2025 Third Quarter Report

What we are seeing in technology

The tech sector is settling down, even as rapid change continues to shape the landscape. While hiring remains competitive, a modest uptick in unemployment could make it a bit easier for businesses to find skilled talent. Venture capital flows into fewer albeit larger deals, highlighting both challenges and opportunities for innovators. Despite stretched valuations and rising cybersecurity risks, the steady advance of AI and cloud technologies offers reasons for cautious optimism as companies to adapt and grow.

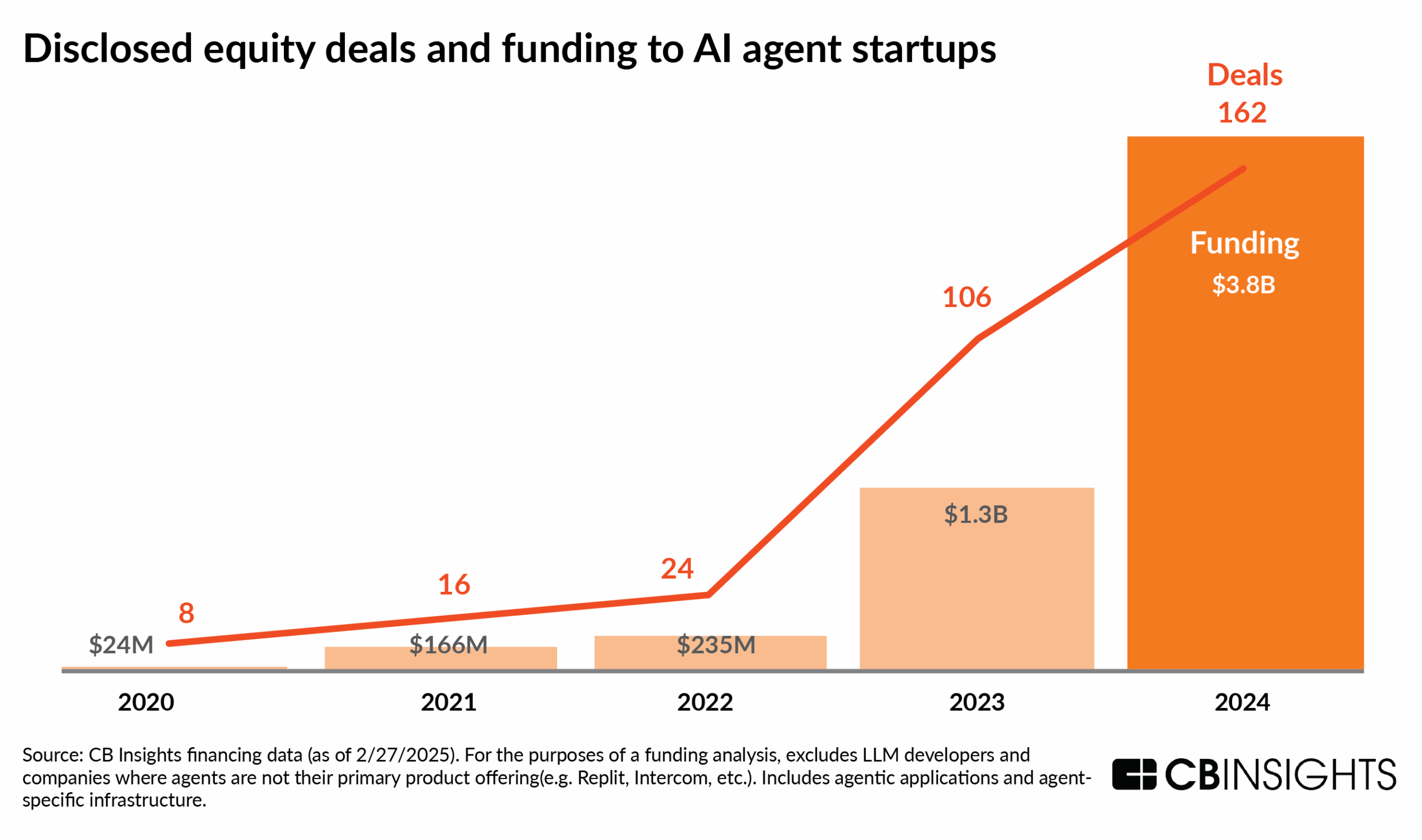

1. AI agent startups attract $3.8 billion in funding

Source: CB Insights

AI agents dominated the conversation on corporate earnings calls, with funding nearly tripling to a record $3.8 billion across 162 deals in the past year alone. More than half of today’s AI players have launched since 2023, reflecting the industry’s swift growth. The fragmented market is beginning to take shape around key layers like data curation, tool use, observability, inference, and full-stack platforms, while private startups are gaining traction in focused verticals (e.g., customer support, software development) where deep workflow integration gives them an edge.

What this means for you: AI agents are poised to move quickly from experimentation to deployment, especially in industries with high-volume processes and structured workflows. For business owners, this means opportunities to streamline operations, but also a need to evaluate vendor risks and implementation hurdles. Expect agents to become cheaper, better, and more common as Big Tech pushes them into the mainstream.

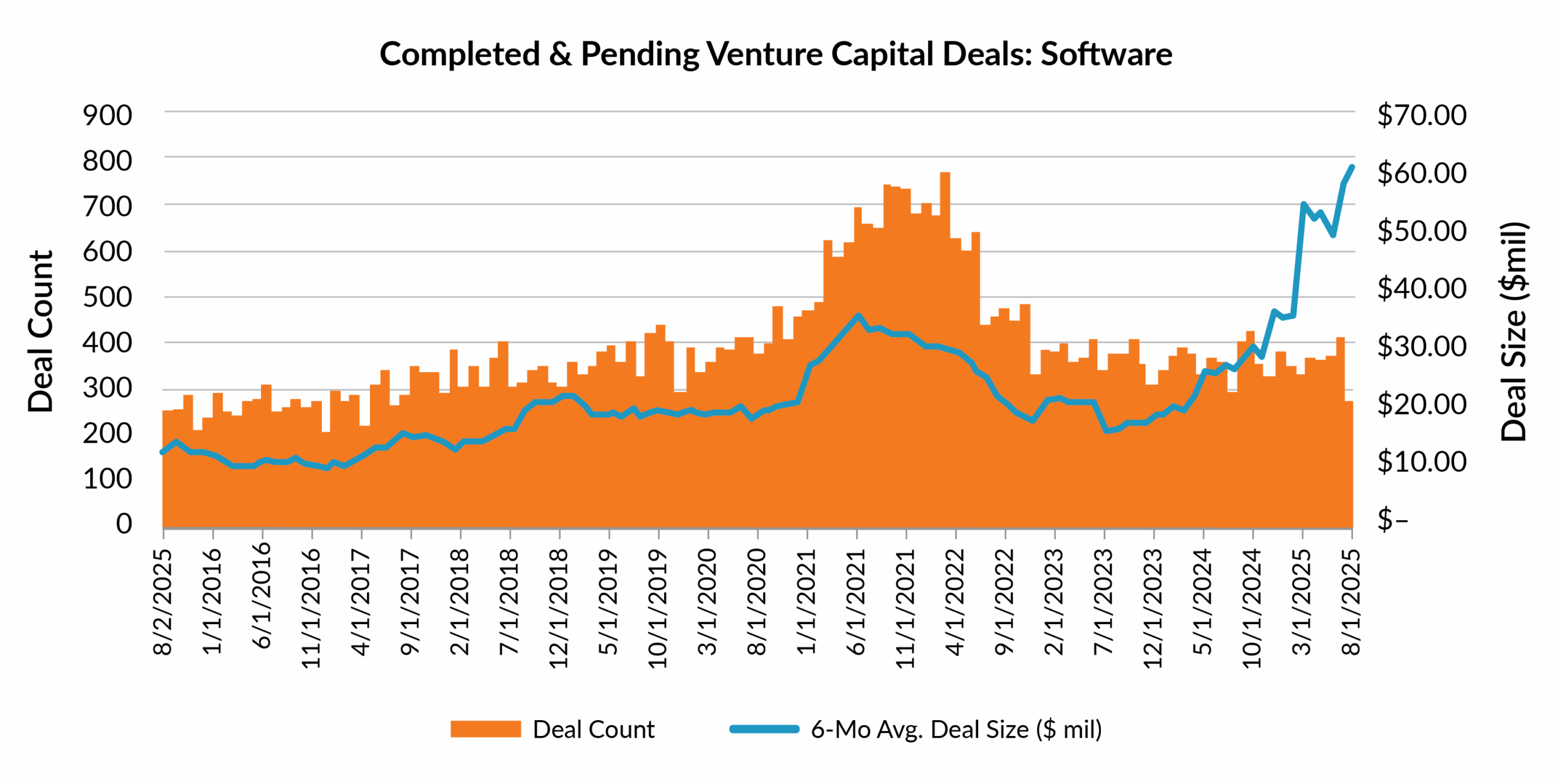

2. Fewer deals, bigger checks in software and AI

Source: Bloomberg Finance, LP

Software funding continues to shift towards bigger, later-stage rounds. Despite fewer overall deals, mega-rounds are dominating. Back in August, Databricks and OpenAI alone accounted for more than half of all funding raised. Both firms now carry valuations in the hundreds of billions, showing that private markets, and not just public ones, are increasingly capturing value creation in technology.

What this means for you: If you’re raising capital, know that investors are pooling their resources in fewer, larger opportunities, and often around proven category leaders. While this potentially means more scrutiny for early-stage companies, it also suggests that today’s emerging leaders may stay private longer.

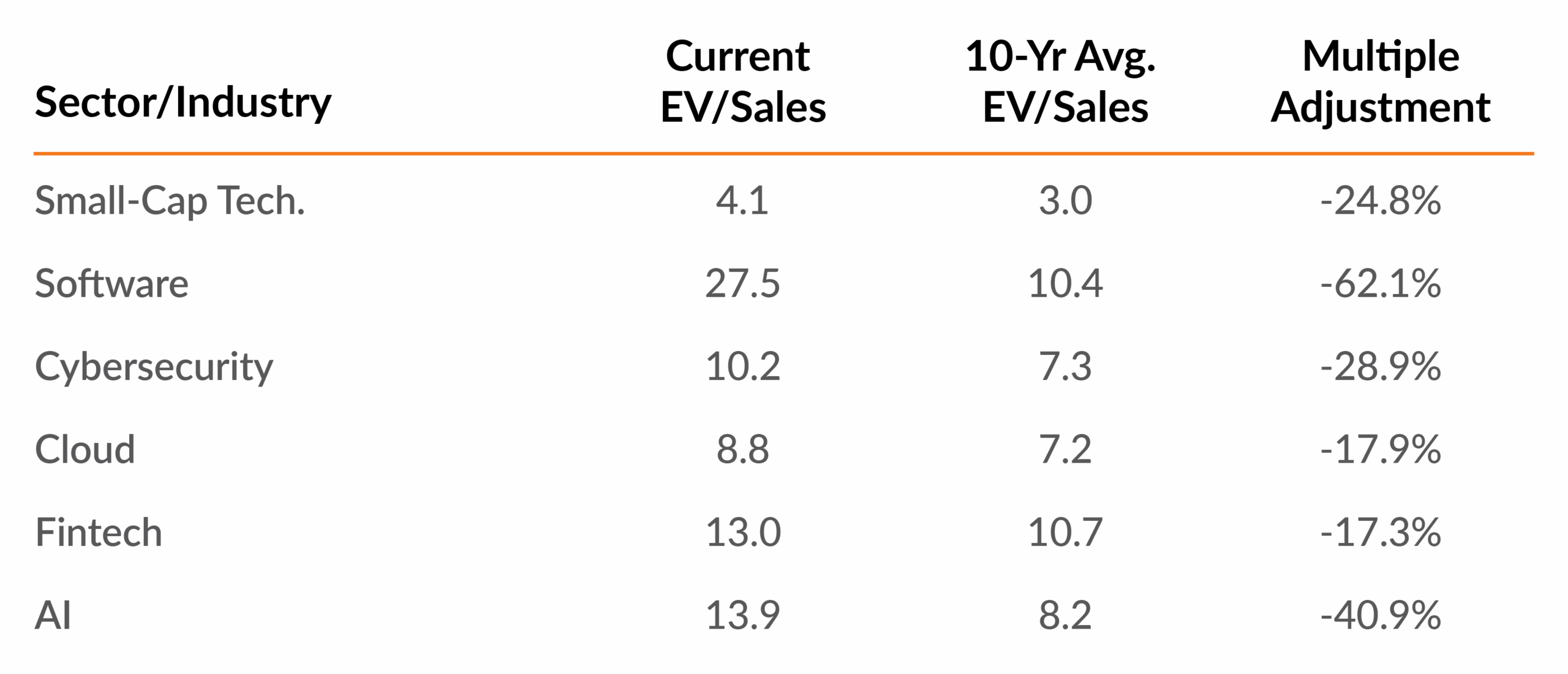

3. Valuations in software and AI are elevated relative to history

Source: Bloomberg Finance, LP

While software companies are trading at more than double their 10-year average, AI valuations also appear stretched, trading 41% above their historical norms. Fintech and Cloud remain expensive as they are closer to their long-term averages.

What this means for you: High valuations can create opportunities if you’re considering an exit, but they also make acquisitions more expensive. If you’re a buyer, focus on companies with strong fundamentals, not hyped-up growth. If you’re selling, consider that the market still favors fast-growing software and AI firms.

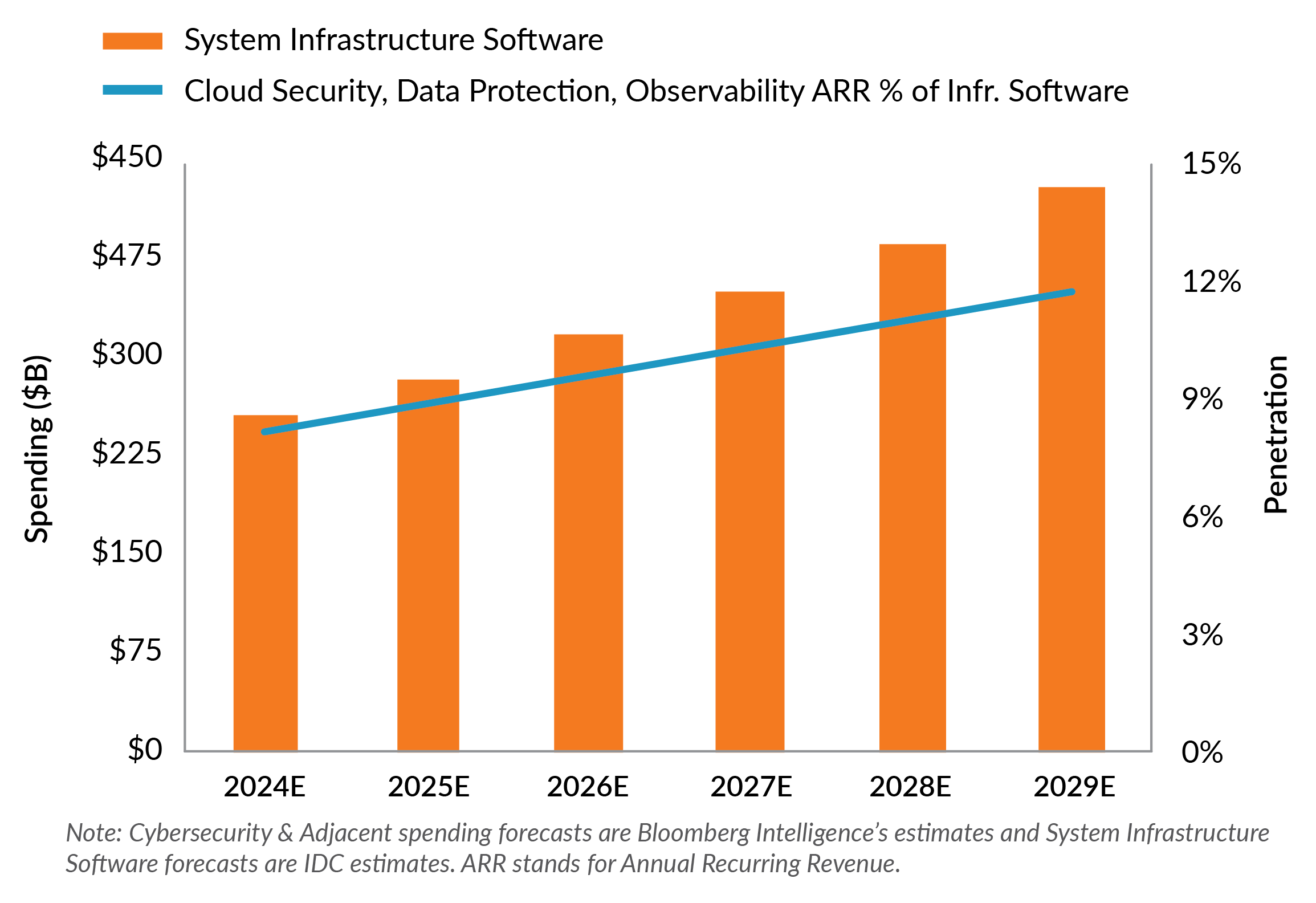

4. Cybersecurity spending continues to grow

Source: IDC, Bloomberg Finance, LP

Spending on system infrastructure software is projected to grow steadily through 2029, with cloud security, data protection, and observability taking an ever-larger share, rising to over 13% of infrastructure budgets. While AI currently remains the biggest long-term driver of cybersecurity spending, extended geopolitical conflicts can position critical infrastructure, supply chains, financial systems, and cloud services as prime targets.

What this means for you: Cybersecurity is no longer optional, whether you’re a tech company or simply a business owner. Investing in security infrastructure is now a crucial cost of doing business. For cybersecurity providers in particular, spending growth, fueled by both AI threats and rising geopolitical risks, represents a powerful tailwind.

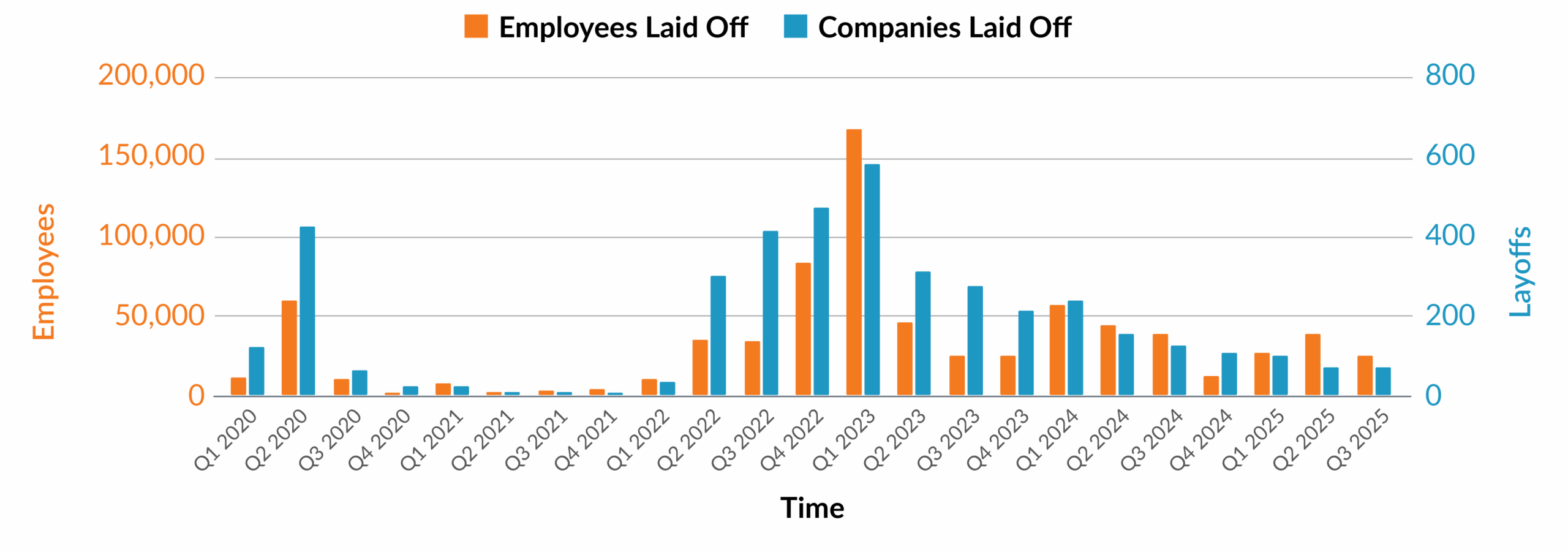

5. Tech layoffs continue to decline

Source: layoffs.fyi

After the massive layoffs of 2022-2023, when over 150,000 workers were downsized in some quarters, layoffs have since declined steadily. In Q2 2025, layoffs are back to pre-pandemic levels.

What this means for you: The days of easy access to surplus tech talent are over. Even with AI penetration, retaining skilled employees should be a strategic priority. Expect wage pressures to persist with in-demand skill sets such as AI skills.

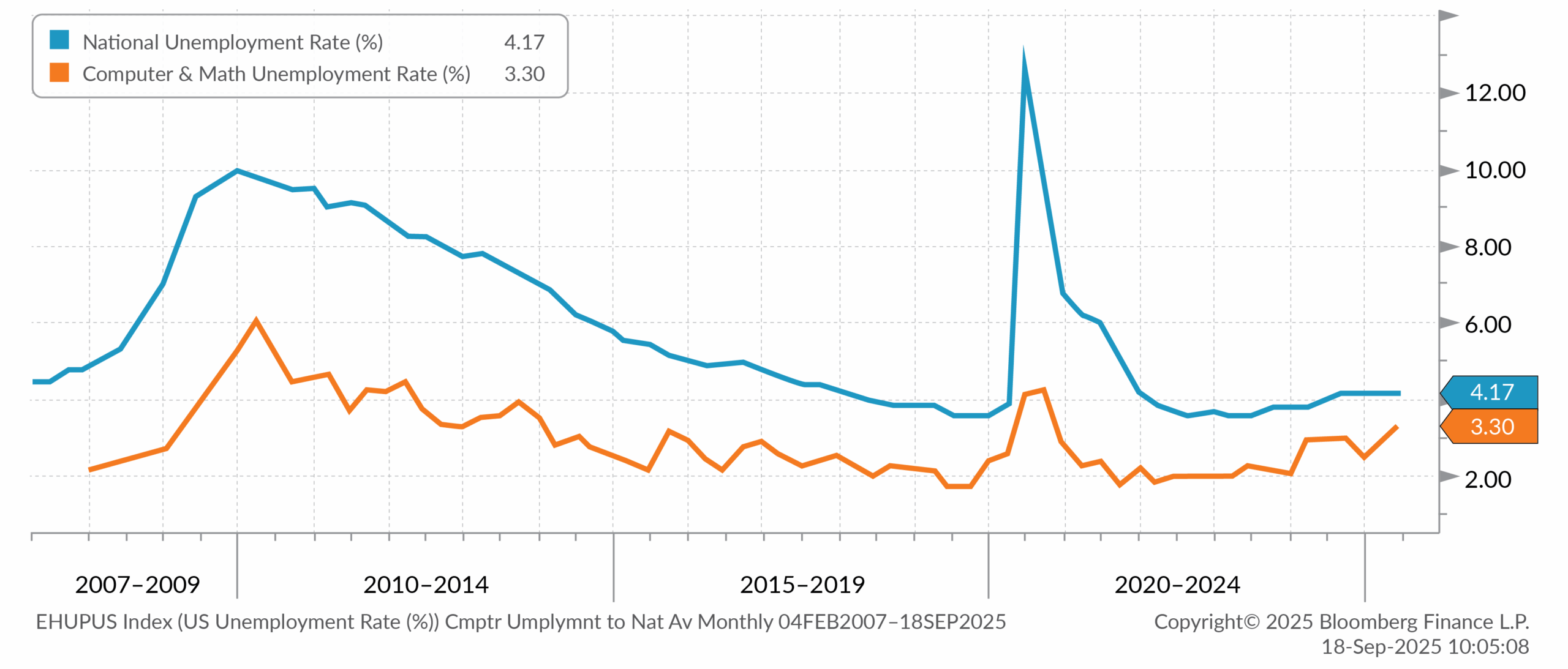

6. Tech unemployment is creeping higher

Source: Bloomberg Finance, LP

Unemployment in computer and math occupations sits at 3.3%, still lower than the national average of 4.2%. However, after years of stability, the rate for tech roles has started to creep higher.

What this means for you: The market for skilled tech workers remains competitive, but the slight uptick signals that talent may become a bit more available. For business owners, it’s still wise to focus on retaining and upskilling key employees, but hiring conditions may improve at the margins.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q