As we enter the second half of 2025, U.S. manufacturing is navigating a familiar set of challenges. Orders are soft, hiring is sluggish, and while production is gradually increasing, it’s doing so in an environment with thinner margins and heightened caution. Rising input prices, particularly in steel, copper, and natural gas, are reigniting margin pressure. Additionally, trade volumes are shifting as businesses accelerate imports ahead of newly reinstated tariffs due dates.

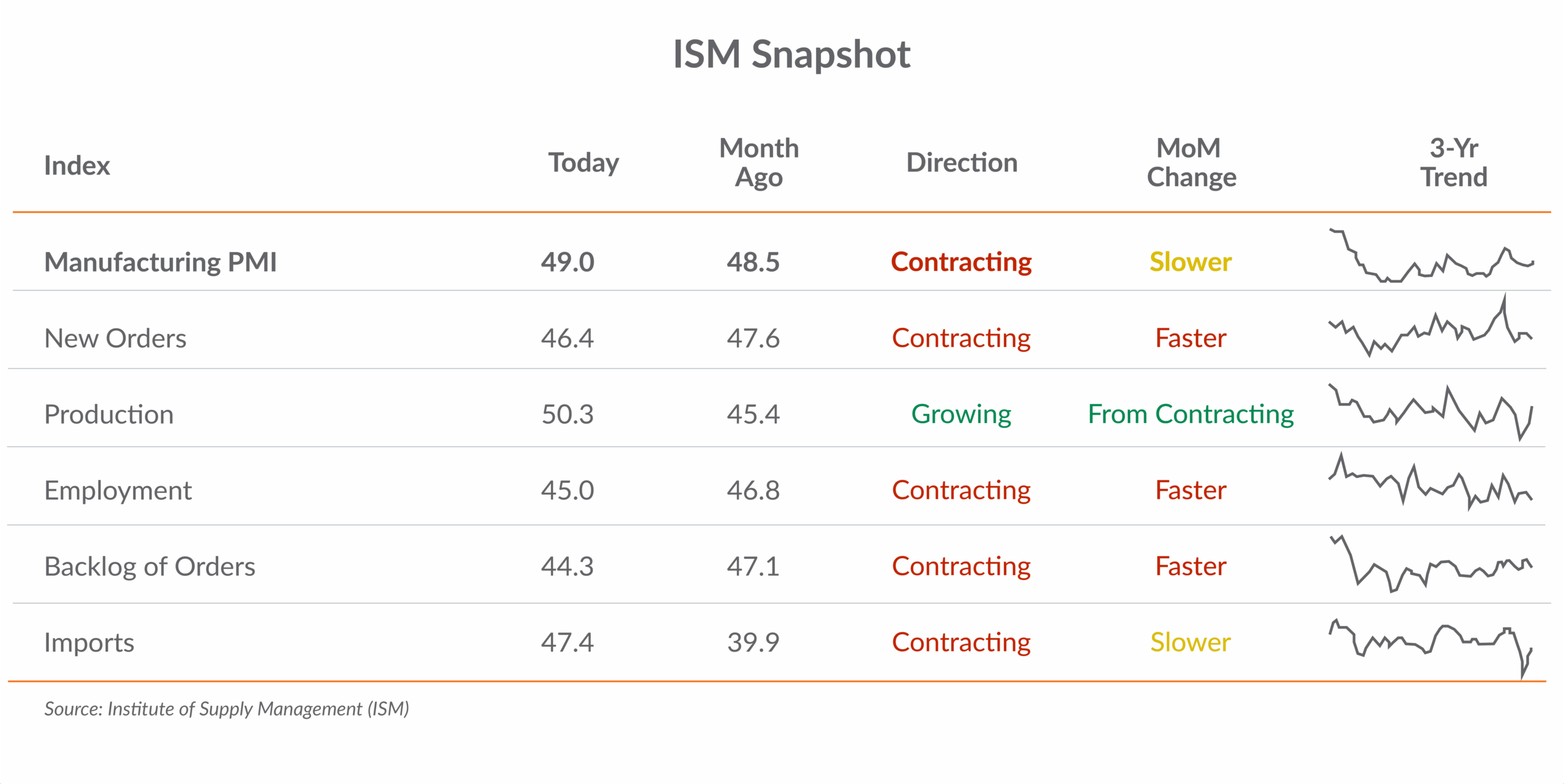

1. Manufacturing PMI Still in Contraction, but Production Rises

Source: Institute of Supply Management (ISM)

The headline Manufacturing PMI inched up to 49.0, still technically in contraction. However, production expanded for the first time in months, reaching 50.3, even as new orders (46.4) and employment (45.0) remained weak. Backlogs and inventories continue to shrink, while imports ticked higher.

What this means for you: We’re seeing a production uptick, but not a full-blown recovery. Manufacturers are producing more, but with fewer people and thinner order books. The focus should be on lean operations and cash preservation. Consider maintaining tight control over capital investments and prioritize high-turnover inventory.

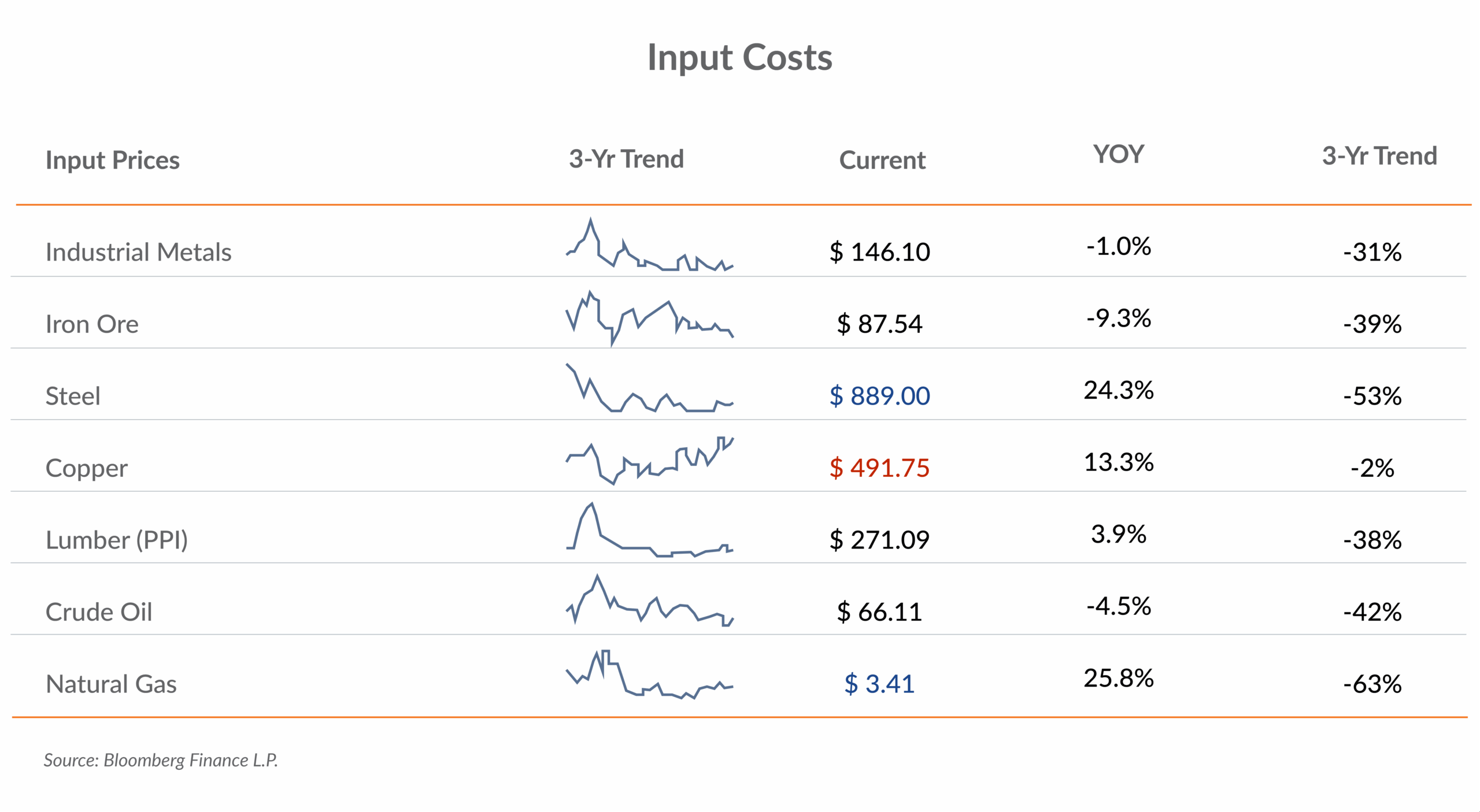

2. Sharp Increases in Steel, Copper, and Gas Prices

Source: Bloomberg Finance, LP

While most industrial metals are flat or down, steel (+24.3%), copper (+13.3%), and natural gas (+25.8%) are spiking year-over-year. Although steel and gas prices remain well below pandemic highs, the trend has reversed directions.

What this means for you: Costs are creeping up again, and with Trump-era tariffs being reimposed, expect more upward pressure on input prices. Consider forward-buying critical materials, renegotiating supplier contracts, and revisiting hedging strategies. Margin management is more crucial than ever.

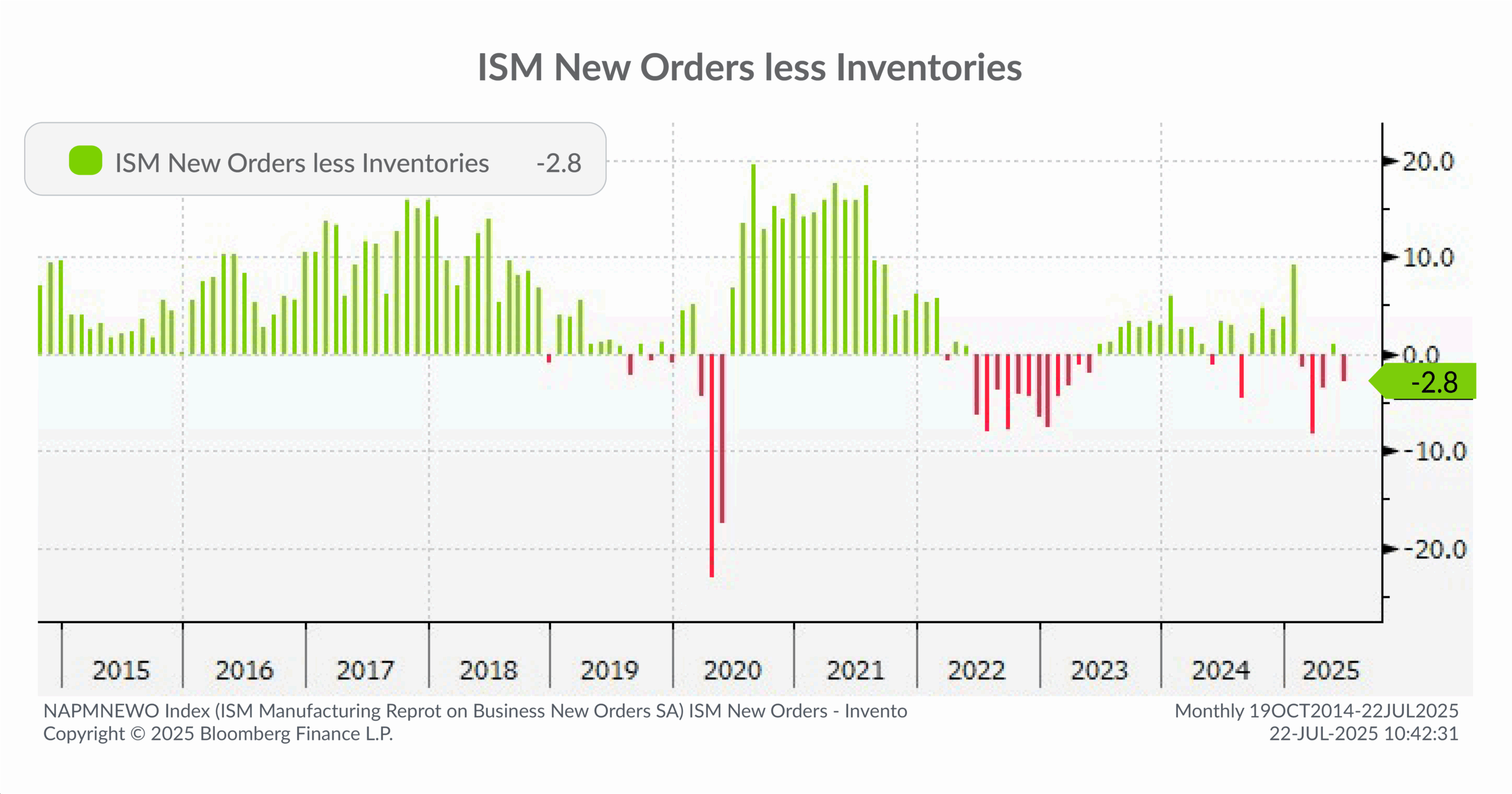

3. New Orders Lag Behind Inventories Again

Source: Bloomberg Finance, LP

The ISM New Orders less Inventories metric dropped to -2.8, signaling demand is again trailing inventory growth. This ratio has been hovering below zero for most of the year, serving as a cautionary signal for factory floors.

What this means for you: Demand is sluggish, and the risk of slowing inventory turns is rising. Manufacturers should be cautious with reorders, rely on shorter-cycle forecasts, track sales-to-inventory ratios closely, and be prepared to adjust purchase orders quickly.

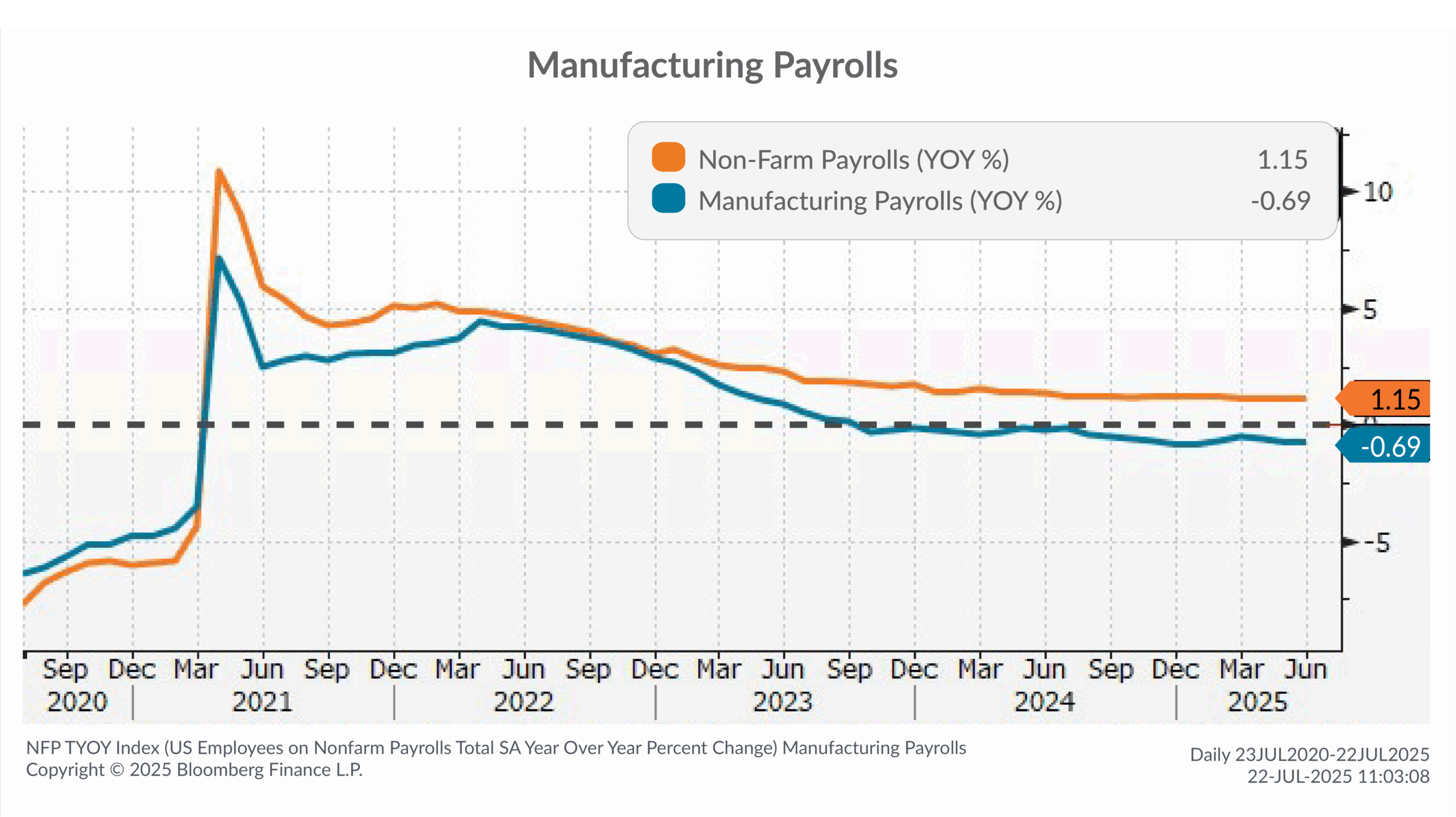

4. Manufacturing Employment is Down Year-over-Year

Source: Bloomberg Finance, LP

Manufacturing payrolls have declined by 0.69% year-over-year, while broader nonfarm payrolls have increased by 1.15%. This divergence highlights the slowdown in factory hiring.

What this means for you: Hiring is slowing, but the labor market isn’t necessarily loosening. Focus on retaining experienced staff and boosting internal flexibility. Cross-training, automation, and performance incentives can help maintain productivity with fewer hands.

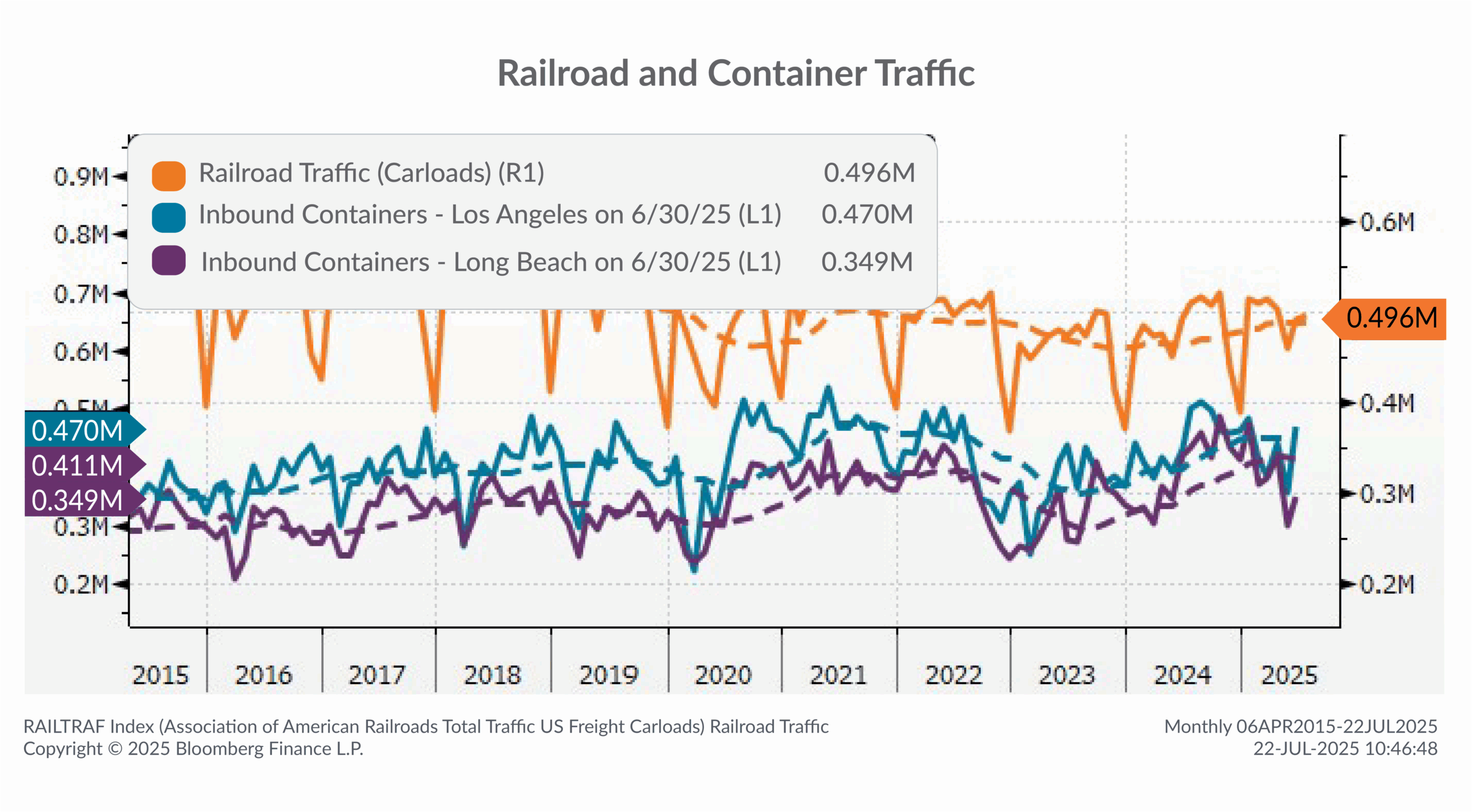

5. Trade Volumes Shift Amid Tariff Uncertainty

Source: Bloomberg Finance, LP

Rail traffic remains stable, but inbound container volumes in Los Angeles and Long Beach have notably increased from earlier this year. This likely reflects a pre-buying response to the Trump Administration’s tariff announcements on Chinese goods.

What this means for you: If you rely on imported components, logistics may become unpredictable. Now is the time to review supply chain continuity, diversify vendors, and revisit reshoring or nearshoring options. While tariffs may not hit immediately, preparing for multiple scenarios is essential.

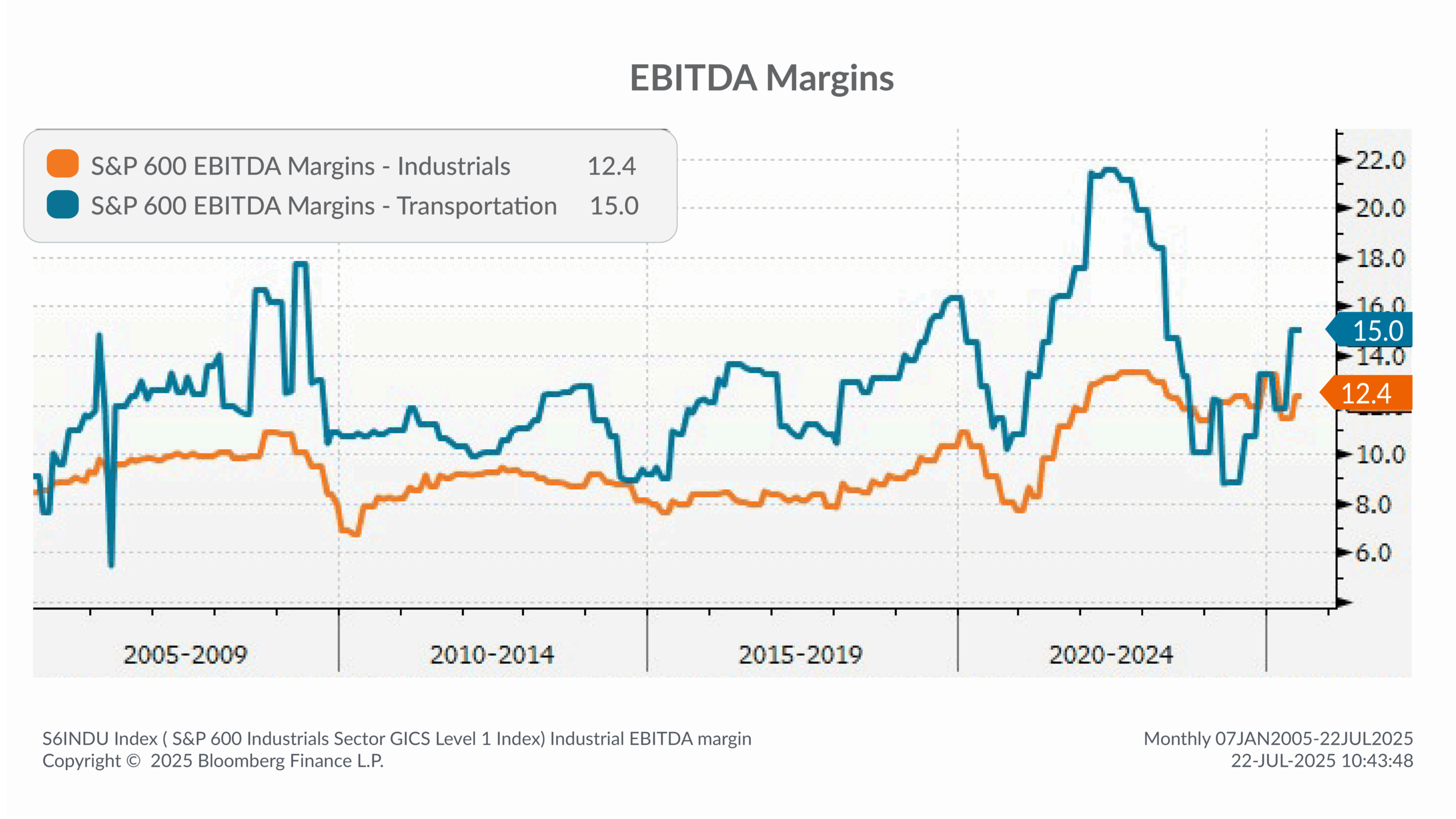

6. Margins Are Stable, But Work is Required

Source: Bloomberg Finance, LP

S&P 600 EBITDA margins for Industrials (12.4%) and Transportation (15.0%) are positive and stable but not climbing. This suggests that businesses are managing, but just barely, amid input cost pressures and soft demand, without benefitting from broader U.S. economic growth.

What this means for you: Efficiency is key. For manufacturers, this means leaner operations, increased technological deployment, and smarter sourcing. For distributors, this means focusing on logistics optimization and route management. Remember, every basis point of margin counts.

This commentary is brought to you by Aprio advisors. If you have any questions, connect with our team today.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q