Rising interest rates are particularly relevant to M&A deal flow. As the cost of debt rises, acquirers that tend to use leverage in their deals may hold back. On the flipside, strategic acquirers with significant cash on their balance sheets may be inclined to seize opportunities. With inflation landing in a more comfortable zone for the Fed, many expect the federal funds target rate to decrease in 2024,[vii] which would provide a boost to deal financing activity.

<

Rising interest rates are particularly relevant to M&A deal flow. As the cost of debt rises, acquirers that tend to use leverage in their deals may hold back. On the flipside, strategic acquirers with significant cash on their balance sheets may be inclined to seize opportunities. With inflation landing in a more comfortable zone for the Fed, many expect the federal funds target rate to decrease in 2024,[vii] which would provide a boost to deal financing activity.

<

At a glance:

- The main takeaway: Overall M&A activity in the US dropped significantly in 2023. Read more about what caused the drop, how the government services sector fared relative to the market as a whole, and what to expect in 2024.

- The impact on your business: Understanding the state of government services M&A activity and how we got here is important for any business leader planning to engage in M&A activity in the near future.

- Next steps: Read this piece, absorb the insights within and reach out to Aprio’s Transaction Advisory Services team to see how we can help you succeed in 2024 and beyond.

To learn how Aprio can help you successfully navigate your next deal, schedule a consultation today.

The full story:

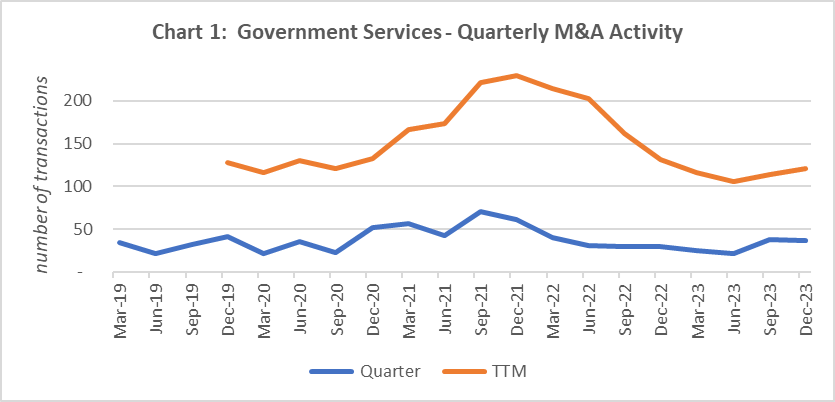

2023 was a down year for US mergers and acquisitions, with the number of deal announcements decreasing by approximately 25% year-over-year. M&A transactions involving government services targets decreased in 2023, but the drop was more muted relative to the broader M&A market, at 8%. There is no doubt that economic turmoil in the US has impacted M&A deal flow, but with 2023 in the rearview mirror it is also clear that an appetite for M&A persists in the government services space.

Chart 1[i] above tracks quarterly M&A activity (number of announced M&A transactions involving US target companies) within the government services arena. As can be seen in the chart, government services M&A fluctuated in 2020 during the throws of the COVID-19 pandemic, setting the stage for a record year for deals in 2021. Some of that transaction surge was likely impacted by 2020 transactions being pushed to 2021 due to pandemic-related uncertainty. And given 2021’s lively market, some sellers may have accelerated deal timelines, pulling what would have otherwise been 2022 transactions into 2021.

From early 2022 to mid 2023 quarterly government services M&A announcements declined gradually, before seeing an uptick in the second half of 2023. Trailing (TTM) deal totals were 116, 106, 114 and 121 for the quarters ended Mar-23, Jun-23, Sep-23 and Dec-23, respectively.[ii] At 121 M&A announcements, 2023 government services activity was only 8% lower than 2022 and only 5% lower than 2019 (year before the onset of the COVID-19 pandemic). In contrast, 2023 M&A announcements across all sectors in the US were approximately 25% lower than 2022 and also approximately 25% lower than 2019. Drawing from the pool of 121 government services deals for 2023, Table 1 below profiles a selection of transactions.[iii]

Table 1: Selected 2023 Government Services M&A Transactions

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

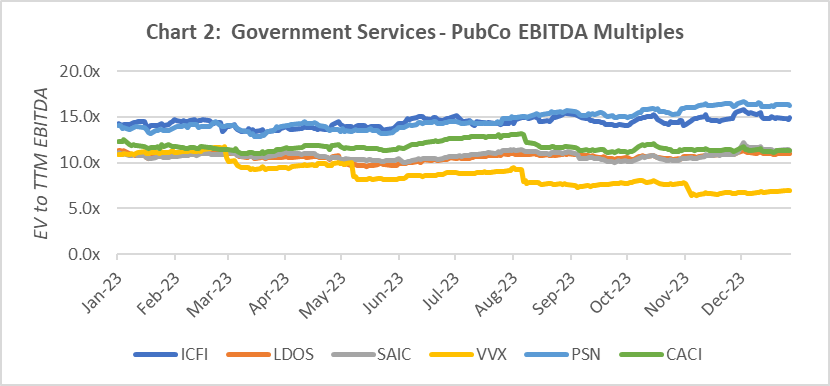

Table 1 presents transaction values (i.e., enterprise value) where available, but it does not present the associated valuation multiples (e.g., enterprise value to revenue, enterprise value to EBITDA) since that information was not disclosed. While not necessarily indicative of valuation multiples at play in any of the M&A deals reflected in Chart 1 or listed in Table 1, we can as food for thought consider such valuation metrics for publicly traded firms.[iv] To that end, Chart 2 below presents EBITDA multiples (i.e., enterprise value to TTM EBITDA) for a reference group of six publicly traded government services companies.[v]

As shown in Chart 2, throughout the first part of 2023 EBITDA multiples across the reference group ranged from approximately 10.0x to 15.0x, before diverging in the latter part of the year. The median EBITDA multiple for the group ranged from a low of 10.7x to a high of 12.3x over the course of the year. At year-end the median multiple was 11.4x.

Circling back to 2021 government services M&A activity, what were the factors (in addition to pent up demand) contributing to a robust M&A environment? One likely factor was a desire by would-be acquirers to build or bolster capabilities around federal government initiatives in areas such as legacy IT system modernization, cloud migration, and machine learning. Other factors at play in 2021 included but were not limited to: increasing valuations; low interest rates; SPAC popularity; available cash on balance sheets; and increases in private equity fundraising.

2022 and 2023, however, saw a variety of factors creating uncertainty on the M&A front. These included:

- Rising inflation

- Fears of recession

- Russia-Ukraine war

- Federal Reserve actions to increase interest rates

- Volatility in the public capital markets

- Federal government shutdown drama

- Regulatory/antitrust considerations

- Israel-Hamas war

Variables such as these, in addition to the size and scope of federal agency budgets, will continue to impact government contractors to varying degrees in 2024. Rising inflation and interest rate hikes are of course linked. In an effort to tame inflation, the Federal Reserve increased its federal funds target rate throughout 2022 and the first half of 2023 (see Chart 3 below).[vi] This followed the federal funds rate having been dropped close to 0% in 2020 during the pandemic. The Fed’s most recent rate hike was nearly six months ago, at which point the federal funds rate was raised to a range between 5.25% and 5.50%.

Rising interest rates are particularly relevant to M&A deal flow. As the cost of debt rises, acquirers that tend to use leverage in their deals may hold back. On the flipside, strategic acquirers with significant cash on their balance sheets may be inclined to seize opportunities. With inflation landing in a more comfortable zone for the Fed, many expect the federal funds target rate to decrease in 2024,[vii] which would provide a boost to deal financing activity.

<