Posts by Aprio Publisher

6 Healthcare Insights from Q4 2024 and What They Mean for You

Healthcare data reveals a stabilizing industry for physician practices as patient visits and consumer spending have reached consistent levels, suggesting steady demand. However, declining online searches by prospective patients highlights the importance of patient retention over digital discovery. While physician job postings have leveled off, the ongoing labor market competition for staff drives wage pressures…

Read MoreHow to Reduce or Eliminate Capital Gains Tax on the Sale of Real Estate

At a glance Schedule a consultation The full story: A long-term capital gain occurs when a qualifying property is held at least for one year plus a day. There is a special preferred capital gains rate to encourage long-term real estate investment. Individuals will generally incur a 20% capital gains tax rate, although lower rates…

Read MoreKayla Kania Named Aprio Mid-Atlantic Regional Leader

ATLANTA/ROCKVILLE – Nov. 14, 2024 – Aprio, a top 25 business advisory and accounting firm, announces Kayla Kania, CPA, Lead Government Contracting Assurance Partner, will become the Mid-Atlantic Regional Leader, effective Jan. 1, 2025. Based in Rockville, Md., Kayla will assume responsibility for operations, client service, and growth across the Mid-Atlantic region, succeeding Lexy Kessler,…

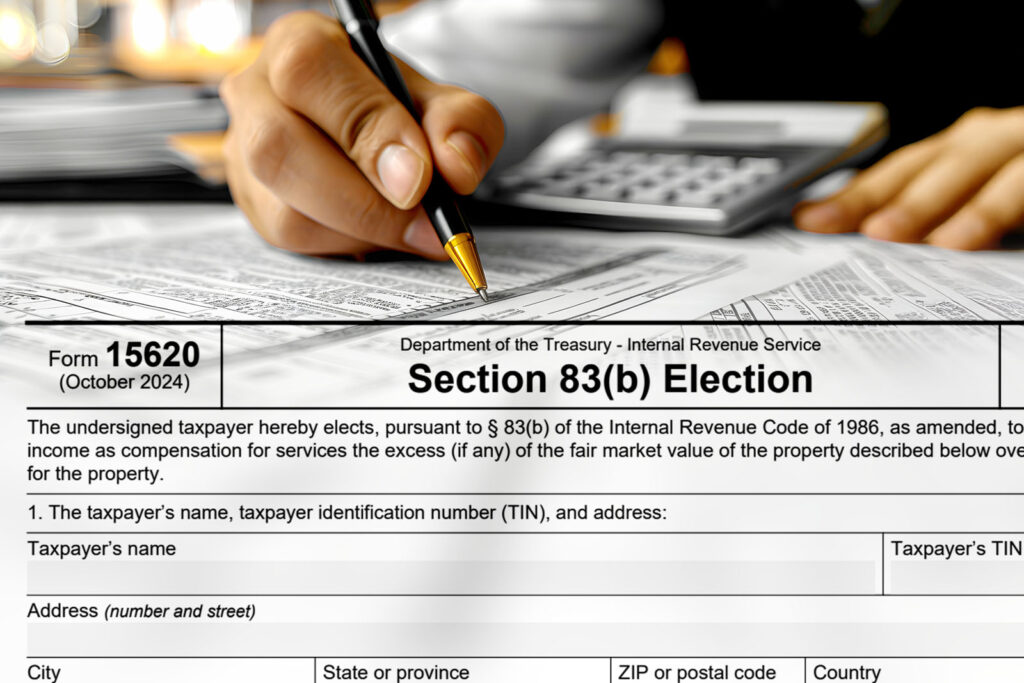

Read MoreWhy Have We Been Preparing Elections Under IRS Code Section 83(b)?

At a glance Schedule a consultation The full story: The IRS released major news on November 7, 2024. If you guessed the long-awaited templated IRS Section 83(b) form, then you’d be correct. IRS Form 15620, commonly known as Section 83(b), is as straightforward as the historical election format we have spent decades preparing for clients.…

Read MoreGlobal Mobility: Year-End Payroll Considerations – What You Need to Know

At a glance Schedule a consultation The full story: It is important for all businesses to perform a year-end payroll review for accuracy and compliance purposes — but the practice is especially critical for those with globally mobile workforces. Your year-end payroll review should incorporate all foreign tax payments, assignment related allowances and adjustments, for…

Read MoreImproving Practice Production by 10%

By Roger P. Levin, DDS Dentists: would you believe me if I told you that you could increase your practice production by 10%? The strategy is relatively simple and even allows some practices to increase production by 30%–50% within three years. So, why doesn’t everyone do it? How to improve practice production The first question…

Read MoreAccounting for Idle Lease/Impairments under ASC 842

At a glance: Need further guidance on ASC 842? Reach out to Aprio’s Government Contracting specialists today. The full story: Has your company transitioned to a hybrid or fully remote workforce and the original lease space is no longer required? Did you win a contract requiring your employees to be on site at a government…

Read MoreJoint Ventures on the GSA Schedule Webinar

https://info.aprio.com/joint-ventures-on-the-gsa-schedule-webinar-video

Read MoreUnderstanding the 1031 Like-Kind Exchange Rules

At a glance Schedule a consultation The full story: Internal Revenue Code (IRC) Section 1031, also referred to as the “like-kind” exchange, provides individuals with an exception by allowing them to defer capital gains if they reinvest the proceeds into other qualifying properties. The 1031 like-kind exchange can be a viable long-term tax saving strategy…

Read MoreRecent Updates on the China Tariff Exclusion Process

At a glance: The full story The U.S. Trade Representative (USTR) has opened a new window for companies importing industrial machinery from China to apply for exclusions from Section 301 tariffs. (Reminder: Section 301 tariffs are trade sanctions that the U.S. can impose on foreign countries that engage in unfair trade practices or violate trade…

Read More