Dates covered: 4/13 – 4/17

Executive Summary

This was the first week of monthly economic news relating to the initial impact of COVID-19 in March. It was worse than expectations generally. The size of the decline is anticipated worse for April. This was the economic expectation when the economy was essentially shut for all but necessary work. We should expect similar results for at least the next 4-6 weeks.

The stock market continued its bounce, somewhat separated from the economic news. This has been attributed to the Fed’s initial buying of risky assets, talk of cases peaking in NY and CA, quickly reopening the economy and a snap-back in the economy. The bond market is telling a different story – a much slower recovery. We started the season of Q1 corporate earnings, with large banks reporting huge reserves against their loan portfolios in anticipation of large losses.

A Few Stories that Caught My Eye

- The perspectives of Charlie Munger (Warren Buffett’s partner) – why their phone hasn’t been ringing off the hook this time (link)

- The Oregon healthcare experiment from the point of view of a young, star healthcare economist (link)

- The Mark Andreesen (founder of Netscape, big-time venture capitalist) reading list (link)

The Markets

Earnings season started with large banks reporting earnings starting Tuesday.

- Generally reports have been below expectations.

- Large banks reported earnings declines of between 45 and 70%.

- Banks have taken large reserves for credit losses (e.g. JPMorgan Chase took an $8 billion charge, relative to its largest quarterly charge during the financial crisis of $4 billion).

- For companies that have reported, S&P 500’s earnings are tracking at down 17% Q1 2019.

The market maintained its initial rebound from COVID-19 15-20% below its highs prior to the virus.

The Economic News

Leading Indicators -6.7% vs. +0.1% in February and expectations of -7.2%

- Negative impact from increased jobless claims (greatest impact) and reduced working hours

- Also hurt by weakness in building permits and new manufacturing orders

- Positive impact from lower interest rates and increase in consumer goods

Consumer:

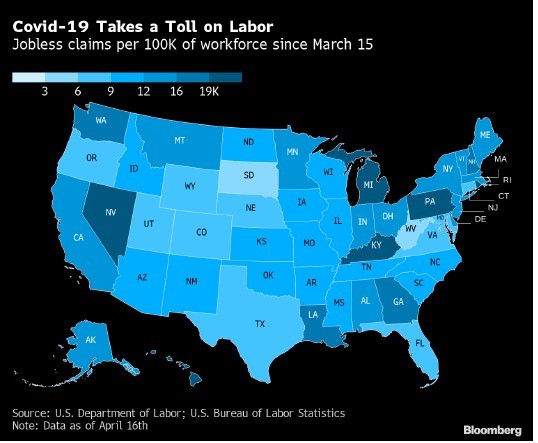

Initial Jobless Claims were 5.2 million for the week, down from last week’s 6.62 million and expectation of 5.25 million

- This is 4 consecutive weeks of what would have been record claims just a month ago

- To date, about 22 million jobs have been lost due to COVID-19 recession. This compares to 21.5 jobs added during the decade-long expansion from 2009 – 2019.

- Latest figures imply an unemployment rate around 17% (vs. prior peak of 10%).

- Unemployment rate before COVID-19 was 3.5%.

Consumer Comfort index was at 44.5 vs. 49.9 last week

- Index is down 5 points in last 4 weeks

- At lowest levels since October 2016

- Attitude toward buying – at 37, which is lowest level since December 2015

- Was at an all-time high in late January

Retail sales declined 8.7% in March vs. 0.5% in February and -8% expectation.

- Was the largest monthly decline since the start of recording (1992)

- Impacted by decline in gas sales and auto sales. Excluding those categories, sales declined 3.1% vs. -0.2% in February and expectations for 5.2%.

- Spending in discretionary categories plummeted: clothing (-50.5%) auto sales (-25.6%), furniture (-26.8%), electronics (-15.1%), sporting goods (-23.3%), department stores (- 7%) and restaurants (-26.5%)

- Spending in necessities/staples jumped: Food and beverages +25.6%, health and personal care items +4.3%.

- Shopping at gas stations declined 17% with 9% drop in gas

Housing Starts were 1.21 million vs. 1.6 million in February and 1.3 million expectation

- The decline compared to February was the largest monthly decline since 1984

- Applications to build (a proxy for future construction) fell 7%.

- Single-family and multi-family declined

Corporate:

Industrial Production declined 5.4% vs. 0.6% gain in February and expectations of -4%.

- This was the largest monthly decline since 1946.

- Production declined 3% from February vs. -0.1% the prior month and expectations of -4%.

- Auto production -28%, Machinery -5.6% led the declines.

Capacity Utilization was 72.7% vs. 77% in February and expectation of 74%.

- Manufacturers were impacted by reduced demand and issues with the supply chain

National Association of Home Builders survey – declined to 30 in March from 72 in February and expectations of 55

- Was a record decline in the 30 year history of the index

- Typically above 50 is a sign of optimism

- This was the lowest level since 2012 and first time below 50 since 2014

- In December 2019 it was at its highest level in two decades. Builder optimism remained in January and February, so decline solely due to COVID-19 impact.