COVID-19 Pandemic Impact on Lease Concessions

August 26, 2020

The impact of the Coronavirus pandemic (COVID-19) on entities continues with a lot of unknowns related to its future effects. Entities need to monitor how they are affected and evaluate the accounting and reporting implications on their businesses, financial condition, operating results, and cash flows. Entities are encountering office and facility closures due to businesses being ordered to close. Lessees in affected areas and/or industries are receiving economic incentives. Entities are also scrutinizing decreased liquidity due primarily to declines in revenue and, in some cases, certain cost increases caused by the pandemic. Additional scrutiny may entail re-evaluating the use of under-utilized existing assets and re-evaluating their fixed recurring obligations, such as leasing agreements. Consequently, an entity may amend the terms of its lease agreement to mitigate the economic impact from the COVID-19 pandemic on the lessee’s operations. For example, there could be amendments such as rent abatements, free rent, deferral of rent payments, reduced future lease payments, among others.

Why is it important?

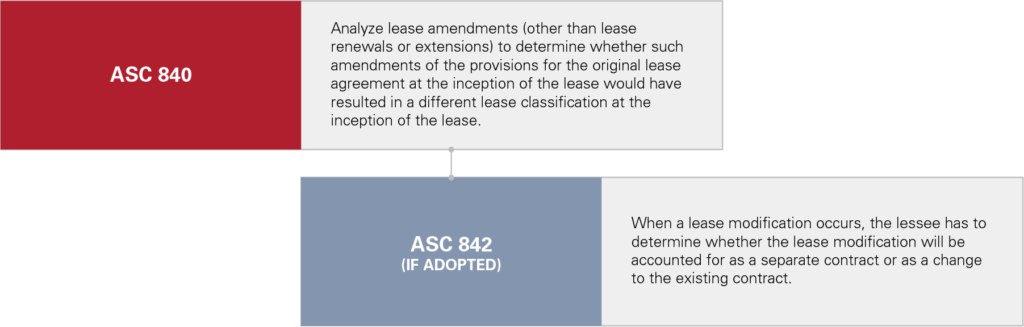

Whenever entities enter into lease negotiations or any form of an amendment of their rental agreements, entities should consider the accounting guidance in Accounting Standard Codification (ASC) 840, Leases, or ASC 842 (in cases that it has been adopted). A lessee is required to analyze lease amendments as follow:

Key points

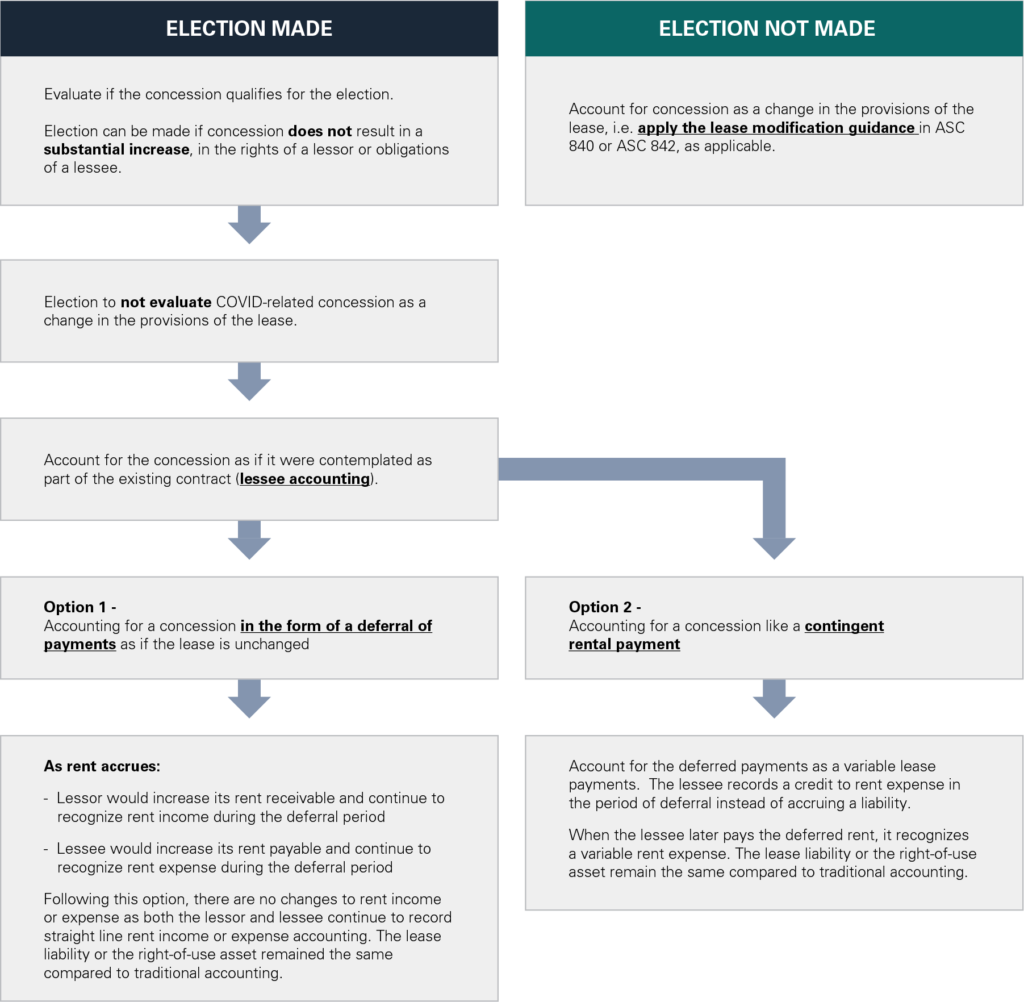

- Taking advantage of the accounting relief provided by FASB would simplify the accounting for both lessees and lessors. Entities that do not take advantage of the COVID-19 accounting election (if allowed) for lease concessions may find it complicated to evaluate the rights and obligations of their lease agreements and apply the appropriate existing guidance on accounting for lease modifications.

- Under the accounting election, the different approaches (2 options noted above) for accounting for deferred lease payments could result in different amounts of lease expenses in a given period.

- Refer to the FASB’s Staff Q&A in the FASB website on accounting for leases during COVID-19 for the details of the application of the election to account for lease concessions as a result of the current global pandemic.

- The FASB requires entities to provide sufficient disclosures about material concessions granted or received, and the accounting effects, to allow financial statement users to understand the nature and financial effect of lease concessions due to the effects of the COVID-19 pandemic.

- Entities need to ensure that changes to a lease agreement must be agreed upon by both parties, regardless of whether they are accounted for as a modification using the accounting election or not. Otherwise, any change in the lease agreement NOT agreed to by both the lessee and the lessor, such as “short-pays,” are not eligible for this election.

Entities should consider the disclosure guidance included within the FASB staff Q&A and ensure that their financial statements include the appropriate disclosures such that the users of the financial statements understand the nature and accounting impact of significant rental concessions granted due to the effects of the COVID-19 pandemic.

Got questions? Connect with an experienced Aprio advisor today.

Schedule a Consultation

Recent Articles

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.