At a glance:

- A rapidly-changing business environment is creating challenges for many small businesses in 2025.

- The lower middle market should weather the storm, but while market disruption persists, companies may look to improve operating efficiencies.

- Strategic initiatives will also come into play, with potential swings in company valuations creating opportunities.

The full story:

The first half of 2025 has been a tumultuous period for many small businesses. In addition to their normal day-to-day challenges, some businesses have had to contend with the changing tariffs landscape and associated supply-chain constraints. Other businesses have seen, or expect to see, adverse consequences from Department of Government Efficiency (DOGE) actions. All of this is occurring against a backdrop of inflation, elevated interest rates, geopolitical conflicts, and concern about a possible recession.

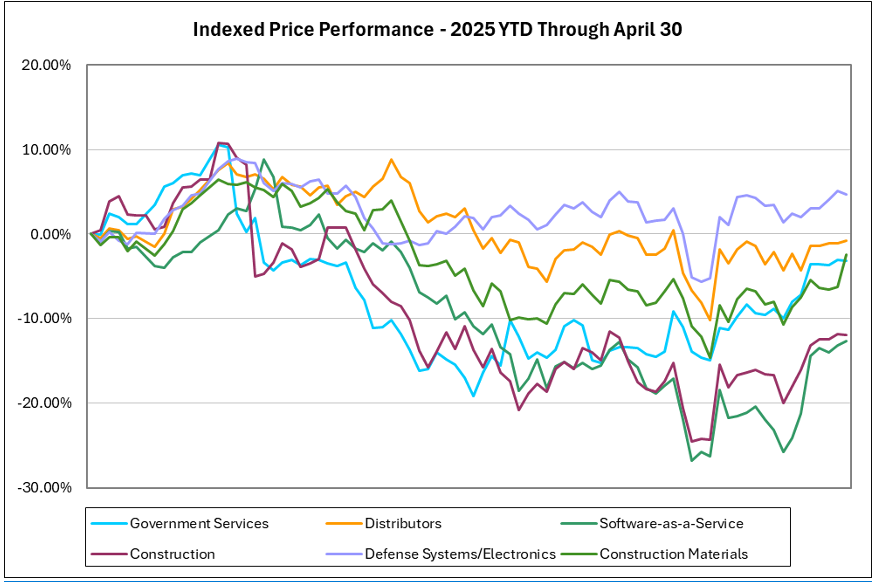

Disruption of this type can have a negative impact on the value of a business. Indeed, the public capital markets bear this out, with share prices fluctuating during the first trimester of 2025. To illustrate the volatility, recent trends in share price performance for six selected industries are charted below: [i]

- Government Services

- Defense Systems/Electronics

- Distributors

- Software-as-a-Service

- Construction

- Construction Materials

As shown in the chart, five of these six industry reference groups displayed a downward trend thus far in 2025. Public company price performance, of course, does not necessarily correlate with the value of middle market/nonpublic companies. Smaller businesses, whose operations and customer sets tend to be more concentrated, may feel the impact of market turmoil more acutely than larger/public companies. Conversely, in some situations smaller businesses may be shielded from market turmoil as a result of their niche specialties.

Downturns, while unsettling, do happen from time to time. Bumps in the road are to be expected. The middle market has proven its resilience before, navigating events like the financial crisis of 2007-2009 and the Covid-19 pandemic. Additionally, while broad market sentiment points toward disruption, that doesn’t mean the core operations of any one business, or its fundamental risk profile, have changed.

For the many small businesses that are feeling uncertain about 2025, there may be some ways to turn that uncertainty into opportunity. Savvy firms in the lower middle market will do more than just weather the storm, using a disciplined approach to make timely investments and improve financial effectiveness. Potential areas that firms may choose to focus on include:

- Strategic initiatives

- Working capital management

- Cost cutting efforts

- Share transfers

Strategic initiatives to combat market uncertainty

During periods of economic uncertainty, M&A deal flow in general may decrease, as certain sellers may want to wait for things to stabilize before bringing their companies to market. Even if the number of companies going to market does not decrease, market turmoil could slow the pace of M&A activity in other ways. For example, the timeline for closing deals may lengthen, or in-process deals may not reach the finish line.

Market volatility may impact M&A activity in other ways as well. Well-positioned buyers who know what they’re looking for may be able to take advantage of market conditions and execute on opportunistic acquisitions at favorable prices/terms.

On the flip-side, divestiture of business units could be an option to generate cash. Lower middle market firms that have scaled may have multiple lines of business or operating units. In times of uncertainty, companies may take a critical look at their business units to determine which parts are core to the business and which are not, or which business units may be underperforming.

Divestiture of non-core assets can help a company streamline operations and refocus on its core business units. Cash generated from such a transaction can be held in reserve to strengthen the balance sheet, be reinvested in the core business units, or used for a subsequent investment in a complimentary asset. In extreme situations, it may be prudent to consider shuttering a business unit that is unprofitable or significantly less profitable than other business units.

Tackle market disruption head on with working capital management

Working capital is a measure of a company’s ability to fund operations and meet its short-term obligations.

The general definition of working capital is current assets less current liabilities. Think of current assets as resources that can be converted to cash within 12 months from the balance sheet date, and current liabilities as obligations that must be settled within 12 months from the balance sheet date.

Working capital management is not the most exciting topic, to be sure. But small changes in finance/accounting operations can pay off during tough periods by reducing the cash conversion cycle. Working capital improvements can help build up cash reserves or pay down indebtedness, ultimately enhancing value.

Many small businesses prepare a rolling 13-week cash forecast. This provides near-term visibility into cash coming in to and going out of a business, allowing finance/accounting teams to anticipate cash needs and make informed decisions. While a 13-week cash forecast can act as an early warning system for financial issues, digging deeper into specific accounting cycles can have a lasting positive impact.

Digging deeper with examples of working capital metrics

Examples of working capital metrics that small businesses can dig into include the following.

- Days Sales Outstanding (DSO)—The DSO metric is a measure of how long it takes for a business to turn revenue into cash. If your company’s DSO metrics are higher than you’d like or higher than industry benchmarks, you may want to look at your collection process and work to collect receivables on a more timely basis.

- Days Payables Outstanding (DPO)—The lower the DPO, the shorter the time between purchases and payments. If your DPO is lower than the industry average, you may have leverage to stretch payment timelines or negotiate better payment terms or early payment discounts with vendors.

- Days Inventory Outstanding (DIO)—DIO measures the number of days a company holds inventory prior to sale. The higher the DIO, the longer it takes to convert inventory into cash. While it may make sense to build inventory levels in certain situations (e.g., in advance of anticipated changes in tariffs), a high DIO may be an indicator of financial or operational inefficiencies.

Working capital is also a focal point in the context of M&A transactions. The general premise in a transaction setting is that a target company will be delivered with adequate working capital to fund current operations. From the sell-side perspective, realizing working capital efficiencies prior to taking a company to market is desirable. So taking a good hard look at working capital management now can pay off down the road if a liquidity event is pursued.

Cost cutting efforts

Market uncertainty may also prompt small businesses to take a look at operating expenses. Sometimes the most direct path to maintaining a company’s profitability is to identify, and cut, non-essential spending. This can be accomplished through activities such as historical trend analyses, industry benchmarking, revamping internal controls, and changes to vendor/supplier management practices.

With respect to vendor/supplier management, lower middle market companies often have limited capacity to manage those relationships. With existing resources focused on maintaining strong relationships with the most significant vendors and suppliers, others may be left unmanaged. Organizations may be able to reduce administrative burdens and save money by carefully reviewing selected expense categories and vendor groups with an eye toward consolidating suppliers and identifying redundant expenditures.

Share transfers at reduced value

During a downturn there may be strategic considerations at the shareholder level as well. If a company is experiencing temporary uncertainty, it might make sense from a tax planning perspective for the shareholders to consider transferring shares at a reduced value.

What factors pull company valuations down during times of uncertainty? Ultimately, it’s about risk. While not an exhaustive list, a few factors that commonly impact both real and perceived risk for smaller businesses are listed below.

- Revenue concentrations

- Profit margin pressure

- Executive team gaps

- Limited earnings visibility

Any one of these factors in isolation could have a downward impact on value for lower middle market companies. When multiple negative factors are combined, the downward impact could be significant.

Middle market/nonpublic firms are often valued using the income approach and the market approach. In the context of the income approach, market turmoil could adversely affect the amount and timing of a company’s future cash flows, and possibly its cost of capital. This could be a function of revenue streams being reduced or delayed, less predictable profit margins, or increased forecast risk.

In the context of the market approach, deteriorating economic conditions can be a drag on valuation multiples. On top of that, the company metrics to which those market multiples are applied (e.g., trailing EBITDA, forward revenue, etc.) may be lower.

For owners of privately held companies, gifting shares to a trust or the next generation is a common estate planning strategy used to minimize future estate tax liabilities. For companies negatively impacted by current market conditions, there may be an opportunity for the owners to take advantage of a dip in valuation (even if temporary) and utilize lifetime exemption amounts.[ii] Also of note, the fair market value of gifted nonpublic company shares will typically be less than the pro rata value of the entire business. For a non-controlling block of shares, the fair market value may be subject to valuation adjustments (i.e., discounts) related to lack of control and lack of marketability.

When life gives you lemons, make lemonade

Small businesses have a lot on their plates for the second half of 2025. Some companies will be contending with evolving global trade dynamics. Others will be scurrying to address the impact of DOGE actions. Faced with these and other challenges, small businesses may look to improve operating efficiencies or take on certain strategic planning initiatives. Companies that can transform market disruption into opportunity will be in a good position when the current wave of market confusion subsides.

Let us help you navigate market uncertainty

Aprio provides advisory services to middle market companies and private equity groups. This includes Valuation & Investigations, Transaction Advisory, and Technical Accounting Consulting. Whether it’s pre-acquisition due diligence, post-acquisition purchase price allocation analyses, navigating the GAAP intricacies of business combination accounting, or assisting in the resolution of a post-acquisition dispute, Aprio can help you succeed in 2025 and beyond. Schedule a consultation today.

[i] Based on a reference group of publicly traded companies for each industry. Information obtained from S&P Capital IQ.

[ii] As a result of the 2017 Tax Cuts and Jobs Act (TCJA), the current lifetime gift and estate exemption for individuals lets you gift $13.61 million to heirs free of federal gift/estate taxes. This TCJA provision is scheduled to expire in 2026. If it is not extended, the exclusion would drop to the pre-2018 level of $5.49 million (about $7 million on an inflation-adjusted basis).