7 Key Real Estate Insights for Q2 2021

June 29, 2021

It has been an exciting and busy quarter for the real estate market. Scroll down for a special look into Multi-Family and Self-Storage Values.

- In residential real estate, affordability for residential housing is strong, with four quarters of growth in a leading residential housing indicator. We expect positive trends to continue over the next year.

- In commercial real estate, financing availability and activity vary by asset type, while valuations, when compared to fixed income alternatives, are reasonable. Except for the multi-family sector, we believe additional commercial supply is likely constrained, supporting current pricing.

Why does this data matter to you? Here are seven of the most important highlights you should know from the latest real estate data, plus some final thoughts for real estate developers, investors and owners:

Residential real estate

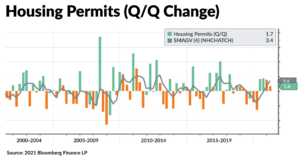

1. Housing permits

Four quarters of positive year-over-year growth (bars above zero) indicate future additional supply. Growth rates are not at levels where we would be concerned about a bubble.

Below, you can see the quarter-over-quarter change in housing permits since 2000.

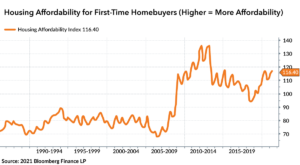

2. Housing affordability

Housing is very affordable. With low interest rates, housing affordability has increased since the beginning of 2020. Recent levels are well above the growth markets of the 1980s–2000s.

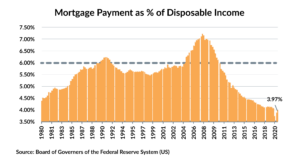

3. Mortgage payments

Due to low interest rates, mortgage payments as a percentage of disposable income have almost never been lower. This is a great sign for demand and the ability to close residential housing transactions.

While people have been whispering about a bubble in residential housing, bubble/cyclical concerns coincide with reaching 6.00% levels, which is nearly 50% higher than the current 3.97%.

Commercial real estate

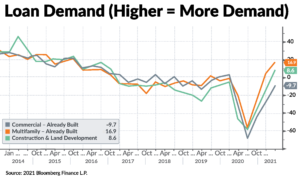

4. Loan demand

Index value above 0 is a sign of growing demand. Multi-family and construction loan demand have rebounded well above pre-COVID levels. Loan demand for commercial properties remains negative.

5. Lending standards

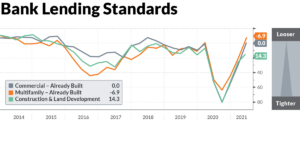

Lending standards are loosening, though vary by asset class and purpose. Multi-family housing bank lending standards are looser than at any point since 2014. Commercial and construction/land development loans are more available than they were at the trough of COVID-19. However, these loans are still below pre-COVID levels, and construction remains more difficult to qualify for.

Valuations

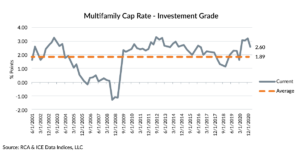

6. The multi-family sector shows relative value, given the spread between the multi-family cap rate and the yield on investment-grade bonds

Institutional investors are comparing real estate to yields they would earn from corporate bonds.

These “spreads” often reveal relative value between investment alternatives. Comparing the multi-family cap rate to the interest rate on the Investment-Grade Corporate Bond Index, we see that spreads remain wider than the 20-year average.

Despite multi-family’s declining cap rates, this sector is now more appealing to investors than any time since 2014. If interest rates remain flat with current levels, cap rates could decline another 0.7 percentage points and still be fairly valued.

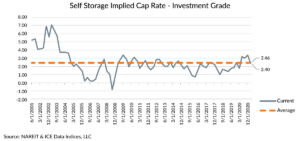

7. The self-storage sector is relatively fair-valued, given the spread between the self-storage cap rate and the yield on investment-grade bonds

Self-storage has been a hot sector in real estate. While cap rates have declined, current comparisons to investment-grade bonds highlight that the asset class is likely reasonably valued.

The current spread, at 2.46% above the Investment-Grade Corporate Bond Index’s yield, is approximately in line with the long-term average. This implies that self-storage is not likely to be overvalued, nor undervalued, and that institutional investors may consider it appealing as a long-term holding in their portfolio.

How does this affect you if you own real estate?

The real estate market is rarely homogenous.

The residential sector is showing signs that recovery is sustainable because affordability is strong and building permits are growing, but not excessively. We expect the tightness of current inventory levels to improve over time — however, demand should match the supply. Investors, developers and owners whose businesses are tied to residential real estate should plan for several years of growth. This is likely to be the healthiest market in decades.

On the other hand, commercial real estate is more mixed and segment-specific.

Be prepared for an additional supply of multi-family units, as lending standards loosen while loan demand increases. The multi-family sector has performed better than many expected throughout the pandemic, and we expect additional capital to flow into that sector, keeping cap rates low. From a valuation perspective, we would expect valuations to remain at current levels or improve for current asset owners.

Another commercial sector to keep an eye on is self-storage. Valuations in this sector are reasonable on a relative value basis, so expect property values to move in line with net operating income (NOI) growth, as opposed to lower cap rates.

We advise clients to be more selective in self-storage, since investment returns are more likely to be based upon improvements in changes in local supply and demand for storage units.

Explore more of the real estate market

Simeon Wallis is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. He regularly provides investors with insights on various sectors of the financial markets to help them better tailor their investment strategies. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (June 29, 2021) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. Simeon brings two decades of professional investing experience in publicly traded and privately held companies, as well as senior-level operating and strategy consulting experiences.