Affordable Housing Developers Can Unlock Hidden Tax Savings with Cost Segregation

April 16, 2024

At a glance

- The main takeaway: Cost segregation is a tax-saving strategy that allows property owners to reduce their income tax burden and increase cash flow.

- Impact on your business: In this article, we explore the significance of cost segregation as a whole, and why a cost segregation study is essential for your affordable housing property’s value.

- Next steps: Reach out to Aprio for help with addressing your affordable housing needs and business objectives.

Schedule a consultation

The full story:

Cost segregation accelerates the depreciation timeline for certain property assets, maximizes your tax benefits, and increases your cash flow. In this article, we will explain how affordable housing developers, in particular, can take advantage of cost segregation to reap greater savings.

What is cost segregation?

Cost segregation is a tax-saving strategy that allows property owners to reduce their income tax burden and increase cash flow by categorizing their assets with particular depreciation lives starting from 5 years up to 39 years. The IRS plays a crucial role in cost segregation, setting up property asset guidelines and implementing depreciation requirements. A cost segregation study identifies which of your assets can be considered for a shorter depreciation class. It’s a powerful tool that requires guidance from qualified team of engineers, CPAs, and accountants who can ensure everything is done correctly according to IRS regulations.

When taxpayers build or acquire properties, federal tax recovery rates require the taxpayer to depreciate or recover the costs. This is usually on a straight-line basis: over 39 years for a commercial property (non-residential rental) with an annual deduction of 2.6% or 27.5 years for a residential rental property with an annual deduction of 3.6%.

Are there any shorter-life assets?

Yes, not all assets attached to a building or land are considered for the 39 or 27.5-year building property. Many assets qualify as personal property, and they have a recovery rate of 5 or 7 years, while some land improvements have a recovery rate of 15 years.

The IRS also defines tangible property as either § 1250 or § 1245 in the tax code. § 1250 Real Property includes:

- Land improvements (may be § 1245 also)

- Buildings

- Structural components of buildings

Conversely, § 1245 Personal Property includes:

- Furniture

- Machinery and equipment

- Impermanent or accessorial improvements

- Land improvements (may be § 1250 also)

When you have identified shorter-life assets, you can “front-load” the recovery. This can increase your tax deductions in the earlier years, which can free up capital. Additionally, you can look at the first-year increased depreciation and cash flow.

Another way to think of this is as an interest-free loan to yourself: more cash flow in the early years of the building’s recovery translates to less cash flow in the later years.

Finally, an easy way to remember the benefits a cost segregation study can provide is the “3-2-1 method” of potential deductions:

[3] Additional depreciation created by these shorter-life assets can generate anywhere between $30,000;

[2] To $200,000;

[1] For every $1,000,000 in building or improvements basis.

Effect your bottom line

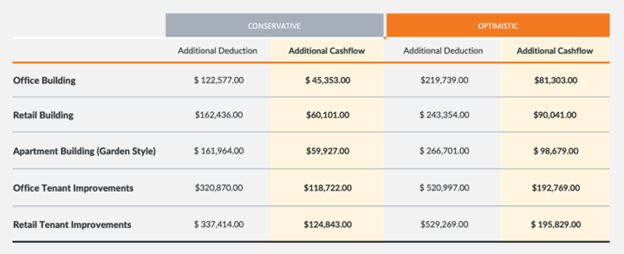

Take a look at the example below (assumptions include $1,000,000 in basis, 37% tax rate, and 80% bonus depreciation):

Other factors to consider

Here are some factors we often consider during a study:

- Whether the project is new construction, an acquisition, or renovations

- Finishes used

- Amount of site improvements

- Business activity

- Complexity of the building

Generally, the depreciable basis for a study should be about $1,000,000 but there are exceptions, some properties may require more basis and some properties may require less basis for a study to make financial sense.

A cost segregation study is a comprehensive analysis of a property. The team you hire should have the expertise to properly classify all of your assets to maximize your deductions while adhering to the guidelines set forth by the Internal Revenue Service. Aprio has a dedicated team of professionals who specialize in this field.

The bottom line

It’s always best to consult with your CPA when you’re in doubt about any of the cost segregation components we have discussed above. A qualified affordable housing CPA can help you analyze the acquisition costs of a property to identify which assets can be included in a cost segregation study.

Aprio’s Cost Segregation Group can give you a personalized and proactive approach to your affordable housing needs and business objectives. We also offer other related services, such as fixed asset reviews, disposition studies, cost allocation studies, and energy efficiency studies for commercial properties and residential properties (179D & 45L).

Schedule a consultation with our team today.

Related Resources/Assets/Aprio.com articles/pages

About Aprio’s Affordable Housing Practice

Aprio Cost Segregation Services and Specialists

Get Up to $5,000 Per Unit in Tax Savings with the 45L Credit

Recent Articles

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.