Employee Retention Credit Audit and Controversy Services

Are you prepared if the IRS audits your ERC position?

Many taxpayers that claimed the Employee Retention Credit (ERC) are now receiving tax notices or audit* notifications from the IRS. Whether you have already received a notice or are concerned that you might, Aprio can help.

Aprio’s dedicated ERC Audit team has the ERC eligibility knowledge and IRS audit experience to provide comprehensive audit representation that can mitigate ERC audit risk before it escalates.

Scott Schapiro

ERC and Employment Tax Leader,

Tax Partner

Aprio Advisory Group, LLC

Patrick Deane

Special Operations, Tax Director

Aprio Advisory Group, LLC

Aprio provides ERC defense experience you can trust

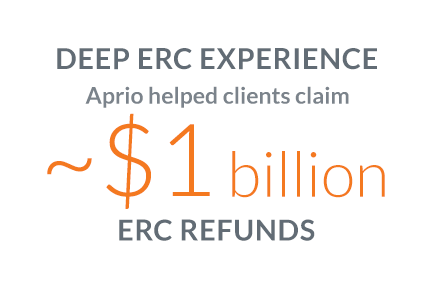

Aprio has been a nationally recognized leader in ERC eligibility analysis since the credit was first enacted in 2020. Our high professional standards have separated Aprio from the fly-by-night promoters being targeted by the IRS.

If you need ERC controversy assistance, the combined power of Aprio’s ERC delivery team and dedicated Tax Controversy Practice provide comprehensive ERC defense and IRS audit representation.

Aprio’s approach to reducing ERC audit risk

At Aprio, it’s our job to reduce ERC audit risk and seek the best possible outcomes for our clients. We apply a pragmatic approach that organizes and presents documentation in a manner that makes it easier for IRS agents to process information and understand how ERC eligibility criteria is applied to support a claim. This approach fosters open dialogue and continues to advance Aprio’s professional reputation within the IRS agent community.

Why is the IRS conducting Employee Retention Credit Audits?

Although the ERC was legislated to help businesses impacted by the pandemic, the nature of the credit has led to potential abuse. This has become so apparent that ERC has been added to the "IRS Dirty Dozen" tax abuse list noting, "blatant attempts by promoters to con ineligible people to claim the credit. “ ERC eligibility must have been based on a clear, documented impact to a business pursuant to legislation and IRS guidance in order to survive audit scrutiny.

If a third-party-firm or your payroll provider filed your ERC claim your organization may be susceptible in the event of IRS audit. A successful audit defense will entail a deep understanding of general ERC eligibility criteria combined with detail as to how your business was impacted by COVID-19 restrictions. Our team works with you to understand your COVID journey and position you for IRS audit success.

Worried about a future ERC audit? Get an Aprio ERC filing pre-review.

Although the IRS has begun auditing ERC claims, you may not be audited for several years since the statute of limitations for audit may extend for up to 5 years from the date of return filing. Don’t let time lapse and team attrition compromise your chances of a positive ERC audit outcome.

Aprio can help to properly document your position in the event of an ERC audit and help you achieve audit readiness by reviewing your ERC position, preparing a memo opining on eligibility and organizing the data in a secure centralized location.