Commercial real estate has absorbed most of its price correction with the reality that low-cost financing isn’t going to return any time soon. Lending standards are normalizing, and supply pressures are easing in several sectors. This market now rewards steady cash flow, disciplined underwriting, and operational execution — not betting on rising valuations.

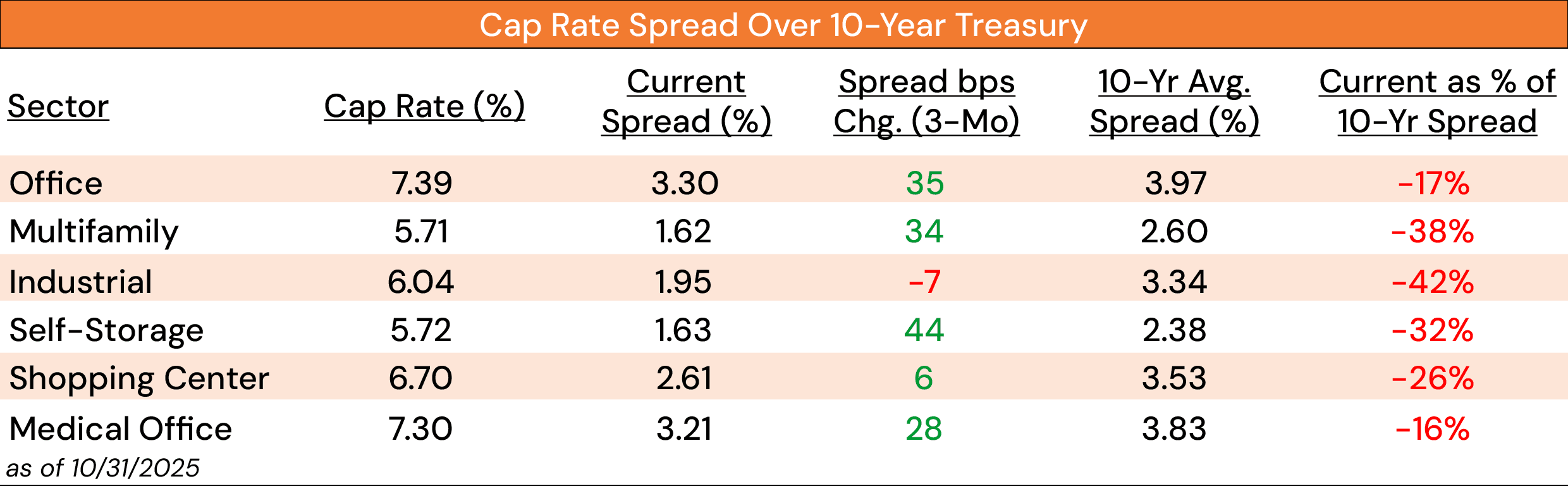

1. Cap Rate Spreads Have Improved but are Still Tight

Source: RCA, NAREIT, & ICE Data Indices, LLC

Note: The narrower the spread, the less additional return an asset owner will receive for the additional risk of owning that asset compared to a risk-free asset, such as the U.S. 10-year Treasury bond.

Cap rate spreads widened slightly in Q4 2025 but remain well below historical averages across all major property types. Multifamily, industrial, and self-storage spreads are still 30%–40% tighter than their 10-year averages. The office and medical office sectors offer higher nominal yields, but with significantly greater operational risk.

What this means for you: Tight spreads mean a real estate asset owner should not rely upon cap rate compression to drive returns. Returns must come from NOI growth, expense control, and disciplined leasing. Assume that refinancing will be tougher and costlier than before.

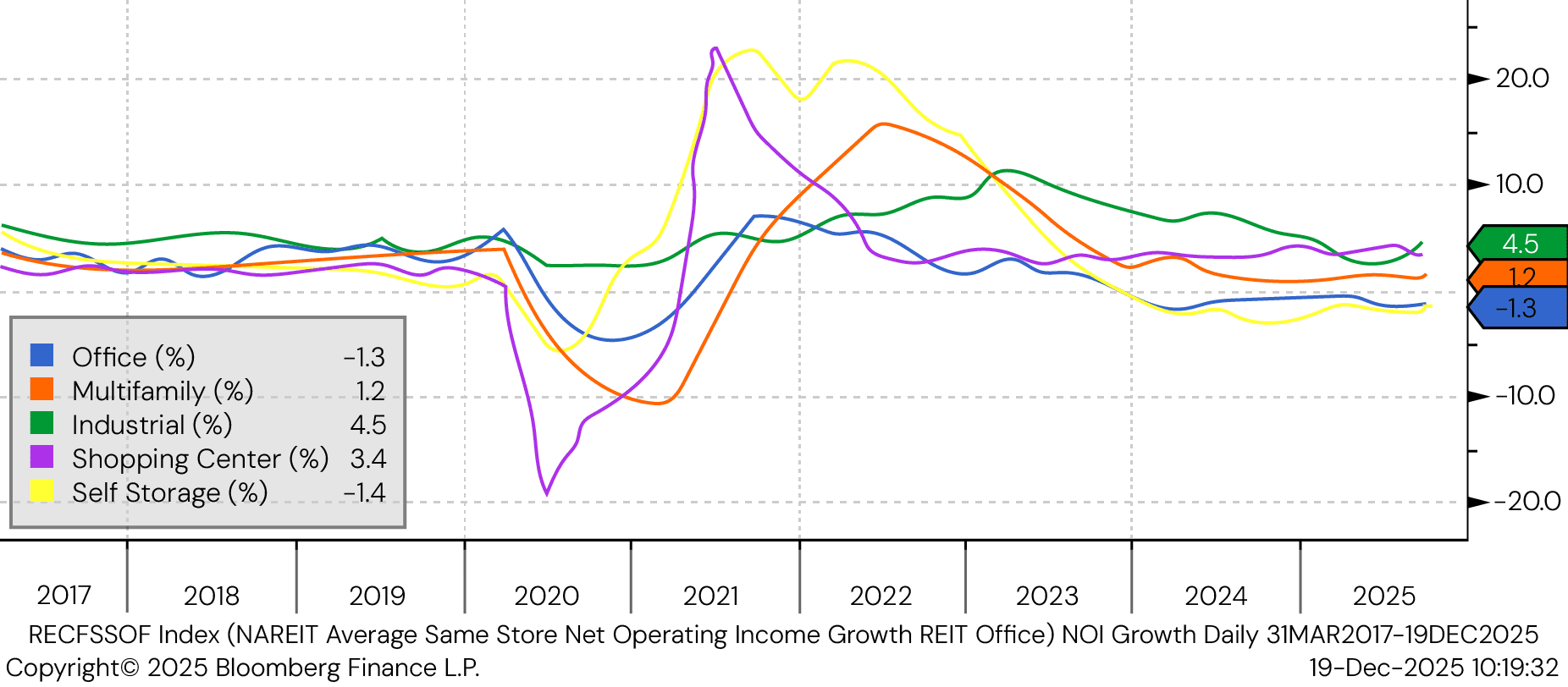

2. NOI Growth is Dispersed Across Sectors

Source: Bloomberg Finance L.P.

Industrial continues to lead NOI growth, while shopping centers remain positive. Multifamily growth is modest nationally. Office and self-storage still show negative NOI growth, reflecting weaker demand and pricing pressure.

What this means for you: Sectors with positive NOI growth deserve higher confidence in underwriting. For office and self-storage, value creation is operational, not market-driven — lease restructuring, tenant retention, and cost control matter more than ever.

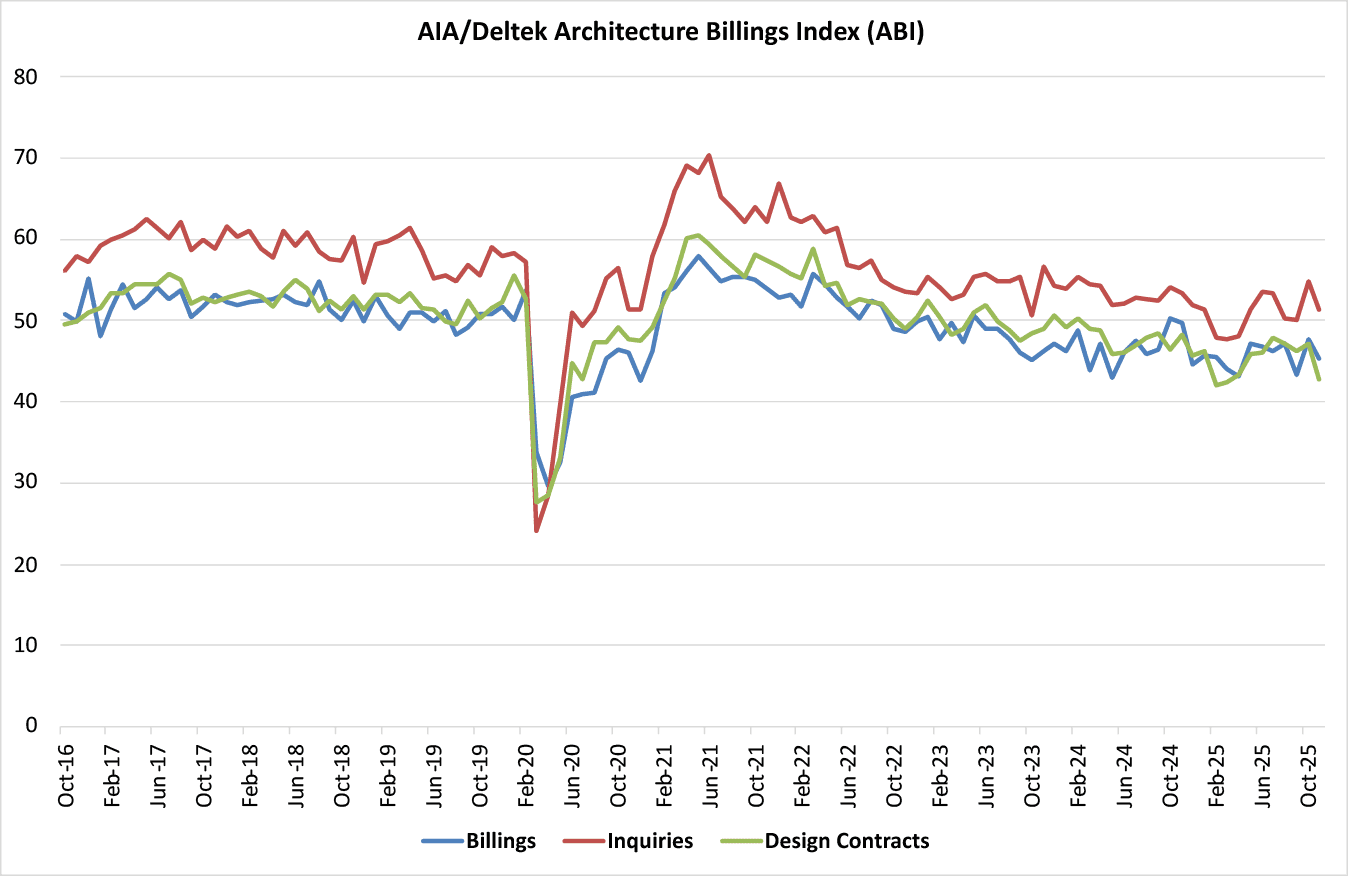

3. Architectural Billings Point to Less New Supply Ahead

Source: AIA Economics

The Architecture Billings Index remains below 50, signaling contraction in design activity. Inquiries have stabilized, but signed contracts remain weak with fewer projects moving toward construction.

What this means for you: Limited development today can create scarcity tomorrow. Existing, well-located assets gain value simply by surviving this period. Renovations and repositioning often deliver better risk-adjusted returns than ground-up development.

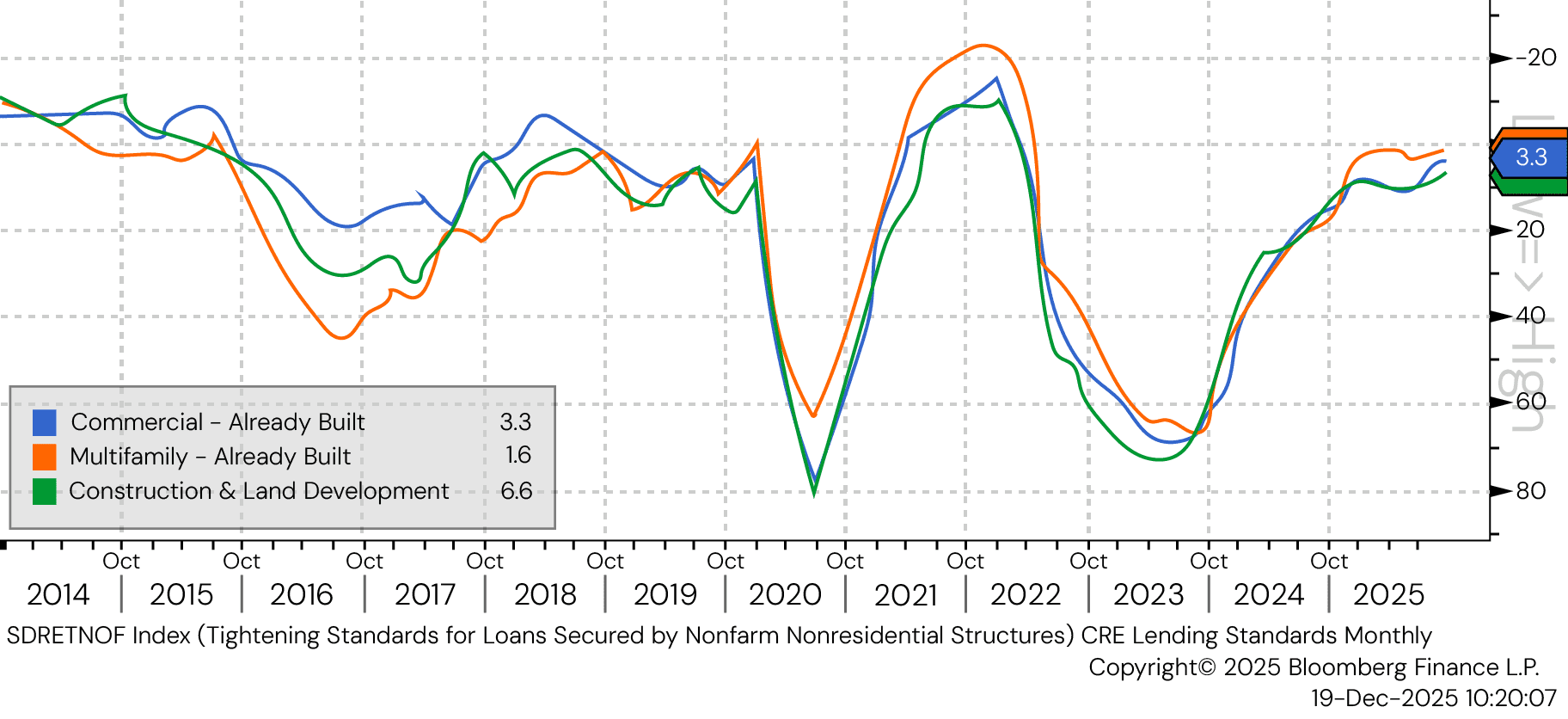

4. Lending Standards Have Returned to “Normal”

Source: Bloomberg Finance L.P.

After years of easy credit followed by abrupt tightening, bank lending standards are back toward historical averages across construction, land development, and stabilized property loans.

What this means for you: Well-capitalized borrowers with realistic assumptions can access financing. Deals that work at today’s rates are getting done; those relying on rate cuts or aggressive leverage are not. Strong cash flow and sponsor equity matter more than ever.

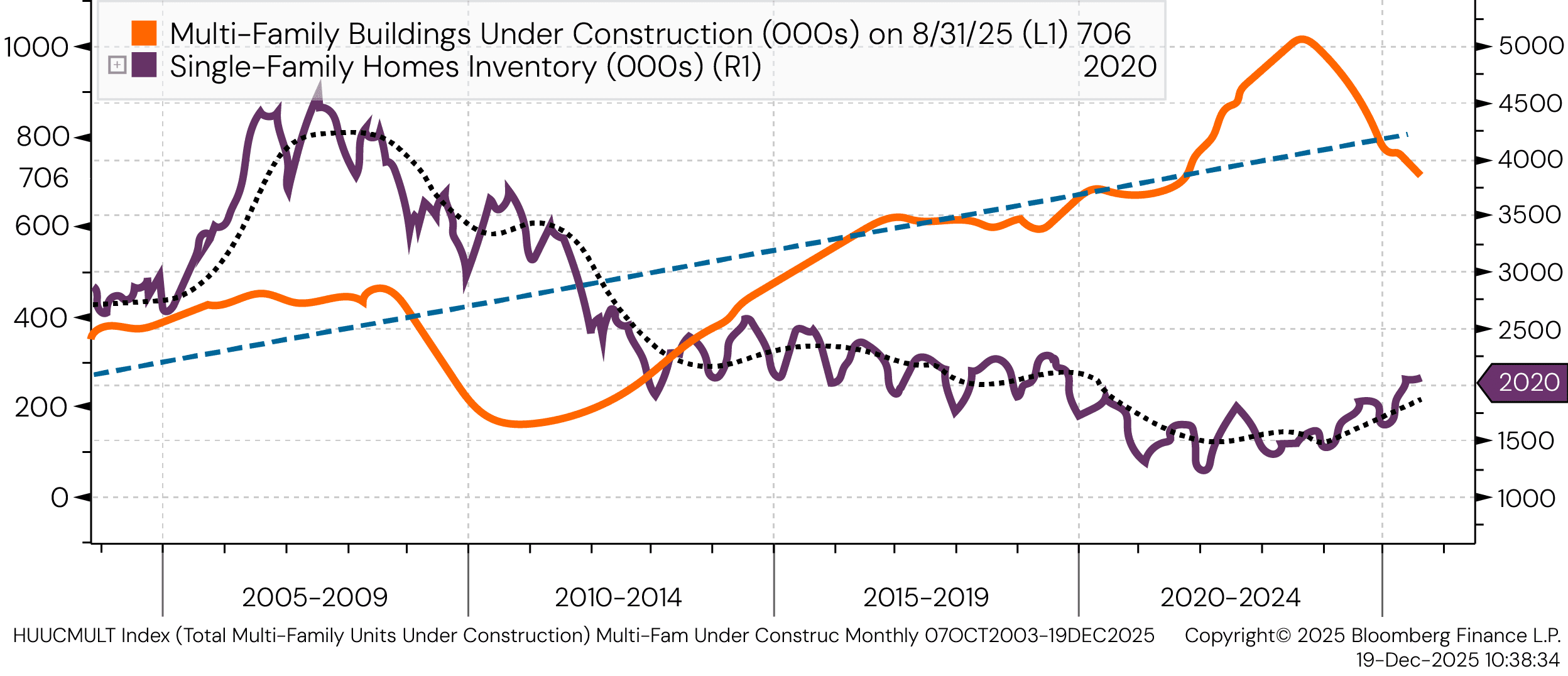

5. Multifamily Supply Is Falling While Single-Family Inventory Rebuilds

Source: Bloomberg Finance L.P.

Multifamily units under construction have declined meaningfully from their peak, while single-family home inventory has been steadily rebuilding. This signals future relief on apartment supply pressure but also more competition from homeownership.

What this means for you: Multifamily fundamentals should improve gradually as new deliveries slow. Rent growth will be more sensitive to affordability. Remain vigilant when tracking changes in the growth rates of local market supply and demand and net absorptions to identify inflection points.

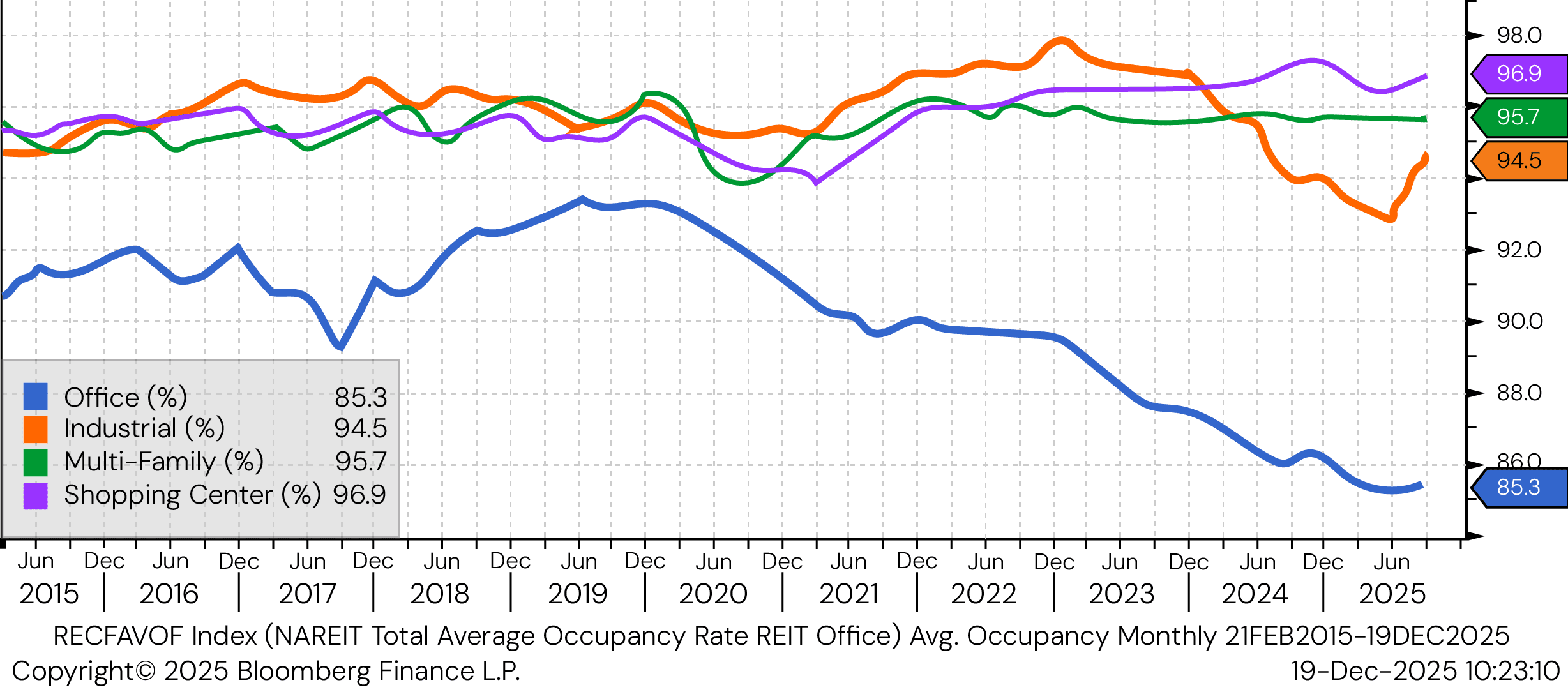

6. Occupancy Remains High Except in the Office Sector

Source: Bloomberg Finance L.P.

The industrial, shopping center, and multifamily sectors continue to operate at mid-90% occupancy levels, showing strong tenant demand. Office occupancy continues its slow decline, now well below other sectors.

What this means for you: High occupancy supports cash flow stability and refinancing prospects. Office owners must assume longer lease-up periods and budget accordingly. For non-office assets, occupancy strength reinforces the case for patient ownership.