Posts by Aprio Publisher

Protecting Your Business from Financial Fraud: Understanding the Risks

At a glance Schedule a consultation The full story: One of the most damaging forms of occupational fraud is financial statement fraud, where financial reports are intentionally manipulated to deceive stakeholders. The consequences can be devastating, from financial losses and legal liabilities to reputational damage. The Most Common Methods of Financial Statement Fraud Financial statement…

Read MoreCase Study: Creating a Legacy of Patient Care

In our third real-life story from our eBook, “Making the Case for Small-Market Dentistry,” we explore the journey of an endodontist practicing in a small Midwest town. We’ll call him Dr. Pat. After many years of practicing in and serving his local community, Dr. Pat had his sights set on retirement but wanted to find…

Read MoreAn Introduction to Transfer Pricing

5 Private Capital Insights from Q1 2025 and What They Mean to You

The private capital market continues to evolve as liquidity conditions improve, valuations reset, and sector-specific opportunities emerge. Private equity distributions have turned positive, signaling a rebound in liquidity and potential for reinvestment. While M&A activity is on the rise, particularly in take-private deals, retail real estate remains a stronghold due to constrained supply and rising…

Read MoreTop Employee Benefits Enhancements for Small Businesses in 2025

At a glance The full story: As we wrap up the first quarter of 2025, small business owners face an increasingly competitive market when it comes to attracting and retaining top talent. To differentiate themselves and stand out from the crowd, many business owners, executives, and leaders are focused on boosting their employee benefits packages…

Read MoreSelling Your Company? Here’s How to Get the Best Deal

At a glance The full story: It can take years to build a successful, thriving business from the ground up — and deciding to merge or sell it can feel overwhelming and even emotional. Furthermore, the decision-making process can trigger a host of new and competing questions: When is the right time? How do you…

Read More2025 Outlook on the Markets & Economy

https://info.aprio.com/2025-economic-outlook-webinar-q1-2025-video

Read MoreUnlocking Secrets of the Sunsetting Estate Tax Provision

https://info.aprio.com/unlocking-secrets-of-the-sunsetting-estate-tax-provision-webinar-q3-2024-video

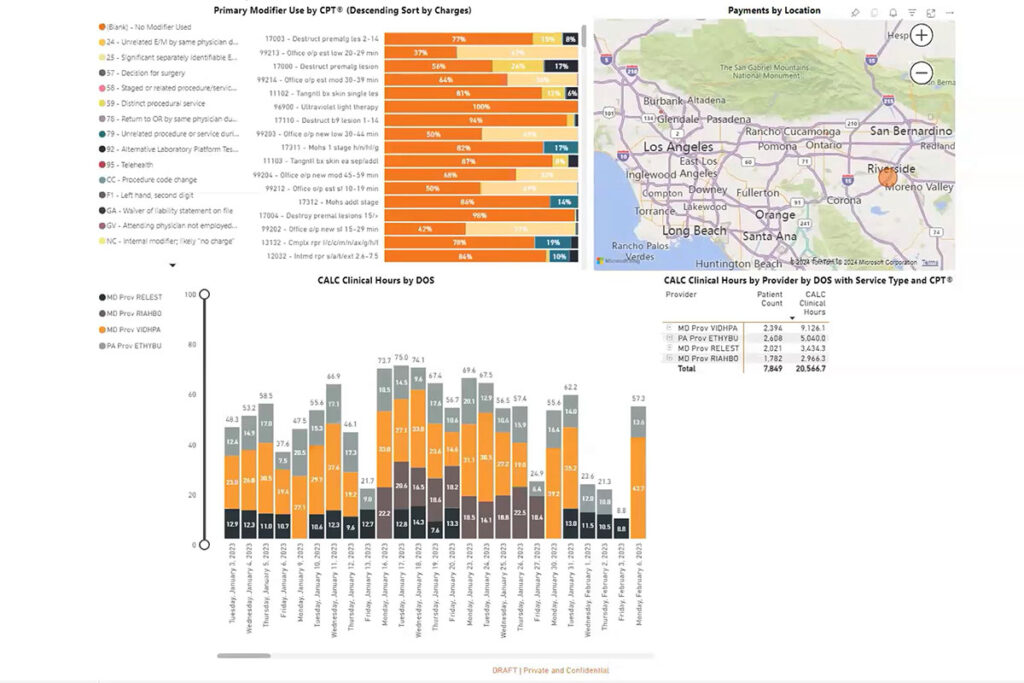

Read MoreFrom Data to Decisions: Solve Reporting Gaps with BI Dashboards

6 Key Restaurant Industry Insights and What They Mean for Your Business

2025 First Quarter Report What we are seeing in restaurants Restaurant operators are navigating mixed signals as performance metrics show signs of optimism and caution. On one hand, key metrics such as same-store sales and traffic are growing at a faster rate. However, persistent challenges like high turnover rates, rising costs, and pressures on consumer…

Read More