New investments. New hires. New markets.

Account for Anything™ with Aprio

If your business is growing, you are likely eligible for more than you think. Governments at every level are offering billions of dollars of federal, state, and local tax credits, grants, abatements and discretionary incentives — but the rules are complex and time-sensitive. Without experienced guidance, it’s easy to leave money on the table or miss program windows entirely.

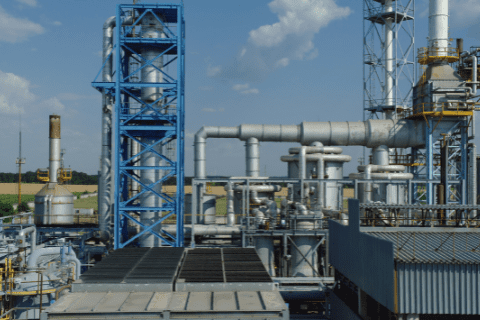

If your business has a building, hires people, buys equipment, produces energy, or invests capital — incentives may apply. And Aprio can help you claim them.