Marketplace Minute: Q2 2023

May 4, 2023

While the US economy grew by 1.1% in the first quarter of 2023, several major events brought headwinds into the transaction markets, including trouble in the financial sector and the shutdown of SVB and Signature Banks. However, based on publicly available data, we are seeing a rebound in transaction multiples, outlined in the graphs below.

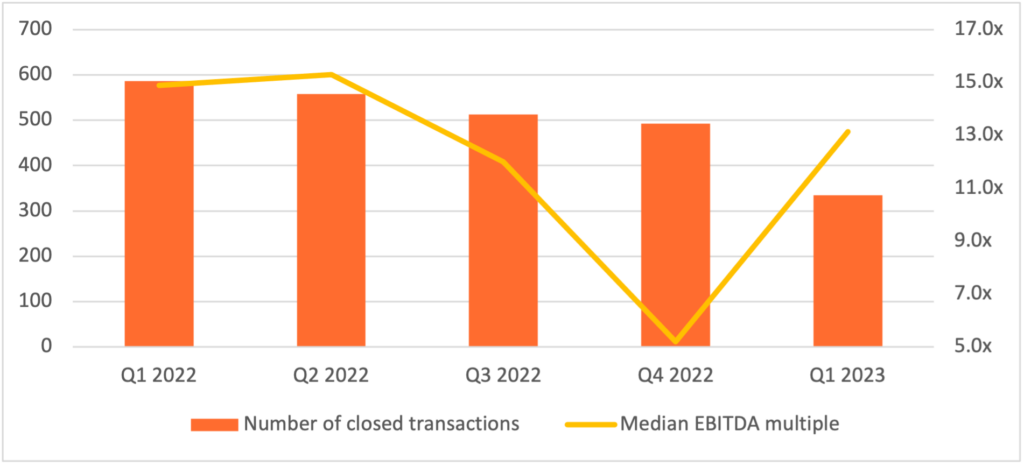

1. Retail and consumer products

Transaction volume in Q1 2023 was down but multiples rebounded to the low double digits.

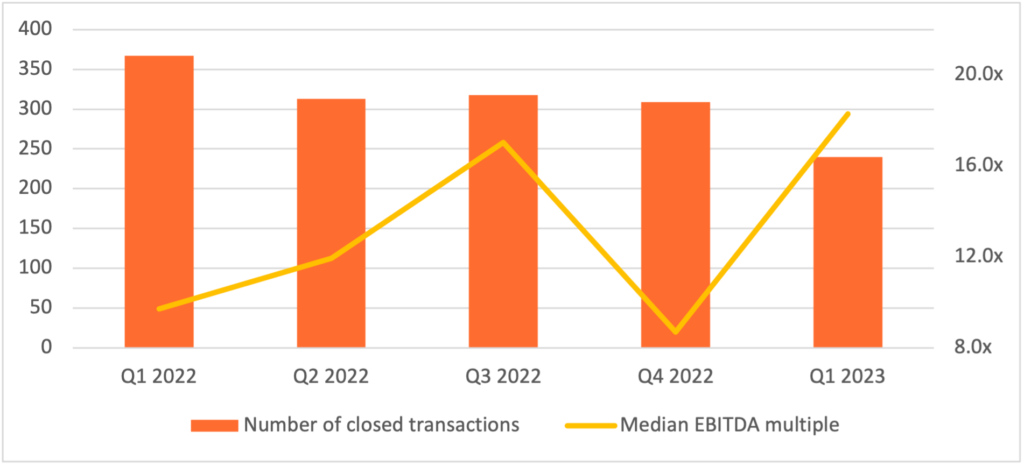

2. Healthcare

With the global economy battling a large inflationary wave, the healthcare industry has faced its own challenges due to wage inflation and increased operating costs. On the bright side, more recent data implies that there is a silver lining. (Check out our recent article, “6 Healthcare Insights from Q4 2022 and What They Mean for You,” for a thorough summary.)

While transactions were down in Q1 2023, multiples rebounded to levels we saw previously in the middle of last year, led by CVS’s acquisition of Signify Health.

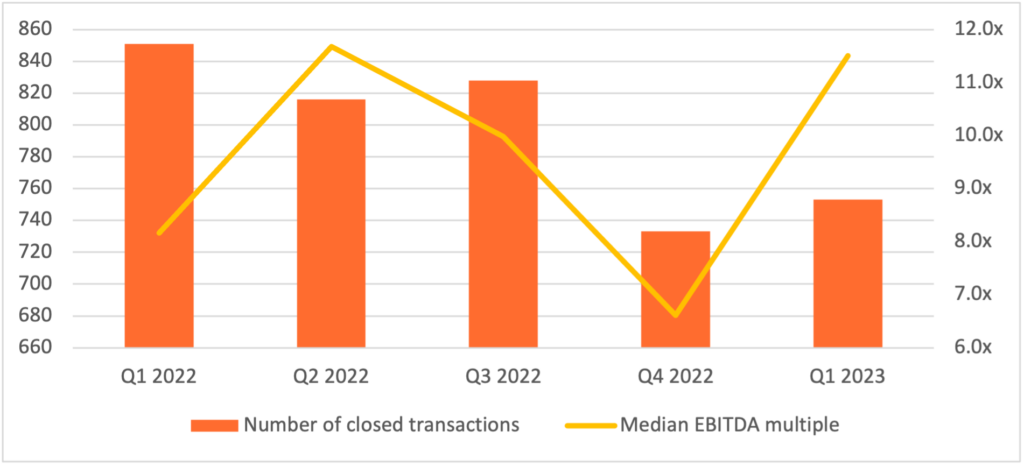

3. Manufacturing and distribution

Although Q1 2023 transaction volume picked up from Q4 2022, it is still off compared to the levels we saw in previous quarters of 2022. On the other hand, multiples rebounded, on the heels of Olympus Partners’ sale of Liqui-Box Corporation to Sealed Air; Gryphon Investors’ sale of Wittichen Supply to Beijer Ref; and Blackrock’s sale of Altra Industrial Motion to Regal Rexnord, all being consummated at ~13.0x.

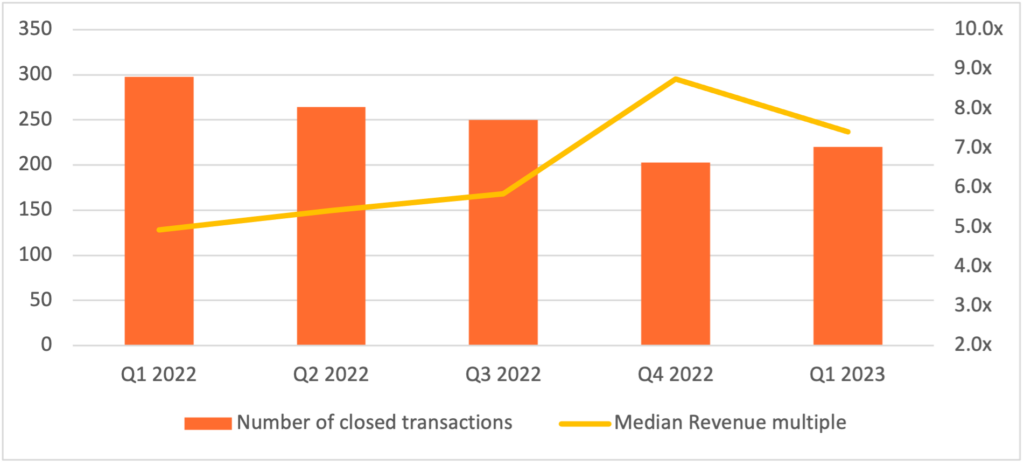

4. Software

Q1 2023 software transactions gained steam from Q4 2022 levels, although revenue multiples pulled back slightly. Deal execution saw a mix of large and small deals with two venture capital/private equity deals trading hands: Blackrock’s sale of Coupa Software to Thoma Bravo and Vista Equity Partners’ acquisition of Duck Creek Technologies.

Want to explore this data in further detail and determine what it means for you? Get in touch with our advisory team today.

Disclosures

Investment advisory services are offered by Aprio Wealth Management, LLC, a Securities and Exchange Commission Registered Investment Advisor. Opinions expressed are as of the current date (May 1, 2023) and subject to change without notice. Aprio Wealth Management, LLC shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. This commentary is for informational purposes only and has not been tailored to suit any individual. References to specific securities or investment options should not be considered an offer to purchase or sell that specific investment.

This commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

No graph, chart, or formula in this presentation can be used in and of itself to determine which securities to buy or sell, when to buy or sell securities, whether to invest using this investment strategy, or whether to engage Aprio Wealth Management, LLC’s investment advisory services.

Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. Any securities mentioned in this commentary are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Before making any investment decision, investors should read and consider all the relevant investment product information. Investors should seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision. There can be no assurance that any financial strategy will be successful.

Securities offered through Purshe Kaplan Sterling Investments. Member FINRA/SIPC. Investment Advisory Services offered through Aprio Wealth Management, LLC, a registered investment advisor. Aprio Wealth Management, LLC and the Aprio Group of Companies are not affiliated with Purshe Kaplan Sterling Investments.

Recent Articles

About the Author

William Foote

William collaborates with middle-market companies, entrepreneurs, private equity groups, investment bankers, lenders, and attorneys, working toward a common goal of achieving successful client outcomes. As a CPA with four additional specialty certifications, he leverages technical knowledge to interpret problems for clients and develop team members.

(301) 231-6299

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.