The Pulse – What’s happening in the Economy and the Capital Markets: May 17-21

May 25, 2021

Executive Summary

-

- Buy the rumor, sell the news: From sideways stocks to bond intimidation, there’s a lot going on in the global financial markets. One of the biggest stories: a sell-off in cryptocurrency.

- Things are heating up: Though inflation is still a big concern, many businesses feel optimistic that the economy will only grow stronger over the next six months. Below, we discuss what you should keep an eye on.

To discuss your current investment strategy, schedule a consultation with an Aprio advisor.

In the Markets

Stock markets continue to move sideways as we wrap up an earnings season in which more than 85% of companies reported better-than-expected earnings. However, the markets already discounted this strength in prices, or as the old Wall Street adage goes, “Buy the rumor, sell the news.”

Due to declining COVID-19 cases across the globe, international markets saw increases on the week.

Return of the (bond market) vigilantes?

The politically astute “Ragin’ Cajun,” James Carville, once quipped that he’d want to be reincarnated as the bond market because you can intimidate everyone.

10 year bond yield minus 2 year bond yield

The bond market has sure intimidated stock investors since the fall. When the difference (i.e., “the spread”) between bond yields for 10-year bonds and two-year bonds widens — a sign of future growth and inflation — stock markets typically increase. In the past few months, that spread has flattened and the market’s performance has followed suit. We’re keeping an eye on this spread as we look to the future.

Rollercoaster … of love

Rip van Winkle may have been on to something … if he was a Bitcoin investor.

Year to date, Bitcoin is up 22%, which is a great return — unless you remember that it was up over 100% not that long ago. Then it’s painful.

Bitcoin prices year to date

What’s behind the recent sell-off? There are three factors:

1. China and competition

Last week, China announced restrictions around cryptocurrencies ahead of its own digital currency launch. Visa’s CEO spoke publicly about these restrictions recently:

“…This is a big subject in all central banks. Some are much more intensely into it. Obviously, China probably is the furthest ahead as they’re trying to use the Beijing Olympics next February as kind of a showcase for digital currency. But the reality is, we’re talking to a lot of central banks.” — Alfred Kelly, CEO of Visa (V)

We’ve noted the rise of central banks’ role in digital currencies before. It’s coming, according to Coinbase:

“I think more and more, central banks will start to create digital currencies. We’ve seen a lot of activity there in China, and I think and hope that the U.S. and other countries will follow.” — Brian Armstrong, CEO of Coinbase (COIN)

2. Reducing leverage from speculators

3. Elon’s about-face

Musk says Tesla won’t accept Bitcoin anymore over climate concerns. Speaking of Elon and Tesla…

“The Big Short,” Part 2?

The movie, “The Big Short,” was great and is one of our favorites (“How big’s your short position?”); the book was even better.

The lead character, Dr. Michael Burry (played by Christian Bale in the movie), bet huge against the housing market … and as we all know, he was completely right. Last week, it came to light in U.S. Securities and Exchange Commission (SEC) filings that Dr. Burry wagered half a billion dollars against Tesla.

Grab some popcorn.

You and me, baby … on the Discovery Channel

There’s something about Time Warner and media M&A debacles.

Less than three years ago, Ma Bell (AT&T) bought Time Warner for over $100 billion (about $80 billion in cash and stock, assumed nearly $25 billion in Time Warner debt); this was three years after it paid nearly $70 billion for DIRECTV (about $50 billion in equity, assuming $26 billion in debt). Even for a Fortune 100 company, $170 billion adds up.

Last week, AT&T announced it was spinning off the rechristened WarnerMedia and merging it with media conglomerate, Discovery Communications (proud owner of a variety of cable channels and programming, such as The Discovery Channel, HDTV, Food Network, Animal Planet and TLC). AT&T will receive about $43 billion for contributing WarnerMedia to a spinoff and merger with Discovery. This comes after AT&T wrote down DIRECTV by about $50 billion earlier this year, which means the company is down about $100 billion on its media adventure.

Why is AT&T doing this? Because of COVID-19, Netflix and Disney.

AT&T’s new CEO knows that the company can’t spend the money to compete for content and spend money on 5G wireless infrastructure. So, media’s got to go.

With Discovery, AT&T stands to benefit from a pure-play streaming platform with HBO Max (a WarnerMedia platform that has performed well), plus the Discovery assets to compete with Netflix and Disney.

So, don’t be surprised to see Joey and Chandler watching Shark Week, while Monica is redoing her apartment with HDTV.

In other interesting news, HBO Max added six times the subscriptions of Netflix in the first quarter:

“We added six times the number of HBO Max subs in the first quarter in the U.S. market, which is the market we operate in compared to Netflix. And that’s what momentum feels like.” — Jason Kilar, AT&T (T) CEO of WarnerMedia

In the Economy

Inflation: what’s here and what’s not, yet

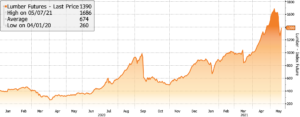

Good news — lumber prices are down from peaks (see A Few Stories That Caught My Eye below):

Lumber prices

Bad news (unless you’re in the steel business) — steel prices are skyrocketing:

Steel prices

Last week, we spoke about the rising popularity of dollar stores, and this week, get ready: higher prices for food are coming. Donnie King, chief operating officer of Tyson Foods (TSN), recently commented on this:

“Overall, we’re seeing an accelerating inflationary environment that is creating a meaningful headwind for prepared foods in the back half of the year. We’re seeing raw material cost up over 15%, as well as increases in logistics, packaging and labor … we’ve been having nonstop conversations with all of our customers around the inflationary need for pricing. And they have been very responsive … I don’t believe consumers at retail have seen the type of food inflation they will see because of rising commodity costs. There is more yet to come.”

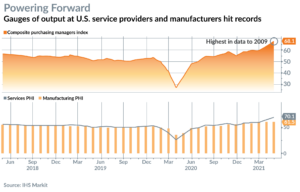

Services and Manufacturing PMI, oh my!

The economy is heating up and businesses see it growing stronger over the next six months. At its highest level in over a decade, the recent growth has been driven by services.

When the PMI Composite is above 50, it is considered a sign of growth. At its most recent reading of 68, we’re up 8% month over month and the trend is clear.

PMI composite

A Few Stories That Caught My Eye

- Check out comprehensive coverage of the AT&T / Discovery deal (link).

- The TimeWarner-Discovery deal will change everything for streaming (link).

- No one was more shocked by “lumber mania” than sawmill operators (link).

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (May 25, 2021) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. Simeon brings two decades of professional investing experience in publicly traded and privately held companies, as well as senior-level operating and strategy consulting experiences.