6 Real Estate Insights from Q2 2023 and What They Mean for You

June 28, 2023

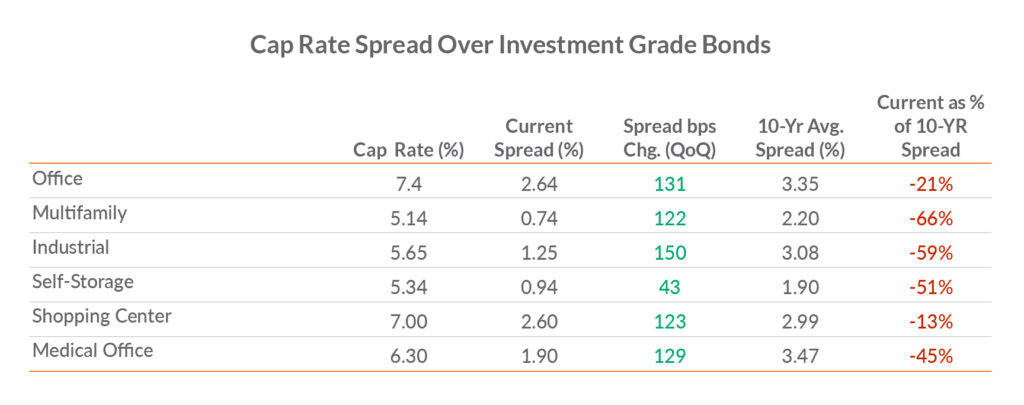

Not surprisingly, key signals are highlighting challenges in current and future real estate fundamentals concurrent with valuation headwinds. Those headwinds are seen in the difference, or spread, between cap rates (the initial rate of return on an investment property) and investment grade bonds, which have widened as interest rates decreased. However, they remain narrower than their ten-year averages, which signals that real estate valuations are still rich.

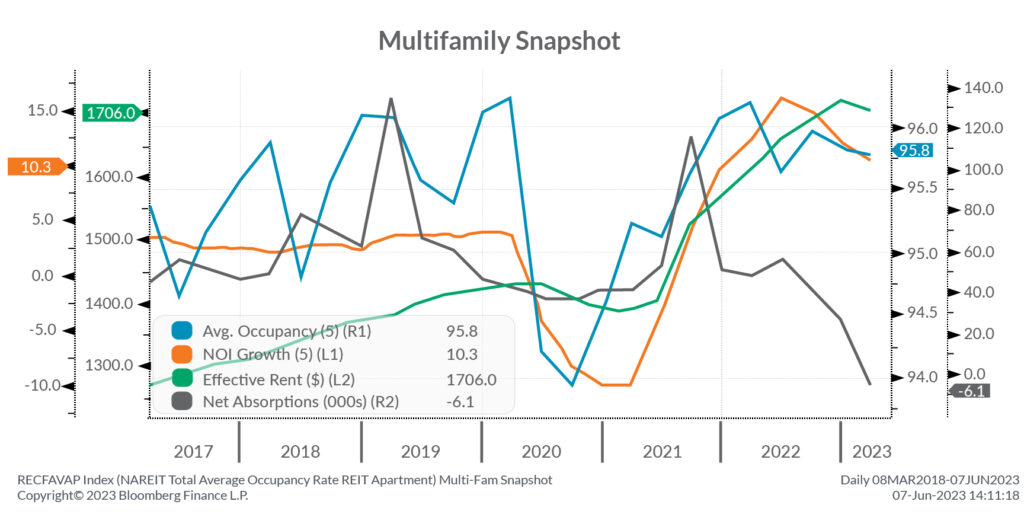

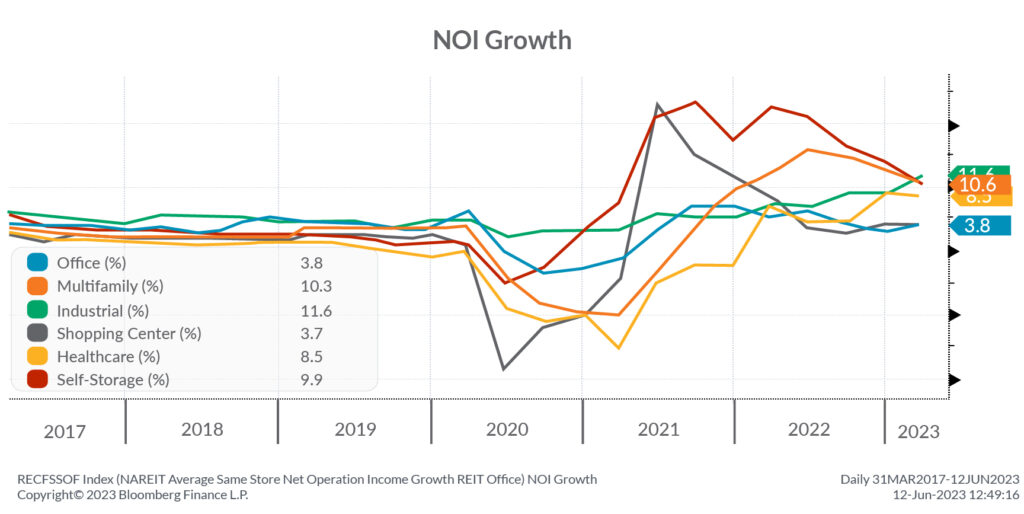

We are seeing slowing rates of growth in Net Operating Income (NOI) in popular sectors including self-storage, multifamily, and shopping centers. Changes in available supply relative to demand (i.e., net absorption or occupied square footage minus vacant square footage), has been decreasing. That is particularly true in the office and multifamily sectors. Further, multifamily housing market is now showing weakness as rents, NOI growth, occupancy and absorptions decline.

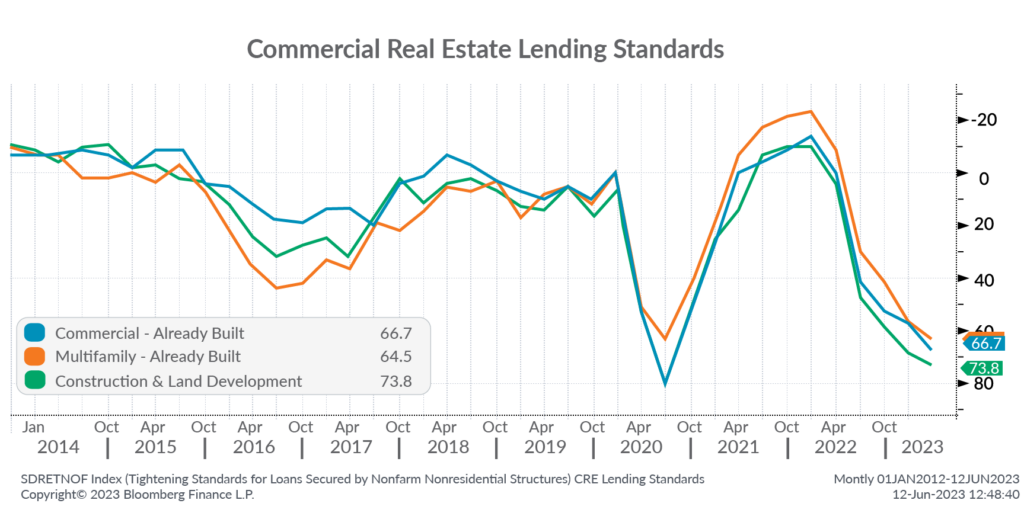

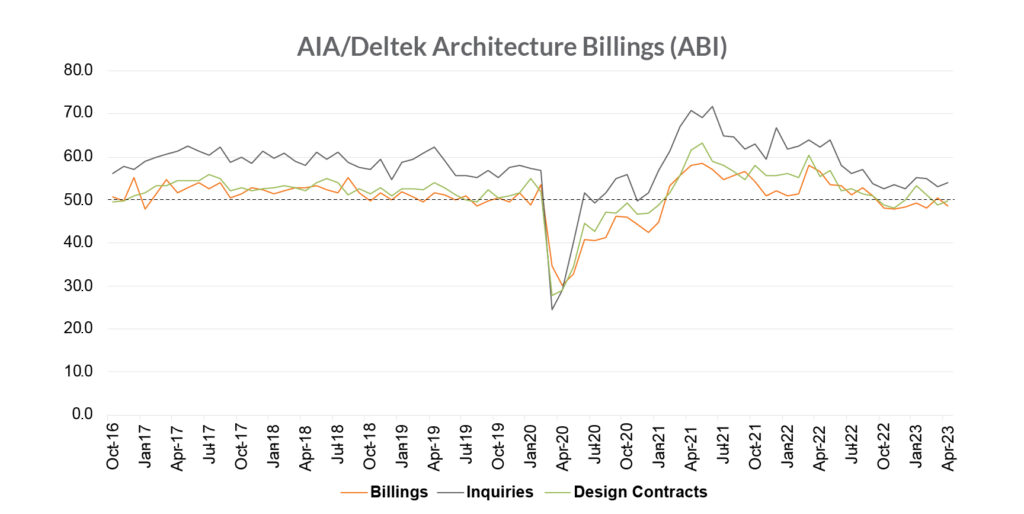

The post-pandemic surge in NOI growth rates seems to have reached a peak with the self-storage and multifamily sectors experiencing the greatest deceleration in growth rates. Leading indicators such as architectural billings and design contracts indicate further weakness, with high construction costs, elevated interest rates, and stricter lending standards hindering new property construction. Meanwhile, more leading yet less concrete architectural inquiries continue to increase.

1. Spreads between cap rates and investment grade bonds widen, but remain historically narrow

Asset allocators compare the spread (or difference) of cap rates to investment grades bonds as a sign of relative value; the higher the rate, the more appealing the investment. Cap rate spreads widened through the first quarter as interest rates declined. However, cap rate spreads are still historically low as they remain below their ten-year averages, signaling real estate is overvalued compared to fixed income alternatives. Self-storage, multifamily, and shopping centers have seen diminishing growth rates of net operating income (NOI), depressing spreads during Q1 2023.

What this means for you: Changes in cap rates tend to lag changes in interest rates. With the significant increase in rates over the last year, cap rates still have room to rise much higher, depressing valuations of existing real estate assets, especially those that will need to refinance over the next few years. Improvements in NOI growth may offset valuation pressures, and thus should be a focus for asset owners.

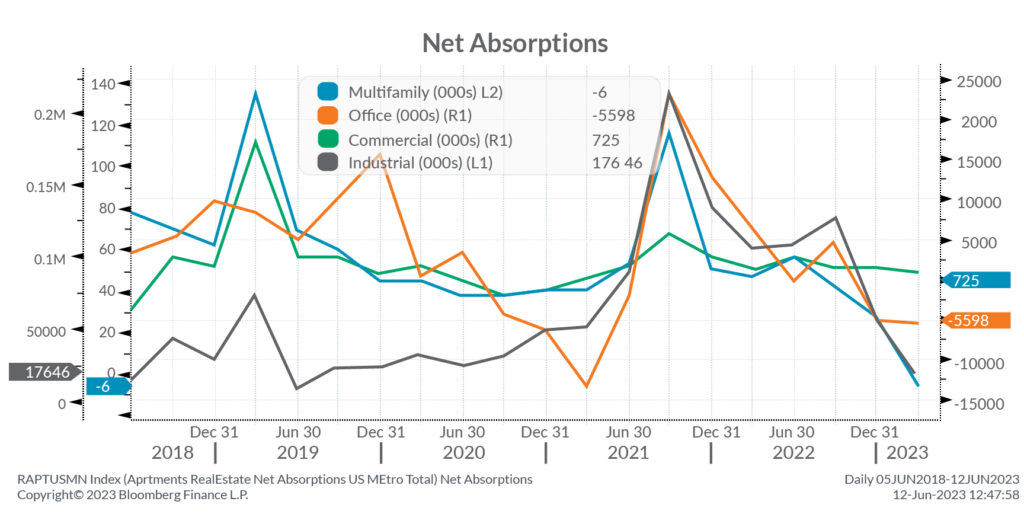

2. Net Absorptions continue to decline in 2023

Net absorptions (i.e., the square feet that became occupied less that which became vacant) continue to trend lower in 2023, after peaking in 2021. While net absorptions for the overall commercial real estate market have steadied, offices continue to face remote work challenges. The multifamily sector is showing signs of weakness with absorptions turning negative due to supply entering the market.

What this means for you: With net absorptions trending lower and economic growth anticipated to slow, expect demand for commercial real estate to further weaken and absorptions to continue to trend lower. To combat falling absorptions, look to competitively price still historically-high rents. Mitigate vacancies by locking in longer-term leases.

3. The post-pandemic strength in multifamily real estate appears to have reached its peak

Net absorptions lead occupancy, which leads net operating income growth, which leads effective rents. The pandemic strengthened the multifamily housing market as limited single-family housing and increased mobility due to more remote work opportunity increased demand for multifamily housing. This rising demand drove net absorptions, occupancy, NOI growth and effective rent higher, yet now those leading indicators have reversed.

What this means for you: With net absorptions turning negative for multifamily housing, we believe that the sector may begin to slow. Expect demand trends to weaken. With rents and occupancy still relatively high, consider offering competitively priced longer-term leases to mitigate headwinds in NOI growth.

4. Lending standards for commercial real estate see further tightening

Economic uncertainty and the recent failure of regional banks (i.e., First Republic, SVB, and Signature Bank) have commercial real estate lenders tightening their lending standards to near pandemic levels.

What this means for you: Tighter lending standards, including lower loan-to-value ratios, will make refinancing existing assets and financing prospective deals more challenging and more expensive. Medium-term, this will benefit replacement values as supply will be constricted. If you are looking to enter a deal in the near-term, consider alternative non-banking sources of capital, such as private markets.

5. Growth in net operating income (NOI) is showing early signs of a slowdown

The post-pandemic rise in NOI growth rates appears to have ended as rates revert toward more normal, pre-pandemic levels. High-flying self-storage and multifamily NOI growth rates appear to be decelerating the most, while industrial and healthcare are showing resiliency with increasing growth rates.

What this means for you: The economy is slowing. NOI growth rates are expected to follow as demand for many segments of commercial real estate declines. To combat any downward pressure in NOI growth, focus on maintaining existing occupancy levels with extending lease terms while rents are still relatively high.

6. Architecture billings and design contracts point to future weakness

As readings above 50 indicate an increase and below 50 a decrease, architectural firms have communicated that their billings and design contracts are trending weaker. High construction costs, elevated interest rates, and tighter lending standards are weighing on the construction of new properties and causing developers to pull back. Meanwhile, the most forward-looking, yet less significant, inquiries continue to increase.

What this means for you: The ongoing weakness in architectural design activity reflects growing concern over the direction of the economy. This indicates likely reduced construction activity over the next year, which may increase labor availability and reduce materials pricing for projects already in the pipeline, including value-add opportunities. Looking further out, current trends imply reduced supply in the market, which should benefit the valuations of existing assets.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (June 23, 2023) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

Recent Articles

About the Author

Simeon Wallis

Simeon is the Chief Investment Officer of Aprio Wealth Management and the Director of Aprio Family Office. Simeon brings two decades of professional investing experience in publicly traded and privately held companies, as well as senior-level operating and strategy consulting experiences.