Posts by Aprio Publisher

Passing the Torch: Succession Planning Strategies for Family-Owned Restaurants

The full story: Succession planning is a critical component to long-term business success — but for family-owned restaurants, the process can be particularly complex. Beyond the standard challenge of identifying and preparing a capable successor, family-owned restaurants must also navigate intricate family dynamics, emotional investments, and the expectations of loyal patrons, who may feel wary…

Read MoreFrom Family Roots to Financial Empowerment: Angela Dotson’s Journey to Uplift Black-Owned Businesses

Having grown up with parents who were small business owners, Angela Dotson developed a deep understanding of the challenges entrepreneurs face. Actively involved in the day-to-day operations, she witnessed firsthand the stress her parents experienced due to working with an unreliable CPA. Her curiosity about accounting led her to take accounting classes at the University…

Read MoreThe Role of GSA eTools in Maximizing Procurement Efficiency

At a Glance Schedule a consultation The Full Story: The General Services Administration (GSA) offers a set of online tools called GSA eTools, designed to help federal agencies and contractors, especially small businesses, simplify the procurement process. Their primary functions are to assist in conducting market research, identify upcoming federal opportunities, respond more quickly to…

Read MoreNo Tax on Tips and Overtime: What Trump’s OBBB Means for Hospitality, Retail, and Construction

At a glance Schedule a consultation The full story: On July 4, 2025, President Trump signed into effect the One Big Beautiful Bill (OBBB), introducing an array of tax changes that will impact individual and entity taxpayers for tax years starting as early as 2025. Some provisions were extended and made permanent while others were…

Read MoreAprio Wealth Management Recognized on Accounting Today’s 2025 Wealth Magnets List

ATLANTA – July 28, 2025 – Aprio, the 24th largest business advisory and accounting firm in the U.S., is proud to announce that Aprio Wealth Management has been named to Accounting Today’s 2025 Wealth Magnets list, which ranks the leading CPA-affiliated firms by assets under management (AUM). Now in its 19th year, the annual Wealth…

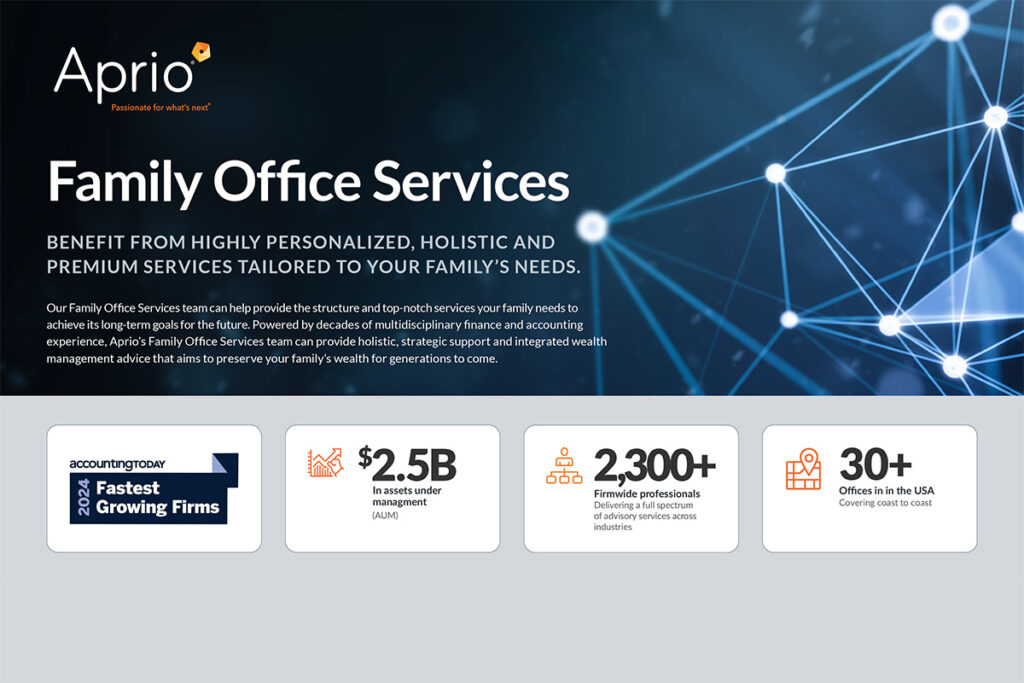

Read MoreFamily Office Brochure

Family Office Services

Webinar: Unpacking the One Big Beautiful Bill: Navigating the Impact on Businesses and Individuals

Key Considerations for Expanding Your Restaurant Business

At a glance Schedule a consultation The full story: Expanding your restaurant business is a major milestone, but one that requires careful consideration of several key factors. Whether you’re opening additional company-owned locations or considering franchising, it’s important to approach growth with the right strategy, structure, and support. In this article, examine several key areas…

Read MoreThe Pulse on the Economy and Capital Markets: July 2025

To Summarize: Despite cooling momentum, stock markets remain resilient, reflecting a surprising upside in economic data. Consumer and business sentiment are holding up better than expected. Although hiring has slowed, real-time data signals that businesses are interested in hiring more employees again. Meanwhile, inflation is becoming sticky, particularly in goods, as tariff-driven price pressures start…

Read More