- All Solutions

- Business Tax

- Audit & Assurance

- Risk & Compliance

- Advisory Services

- Client Accounting Services

- Technology & Digital Transformation

- Federal Government Contracting

- Personal Tax Planning & Wealth Management

- Legal

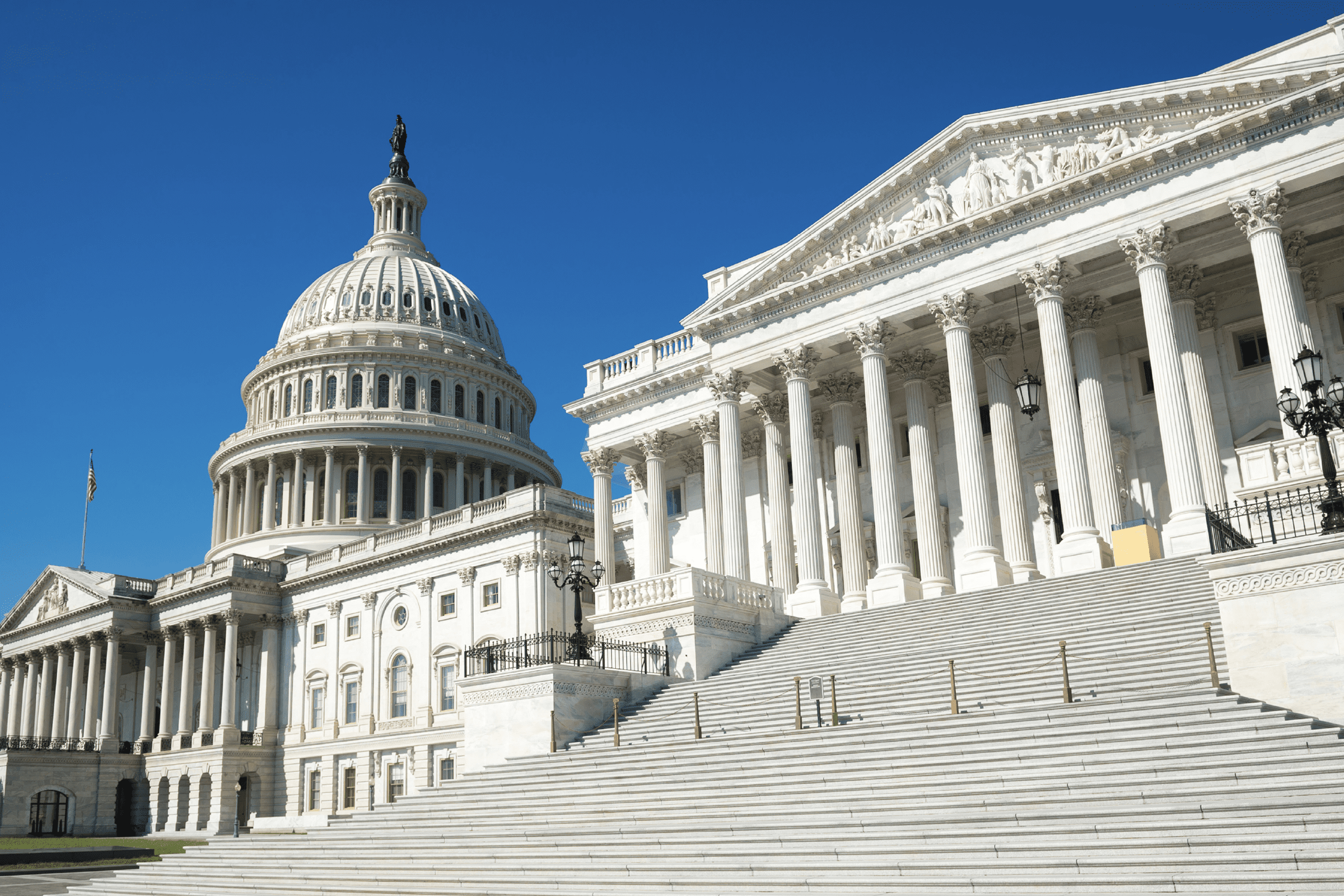

This tax and spending measure solidifies numerous tax law changes originally enacted in the Tax Cuts and Jobs Act (TCJA) of 2017 and signed into law during President Trump’s first term in office. Read more.

- Aerospace, Defense, & Government

- Construction

- Dental

- Financial Services

- Healthcare

- International Business

- Manufacturing, Distribution, & Consumer Products

- Nonprofit & Tax-Exempt

- Private Clients

- Professional Services

- Real Estate

- Restaurant, Franchise, & Hospitality

- Technology

The One Big Beautiful Bill (OBBB), enacted on July 4, 2025, is shaking up the tax world for everyone, from businesses focused on growth to families planning for their future. See why it matters.

Insights & Events

Get the latest insights and industry news delivered straight to your inbox.

The Latest from Aprio

Explore Our Collections

- Webinars Watch the latest webcasts for informative perspectives and insights from Aprio advisors.

- 2025 End of Year Tax Update In Aprio’s 2025 year-end tax update, we break down the most notable twists and shifts in federal, state, and international taxes impacting businesses and individuals.

- Aprio Newsroom Browse Aprio press releases for the latest news on Aprio, our people, and the markets we proudly serve.

- One Big Beautiful Bill Aprio’s Tax advisors have prepared a comprehensive overview of the bill, as well as a deep dive into the many notable provisions.

- Podcasts Hear all the latest insights from your trusted Aprio advisors.

All Insights & Events

-

Live Webinar 3/24/26:

The ICS Playbook Every Government Contractor Needs -

Bridging Policy and Practice: Accounting and Operational Insights from NDAA 2026

-

Stop Leaving Cash on the Shop Floor: Sales Tax Overpayments for Georgia Manufacturers

-

Sell Tax Credits for Cash or Buy Them at a Discount: How Companies Are Monetizing IRA and OBBB Incentives

-

Marketing as a Strategic Growth Engine: Moving Beyond Tactics to Build Enterprise Value

-

Preparing Your Company for Fundraising: Accounting Consequences & Best Practices for Fundraising

-

When Restaurant Growth Outpaces the Insurance Market

-

Unlocking Tax Relief: OBBB’s Impact on Government Contractors

-

Aprio Welcomes New Partners in Transaction Advisory, Financial Services, and Manufacturing & Distribution

-

Aprio Wealth Management Names Courtney Holt Chief Compliance Officer

-

2026 Economic Outlook: Twin Engines of Growth Set to Drive Real Estate Recovery

-

NCREIF PREA Reporting Standards Update: Why Automated Reporting Is Now a Must-Have for Real Estate Firms

Get the latest insights and industry news delivered straight to your inbox.