R&D Road Trip: Exploring the 37 State R&D Tax Credits

November 15, 2022

At a glance

- The main takeaway: Many states offer separate state-specific R&D tax credits that can be taken in combination with the Federal R&D Tax Credit.

- Impact on your business: Assessing your company’s eligibility for state credits can be a useful tool for maximizing your overall credit benefit and increasing cash flow.

- Next steps: Schedule a consultation with Aprio’s R&D credit experts to understand your eligibility and the requirements for claiming the credits.

The full story:

The Federal Research and Development (R&D) Tax Credit offers a valuable incentive to eligible companies by reducing federal tax liability, often providing an immediate cash flow increase. Did you know that 37 states offer a separate R&D credit that can be claimed in addition to the Federal credit to increase your total benefit?

State R&D credits expand your opportunity to get a tax credit on domestic research expenditures.

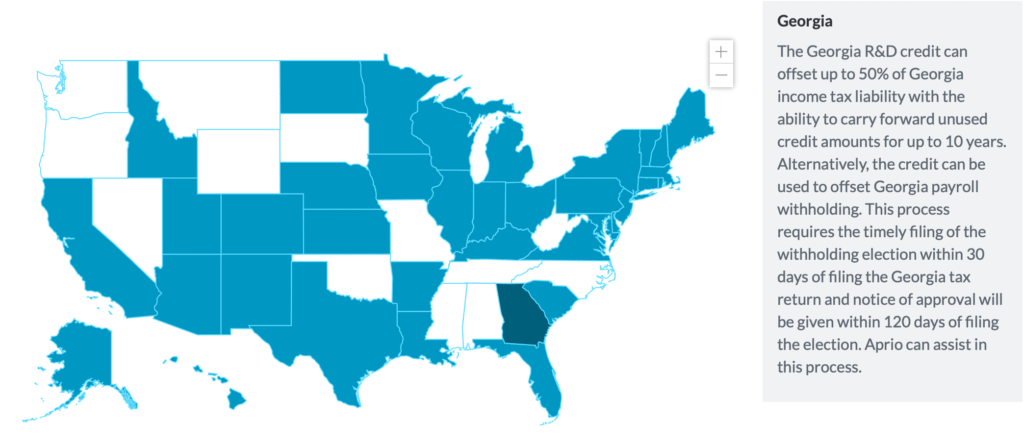

The map below illustrates the states that offer an R&D credit, with a short overview of the benefit. Explore which states might be applicable to your business and read more about the potential credit available.

Map Updated as of 11.15.2022

All R&D Tax Credits are not created equal.

Individual state credits carry many nuances that could have further-reaching tax implications, especially depending on your company structure and your holistic tax plan. Additionally, states are notorious for frequently changing the rules and eligibility requirements around R&D credits.

Because of these nuances, it’s best to seek the help of a seasoned R&D tax credit advisor who can assess your eligibility, ensure you meet the latest necessary requirements, and help maximize your benefit safely within the rules and regulations.

Maximize your benefit with the right R&D credit advisor.

Aprio’s R&D Tax Credit team regularly monitors changes to individual state R&D credit guidelines, and we prioritize a holistic tax planning approach to evaluate each of our clients’ eligibility for all state R&D credit opportunities. This helps us formulate an individualized, holistic tax plan for each of our clients to maximize their benefits while remaining safely within the confines of the regulations.

Schedule a consultation with our team today and learn which state R&D credits you might be eligible for.

Recent Articles

About the Author

Carli Huband

Carli leads the Specialty Tax and the national R&D Tax Credit practice at Aprio. She has worked with companies across a variety of industries and ranging in size from startups to Fortune 500 businesses, performing technical interviews with subject matter professionals, calculating complex credits and preparing technical reports.

(678) 431-9619

Stay informed with Aprio.

Get industry news and leading insights delivered straight to your inbox.