At a glance

-

- The main takeaway: Understanding and using these ratios can provide restaurant owners with valuable insights into how their business operates. These financial ratios help you evaluate, monitor, and improve your business’s health.

-

- Impact on your business: Whether you are planning for growth, working to improve performance, or thinking about long-term strategies, financial ratios are necessary.

-

- Next steps: It takes a whole team to keep the ratios up. Aprio’s Restaurant, Franchise & Hospitality team can help you make guided decisions on corrective actions and plan for the long term.

The full story:

Aprio’s Restaurant, Franchise & Hospitality team is hosting a 4-part webinar series titled “McDonald’s Franchisee Owners/Operators Essentials: Navigating Financial Success with Aprio,” a focused webinar series designed for McDonald’s decision-makers. We will be discussing practical financial strategies to help restaurant owners manage, grow, and future-proof your franchise. Whether you’re new or have been growing with the McDonald’s family, we’ve got you covered. (McDonalds)

In the first session, we will look at financial ratios and how they show a business’s performance. We will focus on five key ratios that can help restaurant owners measure profitability, liquidity, and risk. You will also learn how to use these ratios to set benchmarks and improve your business’s performance.

Why are financial ratios important?

Understanding and using these five key ratios can provide restaurant owners with valuable insights into how their business operates. These financial ratios help you evaluate, monitor, and improve your business’s health. Whether you are planning for growth, working to improve performance, or thinking about long-term strategies, financial ratios are necessary. In an industry characterized by rapid change, leveraging financial ratios to benchmark against industry standards, identifying potential challenges, and improving performance is essential. These numbers, together, are vital for your lenders, investors, and internal decision-making.

Cash flow coverage ratio

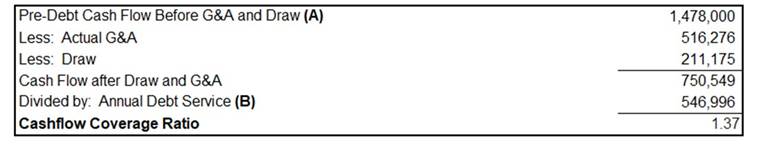

Let’s start with the biggest one that everybody wants to talk about—the cash flow coverage ratio. It talks about your short-term financial stability. A low ratio may suggest cash flow problems even if you have high profitability at restaurants and are preferred by lenders when assessing risk. You need to take a closer look and analyze your cash flow coverage ratio to assess your restaurant’s risk level.

Maintaining a compliance report with a ratio of 1.2 or higher is vital for financial stability. Still, if it’s a little below, restaurant owners start worrying, which leads to their lenders beginning to worry. The 1.2 ratio acts as a “breathing zone” that reassures lenders during times of potential crises. This calculation is based on the trailing 12 months of performance, highlighting the importance of analyzing cash flow beyond just the current month’s income.

During the webinar, we discussed the pre-debt cash flow, which is essential for understanding a restaurant’s financial health. The image above explains where your pre-debt cash flow came from—the store’s operating income before accounting for General & Administrative (G&A) expenses and draws. To calculate your restaurant’s cash flow, add your interest expenses, depreciation, amortization, and reinvestment amounts to the store’s operating income.

For example, taking an additional $500,000 draw can drop your ratio to .45, which is quite challenging to recover from. A $250,000 can move your ratio to .91, still below the standard 1.2 ratio. Analyze your restaurant’s financial obligations quarterly and determine which financial aspects (increasing sales, pre-debt cash flow, lowering food costs, or reducing labor) significantly affect your ratio.

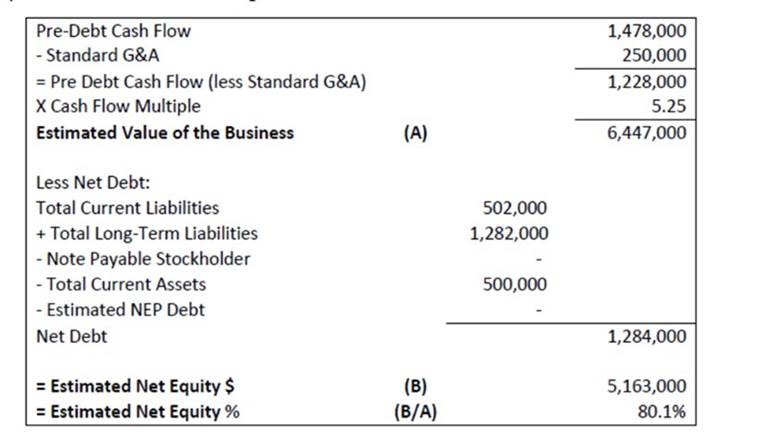

Estimated net equity

The next important ratio to consider is your estimated net equity, often referred to as “the mysterious ratio” by some business owners. It starts with calculating pre-debt cash flow, which in this example is $1.4 million. After subtracting standard G&A costs ($50,000 per location) for a five-store operator, the cash flow stands at $1.2 million, providing a baseline for comparison. McDonald’s use a multiplier of 5.25x cash flow—this is industry standard. But keep in mind, this is not market value—just a foundation. It doesn’t factor in your brand, location, or intangible value.

Estimated Net Equity Calculation Guideline**

Estimated Net Equity Calculation Guideline 25% or above 25% or above

**This serves as a foundational figure. It does not reflect the current market value of the business. The 5.25 cash flow multiplier is a standard measure that does not consider factors such as location, reinvestments, and other variables.

Next, we evaluate the net debt, which includes current liabilities (those due within 30 days) and long-term liabilities, while excluding any amounts owed to stockholders and current assets. In our example, the net debt is $1.2 million, leading to an estimated business value of $5.1 million and a net equity of 80.1%, surpassing the 25% threshold.

Several factors can influence your net equity. Increasing cash flow through strategies like reducing food costs or cutting G&A expenses can enhance your estimated net equity. However, taking on additional liabilities, such as securing a new loan, will decrease your net equity.

Working capital

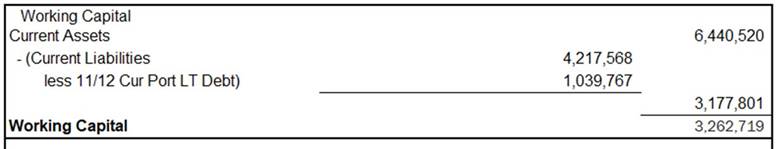

The third ratio is working capital, which is commonly a big talking point when analyzing your financials. In the image below, you can see that there is no threshold because this isn’t an actual measurement. However, you should have a threshold on your ratios because it’s an important measure of your business’s short-term health.

Your working capital uses the current section of your organization’s balance sheet, comparing the amount of liquid current assets to your current liabilities due for that month. It shows the difference between current assets and current liabilities, which is one month’s debt service less 11/12 of your current portion. Ideally, you would want to maintain a positive working capital for your restaurant so that you can position it for continued growth, operational efficiency, and financial stability.

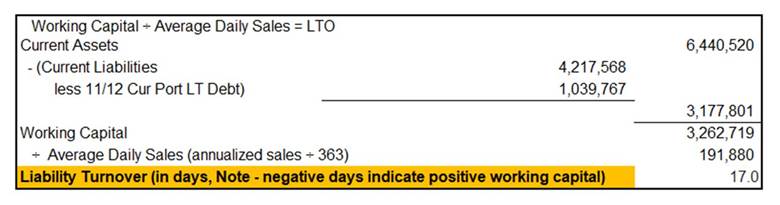

It’s time to address this question: Can you pay your bills in the short term? If your current assets exceed your liabilities, then you’re in a strong position. Negative working capital could mean cash flow problems. Working capital plays into the liability turnover in days and looks at how quickly you can pay off your short-term obligations. To calculate, take your working capital divided by your average daily sales. You would want a positive working capital to meet your current commitments.

Liability turnover

A positive working capital gives insight into how a business manages its liabilities. The guideline here is less than 0 days and is critical for assessing a business’s financial agility and operational effectiveness. An increase in this number usually raises concerns about potential underlying issues, such as declining sales and uncontrolled expenses, which require careful examination.

Consider reflecting on this from a personal perspective: Imagine you are an individual living paycheck to paycheck. The severity of your financial situation hinges on whether you are dipping into your savings to cover your current debts for the month. This situation is like liability turnover, which measures the number of days of indebtedness. A higher number of days indicates negative financial points. For example, if your debt situation results in a positive number of 10, it means that for the next 10 days of the following month, you will be paying off last month’s bills. Therefore, higher days in this ratio will lead to losing more points against you. It just emphasizes the importance of liquidity.

Leverage

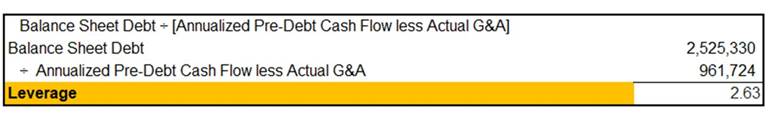

The last financial ratio to consider is leverage. To calculate this, take your current month’s balance sheet debt and divide it by your annualized pre-debt cash flow, subtracting your actual G&A.

Now, here’s a little trivia: if your organization has Business Financial and Leasing Services (BFLS), their pre-debt cash flow is excluded from this calculation because it is deducted from your annualized pre-debt cash flow. As a guideline, aim for a leverage ratio of 3.0 or lower to help you evaluate the extent to which your business is financed by debt. Understanding and calculating your leverage is critical for assessing your financial capacity, stability, and risk exposure.

If you’re considering adding a couple of new stores, you’re looking at a patch. Determine if you are overleveraged by conducting a pre-debt cash flow estimate for the new restaurant, including the amount of debt you will incur. Ask yourself: Does it make sense to add a new restaurant? Maintaining a healthy leverage ratio leads to greater stability and flexibility, which restaurant owners must monitor as they consider expanding continuously.

Transactions impacting multiple ratios

It’s essential to understand how different transactions impact financial ratios to make informed decisions. For example, limiting withdrawals can improve cash flow and possibly increase working capital. Taking on debt can boost working capital temporarily but can also raise leverage and reduce net equity. Understanding how this interconnection is vital for your comprehensive financial analysis and strategic decision-making is important, as business decisions don’t just affect one area.

Yet, improving financial scores is achievable and often simpler than it appears. Many restaurant owners/operators might overlook adjustments like reducing food costs, renegotiating vendor contracts, or managing labor expenses during low sales periods. By considering the overall picture and taking proactive measures, owners can enhance their restaurant’s financial viability, which is scored from a high of 10 to a low of negative 6.

McDonald’s scoring system offers a clear framework for assessing financial viability. A score of 9 or above signifies a gold standard of financial health, while scores of 6 or above meet their viability criteria. Scores of 5 or below indicates financial risk.

Each ratio provides insight into your restaurant’s financial status, but together they give us a 360-degree view of your financial viability.

Recap: Importance of ratios in understanding your financial health

-

- Cash Flow Coverage: Measures the ability to cover debt obligations with operating cash flow.

-

- Estimated Net Equity: Equal to the portion of the business that is free of debt or owned outright.

-

- Liability Turnover: Assesses how efficiently the company repays it liabilities using revenue.

-

- Leverage: Shows the degree to which a business is financed by debt.

The bottom line

Ratios are essential in understanding your restaurant’s financial health. They serve as an early warning system, helping owners see trouble before it hits. Ratios provide insights into identifying your strengths to improve leverage, and every owner/operator should look at these numbers. They should regularly review and analyze their performance to identify improvement areas. Each ratio serves a specific purpose, ranging from measuring debt coverage to assessing operational efficiencies. Ratios are not just about financial health; they’re a decision-making tool to consider before expanding.

It takes a whole team to keep the ratios up. Aprio’s Restaurant, Franchise & Hospitality team can help you make guided decisions on corrective actions and plan for the long term. We can guide you in integrating various financial ratios to uncover a multifaceted view of your restaurant’s financial health. By using these ratios collectively, you can gain insights into liquidity, solvency, efficiency, and risk exposure, and it can also help you with your decision-making and strategic planning.

Related Resources/Assets/Aprio.com articles/pages