multiple intermediaries, as the price inflates with each sale. In these instances, many U.S. importers declare the price paid to the last seller as the customs value using the transaction value method, resulting in higher customs duties. However, the First Sale Rule would allow for the importer to calculate the customs duties based on the price first paid by the intermediary party.

Consider the illustration below. The usual transaction value method would calculate customs duties based on the last pre-import sale, while the First Sale Rule would allow importers to pay customs duties based on the first sale price to the intermediary.

The potential benefits of using the First Sale Rule are clear, but the reality of successfully implementing the rule is not quite as simple. To qualify for these savings, it is critical that importers maintain meticulously accurate and transparent documentation.

Understanding the requirements

The legitimacy of the First Sale Rule has been upheld in court, as can been seen in Nissho Iwai American Corp v. United States, in which the court ruled that an importer can only apply the rule on bona fide sales that are:

- clearly destined for the U.S.;

- transacted at arm’s length; and

- absent of any sort of non-market force.

The Nissho Iwai case also clarified the extensive documentation the CBP requires to use the First Sale Rule, putting an emphasize on documentation that describes the detailed roles of the parties involved in each transaction for merchandise imported into the U.S.

Examples of the required documentation can include:

- purchase orders

- invoices

- proof of payment

- contracts

- correspondence

The bottom line

Companies that import merchandise from foreign manufacturers as part of a multi-tiered transaction should assess whether the First Sale Rule is applicable. Aprio’s Tariffs and Customs advisors can assist with the analysis and research required to ascertain whether the First Sale Rule is truly beneficial for your business and, if so, help prepare the required documentation and evidence to substantiate your qualifications. Schedule a consultation with Aprio’s Tariffs and Customs team today.

Related Resources/Assets/Aprio.com articles/pages

Learn more about Aprio’s Tariffs and Customs Service

Transfer Pricing and Customs Valuations: Finding Peace in a Trade War

Recent Articles

About the Author

Jay Cho

Jay Cho is an international trade advisor and a lawyer by training who helps multinational companies better navigate US import and export complexities. He specializes in providing compliance risk management and strategies to help clients save on duty fees. With a decade of experience on both the consulting and legal sides of international trade, Jay is also well-positioned to offer guidance on many different customs enforcement matters, including customs inquiries, verification requests, audits, investigations and penalty cases.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.