Government Services M&A Activity Remains Strong

January 24, 2024

At a glance:

- The main takeaway: Overall M&A activity in the US dropped significantly in 2023. Read more about what caused the drop, how the government services sector fared relative to the market as a whole, and what to expect in 2024.

- The impact on your business: Understanding the state of government services M&A activity and how we got here is important for any business leader planning to engage in M&A activity in the near future.

- Next steps: Read this piece, absorb the insights within and reach out to Aprio’s Transaction Advisory Services team to see how we can help you succeed in 2024 and beyond.

To learn how Aprio can help you successfully navigate your next deal, schedule a consultation today.

The full story:

2023 was a down year for US mergers and acquisitions, with the number of deal announcements decreasing by approximately 25% year-over-year. M&A transactions involving government services targets decreased in 2023, but the drop was more muted relative to the broader M&A market, at 8%. There is no doubt that economic turmoil in the US has impacted M&A deal flow, but with 2023 in the rearview mirror it is also clear that an appetite for M&A persists in the government services space.

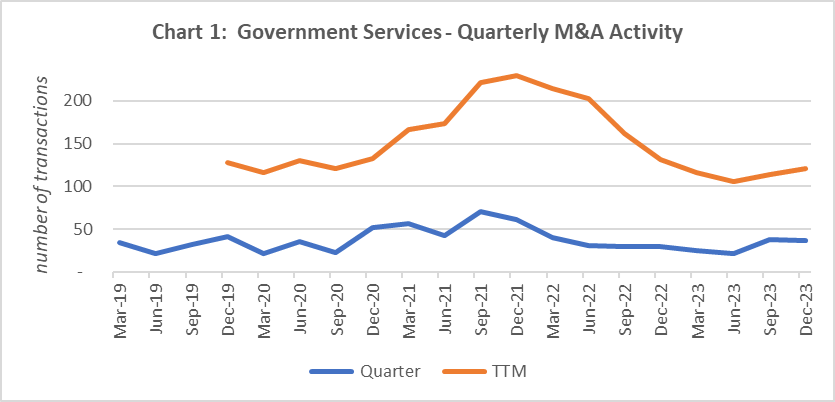

Chart 1[i] above tracks quarterly M&A activity (number of announced M&A transactions involving US target companies) within the government services arena. As can be seen in the chart, government services M&A fluctuated in 2020 during the throws of the COVID-19 pandemic, setting the stage for a record year for deals in 2021. Some of that transaction surge was likely impacted by 2020 transactions being pushed to 2021 due to pandemic-related uncertainty. And given 2021’s lively market, some sellers may have accelerated deal timelines, pulling what would have otherwise been 2022 transactions into 2021.

From early 2022 to mid 2023 quarterly government services M&A announcements declined gradually, before seeing an uptick in the second half of 2023. Trailing (TTM) deal totals were 116, 106, 114 and 121 for the quarters ended Mar-23, Jun-23, Sep-23 and Dec-23, respectively.[ii] At 121 M&A announcements, 2023 government services activity was only 8% lower than 2022 and only 5% lower than 2019 (year before the onset of the COVID-19 pandemic). In contrast, 2023 M&A announcements across all sectors in the US were approximately 25% lower than 2022 and also approximately 25% lower than 2019. Drawing from the pool of 121 government services deals for 2023, Table 1 below profiles a selection of transactions.[iii]

Table 1: Selected 2023 Government Services M&A Transactions

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

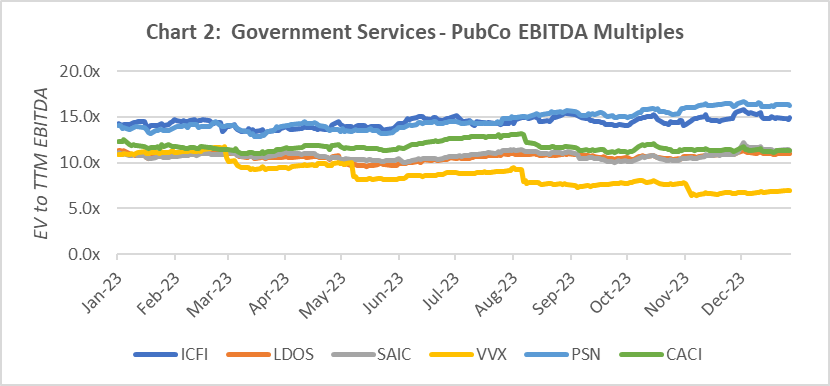

Table 1 presents transaction values (i.e., enterprise value) where available, but it does not present the associated valuation multiples (e.g., enterprise value to revenue, enterprise value to EBITDA) since that information was not disclosed. While not necessarily indicative of valuation multiples at play in any of the M&A deals reflected in Chart 1 or listed in Table 1, we can as food for thought consider such valuation metrics for publicly traded firms.[iv] To that end, Chart 2 below presents EBITDA multiples (i.e., enterprise value to TTM EBITDA) for a reference group of six publicly traded government services companies.[v]

As shown in Chart 2, throughout the first part of 2023 EBITDA multiples across the reference group ranged from approximately 10.0x to 15.0x, before diverging in the latter part of the year. The median EBITDA multiple for the group ranged from a low of 10.7x to a high of 12.3x over the course of the year. At year-end the median multiple was 11.4x.

Circling back to 2021 government services M&A activity, what were the factors (in addition to pent up demand) contributing to a robust M&A environment? One likely factor was a desire by would-be acquirers to build or bolster capabilities around federal government initiatives in areas such as legacy IT system modernization, cloud migration, and machine learning. Other factors at play in 2021 included but were not limited to: increasing valuations; low interest rates; SPAC popularity; available cash on balance sheets; and increases in private equity fundraising.

2022 and 2023, however, saw a variety of factors creating uncertainty on the M&A front. These included:

- Rising inflation

- Fears of recession

- Russia-Ukraine war

- Federal Reserve actions to increase interest rates

- Volatility in the public capital markets

- Federal government shutdown drama

- Regulatory/antitrust considerations

- Israel-Hamas war

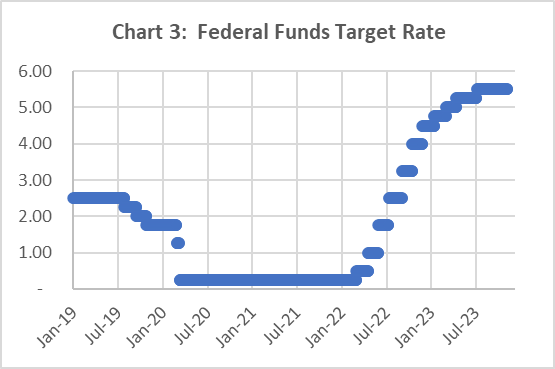

Variables such as these, in addition to the size and scope of federal agency budgets, will continue to impact government contractors to varying degrees in 2024. Rising inflation and interest rate hikes are of course linked. In an effort to tame inflation, the Federal Reserve increased its federal funds target rate throughout 2022 and the first half of 2023 (see Chart 3 below).[vi] This followed the federal funds rate having been dropped close to 0% in 2020 during the pandemic. The Fed’s most recent rate hike was nearly six months ago, at which point the federal funds rate was raised to a range between 5.25% and 5.50%.

Rising interest rates are particularly relevant to M&A deal flow. As the cost of debt rises, acquirers that tend to use leverage in their deals may hold back. On the flipside, strategic acquirers with significant cash on their balance sheets may be inclined to seize opportunities. With inflation landing in a more comfortable zone for the Fed, many expect the federal funds target rate to decrease in 2024,[vii] which would provide a boost to deal financing activity.

Defense spending, as ever, will be a driving force behind both organic and inorganic growth for federal contractors. While the potential for cuts does exist, the expectation is that US defense budgets will continue to grow, given global prioritization of national security and bipartisan support for defense. There are risks to that expectation, however, including a volatile political outlook in the near-term and an election year and debt ceiling debate.[viii]

Government contractors have not been immune to prevailing economic challenges (geopolitical unrest, hostile political environment and unclear outlook to name a few), but deal volumes remained relatively steady in 2023. With inflation slowing, interest rates levelling off and government shutdown jitters subsiding, many are cautiously optimistic about government services M&A levels for 2024. Regardless, profitable target companies that have been awarded contracts on high-priority programs and possess distinguished workforces, unique technological discriminators, and a majority of prime full & open contracts in backlog, will continue to transact.

Aprio provides M&A-related services to middle market government contractors and private equity groups. This includes Transaction Advisory, Business Valuation, Technical Accounting Consulting, and Forensic Accounting. Whether it’s pre-acquisition financial due diligence, post-acquisition purchase price allocation analyses, navigating the GAAP intricacies of business combination accounting, or assisting in the resolution of a post-acquisition dispute, Aprio can help you succeed in 2024 and beyond. Schedule a consultation today.

To learn more about our Government Contracting practice, click here to get in touch.

Related Resources:

4 Priorities for Business Leaders in the First 100 Days Following an Acquisition

Why Estimating Systems are Critical Tools for Winning Government Contracts

When Does Cost or Pricing Data Need to be Certified, and What Does That Mean?

[i] The data supporting this chart was obtained from S&P Capital IQ.

[ii] These figures include only transactions that were publicly disclosed. The actual number of government services M&A transactions is higher, given that some deals are not made public.

[iii] Information obtained from S&P Capital IQ, press releases, and SEC filings.

[iv] A variety of factors can influence the implied valuation multiple reported for any given M&A transaction, including but not limited to the type of buyer involved and the target company’s size, growth prospects, profitability, and capabilities. Public company valuation multiples, while readily available, reflect a different level of value from change-of-control transaction implied valuation multiples, and may be enhanced by factors including but not limited to relative size, diversification, and access to capital.

[v] Based on a reference group of publicly traded government services companies: ICFI, CACI, LDOS, PSN, SAIC, VVX. Data obtained from S&P Capital IQ

[vi] Data points in the chart represent the upper end of the Fed’s target range.

[vii] See, for example, Americans Begin to Believe Inflation is Cooling, Wall Street Journal, January 11, 2024.

[viii] US Defense: National security threat will outweigh deficit, but not without politics-driven volatility, UBS Global Research and Evidence Lab, October 10, 2023.

Recent Articles

About the Author

William Foote

William collaborates with middle-market companies, entrepreneurs, private equity groups, investment bankers, lenders, and attorneys, working toward a common goal of achieving successful client outcomes. As a CPA with four additional specialty certifications, he leverages technical knowledge to interpret problems for clients and develop team members.

(301) 231-6299

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.