The Pulse on the Economy and Capital Markets: May 3–7, 2021

May 11, 2021

Executive Summary

- Mixed Market News for Tech: Last week, markets were positive globally except for high-valuation, fast-growth technology companies.

- Disappointing Economic Data: April’s economic data fell short of expectations, slowing the rise in bond yields. Job market data is also conflicting with what management teams said over the course of the first quarter.

- The Housing Market is Humming: Meanwhile, the real estate market — single family and multi-family residential — is showing strength nationally.

In the Markets

Earnings season continues to be record-breaking, as more companies surpass analysts’ estimates. Markets were higher across the globe this week, shown in the data below:

However, there is weakness in the tech sector, notably with low/no-profit tech companies. The Nasdaq declined 1.5% last week while the smaller-company-focused Russell 2000 Growth Index fell 2.7%.

This coincided with a decline in crypto. Dogecoin, “the It coin,” plummeted 30% while its most famous proponent — the self-proclaimed Dogefather himself, Elon Musk — hosted Saturday Night Live. According to CNBC, the trading app, Robinhood, experienced a crypto-trading outage during Musk’s appearance.

One notable pandemic winner was clean products pioneer, The Honest Company, founded by actress Jessica Alba. A clear beneficiary of the trend toward organic and sustainable products, The Honest Company closed +40% on its first day of trading and closed the week 20% above its initial price. This performance was a high note in what has been a long and difficult journey for the company, replete with lawsuits, product failures, layoffs and executive turnover (click here for the backstory).

Finally, economic news encouraged investors to buy bonds, on the heels of declining concerns that the Fed would raise rates sooner than expected due to April’s weak jobs report.

In the Economy

We received several other pieces of economic news that supported a future recovery, with hiccups along the way — April was one of those hiccups, as the data showed a step back from March amid economists’ high expectations.

“Just a bit outside”

Last week, we had the economic equivalent of Bob Uecker’s “Just a bit outside…” quip in the cult baseball movie, Major League (clip linked here), when the April jobs report missed expectations by roughly 75%. Economists expected one million new jobs in April; we ended up with about 265,000. Manufacturing payrolls also declined 18,000 compared to an expected increase of 54,000.

In concert, the unemployment rate increased in April to 6.1% versus 6.0% in March. Economists were expecting a decline here. One key reason for the increase is that more people started looking for jobs in April, which is a positive for the economy.

But wait … what?

The government data conflicts with what management teams said on first-quarter earnings calls. Companies across a variety of industries are having a hard time finding employees, even though more people are looking for jobs:

“Now the final thing I’d like to acknowledge [as] we close out the discussion on our Q1 results in the U.S. is the very difficult staffing environment that we are in today. The combination of COVID, strong sales, the broader economy reopening and the high level of government stimulus is creating one of the most difficult staffing environments that we’ve seen in a long time.” — Domino’s (DPZ) CEO Ritch Allison

“… Housekeeping and marketing associates and front desk staff — they’re the frontline of the hospitality industry. I do anticipate employment to be a challenge through the summertime.” — Travel + Leisure (TNL) CEO Michael Brown

“… We are seeing this impact more in the downstream, [such as in] trucker shortages. And so that, in terms of personnel, I think that’s, in part, the Amazon effect and all the delivery from UPS and the rest, pulling a lot of truckers off.” — Chevron (CVX) CFO Pierre Breber

“… If you want to get a contractor, everywhere around the country seems to be … off the hook. So, homebuilders and all kinds of stuff and the cost of wood and all that other stuff.” — Brown & Brown (BRO) CEO Powell Brown

In addition to the jobs report, ISM Manufacturing and ISM Services surveys were below expectations and down from March. Both surveys were very strong overall; however, they were a step back from March’s extraordinary levels.

With the ISM Manufacturing report, the prices-paid metric continued its quick ascent post-COVID-19. April was the second-highest level since 1980, only surpassed during the oil spike in 2008.

ISM Prices Paid Index

A quick check on real estate

In recent weeks, we’ve written about the tightness of housing supply and the impact of rising lumber prices. Redfin (RDFN) CEO Glenn Kelman recently said, “The U.S. housing market is like a ‘Soviet-era’ supermarket.”

Landlords have seen this tight supply and are raising rents. Large, single-family home landlords, such as Invitation Homes (INVH) and American Homes for Rent (AMH), have occupancy rates in the 97%–98% range. Rent rates have increased double digits compared to last year.

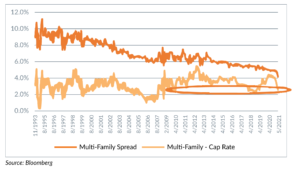

In the multi-family sector, “cap rates,” a short-hand for valuations with lower rates implying higher valuations, for housing have continued their march lower, with national rates approaching 4%.

The difference between cap rates and the 10-year U.S. government bond (i.e., the “spread” to a risk-free alternative) has narrowed significantly and is nearing the post-financial crisis lows of late 2018/early 2019. This implies that investors perceive increasingly lower risks within the multi-family asset class and may be struggling to find better returns elsewhere.

Multi-Family Cap Rates & Spread to 10-Year Treasuries

A Few Stories That Caught My Eye

- We’re reading about a new incident in infrastructure cyberwarfare: a ransomware attack on a critical pipeline for East Coast gas and diesel (link).

- Egg cartons are on backorder as packaging woes roil supply chains (link).

- Bloodless diamonds? The world’s largest jeweler pivots to lab-grown diamonds (link), while Bain & Company releases its 2021 report on the global diamond industry (link).

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (May 11, 2021) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. Simeon brings two decades of professional investing experience in publicly traded and privately held companies, as well as senior-level operating and strategy consulting experiences.