6 Real Estate Insights from Q3 2023 and What They Mean for You

October 13, 2023

The supply of single-family homes remains historically tight, while multifamily housing supply is increasing due to previously permitted projects when demand was increasing and financing costs low. Record low affordability for homebuyers has led many to turn to multifamily housing, which portends to structurally increasing demand across geographies. Compared to historical valuation levels, office and shopping centers appear attractive, yet face challenges from remote work and a potential consumer slowdown.

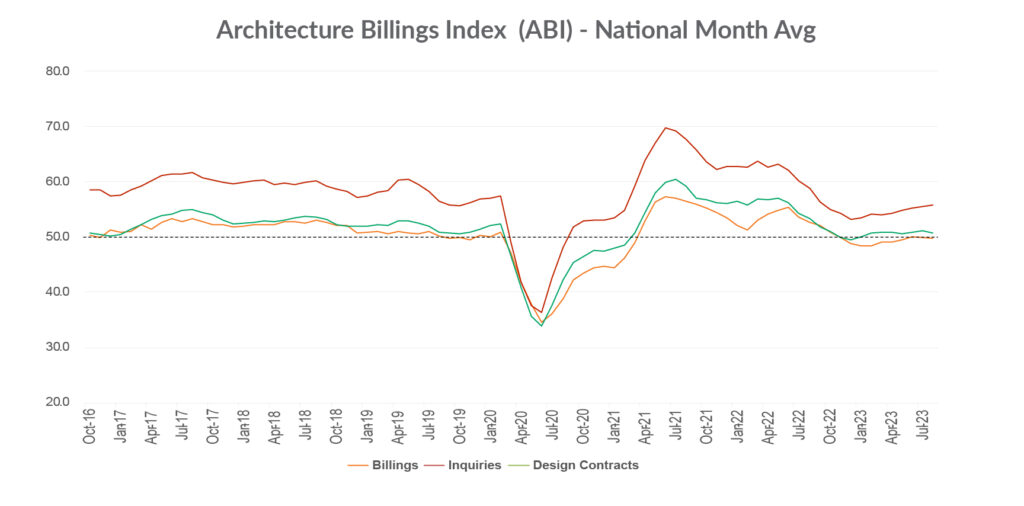

As maturing mortgages coincide with higher interest rates, property owners may struggle with liquidity, most notably in the office property sector. Banks, who hold a significant portion of US commercial real estate loans with smaller banks having higher exposure, have been reducing their loan books for real estate. Surprisingly, architectural firms have seen increased inquiries in 2023, however these have yet to translate into more design contracts and billings.

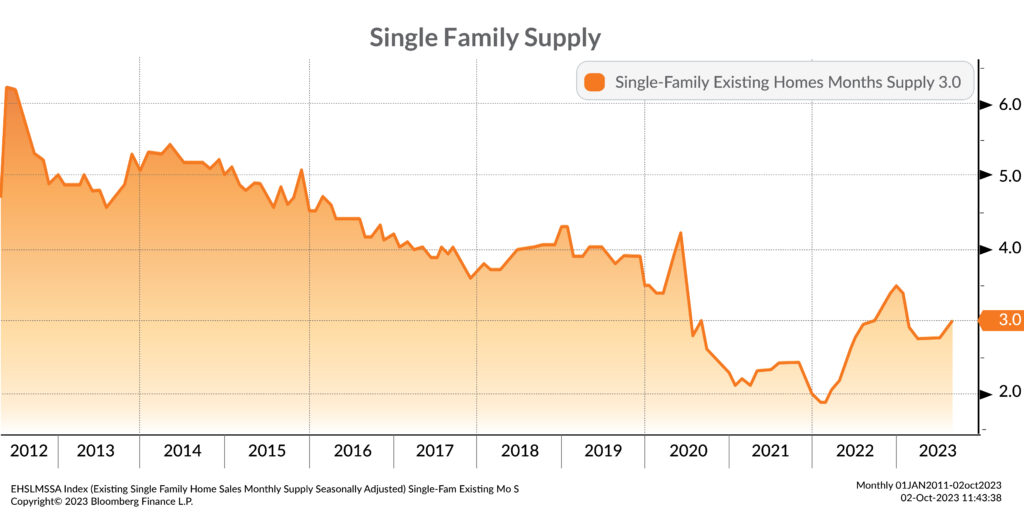

1. The supply of single-family homes remains historically limited

With inflation rising and impaired supply chains in 2020 through 2021, residential housing construction costs increased causing supply to fall as new builds were largely put on hold. Now that inflation and input costs are starting to disinflate, we are starting to see an increase in supply for single-family housing become available online. However, the supply of single-family homes continues to remain historically low.

What this means for you: Demand for single-family housing remains high, but with limited supply, many may resort to multifamily housing until more supply becomes available, thus driving housing prices lower. Expect this single-family supply-demand issue to bring further tailwinds to multifamily housing and keep rents and occupancies elevated.

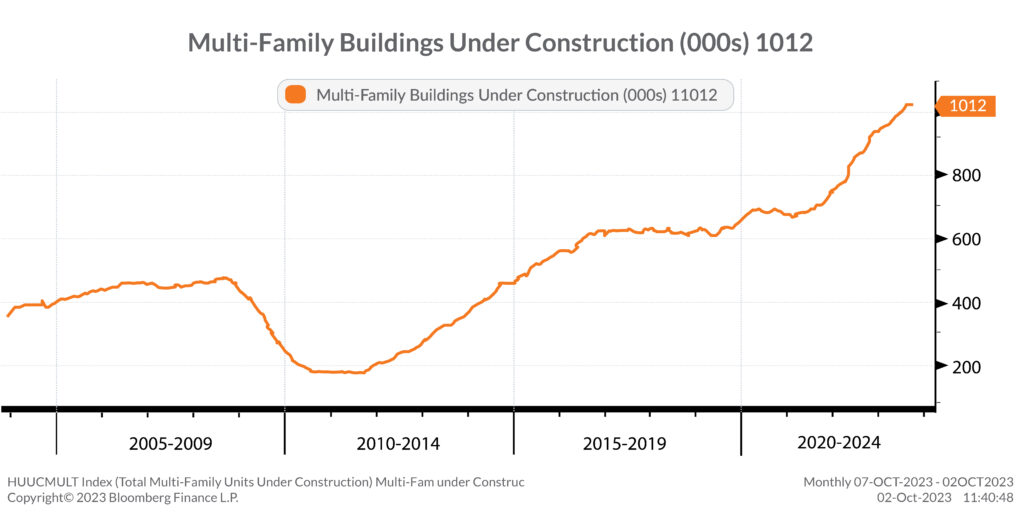

2. Multifamily home supply continues to climb at a fast pace

Supply for multifamily housing continues to become available online at above-average rates, as limited single-family housing supply, and permitting during periods of lower interest rates created demand for new development of multifamily properties. In some markets, supply is now outstripping demand; however, we believe that this will correct itself over the next few years as higher interest rates reduces incremental supply over the next 18-to-36 months.

What this means for you: While limited single-family supply has created tailwinds for multifamily housing, the large and fast increase in multifamily supply could cause headwinds over the next 12-to-18 months as ample supply can drive rents lower. However, beyond that, demand should start outstripping supply.

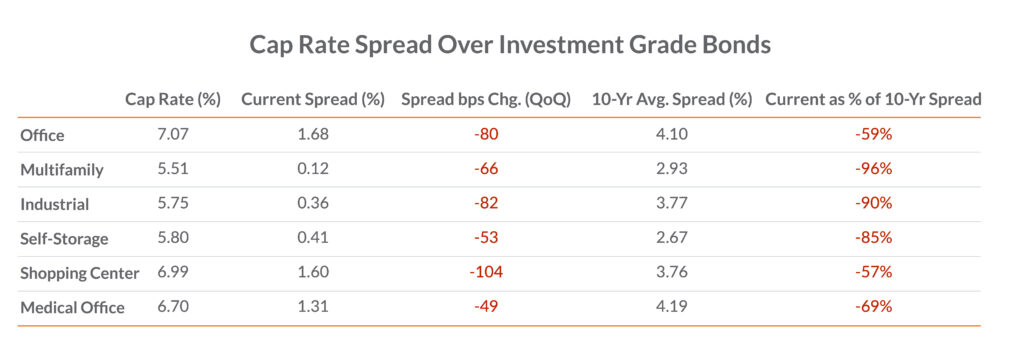

3. Spreads between cap rates and investment grade bonds continues to narrow as bond yields rise

Higher cap rates make more attractive real estate investments, and while many cap rates are still greater than their investment grade bond counterparts, the spread between them is historically low. Over the past quarter that spread narrowed even further as bond yields rose quickly. Relative to 10-year averages, office and shopping centers look the most attractive but face challenges, such as remote work and a potential consumer slow down.

What this means for you: Changes in cap rates tend to lag changes in interest rates, and with the significant increase in rates over the last year, cap rates spreads may have more room to widen. With an expected slowdown in the economy, bond yields would be expected to come down as well as real estate prices, which may bring more attractive real estate deals assuming NOI growth can remain relatively stable.

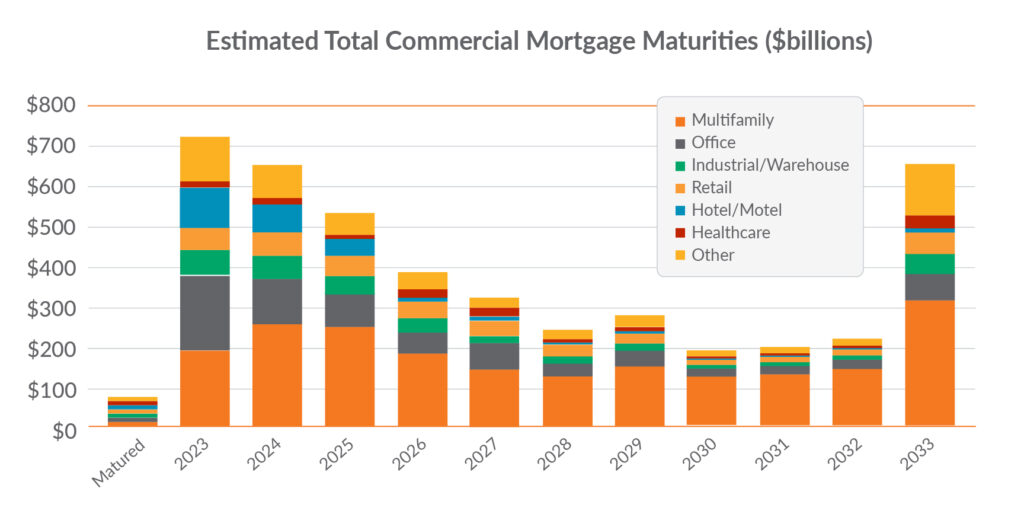

4. Commercial real estate liquidity expected to diminish with a mount of mortgages maturing in the near-term

Property owners may face significant liquidity challenges in the coming years as a mountain of mortgages are due to mature. Furthermore, with interest rates at the highest levels since the Great Financial Crisis, refinancing this debt at higher rates may increase risks of default. Office properties appear to be the most at risk with a relatively large chunk of debt maturing this year in addition to their decreasing cash flows and higher interest rates.

What this means for you: With all this debt expected to mature in the coming years, look to proactively add liquidity options to mitigate the risk of default. If looking to refinance any upcoming maturities, consider the private credit market who may be more willing than a bank to expand their real estate loan book.

5. The largest US banks have the smallest exposure to CRE

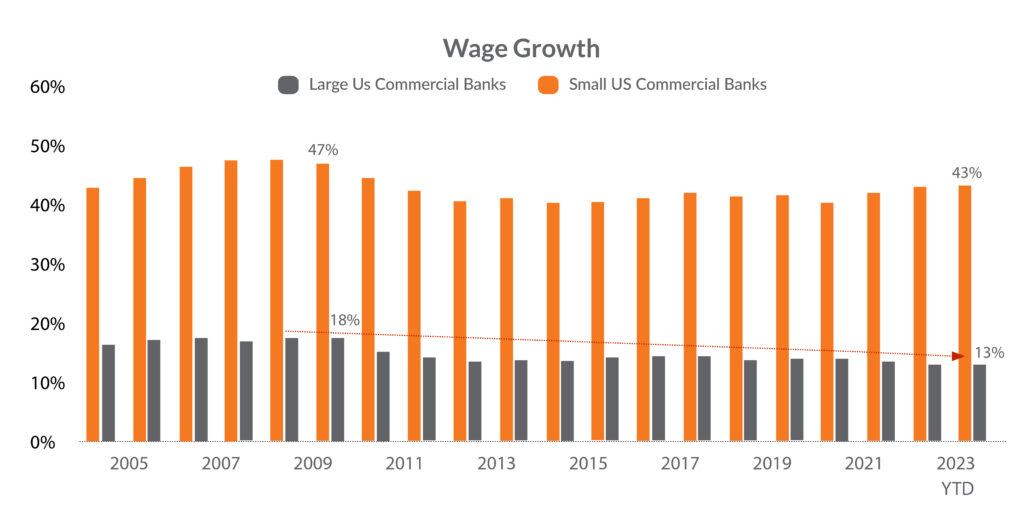

Banks hold about half of US commercial real estate loans, yet real estate loans only account for about 13% of large banks’ total assets; that percentage has only decreased throughout the years. However, smaller US banks are more exposed to commercial real estate, with loans accounting for about 43% of their total assets.

What this means for you: With commercial real estate credit risks starting to rise due to economic uncertainty, rising interest rates, and lack of liquidity from upcoming maturities, banks may further tighten their lending standards and increase their rates to borrowers. If a commercial real estate credit crisis were to occur, small banks will likely suffer while large banks may only suffer minor setbacks.

6. Architecture inquiries indicate some optimistic interest but billings and design contracts fail to follow suit

As readings above 50 indicate an increase and below 50 a decrease, architectural firms have seen rising interest in construction projects, as inquiries have increased in 2023. However, it seems many developers are only testing the waters, or are challenged by financing, as those inquiries have not materialized into an increase in design contracts and billings.

What this means for you: Rising architectural inquiries reflects the readiness of developers to start construction, but the lack of new contracts highlights that something is holding them back from committing, such as higher financing costs. As a result, construction activity may soften until economic and interest rate uncertainty diminishes. Looking out further, demand in several asset classes of commercial real estate have positive demand trends, and with limited future supply, once economic concerns are alleviated, we believe we may see contracts and billings accelerate.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (October 10, 2023) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

Simeon Wallis

Simeon Wallis, CFA, is a Partner, the Chief Investment Officer of Aprio Wealth Management, and the Director of Aprio Family Office. Each month, Simeon brings you insights from the financial markets in Aprio’s Pulse on the Economy. To discuss these ideas and how they may affect your current investment strategy, schedule a consultation.

Alan Vaughn

Alan is the Real Estate and Construction Practice Leader at Aprio and a Tax Partner. Alan advises all types of real estate and construction clients on various 1031 exchanges, structuring of LLCs, and creative exit planning strategies.

Darrin Friedrich

Darrin is a Tax Partner in Aprio’s Real Estate and Construction Practice. Darrin advises C-level executives and business owners within real estate, construction, retail, and hospitality on tax preparation and business consulting.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.