The private capital market is shifting away from a liquidity drought to a selective thaw. Secondaries have become the primary relief valve, with continuation vehicles (CVs) now a mainstream option. Limited partners (LPs) are prioritizing cash returned, otherwise known as distribution-to-paid-in (DPI), over paper internal rate of return (IRR). While private credit defaults are easing, restructurings of private equity backed-syndicated loans remain elevated. Additionally, real estate fundraising is becoming increasingly selective.

If you would like to discuss how private investments fit into your portfolio, please reach out to your main Aprio contact, Simeon Wallis, CFA (Chief Investment Officer).

1. LPs are grading managers on DPI, not just IRR

Source: McKinsey

According to McKinsey, LPs are increasingly prioritizing DPI capital as the most critical performance metric. Over the past three years, DPI has risen to stand nearly equal with IRR and Multiple of Invested Capital (MOIC). This shift reflects longer hold periods and a renewed focus on actual cash returned rather than unrealized gains.

What does this mean for you: When evaluating funds, prioritize managers with repeatable exit strategies and strong relationships with strategic buyers, sponsors, and secondary market participants. Focus on the path to distributions over the next 12-to-24 months, including potential exit routes and the use of secondaries or CVs. Align pacing commitments so that anticipated DPI matches new capital deployments.

2. Secondaries are now the primary release valve for liquidity

Source: JPMorgan

Global secondary transaction volume reached approximately $162 billion in 2024, marking a 45% year‑over‑year increase, driven by both LP‑led and GP‑led deals. Pricing for buyout portfolios has recovered to the low‑to‑mid‑90s percent of NAV, signaling a healthier bid–ask spread and more confident underwriting. Shifts in university endowment economics and funding responsibilities have increased the supply of opportunities.

What does this mean for you: Secondaries can accelerate DPI, while expecting more LP portfolio sales and GP‑led transactions involving high-quality assets. For taxable investors, secondaries and CVs may offer tax‑efficient ways to retain exposure to winners while generating meaningful cash-on-cash returns.

3. Private Equity: Continuation vehicles (CVs) have gone mainstream

Continuation vehicles, structures in which sponsors transfer one or more marquee assets into a new fund, now represent roughly 20% of private equity exits in the first half of 2025, up from low single digits just a few years ago. This trend reflects continued weakness in IPO and M&A markets, though we may be at an inflection point. Sponsors are increasingly using competitive processes and third‑party valuations to manage conflicts, while offering LPs the choice to cash out or roll forward.

What does this mean for you: When evaluating CVs, review valuation rigor, fees structures, and governance terms. CVs can provide liquidity and improve near‑term DPI, while allowing GPs to manage longer-than-expected hold periods without forced sales in a selective M&A environment.

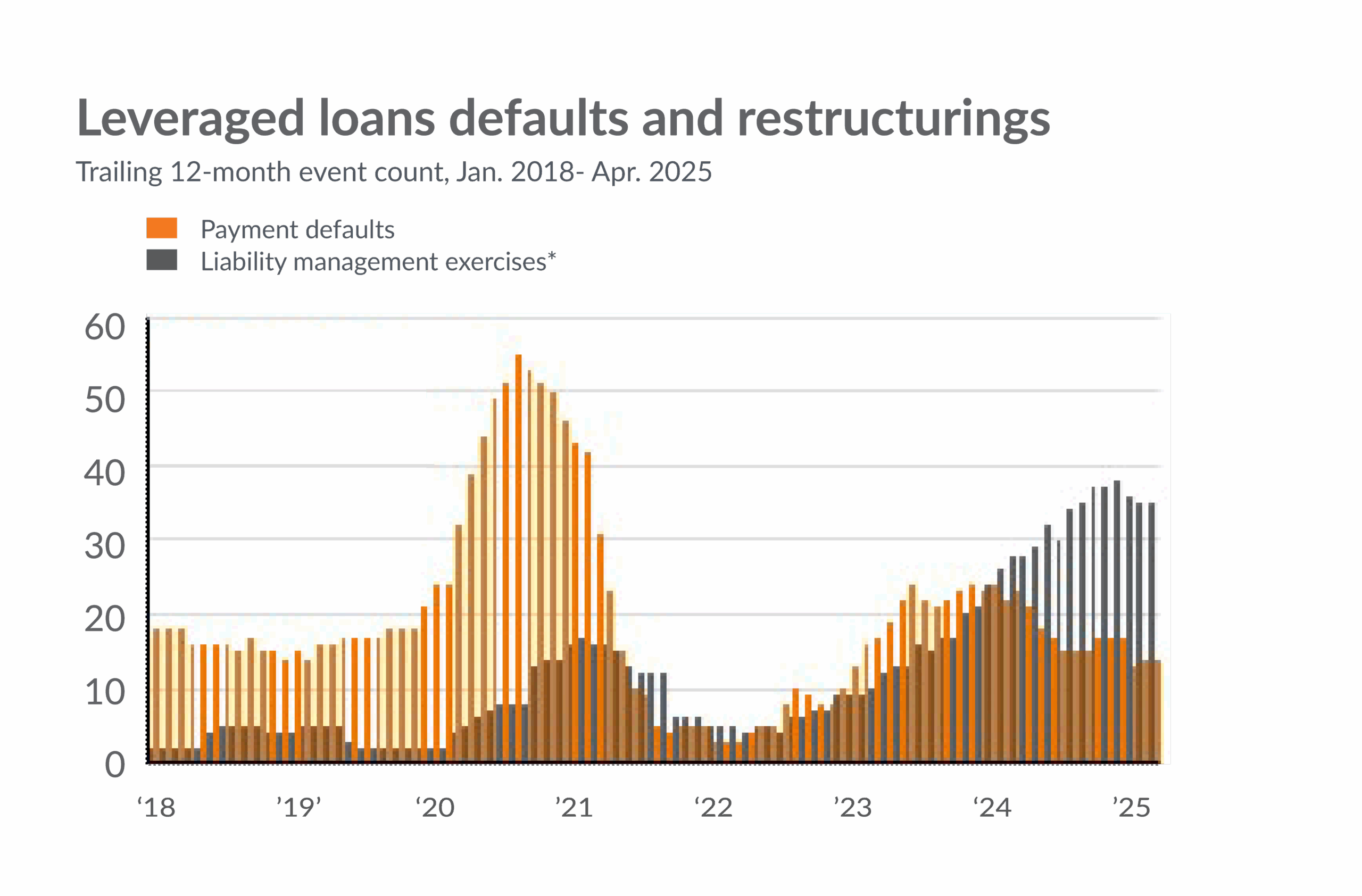

4. Private Credit: Defaults are cooling, but watch the “shadow stress” in syndicated loans

Source: JPMorgan

Default indicators in direct lending eased in Q2 2025, while the broadly syndicated bank loan market continues to show elevated amend‑and‑extend activity and payment-in-kind (PIK) toggle restructurings. Although pure payment defaults have moderated from their 2023 and early‑2024 peaks, restructuring volumes remain above pre‑COVID levels.

What does this mean for you: Selectivity remains key. Focus on senior‑secured, covenant‑protected loans managed by teams with strong underwriting and workout experience. Consider a barbell approach by pairing income‑oriented senior lending with a smaller allocation to opportunistic or special situations credit.

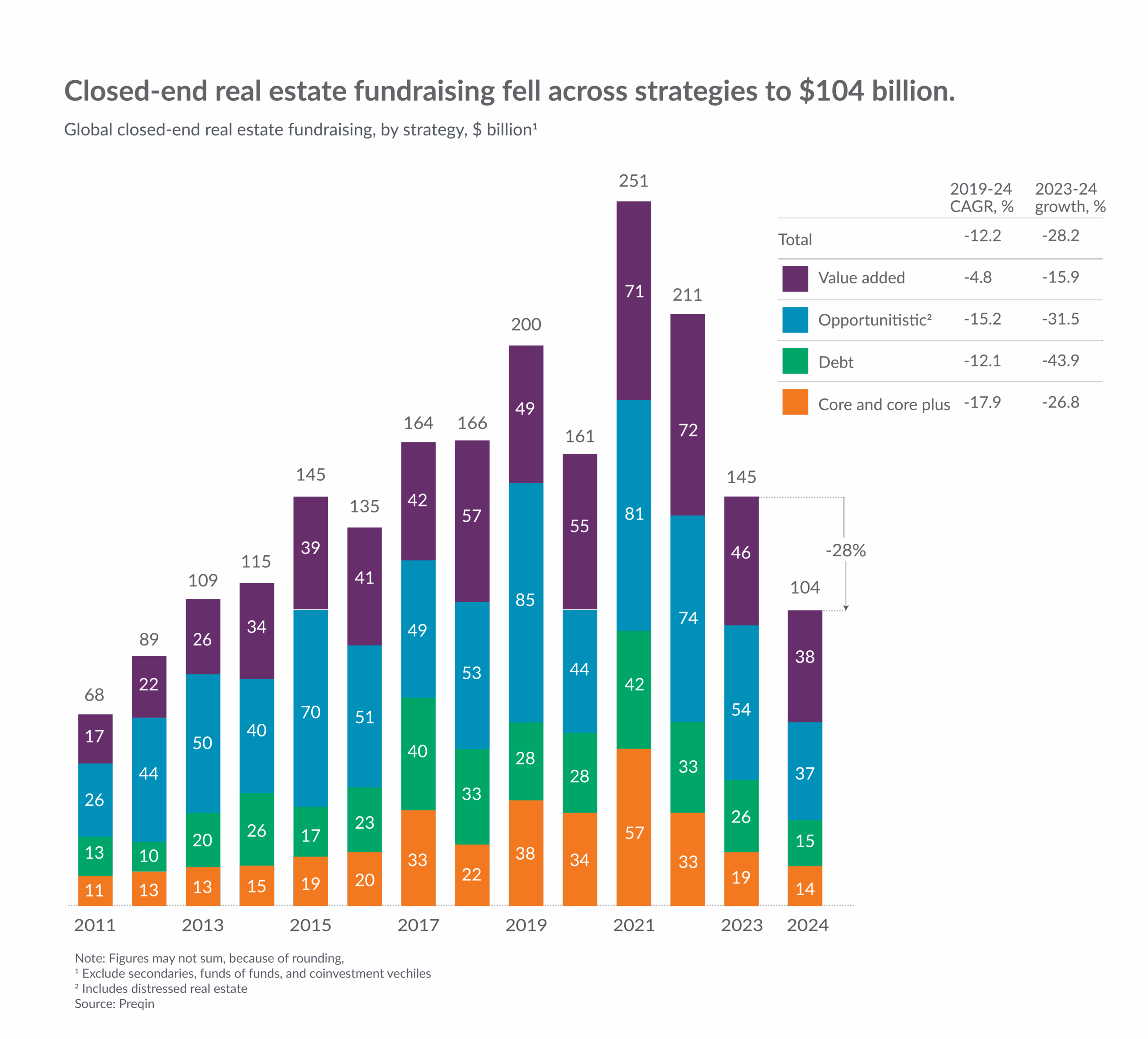

5. Private Real Estate: Fundraising is selective; operations and power access drive returns

Source: McKinsey

Private real estate fundraising declined in 2024 across all strategies, including value‑add, opportunistic, core and core‑plus, and real‑estate debt, with capital concentrating among a smaller group of managers. For those attracting capital often, there are operational advantages, such as local permitting knowledge and reliable access to utility power, which support select retail locations, infill logistics sites, and power‑rich data‑center campuses.

What does this mean for you: To manage the valuation lag between public and private markets, consider pairing public REITs, which reprice more quickly, with private vehicles offering smoother income streams. Underwrite based on NOI growth rather than cap rate compression. Let manager selection drive allocations, favoring operators with demonstrated leasing, redevelopment, and capital markets execution.

What we’re watching into Q4

As we near the fourth quarter, several developments are on our radar. Deal pipelines appear to be reopening, with sponsor‑to‑sponsor activity picking up as bid–ask spreads narrow. A selective IPO calendar could improve DPI. We expect continued growth in single‑asset CVs around durable compounders and further expansion in credit secondaries. In the credit markets, we’re monitoring distressed exchanges and PIK usage in syndicated loans. In the real estate market, we’re tracking NOI and building permit growth across asset classes.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the publication date and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason. No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Certain investor qualifications may apply. Definitions for Qualified Purchaser, Qualified Client and Accredited Investor can be found from multiple sources online or in the SEC’s glossary found here https://www.sec.gov/education/glossary/jargon-z#Q.