Summary: Facing revenue losses from the OBBB, many states are opting out of key provisions. Taxpayers will feel the impact when filing returns due to Section 174 changes, reinstated bonus depreciation, and other tax code updates.

The OBBB and State Impacts

Since the enactment of the One Big Beautiful Bill (“OBBB”) Act in July 2025, many states are experiencing budget impacts due to the OBBB’s changes to the Internal Revenue Code (IRC). As a result, some states are looking for ways to lessen revenue shortfalls, such as decoupling from the OBBB.

The OBBB contains amendments to numerous provisions that will (and already are) directly affecting many taxpayers. Several of these amendments impact states from a revenue perspective, including:

- The treatment of domestic research and experimental (R&E) expenditures under Section 174A

- Bonus depreciation under Section 168(k)

- The adoption of a full deduction for qualified production property under Section 168(n)

- Changes to the business interest expense limitation under Section 163(j)

- Extended and increased deduction under Section 199A

State conformity will have a significant impact on corporate and noncorporate taxpayers’ state income tax filings. When addressing any state IRC conformity issue, it’s critical to first understand the method by which the state conforms to the IRC.

State IRC Conformity Methods

The three main methods utilized by states to conform to the IRC are summarized below:

- Rolling or immediate conformity – these states automatically conform to the tax code as changes go into effect.

- Static or specific-date conformity – these states conform to the tax code as it existed on a specific date and require conforming legislation to adopt federal changes after that date.

- Selective or code-specific conformity – these states conform only to specific sections of the tax code following a convention similar to static conformity

States with rolling or immediate conformity to the IRC have encountered the greatest challenge to balance declining revenues with incentivizing investment, as this conformity approach requires them to adopt IRC changes as they occur unless specific decoupling rules are adopted. To address the revenue impact, some states with rolling conformity have already enacted decoupling laws to help offset revenue impacts. Likewise, states with static specific-date conformity will require conforming legislation to adopt the OBBB. This is typically done by the state enacting legislation that advances its IRC fixed conformity date.

Even for rolling and fixed conformity, states can choose selective or non-conformity provisions. The OBBB’s updates to Section 174 have been a large point of contention for many states by allowing taxpayers to immediately expense R&E costs, thus reducing state revenue. Because of this, many states are choosing to decouple from this part of the legislation specifically, as detailed below.

State Conformity & Section 174

For federal purposes, the OBBB Act allows taxpayers the option to fully deduct domestic R&E expenditures in 2025 and beyond. It also allows eligible small businesses the option to elect retroactive application to the 2022-2024 tax years. (Read more on this here.) Many states have spent the last six months assessing the revenue impact of this provision, as well as other OBBB provisions.

These revenue impact analyses have led to discrepancies across state conformity legislation due to three primary 174-related provisions (listed below) and the impacts of decoupling from them:

- The ability to fully deduct domestic 174 costs on their federal returns beginning in 2025.

- Impact of decoupling: Taxpayers must continue to capitalize domestic 174 costs for the 2025 tax year for state purposes.

- The ability to accelerate the remaining unamortized portion of 2022 – 2024 domestic 174 costs in the 2025 federal return (or 2025 & 2026 returns)

- Impact of decoupling: Taxpayers do not get to accelerate the remaining unamortized portion of their capitalized 2022 – 2024 domestic 174 costs on their applicable 2025 state return (or 2025 & 2026 state returns) and must continue amortizing them in accordance with the original 5-year amortization schedule.

- For certain eligible small businesses, the ability to retroactively apply the OBBB Act by fully deducting domestic 174 costs on amended 2022 – 2024 federal returns.

- Impact of decoupling: Eligible taxpayers that elect to early-adopt the OBBB Act for federal purposes must continue capitalizing and amortizing these costs on their respective state returns.

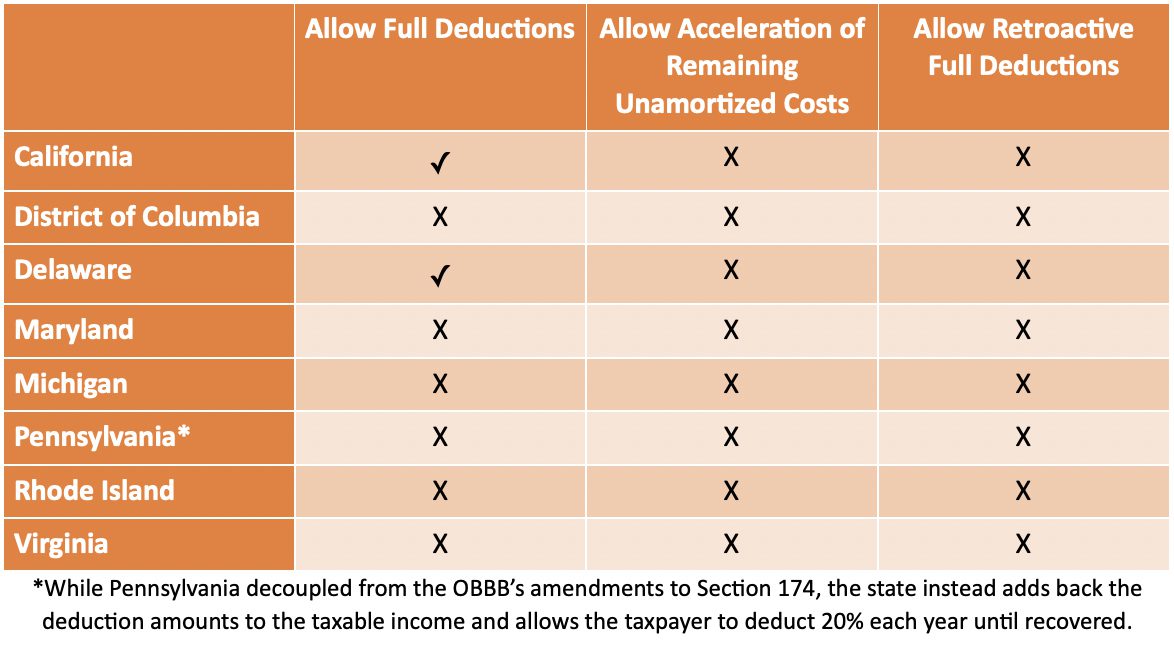

Specific State Responses to OBBB Section 174A Provisions

Many states, as well as D.C, have decoupled from the OBBB’s provisions in varying degrees. We’ve created a table to summarize these updates, with more detailed explanations following. Note that this is not intended as an exhaustive list; taxpayers should work with an advisor knowledgeable in state conformity related to Section 174A to understand individual impact.

California enacted legislation moving its IRC conformity date from January 1, 2015, to January 1, 2025, prior to the enactment of the OBBB’s provisions and, therefore, maintains nonconformity to the OBBBA provisions. As a result, the state does not conform to the federal retroactive relief provisions for amounts previously capitalized. However, the state’s pre-existing decoupling legislation allowed taxpayers to immediately deduct R&E expenses, which will continue for 2025 and subsequent tax years.

D.C. decoupled its corporate and unincorporated franchise taxes from the Section 174 changes for tax years beginning after December 31, 2021, requiring taxpayers to capitalize and amortize deductions over 5-year periods. Additionally, eligible taxpayers who elect to retroactively deduct domestic 174 costs by amending their federal return can no longer amend their DC return to make this election at the state level, nor can they accelerate the remaining unamortized domestic R&D expenditures capitalized during 2022-2024.

Delaware decoupled from the acceleration of unamortized amounts of R&E expenditures from 2022-2024 but did not decouple from the current expensing rule. Therefore, taxpayers are able to expense R&E expenditures in 2025 and subsequent tax years under rolling conformity.

Maryland has decoupled from the OBBB’s Section 174 changes for 2025 and prior tax years, so taxpayers cannot expense domestic R&E expenditures now or retroactively. However, decoupling from any OBBB provisions in 2026 and subsequent tax years will require legislative action from the Maryland General Assembly.

Michigan advanced its fixed-conformity date to January 1, 2025. However, the state explicitly decouples from Section 174, thereby requiring corporate income taxpayers to continue capitalizing domestic R&E expenditures for current and prior tax years.

Pennsylvania decoupled from the OBBB provisions, thereby not allowing full current or retroactive deductions, but added a 20% deduction per year on the remaining R&E expenditures for original amortized Section 174 expenses or Section 174A expensing until fully recovered.

Rhode Island has elected to decouple from all the OBBB’s provisions for purposes of calculating a corporation’s taxable net income in tax year beginning on or before January 1, 2025. Without additional legislation, the state will conform for tax years beginning on or after January 2, 2025.

Virginia adopted rolling conformity in 2023 but amended its unique IRC decoupling provisions in May 2025 so that the state will not conform to any IRC amendments enacted on or after January 1, 2025, and before January 1, 2027.

Although implications of state conformity on taxpayers subject to Section 174 are still being examined, taxpayers can expect significant impact.

Given the complexity and nuances of these conformity laws—and the likelihood of future changes in other states—staying compliant requires constant, thorough research and monitoring. Leaning on a trusted tax advisor who specializes in state and local taxes will help taxpayers navigate new legislation with confidence.

That’s Not All: Other Provisions Impacted by State Conformity Laws

As noted above, states such as California, Michigan, Maryland, and Pennsylvania have chosen to decouple from other OBBB provisions, including the new depreciation allowance for qualified production property and the more generous calculation of the business interest expense limitation.

In addition to electing not to conform to accelerated unamortized R&E expenditures, Delaware has also chosen to decouple from the reinstated bonus depreciation provisions due to an estimated $400 million loss in revenue.

Short- and Long-Term Priorities

In the immediate future, taxpayers that operate in states that do not conform with parts or all the OBBB’s provisions should prioritize:

- Understanding which provisions apply to their state income taxes

- Updating their financial statement reporting

- Estimating state income tax payments for the final quarter of 2025

- Preparing extension payments for 2025 state income tax returns

- Strategizing return preparation in 2026

Businesses that operate in multiple states should also devise long-term strategies to ensure compliance with each state’s conformity laws. Proactive planning, to the extent possible, can make a massive difference in future tax obligations.

Final Thoughts: Handling Provisions with Ease

Navigating state conformity nuances and discerning which provisions apply to your business can be tricky — especially if your company operates in multiple states. Don’t wait to address state decoupling from OBBB provisions until they’ve already affected you.

Connect with a knowledgeable tax advisor with state and local tax expertise to understand the impacts of state legislation on your bottom line and devise a robust tax strategy.