Business Interruption Loss Calculations: Are All Relevant Factors Being Considered?

June 5, 2020

Lately, there has been a lot of attention on the issue of business interruption claims in the COVID-19 era. The battleground has revolved around issues of coverage, but not nearly as much attention has been given to the issue of calculating the loss. While some may view that as putting the cart before the horse, insureds who are submitting claims with their carriers would be well-advised to at least start thinking about the factors to be considered in calculating the damages claim.

A common error in calculating lost profits, whether in a business interruption context or otherwise, is to determine the lost revenues and simply multiply it by the normal profit margin. Doing so, however, would misstate the losses due to the presence of fixed expenses and certain variable expenses that, while still variable, are not being avoided in direct proportion to the lost revenues.

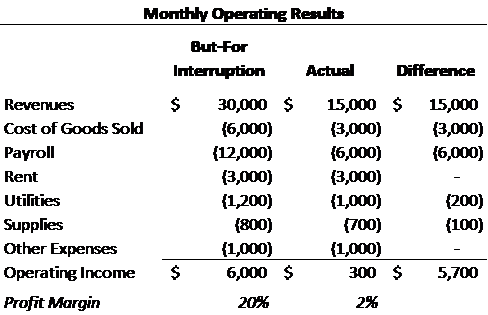

Imagine this extremely simplified example: A restaurant is significantly impacted by the pandemic and the government’s consequent ban on in-restaurant dining. Though the restaurant remains open for take-out and delivery service, its monthly revenues of $30,000 per month fall by 50% to $15,000 per month, over the discrete three-month period of April 1 to June 30, 2020 (the “loss period”), after which the business resumes normal operations and returns to its previous level. During that time, the restaurant has a reduced staff and thus payroll, as well as a lower cost of goods sold. It also has reduced utilities, though not in direct proportion to the revenue loss. The use of kitchen supplies diminishes, but this is offset by an increase in carry-out containers, bags and cleaning supplies, resulting in only a small reduction in supply expenses. Other expenses, such as rent and the cost of certain licenses, are fixed and do not change during the pandemic.

Based on the numbers in this simplistic example, multiplying $15,000 of lost monthly revenues by the normal 20% margin would result in $3,000 of lost profits per month, or $9,000 over the entire loss period, while the actual lost profits are $5,700 per month, or $17,100. Thus, failure to consider all relevant factors would result in a significant understatement of the losses, totaling $8,100 in this example. But while actual results are known, building out a detailed hypothetical income statement absent the business interruption is not so straightforward, especially because normal results may still fluctuate from month to month and season to season. It is also critical to account for the fixed vs. variable (or semi-variable) nature of the cost categories. Use of a consultant can be very beneficial here, and there are different methods by which such losses can be calculated.

Furthermore, it is important to note that insureds have a duty to take reasonable affirmative steps to mitigate losses. Remaining open for take-out and delivery service can be considered as mitigating steps, but in some instances, the incremental expenses of remaining open may not even cover the incremental revenues, in which case a temporary shut-down could be the best way to mitigate issues.

A related consideration is with respect to Payroll Protection Program loans under the CARES Act. If a business qualifies for, and actually receives, forgiveness of the loan, then that forgiveness may need to be factored into the loss calculation.

Aprio’s Forensic Services team provides necessary guidance during business interruptions as well as assistance in calculating losses. Schedule a consultation with our team to learn more.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.