6 Manufacturing & Distribution Insights from Q4 2023 and What They Mean for You

October 26, 2023

The ISM Manufacturers Index showed early signs of improvement as production increased and new orders contracted at a slower rate. Railroad traffic, a leading indicator for manufacturing demand, has also been increasing. Additionally, input prices continue to trend lower due to concerns over global growth. According to Google Trends data, interest in “warehouse jobs” and “factory jobs” remains high, signaling future growth in the manufacturing sector. While container and trucking rates are near recent history lows, early signs indicate they may not move much lower. Supply chain sustainability continues to gain global attention as companies respond to customer and supplier interests in sustainability.

1. The ISM Index shows signs that the worst may be over for manufacturers

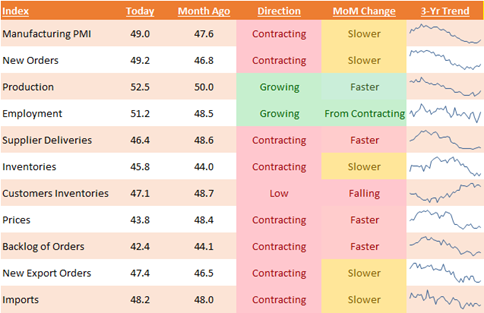

ISM Snapshot

Manufacturing PMI readings above 50 indicates industry expansion and below 50, a contraction. September readings highlight improvements in the manufacturing sector as production grows faster and the rate of contraction for new orders slows.

What this means for you: Expect conditions to improve moving forward. While new orders are still contracting (albeit at a slower rate), input prices are lower, indicating the worst is over for the manufacturing sector. Look to negotiate competitive pricing on input prices, while preparing for increased new orders.

2. Input prices continue to cool

Input Prices

Input prices continue to trend mostly lower as slowing global growth concerns pressure prices. Stimulative efforts from the Chinese Government to offset economic weakness created a rally in iron ore prices as investors speculate on future demand.

What this means for you: Lower input prices can reduce production costs, which provides an opportunity to gain market share by offering products at more competitive prices or use the savings to invest in technology that can improve the scalability and quality of your business.

3. Interest in manufacturing-related jobs continues to trend higher

Google Trends for “warehouse jobs” & “factory jobs”

According to Google Trends data, interest in “warehouse jobs” and “factory jobs” continue to trend higher and sit near peak levels of interest. With signs of improving manufacturing conditions, we could see more job openings created which could be met with strong levels of factory and warehouse candidate interest.

What this means for you: Expect there to be continued interest in manufacturing jobs. Develop recruiting plans to meet anticipated future growth needs if the manufacturing sector continues to show signs of a rebound.

4. Container and trucking rates remain historically low

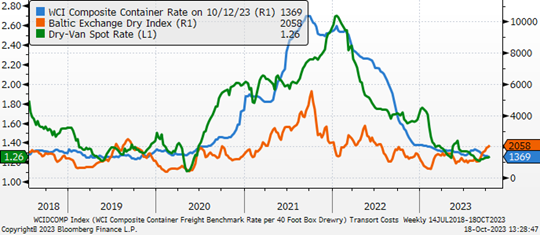

Container and Trucking Rates

After flying high with post-pandemic inflation, higher interest rates and concerns over global growth rates have sharply reduced container and trucking rates. Yet, the Baltic Exchange Dry Index shows signs that shipping rates may have reached a bottom as recently it has started trending higher.

What this means for you: With shipping rates near multi-year lows, consider locking in these lower prices with your logistics suppliers, ideally with longer-than-normal contracts. Should container and trucking rates start to rise, your lower negotiated contract prices could bring opportunities to increase profits and improve your supply chain.

5. Railroad traffic shows leading signs of increased demand for manufacturing

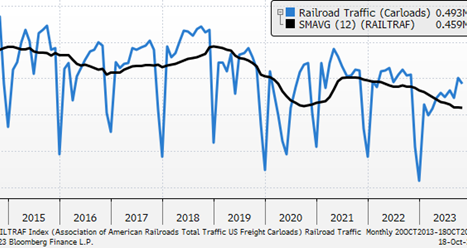

Monthly Railroad Traffic

Railroad traffic has been a leading indicator in demand for manufacturing as it is associated with increased economic activity and movement of raw materials and goods. Outside of the seasonal year-end drop, railroad traffic has been strong and trending higher in recent months.

What this means for you: Railroad traffic is one of the early signs of a potential recovery in manufacturing. Start planning for a stronger demand environment so that you can scale profitably.

6. Google Trend data shows elevated interest in supply chain sustainability

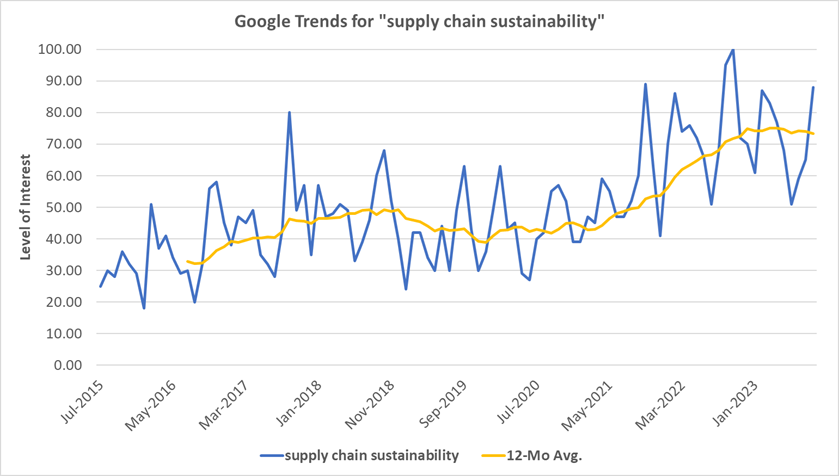

Google Trends: Supply Chain Sustainability

Supply chain sustainability is trending worldwide as companies increasingly recognize the revenue opportunities related to customer and supplier interests in sustainability across their supply chains.

What this means for you: With a rising interest in supply chain sustainability, consider ways to incorporate it into your supply chain. For example, adopt renewable energy sources, optimize transportation logistics, reduce waste, increase use of sustainable packing materials and extending the life of your products. Showing progress matters. Aprio’s ESG Advisory Practice can help you start moving the needles on these initiatives.

Simeon Wallis, CFA, is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. Each week, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (October 25, 2023) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.