Posts Tagged ‘Wealth Management’

The Pulse on the Economy and Capital Markets: June 2024

To Summarize: Large technology firms and emerging markets outperform in a mixed market environment for stocks and bonds. Companies are aggressively exploring how to use AI, which has created a slowdown in enterprise software spending. While consumers have shifted their spending to lower-ticket items, the affordable luxury segments, such as beauty, have been resilient. We…

Read MoreThe Pulse on the Economy and Capital Markets: April 2024

To Summarize: The stock and bond markets forecast a better view of the economy due to a strong performance in equities and oil. For the first time in 16 months, the manufacturing sector is showing growth. Despite healthy balance sheets, small businesses remain concerned about the economy, and the price for cocoa soars presenting issues…

Read MoreAprio Wealth Management Releases 2024 Wealth Management Economic Outlook

Outlook predicts diminished likelihood for a recession, continued global economic normalization and cautionary investment strategies ATLANTA – February 27, 2024 – Aprio Wealth Management, a subsidiary of Aprio, LLP, the fastest-growing business advisory and accounting firm in the U.S., has released its 2024 Wealth Management Economic Outlook, highlighting investment trends, insights and takeaways for investors…

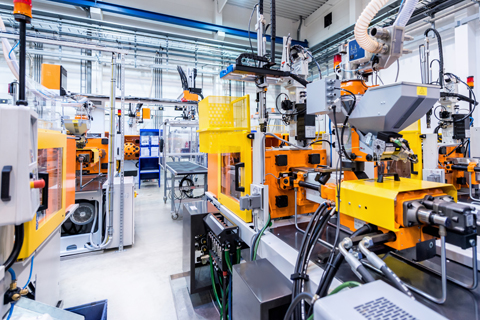

Read More6 Manufacturing Insights from Q1 2023 and What They Mean for You

A slower growing economy and excess inventories have resulted in the manufacturing sector surveys signaling a contraction for consecutive months, the first time since the COVID-19 pandemic. Coupled with rising interest rates, corporate deal makers are now uncertain what lies ahead and have reduced 2022 M&A activity. The silver lining is that slower economic growth…

Read MoreThe Pulse on the Economy and Capital Markets: January 16 – 19, 2023

At a glance Related resources:

Read More6 Manufacturing Insights from Q4 2022 and What They Mean for You

As the US heads into an economic slowdown, overall manufacturing conditions are weakening as ISM indices are showing a reduction in new orders and backlogs. However, a slowdown in the economy has relieved many of the inflationary pressures that manufacturers have been experiencing as input prices have dropped considerably from their three-year highs. Further, truckload…

Read MoreDental – Q3 Economic Update Video

From the US midterm elections to inflation uncertainty, several factors are poised to shape our economy headed into next quarter and 2023. Watch this video to learn the key economic considerations dental practice owners should keep in mind to steer their businesses through the next phase with confidence.

Read MoreThe Pulse on the Economy and Capital Markets: September 12─ 16, 2022

At a glance: Many experts expected the Consumer Price Index (CPI) to decline due to weakening gas prices — but to their surprise, the report showed a positive number, which signifies that inflation is increasing. Excluding food and energy, inflation increased 0.6% last month, or about 7% annualized. This trend has investors worried that the…

Read MoreThe Pulse on the Economy and Capital Markets: September 5 – 9, 2022

At a glance: The price of oil declined last week as markets and stocks receive a much-needed rebound after a tough August. Investors brace for the Federal Reserve to increase rates by three-quarters of a percent in their upcoming meeting. Bonds most sensitive to higher rates — specifically government and investment grade — sold off.…

Read MoreThe Pulse on the Economy and Capital Markets: August 15 – 19, 2022

At a glance: After a strong start to the third quarter, the markets cooled off last week as stocks, bonds, commodities and crypto all declined. The Federal Reserve indicated in their meeting that a switch in policy regarding the reversal of rates is unlikely to happen as quickly as the market speculated. The recent earnings…

Read More