Posts Tagged ‘R&D Tax Credit’

Taking Credit Where Its Due: The Importance of Contracts for Claiming the R & D Credit

At a glance The full story: The IRS recently denied an engineering firm’s claims for the federal R&D tax credit in the Meyer, Borgman, & Johnson, Inc. v. Comm’r of Internal Revenue case. This outcome rested on the principle of funded research under Code Sec. 41 (d)(4)(H), which states that “qualified research” does not include…

Read MoreMORE Updates to Form 6765 for Federal R&D Tax Credits

At a glance The Full Story: On June 21, 2024, the IRS released an updated draft version of a new Form 6765 (the tax form used to claim the Federal R&D Tax Credit), revealing major updates since publishing the first draft of proposed changes in 2023. The nature of the changes, which significantly reduce the…

Read MoreIRS Rolls Back Some Requirements for R&D Refund Claims

At a glance: The full story: One June 18, 2024, the IRS announced a significant update to the filing requirements for R&D Tax Credit refund claims that will benefit taxpayers. Effective immediately, the IRS will waive the requirement for two of the original five pieces of information needed for filing a refund claim, alleviating the…

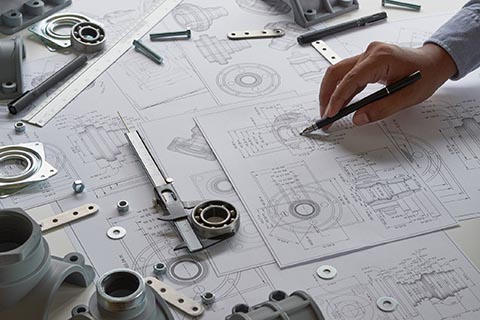

Read MoreManufacturers: Maximize Your R&D Tax Credits

R&D Road Trip: Exploring the 37 State R&D Tax Credits

At a glance The full story: The Federal Research and Development (R&D) Tax Credit offers a valuable incentive to eligible companies by reducing federal tax liability, often providing an immediate cash flow increase. Did you know that 37 states offer a separate R&D credit that can be claimed in addition to the Federal credit to…

Read MoreWhen are U.S. Government Contractors Eligible for the R&D Tax Credit?

At a glance The full story: Many companies often incorrectly assume that any work performed as part of the scope of a government contract is disqualified from the R&D Tax Credit because it is government-funded. In actuality, many of the research and development activities involved through the performance on government contracts can qualify, meaning government…

Read MoreRaising the Stakes for R&D Tax Credit Refunds

At a glance The main takeaway: The transition year provided with the new filing procedures for R&D credit refunds is more than halfway through, so businesses considering amending to claim a refund should act soon to take advantage of the ability to potentially perfect denied claims. Weighing costs and benefits: The additional time and costs…

Read MoreNew CHIPS Tax Credit Provides Opportunities and Complexity for Companies and Investors in Superconductor Manufacturing

At a glance The main takeaway: The recently passed CHIPS Act creates a new Advanced Manufacturing Tax Credit to provide incentives for US companies to invest in domestic semiconductor manufacturing. The Act allows a credit of up to 25% of qualified investment amounts in facilities or equipment used to manufacture semiconductors in the US. There are…

Read MoreWebinar: How R&D Expenditures Can Impact Your 2022 Tax Plan and Beyond

The Tax Cuts and Jobs Act of 2017 (TCJA) made significant changes to Section 174 that will affect companies that perform research and development (R&D). Join the webinar to understand how these changes can impact your 2022 tax year and into the future. This webinar will covers: How these changes impact your R&D expenses Developing…

Read MoreNew Guidance from the IRS Makes Claiming R&D Credits More Complex

At a glance Schedule a consultation with Aprio’s R&D Tax Credit Team today. The full story: In the fall of 2021, the Internal Revenue Service (IRS) issued a Chief Counsel Memorandum requiring stricter reporting and documentation for any taxpayer making an amended claim for a refund arising from an R&D tax credit. In order to comply…

Read More