The Pulse on the Economy and Capital Markets: April 5–9, 2021

April 13, 2021

Executive Summary

- A Solid Start to Q2: The markets kicked off the quarter with strong performance, amid optimism about the U.S. economy — and we’re seeing this trend across a variety of asset classes.

- A Boom in the Services Sector: Last week, we had the strongest report on the services sector on record, which is great news to many of the industries and workers that were most impacted by COVID-19.

In the Markets

Across the capital markets, activities and valuations reflect tremendous amounts of money available and investors’ optimism.

There’s plenty of money in crypto

On August 9, 1995, an initial public offering (IPO) of a Silicon Valley-based company became the seminal event that marked the legitimacy of a new platform for communication — that company was Netscape, and the platform was the internet. Netscape’s valuation at the IPO was (in today’s world, a rather quaint) $2.9 billion, which was groundbreaking for a startup at the time.

Fast forward, and we’re anticipating the expected direct listing of Coinbase, the pre-eminent platform for trading cryptocurrencies. Will it have similar stature, marking the legitimacy of cryptocurrency as an alternative asset? The decade-old company’s expected valuation is incredibly wide — estimates are from $19 billion to $230 billion, with Wall Street estimates in the $70–$100 billion range (link). In terms of the financials:

- Revenue for Q1 2021 was $1.8 billion — $500 million more than all of 2020’s revenue.

- Expected profit in Q1 2021 was $730–$800 million — these are huge margins already.

There’s plenty of money in venture capital

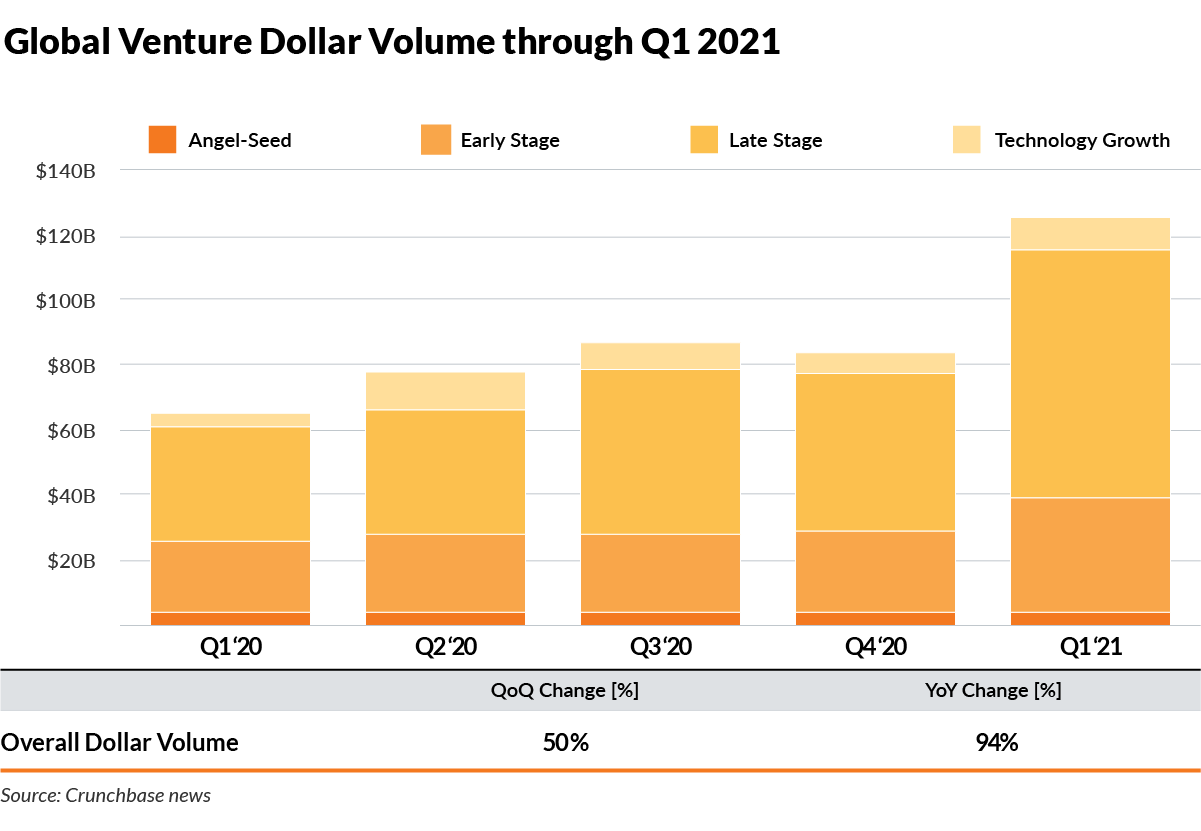

The venture capital (VC) market is incredibly vibrant. According to Crunchbase (link), the first quarter saw global VC investments reach $125 billion, a 94% increase over the same period last year. This is the first time a first quarter was over $100 billion.

There’s plenty of money in high-yield debt

According to Bloomberg, the first quarter was the busiest quarter on record for “junk” (i.e., high-yield) bond sales. Yields continue to plummet, with the riskiest segment of the market dropping to an all-time low. The difference, or “the spread,” between yields on high-yield debt and government bonds shrank to a level not seen since before the 2008 financial crisis. The tighter the spread, the less concern about borrowers’ default risk.

There’s plenty of money in private equity

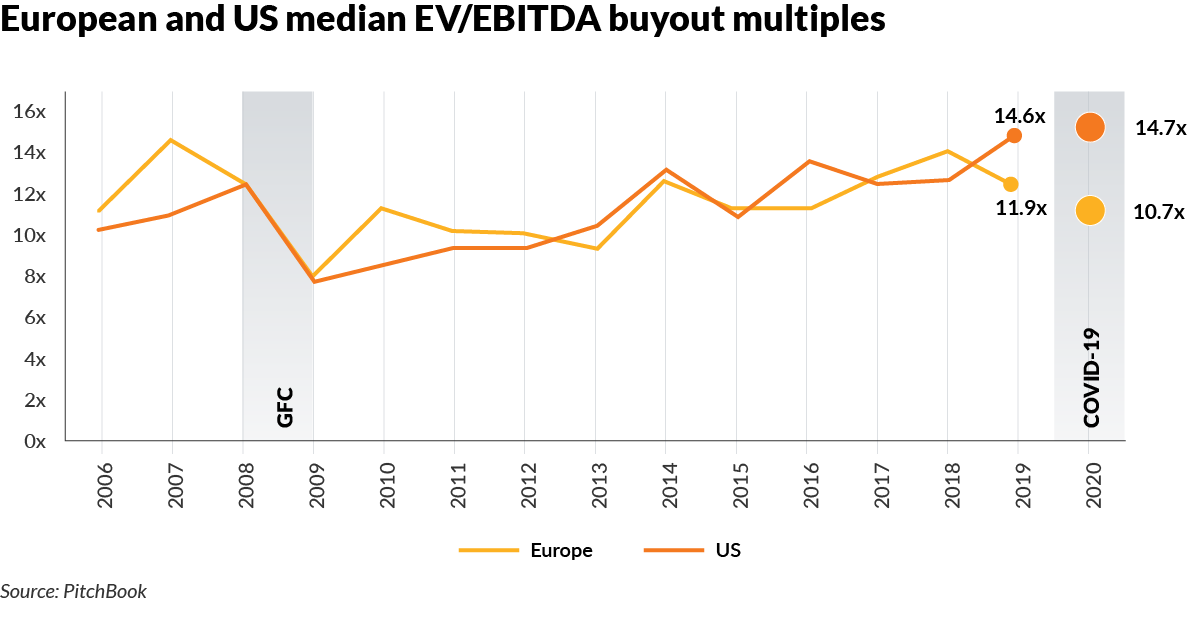

Private equity (PE) is sitting on cash and aggressively bidding for new investments. As interest rates declined globally, the trend was for PE firms to pay higher multiples. U.S. multiples are at all-time highs; yet in 2020, we saw a bifurcation as European and U.S. companies’ multiples diverged, according to PitchBook:

“The four-turn gap between median European and U.S. prices has never been wider and can be partly explained through Europe’s poor public equity performance, considerably lower fiscal-monetary stimuli, mediocre handling of the COVID-19 pandemic, a weakening U.S. dollar and a steeper flight to pandemic-proof assets in the U.S.”

And there’s plenty of money in the stock markets

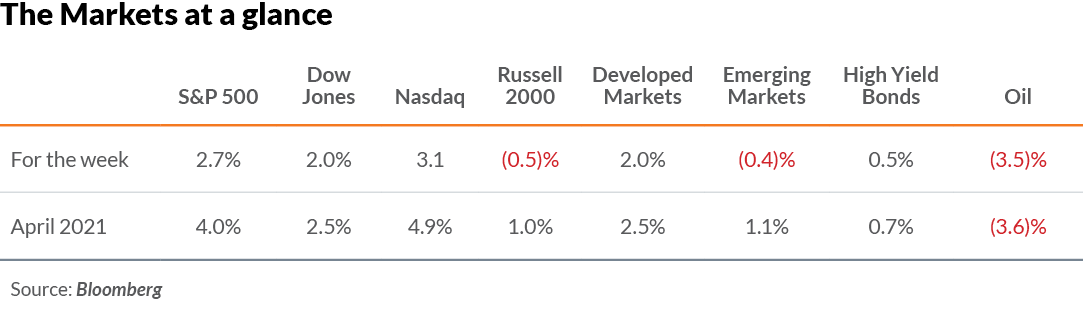

For the start of the second quarter, stock markets across the world are higher, with the tech-focused Nasdaq leading the pack, nearly doubling the more cyclical Dow Jones. This reversed what we saw in the first quarter.

In the Economy

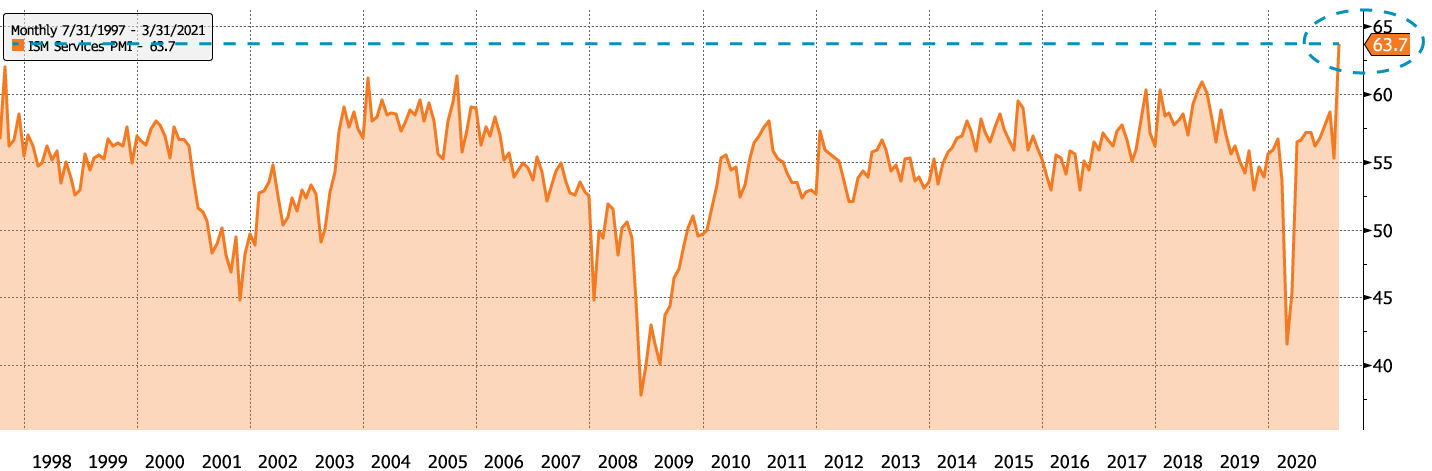

The services sector of the U.S. economy grew at the fastest pace on record in March. On the strength of the COVID-19 rebound and recovery from February weather, services rebounded significantly and are now at a higher level than at any point since 1997. This is a huge driver of U.S. GDP growth because services account for approximately 68% of GDP.[1]

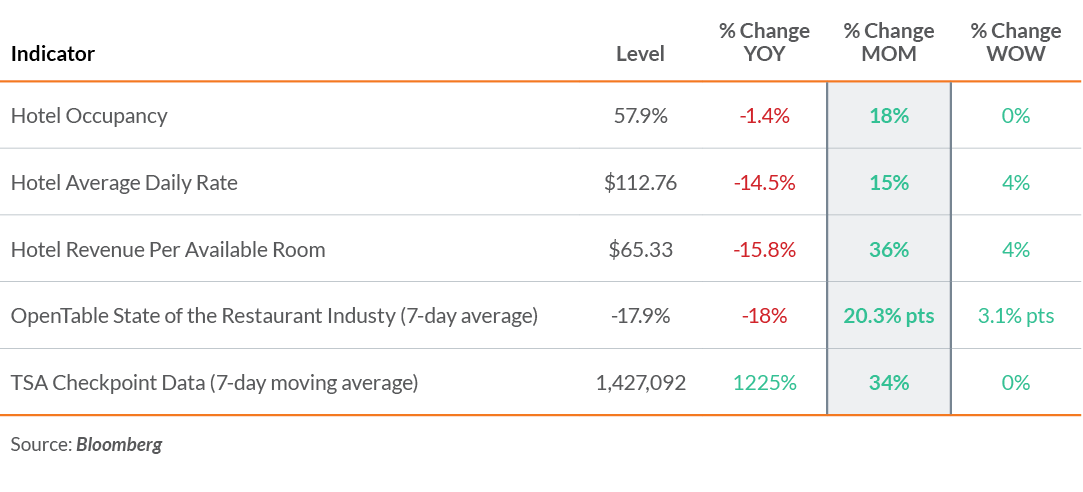

We see this in the rebound in COVID-impacted industries with the high-frequency data that we track daily. Here are a few key points to note:

- Hotel occupancy rates and prices increased double digits compared to four weeks ago.

- Restaurant traffic increased 20% month over month.

- Air travel is approaching 1.5 million passengers per day, up 34% month over month.

The impact of this shift could be significant — these industries typically employ low-and-middle-income workers who spend a higher percentage of wages than wealthier segments. This has a positive ripple effect on local economies and can create a virtuous cycle.

A Few Stories That Caught My Eye

- Jamie Dimon, CEO of JPMorgan Chase, believes the economic rebound could “easily run into 2023.” (link)

- Legendary baseball card manufacturer Topps is going public via a special purpose acquisition company (SPAC) — and the focus is on blockchain and non-fungible tokens (NFTs) more than the market for Ken Griffey rookie cards. (link)

- In March, Atlanta real estate sales were up 15% year over year, with inventory down 58%. (link)

- Amazon warehouse workers in Alabama vote down aligning with a union. (link)

[1] Deloitte, “Changing the lens: GDP from the industry viewpoint,” Economics Spotlight, July 2019, https://www2.deloitte.com/us/en/insights/economy/spotlight/economics-insights-analysis-07-2019.html, accessed April 2021.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (April 13, 2021) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.