2025 and Estimated 2026 Compensation Limits: A Strategic Guide for Government Contractors

Table of Contents

- Summary

- What is the compensation limit for government contractors in 2025 vs. 2026?

- How does the government calculate the compensation cap?

- What compensation elements are included in the cap?

- What are the impacts of strategic disallowance choices?

- Example 1: The Bonus-First Approach

- Example 2: The Costly Alternative

- Who must comply with the 2025 compensation limits?

- What are the reasonableness standards?

- Are there any special agency limitations?

- How can contractors plan for 2026 compensation cap projections?

- What does this mean for audits?

- Final thoughts

Summary: The 2025 compensation limit for government contractors is $671,000, and Aprio has estimated the 2026 limit to be $695,000 — but compliance involves far more than just staying under this threshold. Smart contractors understand that how you structure compensation packages, and which elements you disallow when over the cap, can significantly impact your indirect cost pools and overall contract profitability. This comprehensive guide explores the nuances of compensation compliance, including strategic approaches to minimize unallowable costs and their cascading effects on fringe benefits.

What is the compensation limit for government contractors in 2025 vs. 2026?

The compensation limit for government contractors, established by Section 702 of the Bipartisan Budget Act of 2013, is $671,000 for the calendar year ending December 31, 2025. This represents an increase from previous years’ caps of $646,000 in 2024 and $619,000 in 2023, reflecting ongoing adjustments for economic conditions. The Bureau of Labor Statistics (BLS) has published the June 2025 Employment Cost index (ECI), but not the September 2025 edition, which will be used to calculate the 2026 cap. Thus, the 2026 cap amount is still a projection.

However, this is not a salary ceiling. The government does not restrict the amount you can pay employees. Instead, it limits how much of that compensation you can bill back to the government on cost-reimbursable contracts, time-and-materials contracts, and certain fixed-price contracts priced using cost analysis.

How does the government calculate the compensation cap?

The calculation follows a straightforward formula tied to economic indicators:

Current Year Cap = Prior Year Cap × Employment Cost Index (ECI) Per BLS table 4

For 2025: $646,000 × 1.0387 = $671,000 (rounded to nearest thousand)

The BLS provides ECI data for all civilian workers. While the measurement period normally aligns with the federal fiscal year, the cap is applied on a calendar year basis. This timing distinction creates complexity for contractors whose fiscal years do not align with calendar years. In such cases, they must prorate the cap across the two calendar years within their fiscal period.

What compensation elements are included in the cap?

Understanding what counts toward the cap is crucial for accurate compliance. Per FAR 31.205-6(p)(1)(i), “compensation” includes:

- All employees’ wages and salaries

- All bonuses

- Deferred compensation (subject to FAR 31.205-6(k) requirements)

- Employer contributions to defined contribution pension plans

- Auto allowances and other transportation benefits

- Restricted stock grants when paid as direct compensation (valued at fair market value on grant date per FAR 31.205-6(d)(2))

- Reasonable severance and vacation payouts

Meanwhile, exclusions from the cap include:

- Fringe benefits (e.g., health insurance, dental, vision, life insurance)

- Transportation benefits that are available for all employees

- Amounts already charged to unallowable accounts such as:

- Stock options (FAR 31.205-6(i))

- Change in stock value (e.g. phantom stocks)

- Unallowable labor (e.g., lobbying, M&A)

The Defense Contract Audit Agency (DCAA) uses the ICE Model Supplemental Schedule B to verify these calculations during incurred cost audits. Of note, while Schedule B includes a column for company-paid health insurance, the DCAA confirmed this element is excluded from cap calculations.

What are the impacts of strategic disallowance choices?

Here is where sophisticated government contractors gain a significant advantage: the order in which you disallow compensation elements dramatically affects your indirect cost pools.

Consider the following scenarios:

Example 1: The Bonus-First Approach

Employee: Senior Engineer

- Total Compensation: $720,000

- Base Salary: $600,000

- Performance Bonus: $120,000

- Excess over cap: $49,000

A smart strategy would be to disallow bonuses first:

- Remove $49,000 from the employee’s bonus pool

- Allowable: $600,000 salary + $71,000 bonus = $671,000

- Fringe impact = Zero additional unallowable indirect costs

Example 2: The Costly Alternative

Same employee, but disallowing base salary instead:

- Remove $49,000 from base salary

- Allowable: $551,000 salary + $120,000 bonus = $671,000

- Fringe impact: $49,000 × 35% typical fringe rate = $17,150 additional unallowable costs

- Total cost impact: $66,150 vs. $49,000 using the bonus-first approach

This $17,150 difference occurs because fringe benefits (e.g., health insurance, payroll taxes, workers’ compensation) typically do not apply to bonus payments, but rather to base salary reductions.

Who must comply with the 2025 compensation limits?

The scope of coverage has evolved significantly. For contracts awarded after June 24, 2014, the cap applies to all employees, not just executives. This expansion means that highly compensated engineers, program managers, and technical specialists are all subject to the same $671,000 limitation. Moreover, when working with specific agencies like the NIH, there are additional salary limitations that need to be followed.

Subcontractors must manage their employees in accordance with their subcontracts and applicable FAR flowdown provisions. However, true consultants operating under professional service agreements (FAR 31.205-33) are subject to reasonableness standards rather than the statutory cap. This distinction creates opportunities for structuring high-value relationships.

What are the reasonableness standards?

Even compensation below $671,000 faces scrutiny. DCAA applies reasonableness tests comparing compensation to industry surveys, typically questioning amounts exceeding survey midpoints by more than 10%.

Contractors can defend higher compensation by demonstrating the following:

- Superior company performance metrics (e.g., documenting performance KPIs)

- High-end work that requires clearance

- Higher cost based on locations

- Supporting salary survey data

Are there any special agency limitations?

Government contractors working with specific agencies face additional constraints. For example, the Department of Health and Human Services (HHS) imposes a direct salary cap of $225,700 for 2025 on certain contracts. This means:

- Direct labor contract costs above $225,700 annually are unallowable.

- Associated indirect costs on the excess amount are also unallowable.

- Excess direct compensation becomes nonbillable direct costs. This remains in the base of burdens, and receives the applicable fringe, overhead, and G&A burdens that are also nonbillable.

This dual limitation requires careful rate development and proposal preparation to avoid cost disallowances.

How can contractors plan for 2026 compensation cap projections?

Based on current ECI trends showing approximately 3.6% annual growth, the estimated 2026 compensation cap would approximately be $695,000. The official limit will be published after the Bureau of Labor Statistics (BLS) publishes September price data.

In the meantime, contractors should incorporate this projection into:

- LCAT development for upcoming proposals

- Indirect rate projections and cost volume planning

- Talent acquisition and retention strategies

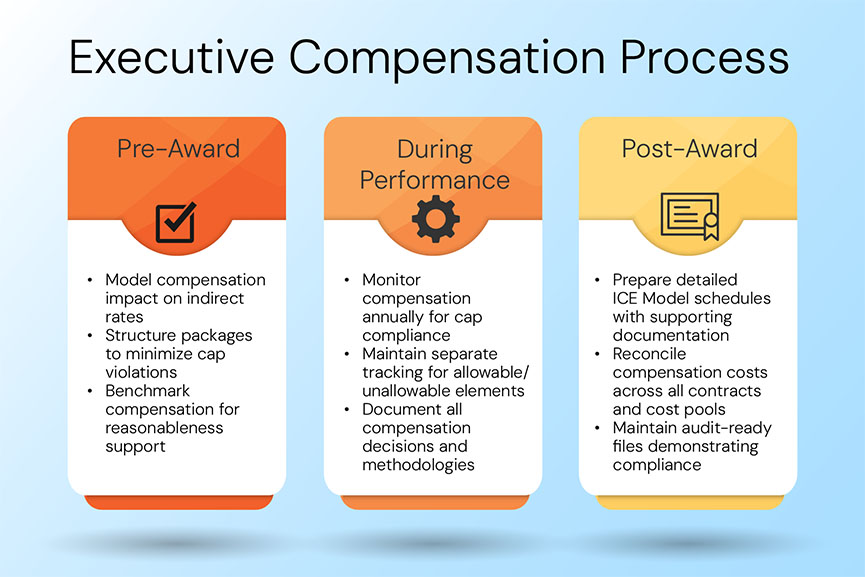

What does this mean for audits?

DCAA auditors focus intensively on compensation during incurred cost submission (ICS) audits. They verify:

- Mathematical accuracy of cap calculations

- Proper classification of compensation elements

- Consistent treatment across accounting periods

- Adequate documentation supporting reasonableness claims

Penalties for compensation over the cap can be severe, since these are considered express statutory violations and are unlike reasonableness determinations, which involve more subjective judgment.

Final thoughts

The compensation cap represents more than a compliance requirement; it is a fundamental business consideration affecting your competitive position, talent retention, and contract profitability.

Here is a table of best practices for your 2026 compensation planning:

Contractors that understand the nuances of compensation structuring, timing strategies, and indirect cost impacts position themselves for sustained success in the government contracting marketplace. Smart contractors do not just comply with the compensation cap; they use their knowledge of these rules to optimize their cost structures, enhance their competitive positioning, and build sustainable advantages in pursuing and performing government contracts.

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.

How we can help

Aprio’s Aerospace, Defense & Government team delivers compliance solutions that empower government contractors to excel in a competitive federal landscape.